Understanding "Salary in Lieu of Notice": A Guide for Professionals

Have you ever seen the phrase "salary in lieu of notice" in an employment contract or a severance package and wondered what it meant? While it might sound complex, it's a straightforward and important concept in the professional world. Understanding it is crucial, as it can significantly impact your finances and career transitions.

This guide will break down exactly what salary in lieu of notice is, how it's calculated, and the key factors that determine the amount you might receive.

What is Salary in Lieu of Notice?

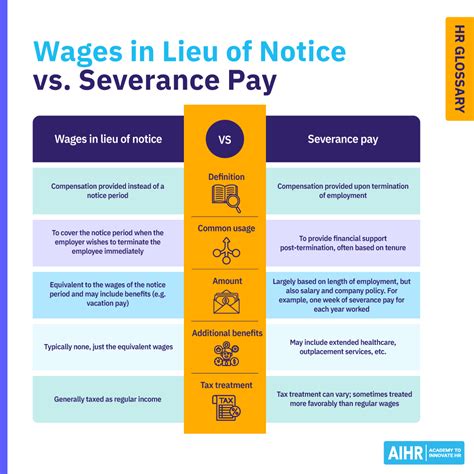

Salary in lieu of notice is a compensation payment an employer makes to an employee for a notice period that they are not required to work. The term "in lieu" simply means "in place of" or "instead of."

Typically, when an employee resigns or an employer terminates their employment, the employment contract specifies a notice period (e.g., two weeks, one month). During this time, the employee continues to work and receive their regular salary.

However, in certain situations, an employer may prefer for the employee's departure to be immediate. This could be due to access to sensitive company data, a potential conflict of interest, or simply to make a clean break during a restructuring. In these cases, the employer pays the employee the salary they *would have earned* during that notice period, effectively buying out the time. The employee's job ends immediately, but they are compensated for the notice they were contractually owed.

How is Salary in Lieu Calculated?

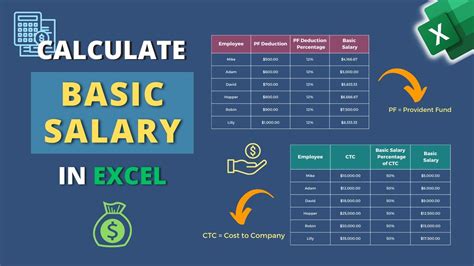

The calculation for salary in lieu of notice is generally based on the compensation the employee would have received if they had worked through their notice period.

The core component is base salary. For example:

- Scenario: An employee earns an annual salary of $78,000 and has a one-month notice period.

- Monthly Salary: $78,000 / 12 = $6,500.

- Salary in Lieu Payment: The employer would pay them $6,500.

In addition to base salary, the calculation may also include other forms of compensation that would have been earned during the notice period, such as:

- Prorated bonuses or commissions

- Value of benefits like health insurance contributions

- Car allowance or other regular stipends

Important Note: The specifics of the calculation are almost always dictated by the employment contract and company policy.

Key Factors That Influence the Payment Amount

The amount of money received as salary in lieu is not arbitrary. It is determined by a combination of legal agreements, company policies, and individual circumstances.

Employment Contract & Company Policy

This is the most critical factor. Your employment agreement should explicitly state the length of your notice period. Some contracts also have a "payment in lieu of notice" clause that details exactly how such a payment would be handled. If it’s not in the contract, it may be covered in the company's official employee handbook or redundancy policy. Without a contractual obligation, an employer is often not required to offer it, though many do as a standard practice during layoffs.

Years of Service

In many companies, especially for roles without a specific contractual notice period, a common rule of thumb is to offer one to two weeks of notice (or pay in lieu) for every year of service. This is particularly common in severance packages during large-scale layoffs. A ten-year veteran of the company will almost certainly receive a more substantial payment than someone who has been there for only one year.

Job Level and Base Salary

Naturally, the higher your base salary, the larger the payment will be. A senior executive with a $250,000 annual salary and a three-month notice period will receive a significantly larger payout ($62,500) than a junior analyst with a $60,000 salary and a two-week notice period (approx. $2,300). Senior-level roles often have longer contractual notice periods, further amplifying the total amount.

Geographic Location (State and Local Laws)

While the U.S. does not have a federal law mandating notice periods for all employees, some laws can influence the situation. The federal Worker Adjustment and Retraining Notification (WARN) Act requires employers with 100 or more employees to provide 60 days' advance notice of mass layoffs or plant closings. If they fail to provide this notice, they must pay affected employees their wages for those 60 days. This is a form of payment in lieu of notice enforced by federal law. Some states have their own "mini-WARN" acts with different requirements.

Reason for Termination

The context of the departure is key.

- Layoff/Redundancy: Salary in lieu is most common in these scenarios, where the company is eliminating the position for business reasons. It's often part of a larger severance package intended to create goodwill and protect the company from legal action.

- Termination for Cause: An employee fired for gross misconduct (e.g., theft, harassment, major policy violation) is typically not entitled to a notice period or payment in lieu.

- Mutual Agreement: Sometimes, an employer and employee mutually agree to part ways. In this case, a payment in lieu of notice can be a key part of the negotiated separation agreement.

Tax Implications of Salary in Lieu

It is critical to understand that salary in lieu of notice is not a tax-free gift. According to the IRS, these payments are considered wages and are subject to the same income and payroll taxes (Social Security, Medicare) as your regular paycheck. Your former employer will withhold these taxes just as they normally would.

Conclusion: Key Takeaways for Your Career

Understanding "salary in lieu of notice" empowers you to better navigate your career, especially during job changes or contract negotiations.

Here are the essential points to remember:

- It's a Payment, Not a Job: It is compensation for a notice period you do not work.

- The Contract is King: Your employment agreement is the primary document that determines your entitlement to and the amount of the payment. Always read it carefully.

- Multiple Factors Apply: Your seniority, salary, years with the company, and the reason for your departure all influence the final amount.

- It's Taxable Income: Plan for tax withholdings on any payment you receive.

When faced with a job offer or a separation agreement, pay close attention to the clauses regarding the notice period and payment in lieu. If the terms are unclear or you believe you are being treated unfairly, it is always wise to consult with an employment lawyer or a financial advisor to understand your rights and options.