Receiving your first job offer is an exciting milestone. You've negotiated your annual salary, a figure that represents your value and potential. But how does that annual number translate into the money that hits your bank account? Understanding your pay schedule is a critical piece of financial literacy, and one of the most common, yet frequently misunderstood, is the bi-monthly salary.

While "bi-monthly salary" isn't a job title, understanding this pay frequency is crucial for budgeting, comparing job offers, and managing your financial health. This guide will break down exactly what a bi-monthly salary is, how to calculate it, and the key career factors that determine the size of your paycheck.

What Is a Bi-Monthly Salary and How Does It Work?

A bi-monthly pay schedule means you are paid twice per month, typically on specific, consistent dates. For example, an employer might pay its employees on the 15th and the last day of every month.

This results in 24 paychecks per year (12 months x 2 paychecks per month).

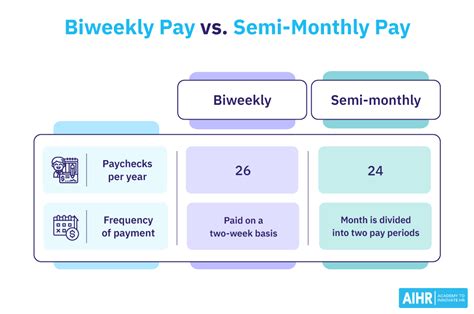

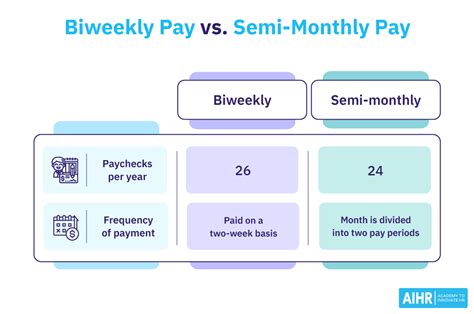

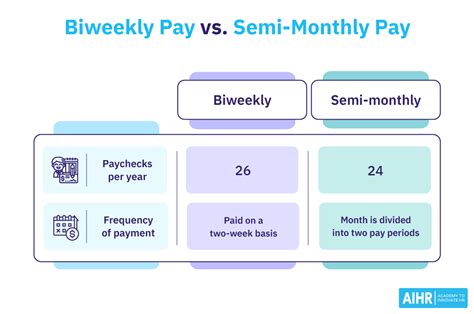

It is essential to distinguish this from a *bi-weekly* pay schedule, which is the most common pay frequency in the United States.

| Feature | Bi-Monthly Pay | Bi-Weekly Pay |

| :--- | :--- | :--- |

| Frequency | Twice per month | Every two weeks |

| Paycheck Dates | Fixed dates (e.g., 1st & 15th) | A fixed day (e.g., every other Friday) |

| Total Paychecks/Year| 24 | 26 |

| "Extra" Paychecks | None. Paycheck amounts are consistent. | Two months in the year will have three paychecks. |

The primary difference lies in those two "extra" paychecks in a bi-weekly schedule. With a bi-monthly schedule, each paycheck is slightly larger, but the cash flow is predictable and even throughout the year.

How to Calculate Your Bi-Monthly Salary

Calculating your gross pay (before taxes, insurance, and other deductions) on a bi-monthly schedule is straightforward.

The Formula: `(Your Annual Salary) / 24 = Your Gross Bi-Monthly Paycheck`

Example:

Let's assume you've accepted a job with an annual salary of $62,400. This figure is close to the median annual wage for all full-time wage and salary workers in the U.S., which was $61,900 in the fourth quarter of 2023, according to the U.S. Bureau of Labor Statistics (BLS).

- Calculation: `$62,400 / 24 = $2,600`

In this scenario, your gross pay for each of your 24 paychecks would be $2,600.

Key Factors That Influence Your Salary (And Your Bi-Monthly Paycheck)

The annual salary figure used in the calculation above is not arbitrary. It's determined by a complex interplay of your personal qualifications, your industry, and market forces. Understanding these factors is key to maximizing your earning potential.

###

Level of Education

There is a direct and well-documented correlation between educational attainment and earning potential. Higher degrees often signal advanced knowledge and specialized skills to employers, commanding higher salaries.

According to 2022 data from the U.S. Bureau of Labor Statistics, median usual weekly earnings show a clear progression:

- High School Diploma: $853 ($44,356 annually)

- Bachelor's Degree: $1,432 ($74,464 annually)

- Master's Degree: $1,661 ($86,372 annually)

- Doctoral Degree (Ph.D.): $2,083 ($108,316 annually)

A higher annual salary directly results in a larger bi-monthly paycheck.

###

Years of Experience

Experience is a powerful driver of salary growth. As you progress in your career, you move from executing tasks to managing projects, leading teams, and setting strategy, all of which add significant value to an organization.

Salary aggregator Payscale.com illustrates this trend clearly across professions:

- Entry-Level (0-1 year): Workers are learning the ropes and have the lowest earning potential.

- Mid-Career (5-9 years): Professionals have developed substantial expertise, leading to significant salary increases.

- Late-Career/Senior (20+ years): These individuals are often in leadership or high-level specialist roles, commanding the highest salaries.

For example, an entry-level software engineer might earn around $78,000, while a senior software engineer with over 10 years of experience could earn upwards of $135,000, according to Salary.com data from late 2023.

###

Geographic Location

Where you work matters immensely. Salaries are often adjusted based on the local cost of living and the demand for talent in a specific metropolitan area. A job in New York City or San Francisco will almost always pay more than the identical role in Omaha, Nebraska, to account for vast differences in housing, taxes, and other expenses.

For instance, a Marketing Manager in San Francisco, CA, can expect to earn about 26.5% more than the national average, while the same role in Orlando, FL, pays about 2.2% below the national average, according to data from Glassdoor. When evaluating an offer, always consider it in the context of the local cost of living.

###

Industry and Company Type

The industry you work in is a massive determinant of your pay. Industries with high revenue margins and intense demand for specialized talent, like technology and finance, typically offer higher salaries than sectors like education or non-profit.

Furthermore, the type and size of the company matter.

- Large Corporations (Fortune 500): Often have structured, competitive salary bands and robust benefits packages.

- Tech Startups: May offer lower base salaries but compensate with potentially lucrative stock options.

- Government/Public Sector: Tend to have highly transparent and rigid pay scales (like the GS scale), with predictable but often slower growth.

###

Job Role and Specialization

Ultimately, the most direct factor influencing your salary is your specific job function and any specializations within it. A generalist role will have a different pay scale than a highly specialized one. For example, within the field of data analysis, a "Data Scientist" specializing in Machine Learning will typically earn more than a "Business Intelligence Analyst" who primarily works with dashboards. Niche, in-demand skills command a premium.

Job Outlook: The Prevalence of Bi-Monthly Pay

While we can't discuss a "job outlook" for a pay schedule, we can look at its prevalence. According to BLS data, the most common pay frequency in the U.S. is bi-weekly (43% of establishments).

However, bi-monthly pay is still a significant and widely used method, especially in professional, scientific, and technical services industries. It is favored by some companies for its administrative simplicity, as it aligns payroll processing with monthly accounting cycles. As a professional, you are very likely to encounter bi-monthly pay schedules during your career.

Conclusion: Mastering Your Bi-Monthly Budget

Understanding the mechanics of a bi-monthly salary is a fundamental step toward professional and financial empowerment.

Here are the key takeaways:

- It's a Pay Schedule, Not a Job: "Bi-monthly" means you receive 24 paychecks per year on fixed dates.

- Know the Difference: Do not confuse it with bi-weekly pay (26 paychecks), as this impacts your budgeting, especially in months where a bi-weekly schedule would yield a third paycheck.

- Your Value Determines Your Paycheck: Your salary—and thus the size of your bi-monthly check—is a reflection of your education, experience, location, industry, and specialization.

- Plan Accordingly: A bi-monthly schedule provides slightly larger but fewer paychecks than a bi-weekly one. This consistency can make monthly budgeting more straightforward, as your income is the same every month.

When you receive a job offer, look beyond the annual salary. Ask about the pay frequency—bi-monthly, bi-weekly, or monthly—so you can accurately forecast your cash flow and build a budget that sets you up for financial success.

Sources:

- U.S. Bureau of Labor Statistics (BLS), "Usual Weekly Earnings of Wage and Salary Workers," 2022 Annual Averages.

- U.S. Bureau of Labor Statistics (BLS), "Quarterly Census of Employment and Wages," Q4 2023 Data.

- U.S. Bureau of Labor Statistics (BLS), "National Compensation Survey: Pay Periods."

- Salary.com, Glassdoor.com, and Payscale.com for aggregated, real-time salary data by role, location, and experience.