Table of Contents

- [Introduction](#introduction)

- [What is the US Minimum Wage? A Comprehensive Overview](#what-is-the-us-minimum-wage)

- [US Minimum Wage Rates: A Deep Dive into the Numbers](#us-minimum-wage-rates-a-deep-dive)

- [Key Factors That Determine Your Actual Minimum Wage](#key-factors-that-determine-your-actual-minimum-wage)

- [The Economic Impact and Future of the US Minimum Wage](#the-economic-impact-and-future)

- [Know Your Rights: A Practical Guide for Workers](#know-your-rights-a-practical-guide)

- [Conclusion](#conclusion)

Introduction

For millions of people, both within the United States and those dreaming of working here, the concept of a minimum wage is the starting point of their economic journey. Whether you are a student taking your first job, a recent immigrant navigating a new labor market, or a worker in a foundational service industry, understanding the "salario minimo EUA" (US minimum wage) is not just an academic exercise—it is the key to ensuring you are paid fairly and legally. The US system, however, is far from simple. It's a complex tapestry woven from federal, state, and even city-level laws, creating a landscape where the minimum wage in one town can be more than double that of another just a state line away.

The federal minimum wage currently stands at $7.25 per hour, a figure that has not changed since 2009. However, the vast majority of states—and a growing number of cities and counties—have enacted their own higher minimums, with some reaching over $17.00 per hour in 2024. This guide is designed to be your definitive resource for navigating this complexity. We will dissect the federal law, provide a state-by-state breakdown of rates, and explore the critical factors that determine your actual, on-the-ground wage.

I've spent over a decade analyzing labor market data and advising individuals on their career paths. I once helped a young immigrant from Brazil who was working at a coffee shop in a major city. He was being paid the federal minimum wage, unaware that his city had a local ordinance mandating a rate nearly twice as high. By helping him understand his rights and showing him the official government resources, he was able to approach his employer, get his pay corrected, and receive back wages. This experience cemented for me that knowledge about labor law isn't just power; it's tangible income and a vital form of self-advocacy. This guide is built to provide you with that same power.

What is the US Minimum Wage? A Comprehensive Overview

The US minimum wage is not a single, national number but a legal framework designed to establish a minimum hourly wage that most employers must pay to their workers. The foundational law governing this is the Fair Labor Standards Act (FLSA), enacted in 1938. The primary purpose of the FLSA, as stated by the U.S. Department of Labor (DOL), is to protect workers from unfairly low pay and to establish a "floor" below which wages cannot fall.

The core principle of the US minimum wage system is a hierarchy of laws. It operates on three main levels:

1. Federal Minimum Wage: This is the national baseline, set by the U.S. Congress. As of 2024, this rate is $7.25 per hour. It applies to "covered non-exempt employees" across the country.

2. State Minimum Wage: The majority of states have passed their own minimum wage laws. If a state's minimum wage is higher than the federal rate, employers in that state must pay their employees the higher state rate. If a state has no minimum wage or a rate lower than the federal one, the federal rate of $7.25 applies.

3. Local (City or County) Minimum Wage: A growing trend involves cities and counties passing their own, even higher, minimum wage ordinances. If you work in a city with its own minimum wage, your employer must pay you the highest rate applicable among the federal, state, and your local ordinance.

The golden rule is simple: An employee is entitled to the highest minimum wage rate that applies to them, whether it's federal, state, or local.

### A "Day in the Life" Example

Let's illustrate this with a practical scenario. Consider two friends, Maria and David, both working in entry-level retail positions.

- Maria lives and works in Houston, Texas. Texas does not have its own state minimum wage law, so it defers to the federal rate. Her city, Houston, also does not have a local minimum wage. Therefore, Maria's legal minimum wage is the federal rate of $7.25 per hour.

- David lives and works in Denver, Colorado. The federal minimum wage is $7.25. The state of Colorado has a minimum wage of $14.42 per hour in 2024. However, the City of Denver has enacted its own local ordinance, setting the minimum wage at $18.29 per hour for 2024. Because David works within Denver's city limits, his employer is legally required to pay him the highest applicable rate, which is the city rate of $18.29 per hour.

This example highlights the immense impact of geography on the "salario minimo EUA." David earns over $11 more per hour than Maria for performing a similar job, purely based on their location and the corresponding local laws. This demonstrates why understanding this three-tiered system is absolutely critical for any worker in the United States.

US Minimum Wage Rates: A Deep Dive into the Numbers

While the federal rate of $7.25 per hour serves as a national floor, it is increasingly becoming a footnote rather than the norm. According to the Economic Policy Institute (EPI), a non-partisan think tank, as of January 1, 2024, 22 states raised their minimum wages, and 38 cities and counties did the same. This has resulted in a vast and varied landscape of wage rates across the country.

### Federal, State, and Tipped Minimum Wage Overview

To understand your potential earnings, you must first know the rates that apply to you. Here's a breakdown of the key figures and concepts.

- Federal Standard Minimum Wage: $7.25 per hour. This applies to covered, non-exempt workers.

- Federal Tipped Minimum Wage: $2.13 per hour. This is a crucial distinction. Under the FLSA, employers of "tipped employees"—those who customarily and regularly receive more than $30 per month in tips—can pay a lower direct cash wage and take a "tip credit." However, the employer must ensure that the employee's direct wages plus their tips equal at least the full federal minimum wage of $7.25 per hour. If tips fall short, the employer must make up the difference.

### State-by-State Minimum Wage Rates (as of early 2024)

The landscape of state minimum wages is constantly evolving. The following table provides a comprehensive look at the standard minimum wage rates for all 50 states and the District of Columbia. It is essential to verify these figures with your state's Department of Labor, as many have scheduled increases throughout the year or have annual adjustments based on the Consumer Price Index (CPI).

| State | 2024 Minimum Wage | Notes on Tipped Wage and Future Increases |

| :--- | :--- | :--- |

| Alabama | $7.25 (Federal Rate) | No state minimum. |

| Alaska | $11.73 | Annually indexed for inflation. Tipped employees must receive the full state minimum wage. |

| Arizona | $14.35 | Annually indexed for inflation. Tipped wage is $11.35. |

| Arkansas | $11.00 | Tipped wage is $2.63. |

| California | $16.00 | Tipped employees must receive the full state minimum wage. Some cities have higher rates. |

| Colorado | $14.42 | Annually indexed for inflation. Tipped wage is $11.40. Some cities have higher rates. |

| Connecticut | $15.69 | Annually indexed for inflation. Tipped wage is $6.38 (bartenders $8.23). |

| Delaware | $13.25 | Tipped wage is $2.23. Scheduled to increase to $15.00 in 2025. |

| District of Columbia | $17.00 | Tipped wage is $8.00. Will increase to $17.50 on July 1, 2024. |

| Florida | $12.00 | Tipped wage is $8.98. Scheduled to increase by $1.00 annually until it reaches $15.00 in 2026. |

| Georgia | $5.15 ($7.25 Federal Rate applies) | State rate is below federal, so most employers must pay $7.25. Tipped wage is $2.13. |

| Hawaii | $14.00 | Tipped wage allows a credit of $1.25. Scheduled to increase to $16.00 in 2026. |

| Idaho | $7.25 (Federal Rate) | Tipped wage is $3.35. |

| Illinois | $14.00 | Tipped wage is $8.40. Scheduled to increase to $15.00 in 2025. |

| Indiana | $7.25 (Federal Rate) | Tipped wage is $2.13. |

| Iowa | $7.25 (Federal Rate) | Tipped wage is $4.35. |

| Kansas | $7.25 (Federal Rate) | Tipped wage is $2.13. |

| Kentucky | $7.25 (Federal Rate) | Tipped wage is $2.13. |

| Louisiana | $7.25 (Federal Rate) | No state minimum. |

| Maine | $14.15 | Annually indexed for inflation. Tipped wage is $7.08. |

| Maryland | $15.00 | Tipped wage is $3.63. Some counties have higher rates. |

| Massachusetts | $15.00 | Tipped wage is $6.75. |

| Michigan | $10.33 | Tipped wage is $3.93. Scheduled to increase based on an ongoing legal case. |

| Minnesota | $10.85 (large employers), $8.85 (small employers) | Tipped employees must receive the full state minimum wage. Some cities have higher rates. |

| Mississippi | $7.25 (Federal Rate) | No state minimum. |

| Missouri | $12.30 | Tipped wage is $6.15. |

| Montana | $10.30 | Annually indexed for inflation. Tipped employees must receive the full state minimum wage. |

| Nebraska | $12.00 | Tipped wage is $2.13. Scheduled to increase to $13.50 in 2025 and $15.00 in 2026. |

| Nevada | $11.25 (no health benefits), $10.25 (with health benefits) | Tipped employees must receive the full state minimum wage. Set to become a single $12.00 rate in July 2024. |

| New Hampshire | $7.25 (Federal Rate) | Tipped wage is 45% of the applicable minimum. |

| New Jersey | $15.13 | Tipped wage is $5.26. Annually indexed for inflation. |

| New Mexico | $12.00 | Tipped wage is $3.00. Some cities have higher rates. |

| New York | $16.00 (NYC, Long Island, Westchester), $15.00 (Rest of State) | Tipped wages vary by region and industry. Annually indexed for inflation. |

| North Carolina | $7.25 (Federal Rate) | Tipped wage is $2.13. |

| North Dakota | $7.25 (Federal Rate) | Tipped wage is $4.86. |

| Ohio | $10.45 | Annually indexed for inflation. Tipped wage is $5.25. |

| Oklahoma | $7.25 (Federal Rate) | Tipped wage is $2.13. |

| Oregon | $14.20 (Standard), $15.45 (Portland Metro), $13.20 (Non-urban) | Tipped employees must receive the full state minimum wage. Annually indexed for inflation. |

| Pennsylvania | $7.25 (Federal Rate) | Tipped wage is $2.83. |

| Rhode Island | $14.00 | Tipped wage is $3.89. Scheduled to increase to $15.00 in 2025. |

| South Carolina | $7.25 (Federal Rate) | No state minimum. |

| South Dakota | $11.20 | Annually indexed for inflation. Tipped wage is $5.60. |

| Tennessee | $7.25 (Federal Rate) | No state minimum. |

| Texas | $7.25 (Federal Rate) | Tipped wage is $2.13. |

| Utah | $7.25 (Federal Rate) | Tipped wage is $2.13. |

| Vermont | $13.67 | Annually indexed for inflation. Tipped wage is $6.84. |

| Virginia | $12.00 | Tipped wage is $2.13. |

| Washington | $16.28 | Annually indexed for inflation. Tipped employees must receive the full state minimum wage. Some cities have higher rates. |

| West Virginia | $8.75 | Tipped wage is 70% of the minimum wage ($6.13). |

| Wisconsin | $7.25 (Federal Rate) | Tipped wage is $2.33. |

| Wyoming | $5.15 ($7.25 Federal Rate applies) | State rate is below federal, so most employers must pay $7.25. Tipped wage is $2.13. |

*Source: Data compiled from the U.S. Department of Labor (DOL) and the National Conference of State Legislatures (NCSL), updated for 2024.*

### Beyond the Hourly Rate: Overtime and Deductions

Your compensation is more than just your hourly wage. The FLSA also establishes other critical protections:

- Overtime Pay: For non-exempt employees, the law requires overtime pay at a rate of one and a half times their regular rate of pay for all hours worked over 40 in a workweek. For a worker earning $15.00/hour, their overtime rate would be $22.50/hour. Some states, like California, have more generous overtime laws, requiring it for hours worked over 8 in a day.

- Legal Deductions: An employer can legally deduct things like taxes, social security, and health insurance premiums from your paycheck. However, they generally cannot make deductions for things like broken equipment, cash register shortages, or required uniforms if doing so would cause your earnings to fall below the minimum wage for the hours you worked.

Key Factors That Determine Your Actual Minimum Wage

Your actual, legal minimum wage is a result of several overlapping factors. Understanding these variables is key to knowing exactly what you should be earning. This section provides a detailed breakdown of the elements that have the biggest impact on the "salario minimo EUA."

### 1. Geographic Location: The Single Biggest Influencer

As our earlier example showed, where you work is the most significant factor. The difference between a federal-rate state and a city with a high local ordinance can amount to over $20,000 per year for a full-time worker.

#### State-Level Tiers

We can group states into three broad categories:

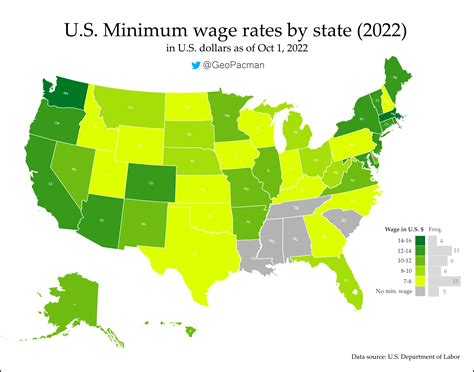

- Federal Minimum States (20 states): These states either have no state-level minimum wage (like Alabama, Louisiana, Mississippi, South Carolina, Tennessee) or have a rate equal to or lower than the federal $7.25 rate (like Georgia, Wyoming, Texas, Pennsylvania, Idaho). In these states, the vast majority of employers are subject to the $7.25 federal minimum wage.

- Mid-Tier States (Approx. 20 states): These states have set their minimum wage modestly to significantly above the federal rate, often in the $10.00 to $14.00 range. Examples include Missouri ($12.30), Arkansas ($11.00), and Ohio ($10.45). Many of these states passed legislation for phased increases over several years.

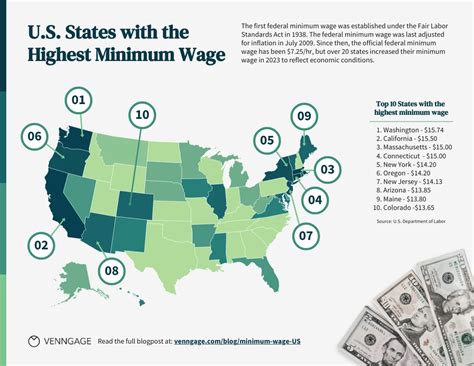

- High-Wage States (Approx. 10 states + D.C.): These are states that have pushed their minimum wage to $15.00 or higher, with many now implementing annual cost-of-living adjustments (COLA). This group includes California ($16.00), Washington ($16.28), New York ($16.00 in NYC area), Massachusetts ($15.00), and New Jersey ($15.13). The District of Columbia leads the nation with a rate of $17.00 (increasing to $17.50 in mid-2024).

#### City and County Ordinances: The Hyper-Local Effect

Even within high-wage states, your earnings can change dramatically based on your specific city. Local governments in high-cost-of-living areas have taken the lead in setting wage floors that they feel better reflect local economic realities.

Here are some examples of U.S. cities with minimum wages that are significantly higher than their state's minimum wage for 2024:

- Tukwila, Washington: $20.29 per hour (for large employers). The state minimum is $16.28.

- Seattle, Washington: $19.97 per hour (for large employers).

- West Hollywood, California: $19.08 per hour. The state minimum is $16.00.

- Denver, Colorado: $18.29 per hour. The state minimum is $14.42.

- New York City, New York: $16.00 per hour. The rest of upstate New York is at $15.00.

- Chicago, Illinois: $15.80 per hour (for large employers). The state minimum is $14.00.

Pro-Tip: If you are looking for work, always search for "[Your City Name] minimum wage" in addition to the state rate. Official city government websites are the most reliable source for this information.

### 2. Type of Work and Industry Nuances

The nature of your job and the industry you work in introduce further layers of complexity, primarily centered around tips and special exemptions.

#### Tipped vs. Non-Tipped Employees

This is one of the most contentious and confusing aspects of U.S. wage law.

- States with a Tip Credit: In states like Texas, Pennsylvania, and Virginia, employers can pay a very low direct cash wage (as low as the federal $2.13) and use a "tip credit" to make up the rest of the minimum wage. This system places a heavy reliance on the generosity of customers. While employers are legally required to ensure total earnings (wages + tips) meet the full minimum wage, enforcement can be challenging. This system is prevalent in the restaurant, hospitality, and service industries.

- One Fair Wage States: A growing number of states have eliminated the subminimum wage for tipped workers. In these "One Fair Wage" states, tipped employees must be paid the full state minimum wage *before* tips. Tips are then an additional bonus on top of their regular pay. This provides much greater income stability. These states include California, Washington, Oregon, Nevada, Minnesota, Montana, and Alaska. This policy dramatically increases the base earnings for servers, bartenders, and other tipped staff in these locations.

#### Exemptions for Specific Worker Categories

The FLSA and state laws contain specific rules or exemptions for certain types of workers:

- Youth Minimum Wage: The FLSA allows employers to pay employees under 20 years old a wage of $4.25 per hour for the first 90 consecutive calendar days of employment. After 90 days, or when the worker turns 20, they must receive the full minimum wage.

- Student-Learners: Full-time students employed in vocational training programs may be paid as little as 75% of the minimum wage.

- Agricultural and Domestic Workers: These categories of workers have historically been excluded from many labor protections, and while some states have extended coverage, complex federal and state-specific rules still apply. It is crucial for workers in these fields to consult their state's labor department for specifics.

### 3. Worker Classification: Employee vs. Independent Contractor

This is a critical modern battleground in labor law, particularly with the rise of the "gig economy."

- Employees (Non-Exempt): Minimum wage, overtime, and other FLSA protections apply to workers classified as employees. An employer withholds taxes, pays a portion of social security taxes, and has significant control over how, when, and where the work is done. Most traditional jobs fall under this category.

- Independent Contractors: These workers are considered self-employed. They are not covered by minimum wage or overtime laws. Companies that hire contractors do not withhold taxes and are not required to provide benefits. This classification is common for freelancers, consultants, and many gig workers (e.g., rideshare drivers, delivery app couriers).

The distinction is legally complex and often contested. Misclassifying an employee as an independent contractor to avoid paying minimum wage and overtime is illegal. Federal and state agencies, like the IRS and Departments of Labor, have multi-factor tests to determine the correct classification, focusing on the degree of behavioral and financial control the company has over the worker. If you believe you are misclassified, you can file a complaint with the appropriate labor authorities.

### 4. Scheduled Increases and Inflation Adjustments

Unlike personal salary growth based on experience, the minimum wage grows through legislative action. This creates a predictable (or sometimes stagnant) path for wage increases.

- States with Phased Increases: States like Florida, Virginia, and Nebraska have passed laws that schedule specific, incremental increases over several years to reach a target wage (e.g., $15 per hour). This allows businesses time to adjust to rising labor costs.

- States with Inflation Indexing (COLA): A more modern approach, adopted by states like Washington, Colorado, and New Jersey, is to tie the minimum wage to the Consumer Price Index (CPI) or a similar inflation measure. This results in smaller, automatic adjustments each year to ensure that the purchasing power of the minimum wage does not erode over time. This provides the most consistent and predictable growth for low-wage workers.

The Economic Impact and Future of the US Minimum Wage

The debate over the "salario minimo EUA" is one of the most enduring and passionate in American economic and political discourse. It sits at the intersection of social equity, business economics, and government policy. Understanding the arguments and the future direction of this issue provides crucial context for anyone whose income is tied to it.

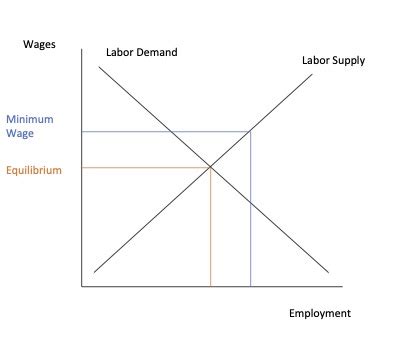

### The Economic Debate: A Tale of Two Arguments

Economists and policymakers are deeply divided on the effects of raising the minimum wage. The research is vast and often conflicting, but the core arguments can be summarized as follows.

Arguments for Raising the Minimum Wage:

- Poverty Reduction and Improved Living Standards: This is the primary goal. Proponents argue that a higher minimum wage lifts families out of poverty and reduces their reliance on public assistance programs. A 2021 report from the Congressional Budget Office (CBO) on a proposed $15 federal minimum wage estimated that it would lift 0.9 million people out of poverty.

- Increased Consumer Spending: When low-wage workers earn more, they tend to spend it immediately on essential goods and services. This injection of cash into the economy can stimulate demand and boost overall economic growth, a concept favored by organizations like the Economic Policy Institute (EPI).

- Reduced Employee Turnover: Paying a higher wage can lead to increased employee morale and loyalty, reducing the high costs associated with recruiting, hiring, and training new staff, particularly in high-turnover industries like retail and food service.

- Closing Wage Gaps: Minimum wage increases have been shown to disproportionately benefit women and minority workers, who are overrepresented in low-wage jobs, thereby helping to narrow racial and gender pay gaps.

Arguments Against Raising the Minimum Wage:

- Potential for Job Losses: This is the most common counterargument. Opponents, such as the National Federation of Independent Business (NFIB), argue that when businesses are forced to pay higher wages, they may compensate by reducing staff, cutting hours, or slowing down hiring, particularly impacting small businesses with thin profit