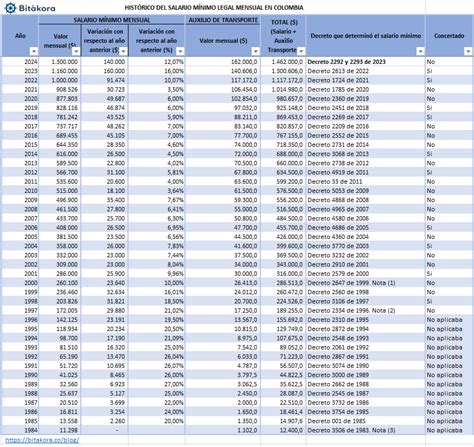

Understanding the Minimum Wage in Colombia (Salario Mínimo): A Comprehensive 2024 Guide

For anyone considering working in Colombia or seeking to understand the country's economic landscape, the national minimum wage—or *salario mínimo*—is a crucial benchmark. It serves as the foundation for the country's wage structure and directly impacts millions of workers. This guide breaks down the official 2024 minimum wage, the factors that influence take-home pay, and the broader economic context for this essential financial standard.

What is the "Salario Mínimo" in Colombia?

The *Salario Mínimo Legal Mensual Vigente (SMLMV)* is the legally mandated minimum monthly wage that a formal, full-time employee must receive in Colombia. It is a cornerstone of the nation's labor policy, designed to provide a baseline income level for workers.

This figure is not just a base salary; it's a reference point for various legal and commercial matters, including court fees, social housing eligibility, and penalties. Each year, the SMLMV is negotiated between government, business associations, and labor unions. If they cannot reach an agreement, the government sets the new rate by decree, adjusting for factors like the previous year's inflation.

The Official Minimum Wage in Colombia for 2024

In Colombia, the total minimum compensation package consists of two primary components: the base salary and a mandatory transportation subsidy for eligible employees.

According to the official decree set by the Colombian Ministry of Labor (*Ministerio del Trabajo*), the figures for 2024 are:

- Base Minimum Salary (SMLMV): $1,300,000 COP per month.

- Transportation Subsidy (*Auxilio de Transporte*): $162,000 COP per month. This subsidy is legally mandated for employees earning up to two times the SMLMV.

- Total Minimum Monthly Compensation: $1,462,000 COP per month.

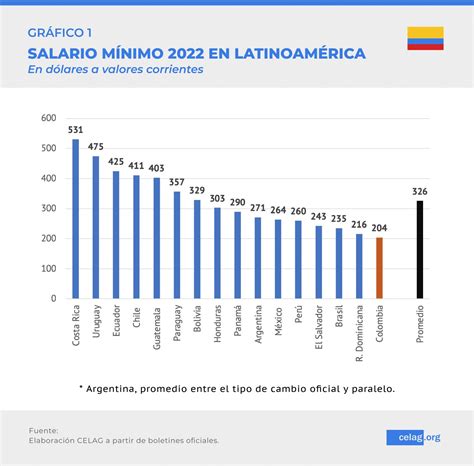

For context, using an exchange rate of approximately 4,000 COP to 1 USD, this total compensation is roughly $365 USD per month. It is crucial to note that currency exchange rates fluctuate daily.

Key Factors That Influence Your Take-Home Pay

While the headline number is $1,462,000 COP, the actual net income (take-home pay) for a minimum wage earner is affected by several legally mandated deductions and additions.

### Mandatory Legal Deductions

All employees in the formal sector must contribute to the national social security system. For a minimum wage earner, these deductions are calculated from the base salary of $1,300,000 COP:

- Health Insurance (*Salud*): 4% of the base salary. This amounts to a deduction of $52,000 COP.

- Pension Fund (*Pensión*): 4% of the base salary. This amounts to a deduction of $52,000 COP.

The total monthly deduction is $104,000 COP. Therefore, the net take-home pay for a minimum wage earner in the formal sector is typically $1,358,000 COP ($1,300,000 base + $162,000 subsidy - $104,000 deductions).

### Geographic Location and Cost of Living

The purchasing power of the minimum wage varies dramatically across Colombia. A salary of $1,358,000 COP goes much further in a smaller city or rural area than in major metropolitan hubs.

- Major Cities (Bogotá, Medellín, Cali): These cities have a significantly higher cost of living. According to cost-of-living aggregator Numbeo, rent for a one-bedroom apartment outside the city center in Bogotá can easily consume 50-70% of the net minimum wage.

- Smaller Cities (Pereira, Bucaramanga, Manizales): The cost of housing, transportation, and food is generally lower in these cities, allowing the minimum wage to stretch further.

### The Formal vs. Informal Economy

A critical factor in the Colombian labor market is the distinction between formal and informal employment.

- Formal Sector: Employees receive a formal contract, are guaranteed at least the SMLMV, receive the transportation subsidy, and are enrolled in the social security system. Employers also contribute to a severance fund (*cesantías*) and provide semi-annual bonuses (*prima de servicios*).

- Informal Sector: The World Bank and the Colombian National Administrative Department of Statistics (DANE) consistently report that a significant portion of Colombia's workforce operates in the informal economy. Workers in this sector often lack contracts, may earn less than the SMLMV, and do not receive legal benefits like social security, paid leave, or bonuses.

### Additional Compensation: Overtime and "Primas"

Formal employment includes opportunities to earn more than the base minimum wage.

- Overtime: Colombia has legally defined rates for work performed outside of standard hours, which can increase monthly earnings.

- *Prima de Servicios* (Service Bonus): This is a legally required bonus equivalent to 30 days of salary per year, paid in two installments (one in June, one in December). For a minimum wage earner, this translates to an extra half-month's salary paid at mid-year and year-end, providing a significant boost to annual income.

Economic Outlook and the Minimum Wage Discussion

The annual adjustment of the SMLMV is a major economic and political event in Colombia. Discussions revolve around finding a balance between protecting workers' purchasing power against inflation and avoiding a negative impact on employment.

Economists from institutions like the IMF and Colombia's central bank (*Banco de la República*) often analyze the potential effects of large minimum wage hikes on formal job creation and overall economic competitiveness. While a direct growth projection for "minimum wage jobs" isn't tracked by agencies like the U.S. Bureau of Labor Statistics (BLS), the health of sectors that heavily rely on minimum wage labor—such as retail, agriculture, and hospitality—is closely tied to Colombia's overall economic growth forecasts. For 2024, the OECD projects Colombia's GDP growth to be modest, which puts pressure on the labor market's ability to absorb higher wage costs.

Conclusion: Key Takeaways

Understanding the "salario minimo" in Colombia requires looking beyond a single number. For prospective professionals, students, and analysts, here are the key takeaways:

- The Official Figure: For 2024, the total minimum monthly compensation is $1,462,000 COP, which includes a base salary and a transportation subsidy.

- Net vs. Gross: After mandatory health and pension deductions, the typical take-home pay is approximately $1,358,000 COP.

- Location Matters: The real-world value of this wage depends heavily on the cost of living, which is significantly higher in major cities like Bogotá.

- Formal Benefits Are Key: Workers in the formal economy receive crucial benefits, including social security, paid leave, and semi-annual bonuses (*primas*), which are often absent in the large informal sector.

The *salario mínimo* is a vital social safety net and a central element of the Colombian economy, reflecting the ongoing dialogue between labor rights, inflation, and national productivity.