Introduction

For countless individuals and families across the Tar Heel State, the phrase "salario mínimo en Carolina del Norte" is more than just a number—it's the baseline for their economic reality. It's the starting block from which they build their lives, support their families, and pursue their dreams. Whether you're a student working a first job, a parent balancing multiple roles, or someone considering a move to North Carolina, understanding the nuances of the state's minimum wage is a critical first step in navigating its economic landscape. This guide is designed to be your definitive resource, moving beyond a simple statement of the hourly rate to explore the deeper context: the cost of living, the legal protections you have as a worker, and, most importantly, the tangible pathways to earning a sustainable, thriving wage in this dynamic state.

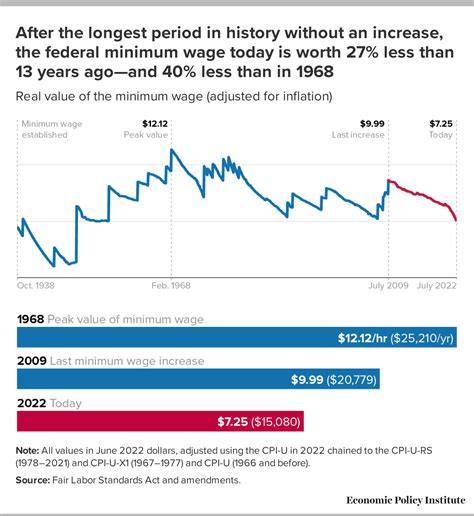

The current minimum wage in North Carolina is $7.25 per hour, a figure that has stood in line with the federal minimum wage since 2009. While this number provides a legal floor for compensation, it rarely tells the whole story. The true value of this wage is determined by what it can provide against the backdrop of housing, food, and healthcare costs. The average salary for all occupations in North Carolina is significantly higher, with data from the U.S. Bureau of Labor Statistics (BLS) showing a state mean wage of approximately $28.85 per hour or $60,010 per year as of May 2023. This gap highlights a crucial reality: while the minimum wage is the legal starting point, the state's economy offers vast opportunities for growth well beyond it.

I once mentored a young man working two minimum-wage jobs in Raleigh, feeling trapped by the cycle of living paycheck to paycheck. By focusing on a few specific, in-demand skills offered at a local community college, he was able to transition into a healthcare support role within a year, more than doubling his hourly wage. His story is a powerful testament that the minimum wage doesn't have to be a destination; it can be a temporary stop on a journey toward greater financial stability and career satisfaction.

This guide is built to provide you with the knowledge and tools to navigate that journey. We will dissect the legal framework of the minimum wage, analyze its purchasing power across the state, and lay out a clear, actionable roadmap for leveraging North Carolina's economic strengths to advance your career and income.

### Table of Contents

- [Understanding Minimum Wage in North Carolina: The Legal Framework](#understanding-minimum-wage-in-north-carolina-the-legal-framework)

- [The Real Value of the Minimum Wage: A Cost of Living Analysis](#the-real-value-of-the-minimum-wage-a-cost-of-living-analysis)

- [Pathways Beyond Minimum Wage: Key Factors for Increasing Your Income](#pathways-beyond-minimum-wage-key-factors-for-increasing-your-income)

- [Economic Landscape and Job Outlook in North Carolina](#economic-landscape-and-job-outlook-in-north-carolina)

- [A Practical Guide to Advancing Your Career in North Carolina](#a-practical-guide-to-advancing-your-career-in-north-carolina)

- [Conclusion](#conclusion)

---

Understanding Minimum Wage in North Carolina: The Legal Framework

To fully grasp the employment landscape in North Carolina, one must first understand the legal structure that governs wages. The "salario mínimo" is not just a suggested guideline; it is a legally mandated pay floor established by both federal and state law. Navigating this framework is the first step toward understanding your rights as an employee and the obligations of your employer.

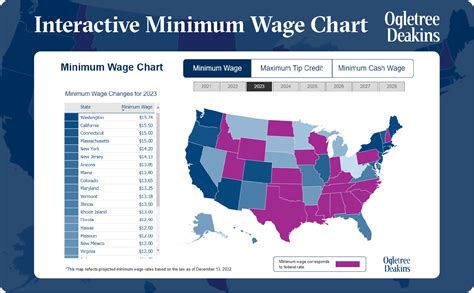

The primary law governing this area is the North Carolina Wage and Hour Act (NCWHA). This state-level legislation sets the standards for minimum wage, overtime pay, record-keeping, and youth employment. Critically, the NCWHA aligns its primary minimum wage rate with the federal Fair Labor Standards Act (FLSA). This means that as of 2024, North Carolina’s minimum wage is $7.25 per hour. If the federal minimum wage were to increase, North Carolina's rate would automatically rise to match it.

Who Is Covered by the Minimum Wage?

The vast majority of employees in North Carolina are covered by this law. If an employer is subject to the FLSA, they must pay the federal minimum wage. The FLSA applies to businesses with annual sales of $500,000 or more, as well as smaller companies engaged in "interstate commerce." In today's interconnected world, nearly every business is considered to be engaged in interstate commerce, whether by processing credit card transactions, shipping goods, or using the internet. The NCWHA further extends coverage to many employers not covered by the FLSA, making coverage nearly universal.

However, there are specific and important exemptions. According to the North Carolina Department of Labor, some categories of workers who may be exempt from the minimum wage include:

- Tipped Employees: This is the most common and significant exception.

- Family Members: Individuals employed by their parents, spouses, or children.

- Agricultural Workers: Certain farm laborers have different wage rules.

- "White Collar" Exemptions: Salaried executive, administrative, and professional employees who meet specific duty and salary tests.

- Seasonal and Recreational Workers: Employees of certain seasonal amusement or recreational establishments.

- Some Trainees and Interns: Under very specific criteria, certain learners and apprentices may be paid a subminimum wage for a limited time.

A Deeper Look: The Tipped Minimum Wage

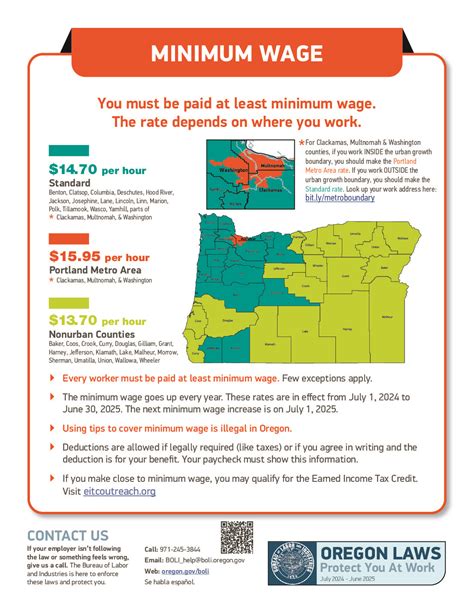

One of the most complex areas of wage law involves tipped employees, such as restaurant servers, bartenders, and valets. North Carolina law allows employers to pay a significantly lower direct cash wage to these workers, provided that the employee's tips bring their total hourly earnings up to at least the full minimum wage of $7.25 per hour.

- The Tipped Minimum Wage: The direct cash wage an employer must pay a tipped employee is $2.13 per hour.

- The Tip Credit: The employer can then take a "tip credit" of up to $5.12 per hour ($7.25 - $2.13). This is not money the employer takes; it is the amount of tips the employee must earn to reach the full minimum wage.

- Employer's Responsibility: If an employee’s tips combined with their direct cash wage of $2.13 do not average at least $7.25 per hour for a given workweek, the employer is legally required to make up the difference.

This system places a heavy reliance on customer tipping and requires diligent record-keeping from both the employee and employer to ensure compliance.

A Day in the Life: The Minimum Wage Reality

To make this concrete, let's imagine "Alex," a full-time retail associate at a clothing store in a North Carolina suburb. Alex's role is governed by the $7.25 per hour minimum wage.

- 8:45 AM: Alex arrives, clocks in, and begins morning tasks: tidying shelves, checking stock levels in the backroom, and preparing the cash register.

- 10:00 AM: The store opens. Alex's day is now a mix of greeting customers, answering questions about products, operating the point-of-sale system for purchases and returns, and directing shoppers to fitting rooms.

- 1:00 PM: Alex takes a mandatory 30-minute unpaid lunch break. At $7.25/hour, a 40-hour work week yields a gross income of $290, or approximately $1,257 per month before taxes and deductions.

- 1:30 PM: The afternoon involves more customer interaction, restocking items left in fitting rooms, and helping with a new shipment of inventory, which involves unboxing, tagging, and placing items on the floor.

- 5:15 PM: As the shift ends, Alex does a final clean-up of their assigned section and cashes out their register, ensuring the total matches the day's sales records. Alex clocks out, having completed an 8-hour shift, earning a gross total of $58 for the day.

This snapshot illustrates the duties involved in many minimum-wage positions. While essential to the functioning of the business, the financial reality of this wage level presents significant challenges, which we will explore in the next section.

---

The Real Value of the Minimum Wage: A Cost of Living Analysis

Stating the minimum wage as "$7.25 per hour" is a simple fact. Understanding its actual purchasing power in the modern North Carolina economy is a much more complex and vital exercise. A wage is only as valuable as what it can buy. In this section, we'll conduct a deep dive into the cost of living across the state to determine the real-world value of the minimum wage and establish a more realistic "living wage."

A full-time employee working 40 hours a week, 52 weeks a year, at the minimum wage of $7.25 per hour will earn a gross annual income of $15,080. After factoring in federal and state income taxes, FICA taxes (Social Security and Medicare), this net take-home pay is closer to $13,500 - $14,000 per year, depending on filing status.

Now, let's compare this income to the actual cost of living in North Carolina. For this, we will turn to one of the most authoritative sources on the topic: the MIT Living Wage Calculator. This tool calculates the hourly rate an individual must earn to support themselves or their family, meeting basic needs while remaining self-sufficient. It is not a "luxury" wage; it covers essentials like food, childcare, health insurance, housing, transportation, and other necessities.

Living Wage vs. Minimum Wage in North Carolina (2023 Data)

The MIT Living Wage Calculator provides a stark contrast to the legal minimum wage. Here's a look at the calculated living wage for a single adult with no children in various North Carolina metropolitan areas:

| Metropolitan Area | Required Living Wage (Hourly) | Annual Income Needed (before tax) | Minimum Wage Shortfall (Annual) |

| ----------------------- | ----------------------------- | --------------------------------- | ------------------------------- |

| Statewide Average | $21.79 | $45,323 | $30,243 |

| Charlotte-Concord-Gastonia | $23.10 | $48,048 | $32,968 |

| Raleigh-Cary | $23.36 | $48,589 | $33,509 |

| Asheville | $22.42 | $46,634 | $31,554 |

| Durham-Chapel Hill | $23.79 | $49,483 | $34,403 |

| Wilmington | $21.57 | $44,866 | $29,786 |

| Greensboro-High Point | $20.73 | $43,118 | $28,038 |

| Fayetteville | $19.66 | $40,893 | $25,813 |

*Source: MIT Living Wage Calculator, data retrieved for 2023.*

The data is unequivocal: in every major metropolitan area of North Carolina, the legal minimum wage of $7.25 per hour falls dramatically short of a living wage for even a single adult. In the state's economic hubs like Raleigh and Charlotte, the minimum wage covers only about 31% of what is needed to meet basic living expenses. For a single parent with one child, the required living wage in Raleigh jumps to $41.52 per hour, making the gap even more immense.

Breaking Down the Budget on a Minimum Wage Income

Let's dissect a monthly budget for our full-time minimum wage earner, "Alex," who has a net monthly income of approximately $1,150. We'll use statewide averages for costs.

- Housing: According to Salary.com (data accessed 2024), the median rent for a 1-bedroom apartment in North Carolina is around $1,200 per month. For a studio, it's about $1,100. This single expense immediately exceeds the entire net monthly income of a minimum wage worker. The only viable options are finding multiple roommates or securing subsidized housing, which often has long waiting lists.

- Food: The USDA's "Thrifty Food Plan" (as of late 2023) estimates a minimum food cost of about $300 per month for a single adult. This assumes all meals are prepared at home with low-cost ingredients.

- Transportation: The MIT Calculator estimates monthly transportation costs for a single adult in North Carolina to be around $450. This covers car payments, insurance, gas, and maintenance. Relying on public transit, where available, can reduce this, but it is not an option in many parts of the state.

- Healthcare: Even with a subsidized plan through the ACA marketplace, monthly premiums, deductibles, and co-pays can easily amount to $150-$250 per month or more.

- Utilities & Internet: Electricity, water, and a basic internet connection can conservatively add another $150 per month.

Total Estimated Monthly Expenses: $1,100 (housing) + $300 (food) + $450 (transportation) + $200 (healthcare) + $150 (utilities) = $2,200.

This basic budget of $2,200 per month is nearly double the $1,150 net monthly income from a full-time minimum wage job. This analysis reveals why so many individuals working for minimum wage must rely on multiple jobs, public assistance programs, or the support of family members to survive. It also powerfully underscores why understanding the pathways to earning *more* than the minimum wage is not just a matter of career ambition, but of economic necessity.

---

Pathways Beyond Minimum Wage: Key Factors for Increasing Your Income

While the legal minimum wage creates a challenging economic floor, it is crucial to view it as a starting point, not a career destination. North Carolina's diverse and growing economy offers numerous avenues for financial advancement. Your ability to increase your earnings hinges on a set of key factors: your education, your experience, your location, the type of company you work for, and the specific skills you possess. This section provides a detailed roadmap for how to strategically leverage these factors to move significantly beyond the $7.25 per hour benchmark.

###

Level of Education

Education remains one of the most powerful and reliable levers for increasing earning potential. Each step up the educational ladder unlocks access to higher-paying jobs and entirely new career fields.

- High School Diploma or GED: This is the foundational requirement for moving beyond the most basic entry-level jobs. Earning a diploma or its equivalent is the single most important first step. According to the BLS, workers with only a high school diploma nationally earn a median of over $850 per week, substantially more than a minimum wage earner.

- Vocational Training and Certifications: This is often the fastest route to a higher wage. Programs offered by North Carolina's robust Community College System can be completed in months, not years. Certifications in fields like Welding, HVAC Repair, Certified Nursing Assistant (CNA), or Commercial Driver's License (CDL) can immediately qualify you for jobs paying $20 to $30 per hour or more. For example, Payscale reports the average hourly wage for a CNA in North Carolina is around $15-$16, and for an HVAC technician, it's over $25 per hour.

- Associate's Degree (A.A., A.S.): A two-year degree from a community college opens doors to technical and paraprofessional roles. Fields like Information Technology (IT Support), Medical Assisting, Paralegal Studies, and Advanced Manufacturing have strong demand in North Carolina. According to Salary.com, an IT Support Technician in Raleigh with an associate's degree can expect to start in the $50,000-$60,000 range per year ($24-$29 per hour).

- Bachelor's Degree (B.A., B.S.): A four-year degree is the gateway to professional careers in business, finance, engineering, healthcare, and technology. The earning differential is significant. The BLS reports that the median weekly earnings for bachelor's degree holders are nearly double those of high school graduates. In North Carolina, graduates from the UNC system or private universities are highly sought after in sectors like finance in Charlotte and tech in the Research Triangle Park, with starting salaries often exceeding $65,000 per year.

###

Years of Experience

Even if formal education isn't an immediate option, accumulating experience—and learning to articulate its value—is a powerful tool for wage growth.

- Entry-Level (0-2 years): In this stage, the focus is on mastering core job functions and demonstrating reliability, a strong work ethic, and a willingness to learn. Many jobs may start at or near minimum wage, but even a year of solid performance can justify a raise or a move to a slightly higher-paying competitor.

- Mid-Career (2-8 years): After a few years, you are no longer just a worker; you are an experienced team member. You can leverage this experience to move into supervisory or training roles. A retail associate might become a Shift Lead or Assistant Manager, with pay increasing to the $15-$20 per hour range. Your goal is to transition from "doing the work" to "overseeing the work."

- Senior/Experienced (8+ years): With significant experience, you can move into management roles (e.g., Store Manager, Operations Manager) or become a specialized individual contributor. Your deep industry knowledge becomes your primary asset. At this level, salaries are highly variable but are typically in the professional range of $60,000+ per year, far removed from the minimum wage.

The salary aggregator Payscale.com illustrates this trajectory well. An entry-level retail sales associate might earn close to minimum wage, but a Retail Store Manager in North Carolina with 5-9 years of experience earns an average base salary of over $55,000 per year.

###

Geographic Location

While the *state* minimum wage is uniform, the *de facto* minimum wage—what companies actually pay for entry-level labor—varies significantly based on the local cost of living and labor market demand.

- High-Paying Urban Centers (Charlotte, Raleigh, Durham): In these major economic hubs, the competition for workers is fierce, and the cost of living is high. Consequently, many large employers and even small businesses must offer a starting wage well above $7.25 to attract and retain talent. It is common to see entry-level positions in retail, food service, and logistics in these cities advertised at $12 to $16 per hour.

- Mid-Tier Cities (Greensboro, Winston-Salem, Wilmington): These areas have solid economies but a more moderate cost of living. Starting wages here may be slightly lower than in the major hubs but are still typically above the legal minimum, often in the $10 to $14 per hour range.

- Rural Areas: In more rural parts of the state, where the cost of living is lower and there are fewer employers, wages for unskilled labor are most likely to hover at or very near the $7.25 legal minimum. Career advancement in these areas often requires developing a specialized skill (like a trade) or commuting to a nearby urban center.

###

Company Type & Size

The type of organization you work for has a massive impact on your starting wage and benefits.

- Large Corporations: Many national and multinational corporations with a presence in North Carolina have established their own corporate minimum wage that is significantly higher than the federal mandate.

- Bank of America (headquartered in Charlotte) raised its minimum wage to $23 per hour in 2023, with plans to reach $25.

- Target and Costco have nationwide starting wages of $15 per hour and $17 per hour, respectively.

- Amazon facilities across North Carolina also typically start at $15 per hour or more.

Working for one of these large companies is one of the most direct ways to immediately earn double the state minimum wage in an entry-level role.

- Startups and Small Businesses: Pay at these companies can be highly variable. Tech startups in the Research Triangle may offer competitive wages to attract talent, while a small, family-owned shop in a rural town may only be able to afford the legal minimum.

- Government and Non-Profits: State and municipal government jobs in North Carolina often have a higher pay floor than the private sector minimum. For example, in 2023, the State of North Carolina set a minimum wage of $15 per hour for all state agency employees. Non-profits' pay scales vary widely depending on their size and funding.

###

Area of Specialization / Industry

Moving from a general labor role into a specific, in-demand industry is a key strategy for growth. North Carolina has several thriving sectors with strong demand for skilled and semi-skilled workers.

- Healthcare Support: As the population ages, demand for roles like Certified Nursing Assistants (CNAs), Medical Assistants, and Phlebotomists is booming. These roles often require a short certification program and offer starting wages in the $15-$20 per hour range.

- Skilled Trades: There is a critical shortage of skilled trade professionals. Electricians, plumbers, welders, and HVAC technicians are in high demand across the state. Apprenticeship programs allow you to earn while you learn, and experienced tradespeople can earn $60,000 to over $100,000 per year.

- Manufacturing and Logistics: North Carolina is a hub for advanced manufacturing and distribution. Roles like forklift operators, machine operators, and logistics coordinators often start in the $16-$22 per hour range and offer clear paths for advancement.

- Information Technology (IT): Even entry-level IT roles, such as help desk support, offer a significant pay bump over the minimum wage. A CompTIA A+ certification can be the entry ticket to a job starting at $45,000-$50,000 per year.

###

In-Demand Skills

Regardless of your industry, developing specific, marketable skills will always increase your value as an employee.

- Technical Skills:

- Bilingualism (especially Spanish): In customer-facing roles, being bilingual can command a higher hourly wage or a "language differential" bonus.

- Software Proficiency: Expertise in common business software (e.g., Microsoft Office Suite, especially Excel), point-of-sale systems, or industry-specific software (e.g., QuickBooks, Salesforce) is highly valued.

- Data Entry/Typing Speed: Demonstrating high speed and accuracy can open doors to administrative and clerical roles paying above minimum wage.

- Soft Skills:

- Customer Service: The ability to effectively de-escalate situations and create positive customer experiences is a skill that can lead to supervisory roles.

- Communication: Clear verbal and written communication is essential for advancing into team lead or management positions.

- Problem-Solving: Proactively identifying and solving problems, rather than just waiting for instructions, makes you an invaluable asset to any team.

By consciously focusing on these six factors, a worker in North Carolina can architect a career path that systematically moves them from the legal minimum wage toward a true living wage and beyond.

---

Economic Landscape and Job Outlook in North Carolina

Understanding the broader economic currents and future job market trends in North Carolina is essential for anyone planning a long-term career in the state. Simply put, it's easier to advance your career in a growing industry than in a declining one. Fortunately, North Carolina boasts one of the most robust and dynamic economies in the United States, with a positive outlook for job growth in several key sectors over the next decade.

According to the North Carolina Department of Commerce, the state is projected to add over 400,000 new jobs between 2021 and 2030. This growth is not evenly distributed; it is concentrated in specific industries that offer significant opportunities for workers currently at or near the minimum wage to transition into more lucrative and stable careers. The U.S. Bureau of Labor Statistics (BLS) provides complementary data, consistently ranking North Carolina as a top state for business and job growth.

High-Growth Sectors in North Carolina

Let's examine the specific industries projected to see the most significant job growth, providing a strategic map for career advancement.

1. Healthcare and Social Assistance: This is, by far, the largest and fastest-growing sector in the state. Driven by an aging population and the state's status as a healthcare hub, this industry is expected to add tens of thousands of jobs.

- Key Roles: Registered Nurses (RNs), Nursing Assistants, Medical Assistants, Home Health and Personal Care Aides, and Physical Therapists.

- Outlook: The BLS projects a 13% growth for healthcare support occupations nationally through 2032. North Carolina's growth is expected to meet or exceed this rate. A Personal Care Aide, an entry-level role with minimal formal education requirements, has a median pay of around $14.50 per hour ($30,180/year), according to the BLS. This offers a clear step up from minimum wage, with further opportunities to become a Certified Nursing Assistant (CNA) or Medical Assistant for higher pay.

2. Professional, Scientific, and Technical Services: This sector is the engine of North Carolina's "knowledge economy," centered heavily around the Research Triangle Park (Raleigh-Durham-Chapel Hill) and Charlotte's financial tech scene.

- Key Roles: Software Developers, Computer and Information Systems Managers, Management Analysts, Market Research Analysts.

- Outlook: This is a high-wage, high-growth sector. While many roles require a bachelor's degree, there are entry points. For instance, the demand for Computer User Support Specialists is strong, with a median pay of $59,660 per year ($28.68/hour) according to the BLS. This career can be entered with an associate's degree or industry certifications like CompTIA A+.

3. Construction and Skilled Trades: A booming population and continuous business investment have created immense demand for construction and skilled trades.

- Key Roles: Carpenters, Electricians, Plumbers, HVAC Technicians, Construction Laborers.

- Outlook: The need for skilled trades is critical, leading to high wages and strong job security. While a "Construction Laborer" starts at a higher-than-minimum wage (median pay of $40,750/year or $19.59/hour per BLS),