Navigating the complexities of wages, job markets, and cost of living can be a daunting task, especially in a state as vast and economically diverse as Texas. For millions of workers, the starting point of this financial journey is the legal wage floor: the *salario mínimo*. But what does this figure truly mean for your daily life and career potential? It's not just a number on a government poster; it's the foundation upon which livelihoods are built, a critical factor in business operations, and a subject of intense economic debate. Understanding the minimum wage in Texas is the first step toward financial literacy and career empowerment, whether you're entering the workforce for the first time, supporting your family on an hourly wage, or running a business that employs entry-level talent.

The reality is that while the official "salario mínimo en texas" is set at a specific rate, the actual take-home pay for workers in entry-level and service positions varies significantly across the state. The true earning potential is a dynamic figure shaped by location, industry, company policy, and individual skill. In this comprehensive guide, we will move beyond the simple legal definition to provide a deep, authoritative analysis of the Texas wage landscape. We will explore not only the law itself but also the real-world salaries for common jobs, the key factors that can increase your hourly rate, and actionable strategies for advancing beyond a minimum-wage role. I once mentored a young individual working two fast-food jobs in Houston who felt trapped by their hourly rate; by focusing on developing specific customer service and inventory skills, they were able to transition into a shift lead position within six months, significantly boosting their income and career prospects. This guide is built on that same principle: knowledge and strategy are the keys to unlocking your earning potential.

### Table of Contents

- [Understanding the Salario Mínimo en Texas: The Law and Its Implications](#understanding-the-salario-mínimo-en-texas-the-law-and-its-implications)

- [Beyond the Minimum: A Deep Dive into Real-World Earnings in Texas](#beyond-the-minimum-a-deep-dive-into-real-world-earnings-in-texas)

- [Key Factors That Influence Your Hourly Wage in Texas](#key-factors-that-influence-your-hourly-wage-in-texas)

- [Job Outlook and Growth in Texas's Low-Wage Sectors](#job-outlook-and-growth-in-texass-low-wage-sectors)

- [How to Increase Your Earnings Beyond the Minimum Wage](#how-to-increase-your-earnings-beyond-the-minimum-wage)

- [Conclusion: Taking Control of Your Financial Future in the Lone Star State](#conclusion-taking-control-of-your-financial-future-in-the-lone-star-state)

Understanding the Salario Mínimo en Texas: The Law and Its Implications

At its core, the concept of a "minimum wage" is a legal mandate that establishes the lowest hourly, daily, or monthly remuneration that employers may legally pay to workers. It serves as a protective floor, designed to prevent exploitation and ensure that employees receive a baseline level of compensation for their labor. In the United States, this is governed by both federal and state laws.

As of 2024, Texas does not have its own state-specific minimum wage law. Therefore, the state defaults to the federal minimum wage as established by the Fair Labor Standards Act (FLSA).

- Current Federal Minimum Wage: $7.25 per hour

This rate has been in effect since July 24, 2009. This means that for the vast majority of employees in Texas, the legal minimum they can be paid is $7.25 per hour. It is crucial to understand that this is a *floor*, not a ceiling. Employers are free—and often encouraged by market forces—to pay more than this rate, and many do.

### Who Is Covered by the Minimum Wage?

The FLSA applies to employees of enterprises that have an annual gross volume of sales made or business done of at least $500,000. It also covers employees of smaller firms if they are engaged in interstate commerce or in the production of goods for commerce. This includes employees who work on or produce goods for the internet or who handle credit card transactions, as these are considered forms of interstate commerce. Furthermore, the law covers all employees of federal, state, and local government agencies, hospitals, and schools. Domestic service workers (such as housekeepers, full-time babysitters, and cooks) are also typically covered.

In practical terms, this means that nearly all workers in Texas are covered by the federal minimum wage law.

### Key Exemptions and Special Cases

While the $7.25 rate is the general rule, there are critical exceptions and sub-minimum wage categories that workers and employers must be aware of:

1. Tipped Employees: This is one of the most significant exceptions in Texas, a state with a massive hospitality and service industry. Under the FLSA, employers can pay a "tipped employee" a direct cash wage of as little as $2.13 per hour. A tipped employee is defined as someone who customarily and regularly receives more than $30 per month in tips.

However, there's a crucial catch: the employer must be able to show that the employee's direct cash wage ($2.13/hour) combined with their tips equals at least the federal minimum wage ($7.25/hour). This is known as the "tip credit." If the combined total does not reach $7.25 per hour in any given workweek, the employer is legally required to make up the difference.

2. Youth Minimum Wage: The FLSA allows employers to pay a youth minimum wage of $4.25 per hour to employees under the age of 20. This special rate is only applicable for the first 90 consecutive calendar days of employment. After 90 days, or once the employee turns 20 (whichever comes first), the employer must pay them the full federal minimum wage of $7.25 per hour.

3. Student Learners: Full-time students employed in vocational training programs (student-learners) or those employed by certain colleges and universities may be paid not less than 75% of the minimum wage ($5.44 per hour) under special certificates issued by the Department of Labor.

4. Workers with Disabilities: Section 14(c) of the FLSA authorizes employers, after receiving a certificate from the Wage and Hour Division, to pay sub-minimum wages to workers who have disabilities for the work being performed. This is a complex and often controversial provision intended to stimulate employment opportunities for individuals with disabilities.

### A "Day in the Life" of a Minimum Wage Earner in Texas

To make this tangible, let's consider a hypothetical "Day in the Life" for a new retail associate at a small, independent shop in a rural Texas town, earning the federal minimum wage.

- 7:30 AM: Wake up. The commute is 25 minutes, and gas prices are a major budget consideration. A full-time, 40-hour week at $7.25 per hour equals a gross income of $290 per week, or about $1,257 per month before taxes.

- 9:00 AM - 1:00 PM: The morning shift begins. Responsibilities include stocking shelves, organizing merchandise, running the cash register, and providing customer service. The work is physically demanding, requiring constant standing and occasional heavy lifting.

- 1:00 PM - 1:30 PM: An unpaid 30-minute lunch break. The choice is between a pre-packed meal from home to save money or buying lunch, which can cost more than an hour's wages.

- 1:30 PM - 5:30 PM: The afternoon shift continues. Tasks might include cleaning the store, processing returns, and preparing for closing. Maintaining a positive and helpful attitude with customers is a key job requirement, regardless of personal stress or fatigue.

- 6:00 PM: Arrive home. After a full day of work, the gross earnings are $58. This amount must cover rent, utilities, groceries, transportation, and all other living expenses. In most Texas cities, this daily wage would not be enough to cover the average daily cost of living, highlighting the growing gap between the minimum wage and a "living wage."

This example illustrates that the role of a minimum wage worker is not simply "unskilled labor." It requires a host of soft skills—reliability, customer service, time management, physical stamina—all for a wage that presents significant financial challenges.

Beyond the Minimum: A Deep Dive into Real-World Earnings in Texas

While the legal *salario mínimo* in Texas is $7.25 per hour, a critical analysis of the labor market reveals that this figure is more of a theoretical floor than a practical reality for a large portion of the workforce. Market forces, competition for labor, and corporate policies have pushed the effective starting wage for many entry-level jobs above the federal minimum. However, this varies dramatically by industry, company, and location.

According to the U.S. Bureau of Labor Statistics (BLS), in 2022, only about 1.3% of hourly paid workers in Texas earned wages at or below the federal minimum wage. This statistic can be misleading. It doesn't mean that everyone else is earning a high wage; rather, it indicates that the market has naturally set a slightly higher, albeit still low, baseline. Many jobs that were once "minimum wage jobs" now start at $9, $10, or even $12 per hour due to the need to attract and retain employees.

The conversation in Texas, especially in its booming urban centers, has shifted from the *minimum wage* to the *living wage*. A living wage is the theoretical income level that allows an individual or family to afford adequate shelter, food, and other necessities. The MIT Living Wage Calculator is an excellent resource for this. For example, in 2023, the calculated living wage for a single adult with no children was:

- Travis County (Austin): $20.93 per hour

- Harris County (Houston): $18.25 per hour

- Dallas County (Dallas): $18.92 per hour

- Bexar County (San Antonio): $17.07 per hour

Clearly, there is a massive chasm between the legal minimum of $7.25 and the amount needed to live comfortably in Texas's major metropolitan areas. This disparity is the central challenge for low-wage workers in the state.

### Real-World Salary Brackets for Common Low-Wage Jobs in Texas

Let's examine what people in common entry-level and service industry jobs *actually* earn in Texas. The data below is aggregated from sources like the BLS, Salary.com, Glassdoor, and Payscale, reflecting typical pay ranges as of late 2023 and early 2024.

Comparison Table: Typical Hourly Wages for Low-Wage Jobs in Texas (2024)

| Job Title | Entry-Level Hourly Wage (Bottom 10%) | Average Hourly Wage (Median) | Experienced Hourly Wage (Top 10%) | Authoritative Source(s) |

| :--- | :--- | :--- | :--- | :--- |

| Fast Food Worker | $9.50 - $11.00 | $12.50 | $15.00+ | Payscale, BLS |

| Retail Sales Associate / Cashier | $10.00 - $12.00 | $14.15 | $17.50+ | Salary.com, BLS |

| Restaurant Server (Tipped) | $2.13 - $5.00 (plus tips) | N/A (Highly variable) | N/A (Highly variable) | FLSA, Glassdoor |

| Home Health Aide | $10.50 - $12.00 | $13.25 | $16.00+ | BLS, Payscale |

| Hotel Front Desk Clerk | $11.00 - $13.00 | $14.75 | $18.00+ | Salary.com, Glassdoor |

| Warehouse Worker / Package Handler | $14.00 - $16.00 | $17.80 | $22.00+ | BLS, Indeed |

| Janitor / Cleaner | $11.00 - $12.50 | $14.05 | $17.00+ | BLS, Salary.com |

| Barista | $10.00 - $12.00 (plus tips) | $13.50 (plus tips) | $16.00+ (plus tips) | Payscale |

| Security Guard | $12.00 - $14.50 | $16.20 | $20.00+ | BLS |

*Note on Server Wages:* The total earnings for servers are incredibly variable, depending on the restaurant's price point, location, shift, and the individual's skill. An effective server at a high-end steakhouse in Dallas could potentially earn an equivalent of $40-$50 per hour or more in tips, while a server at a small-town diner might struggle to consistently break $15 per hour.

### Breakdown of Compensation Components

For low-wage workers, "salary" is almost always calculated on an hourly basis. Total compensation, however, can include more than just the base wage.

- Base Hourly Wage: The guaranteed rate of pay for each hour worked. As shown above, this is often higher than the legal minimum.

- Overtime Pay: Under the FLSA, non-exempt employees must be paid 1.5 times their regular rate of pay for all hours worked over 40 in a workweek. For a worker earning $12/hour, the overtime rate would be $18/hour.

- Tips: For service workers, tips often constitute the majority of their income. This income is less stable and predictable than a fixed hourly wage.

- Bonuses: While less common for entry-level hourly roles, some companies, particularly in retail and warehousing, may offer performance bonuses, attendance bonuses, or sign-on bonuses to attract talent in a tight labor market. For example, Amazon warehouses frequently offer sign-on bonuses during peak seasons.

- Benefits: This is a major differentiator. While a small business paying $10/hour might not offer benefits, a large corporation like Target or H-E-B paying $15/hour or more often provides access to health insurance, retirement plans (like a 401(k)), and paid time off. The value of these benefits can be equivalent to several extra dollars per hour in total compensation.

Understanding these components is key. A job offer at $14/hour with no benefits might be less valuable than a job at $13/hour with comprehensive health insurance and paid vacation days. Aspiring workers must learn to evaluate the entire compensation package, not just the headline hourly rate.

Key Factors That Influence Your Hourly Wage in Texas

The single most important takeaway for anyone navigating the Texas job market is that the $7.25 minimum wage is not your destiny. It is a legal starting line. Numerous factors can significantly increase your earning power, even without a college degree. Mastering these factors is the difference between being stuck at a base-level wage and building a path toward financial stability. This section provides an exhaustive breakdown of what truly drives hourly wages in the Lone Star State.

###

1. Geographic Location: The Urban vs. Rural Wage Divide

Location is arguably the most powerful factor influencing wages in Texas. The state's sheer size creates distinct economic ecosystems with vastly different costs of living and corresponding pay scales. A wage that is considered competitive in East Texas might be unlivable in Austin.

High-Paying Metropolitan Areas:

Major cities have a higher cost of living, which forces employers to offer more competitive wages to attract a sufficient workforce. These urban centers are also home to more large corporations and high-growth industries.

- Austin-Round Rock, TX: Austin consistently leads the state in wage pressure. The booming tech scene and high cost of living have created a high unofficial wage floor. It is very difficult to find jobs advertised for less than $15 per hour, even in food service and retail. Companies like H-E-B and the City of Austin itself have set minimum pay rates significantly higher than the federal mandate (e.g., the City of Austin's minimum wage for city employees is over $20/hour).

- Dallas-Fort Worth-Arlington, TX: The DFW Metroplex is a massive economic hub for logistics, finance, and corporate headquarters. The sheer competition for labor, especially in sectors like warehousing and transportation, drives starting wages up. According to the BLS, the mean hourly wage across all occupations in DFW is consistently higher than the state average. Entry-level warehouse jobs in this region, for instance, frequently start in the $16-$18 per hour range.

- Houston-The Woodlands-Sugar Land, TX: As a global center for the energy industry and home to one of the nation's largest ports, Houston offers higher-than-average wages. The industrial base provides numerous entry points for roles in manufacturing, logistics, and skilled trades that pay well above the minimum.

Lower-Paying Rural and Regional Areas:

In contrast, rural counties and smaller cities have a lower cost of living and less competition among employers. In these areas, it is more common to find jobs advertised closer to the federal minimum wage, or in the $9-$11 per hour range.

- Rio Grande Valley (McAllen-Edinburg-Mission, TX): This region historically has one of the lowest per-capita incomes in the nation. While the cost of living is also lower, wages for service and retail jobs often lag significantly behind the major metro areas.

- East Texas (e.g., Tyler, Longview): While these cities have stable economies, their wage scales are generally lower than the "Texas Triangle" (DFW-Houston-Austin/San Antonio).

- West Texas (e.g., outside of the Midland-Odessa oil patch): In areas not directly benefiting from the oil and gas boom, wages can be quite low due to limited economic diversity.

Actionable Insight: If you have geographic mobility, moving from a rural area to a major metropolitan hub is one of the fastest ways to increase your hourly earning potential, though you must carefully weigh this against the sharp increase in housing and living costs.

###

2. Company Type & Size: Corporate Giants vs. Small Businesses

The type and size of your employer are massive determinants of your pay and benefits.

- Large National/International Corporations: Companies like Amazon, Target, Walmart, Costco, and H-E-B are in a constant war for labor. They often use their starting wage as a key marketing and recruitment tool.

- Target and Costco have corporate-wide minimum wages well over $15/hour (Costco's is currently $17/hour).

- H-E-B, a beloved Texas-based grocer, is renowned for its competitive pay and benefits, often setting the standard in the communities it serves. Many entry-level "partner" roles start at or above $15/hour.

- Amazon warehouse roles are a major employer in Texas, with starting wages that fluctuate based on demand but are almost always in the $15-$18 per hour range, often with sign-on bonuses and comprehensive benefits from day one.

- Small and Medium-Sized Businesses (SMBs): A local "mom-and-pop" restaurant or an independent retail boutique simply does not have the revenue or scale to compete with the wages offered by corporate giants. These employers are much more likely to pay closer to the market average for their specific locale, which could be anywhere from the federal minimum up to $12-$14 per hour. Their ability to offer benefits like health insurance or retirement plans is also often limited.

- Franchises: Wages at franchise locations (e.g., McDonald's, Subway) can be a mixed bag. While they carry a national brand name, each franchise is an independently owned and operated business. Their wage policies are set by the individual owner and are heavily influenced by the local labor market, meaning a McDonald's in Austin will likely pay more than one in a small rural town.

- Government and Public Sector: Entry-level jobs with city, county, or state governments often come with slightly higher starting pay than comparable private sector roles and, most importantly, superior benefits packages (pensions, stable health insurance, generous paid time off). For example, an entry-level clerical assistant for the City of Houston will likely have a more robust total compensation package than a clerical assistant at a small private company.

###

3. Industry and Area of Specialization

The industry you work in has a profound impact on your wage floor and ceiling.

- Warehousing, Transportation, and Logistics: This is currently one of the highest-paying sectors for workers without a college degree in Texas. The explosion of e-commerce has created immense demand. Jobs like warehouse associate, package handler, and forklift operator in hubs like Dallas and Houston often start above $16/hour and can reach over $20/hour with experience. (Source: BLS, Occupational Employment and Wage Statistics)

- Retail Trade: This is a broad category. Working for a big-box retailer like Target or a specialty grocer like H-E-B will yield higher wages than working for a discount clothing store or a small convenience store. The median hourly wage for Retail Salespersons in Texas was $14.36 in May 2022 (BLS).

- Accommodation and Food Services: This sector is the most likely to pay at or near the minimum wage, especially for tipped positions ($2.13/hour plus tips). Fast food workers (classified under "Fast Food and Counter Workers") had a median wage of $12.01 in Texas in May 2022, but the bottom 10% earned $9.21 or less (BLS). This industry has a very wide range of outcomes.

- Healthcare Support: This is a growing field with a higher wage floor than retail or food service. Roles like Home Health Aide (median wage $12.92) or Certified Nursing Assistant (CNA) (median wage $15.54) offer a clear pathway to higher earnings. Obtaining a simple certification, like a CNA license, can immediately boost your earning potential by several dollars per hour.

- Manufacturing: Texas has a strong manufacturing base. Entry-level production worker jobs often start in the $14-$17 per hour range and provide opportunities for on-the-job training and skill development that lead to higher-paying roles.

###

4. Years of Experience and Career Progression

Even within a low-wage job, experience is valuable and translates to higher pay. Employers are willing to pay more to retain reliable, knowledgeable staff.

- Entry-Level (0-1 year): At this stage, you are likely to earn the company's advertised starting wage. Your primary focus is on demonstrating reliability (showing up on time, every time), a positive attitude, and a willingness to learn.

- Mid-Level (2-4 years): After a couple of years, you have proven your worth. You understand the job's nuances and may have taken on informal leadership roles (e.g., training new hires). This is the prime time to ask for a raise or seek a promotion. Your wage could increase by 10-25% over your starting rate. A cashier who started at $12 might now be earning $14 or $15.

- Experienced / Shift Lead (5+ years): With significant experience, you become a candidate for supervisory roles. A Shift Leader, Team Lead, or Assistant Manager position is the most common and accessible advancement path. This promotion comes with a significant pay bump and additional responsibilities. For example, a retail Shift Supervisor in Texas has an average base salary of around $17-$19 per hour (Salary.com). This is a substantial jump from a sales associate role.

###

5. In-Demand Skills That Command Higher Pay

Your specific skillset is your lever for negotiating a better wage. Even in "unskilled" jobs, certain skills are highly valued.

- Bilingualism (English/Spanish): In Texas, being fluent in both English and Spanish is a massive asset in almost any customer-facing role. Companies will often pay a "bilingual differential"—an extra $0.50 to $2.00 per hour—for employees who can effectively serve a wider customer base.

- Technical Certifications: Obtaining specific, tangible certifications can immediately boost your pay.

- Forklift Certification: A certified forklift operator in a warehouse will earn significantly more than a general package handler.

- Certified Nursing Assistant (CNA): As mentioned, this is a key entry point into the healthcare field with higher pay.

- ServSafe Certification: For food service, this demonstrates knowledge of food safety and can make you a more attractive candidate for a kitchen lead or manager role.

- Customer Service Excellence: This is more than just being friendly. It involves skills in de-escalation, problem-solving, and communication. Employees who can handle difficult customers effectively are invaluable and are more likely to be promoted to supervisory roles.

- Cash Handling and Point-of-Sale (POS) System Expertise: Demonstrating accuracy, speed, and trustworthiness with cash and complex POS systems can lead to positions like head cashier or bookkeeper, which come with higher responsibility and pay.

- Inventory Management: In retail or warehousing, showing an aptitude for tracking stock, organizing backrooms, and using inventory software can lead to specialized roles that pay better than general floor positions.

By strategically developing these factors, a worker can actively manage their career trajectory and move their hourly wage far beyond the legal minimum.

Job Outlook and Growth in Texas's Low-Wage Sectors

Understanding the future trajectory of industries that traditionally employ minimum and low-wage workers is crucial for long-term career planning. The Texas economy is a powerhouse, projected to grow significantly over the next decade. However, this growth is not evenly distributed, and trends like automation and shifts in consumer behavior are reshaping the job landscape.

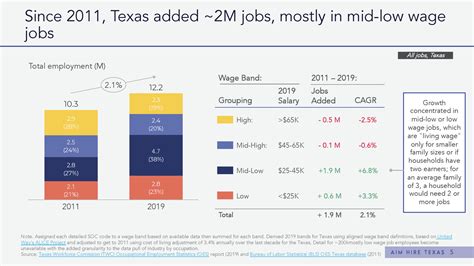

The Texas Workforce Commission (TWC), using data in line with the BLS, projects robust job growth across the state. The overall employment in Texas is projected to grow by 19.0 percent from 2020 to 2030, adding over 2.4 million jobs. Many of these openings will be in sectors that provide entry-level opportunities.

### High-Growth Sectors for Entry-Level Work

1. Accommodation and Food Services: This sector is a perennial source of entry-level jobs. TWC projects this industry will see some of the fastest growth, adding hundreds of thousands of jobs by 2030.

- Job Titles: Fast Food and Counter Workers, Waiters and Waitresses, Hosts, Cooks.

- Outlook Analysis: The demand is consistent due to population growth and a culture that values dining out. However, wages will continue to be heavily influenced by the tipped-wage model and intense competition. The high turnover rate in this industry means there are always openings, but also that upward mobility requires intentionally seeking out management track positions. The median hourly wage for Food Preparation and Serving Related Occupations in Texas was $12.56 in May 2022 (BLS), indicating a large number of jobs are clustered at the low end of the pay scale.

2. Retail Trade: As Texas's population booms, so does the need for retail services.

- Job Titles: Retail Salespersons, Cashiers, Stockers and Order Fillers.

- Outlook Analysis: This sector is undergoing a major transformation. While brick-and-mortar retail remains strong, the growth of e-commerce is changing the nature of the jobs. There is less emphasis on traditional cashiers and more on roles related to online order fulfillment ("click and collect"), customer experience, and inventory management. The BLS projects a slight decline nationally for cashiers (-10%) over the next decade due to automation (self-checkout), but a modest growth for Retail Salespersons (1%). Workers who can adapt to this new "omnichannel" retail environment will be more valuable.