For anyone entering the workforce, changing careers, or managing a business, understanding the minimum wage is fundamental. While it's not a career path, the minimum wage is the foundational floor upon which many careers are built. In 2024, the landscape is a complex patchwork of federal, state, and local laws. The federal minimum wage has remained at $7.25 per hour, but the majority of states have mandated higher rates, with some metropolitan areas pushing wages to $17 per hour or more. This guide will break down the essential details you need to know.

What Is the Minimum Wage?

The minimum wage is the legally mandated lowest hourly rate that employers can pay their employees for their work. Established by the Fair Labor Standards Act (FLSA) in 1938, its primary purpose is to create a wage floor, preventing worker exploitation and ensuring a basic standard of living. It's crucial to understand that the federal rate is the absolute minimum; states and even cities can set their own, higher minimum wages, and employers in those locations must pay the rate that is most generous to the employee.

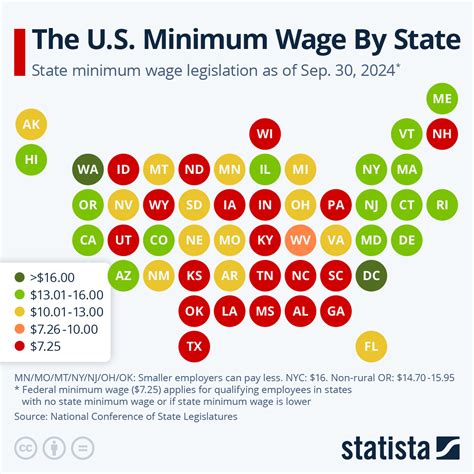

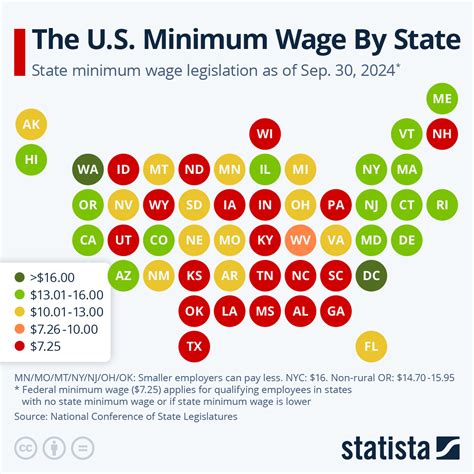

Federal and State Minimum Wage Rates in 2024

The average minimum wage you can expect to earn is entirely dependent on where you work. While the federal rate is a common reference point, it is increasingly becoming irrelevant in many parts of the country.

- Federal Minimum Wage: $7.25 per hour. This rate has not changed since 2009.

- Federal Tipped Minimum Wage: $2.13 per hour. This is the rate for employees who regularly receive tips, with the expectation that tips will bring their total earnings up to at least the full minimum wage.

- State Minimum Wage Range: As of 2024, state-mandated rates range from $7.25 per hour (in states that follow the federal minimum) to over $16.00 per hour.

According to the U.S. Department of Labor and reports from the Economic Policy Institute, over 30 states and the District of Columbia have minimum wages higher than the federal level. For example, Washington state's minimum wage is $16.28, and California's is $16.00. Many other states implemented increases at the start of 2024, including Maryland ($15.00), New York ($16.00 in NYC and surrounding counties), and Illinois ($14.00).

Key Factors That Influence Minimum Wage Levels

The minimum wage is not a static figure. It is a dynamic policy influenced by several economic, social, and political factors.

###

Geographic Location

This is the single most significant factor. A job in a rural town in a state with no minimum wage law will default to the $7.25 federal rate. That same job in Seattle, Washington, would command a minimum of $19.97 per hour due to city-level ordinances. High cost-of-living areas, typically major cities and states on the West Coast and in the Northeast, lead the country in setting higher minimum wages to reflect the financial pressures on their residents.

###

Cost of Living and Inflation

Many state and city laws now include provisions for annual cost-of-living adjustments (COLAs). This means the minimum wage is indexed to inflation, automatically increasing each year to keep pace with rising prices for goods and services. This is a key reason why wages in some states rise annually while the federal rate remains stagnant. For example, Washington's 2024 increase was a direct result of an inflation-based adjustment.

###

Political and Economic Debates

The level of the minimum wage is a subject of intense political debate. Proponents of higher wages, like those in the "Fight for $15" movement, argue it is essential for reducing poverty and stimulating the economy by increasing consumer spending power. Opponents often express concern that significant wage hikes could lead to job losses, particularly in small businesses, or cause price increases for consumers. This ongoing debate heavily influences legislation at all levels of government.

###

Industry and Tipped Status

As mentioned, tipped employees (such as restaurant servers, bartenders, and valets) can be paid a lower cash wage under federal law, provided their tips make up the difference to the full minimum wage. However, this is also dictated by location. Seven states, including California and Washington, have eliminated the tipped minimum wage entirely, requiring employers to pay all employees the full state minimum wage before tips. This provides significantly higher and more stable base earnings for workers in the service industry.

Job Outlook: The Future of the Minimum Wage

The outlook for the minimum wage points toward continued increases at the state and local levels, while the federal rate is likely to remain unchanged in the near term.

The trend of states taking the lead is expected to accelerate. More states are phasing in increases to reach a $15.00 per hour benchmark or higher over the next few years. Furthermore, the practice of indexing wages to inflation is gaining popularity, ensuring that wages don't lose purchasing power over time.

While there is ongoing discussion about raising the federal minimum wage, political gridlock has prevented any changes for over a decade. Therefore, the most significant developments will continue to happen in state legislatures and city councils, widening the gap between wages in different parts of the country.

Conclusion: Key Takeaways

For anyone tracking "salario mínimo 2024," the key is to look beyond the federal number. Here are the most important takeaways:

- Location is Everything: Your legal minimum earning potential is determined by your state and city, not the federal government.

- The Federal Rate is a Floor, Not a Standard: At $7.25, the federal rate serves as the lowest possible wage, but a growing majority of the U.S. workforce is covered by higher state-level minimums.

- The Trend is Upward: Fueled by advocacy, inflation, and high living costs, minimum wages are on a steady upward trajectory in many parts of the country.

- Know Your Rights: Whether you are a student with a part-time job or a full-time employee, it is essential to know the specific minimum wage for your location and to understand the rules regarding tipped status in your state.

Ultimately, while the minimum wage provides a crucial safety net, it should be viewed as a starting point. Building skills, gaining experience, and pursuing education remain the most effective strategies for advancing your career and increasing your earning potential far beyond this legal floor.

Sources:

- U.S. Department of Labor (DOL), "Minimum Wage."

- Economic Policy Institute (EPI), "Minimum wage tracker."

- National Conference of State Legislatures (NCSL), "State Minimum Wages."

- Salary.com and Glassdoor for general labor market analysis.