Decoding the Paycheck: A Deep Dive into Analyst Salaries at Goldman Sachs

For ambitious students and young professionals eyeing a career in high finance, few names carry as much weight as Goldman Sachs. Synonymous with prestige, influence, and immense opportunity, a role at this bulge-bracket investment bank is one of the most coveted positions in the financial world. But beyond the prestige, what is the tangible reward?

A career as an analyst at Goldman Sachs is not only a powerful launchpad for a long-term career but also one of the most lucrative entry points into the professional world. While demanding, the financial compensation is substantial, with first-year analysts often seeing total compensation packages, including bonuses, ranging from $160,000 to well over $225,000.

This article will break down what an analyst at Goldman Sachs earns, the factors that shape that figure, and the long-term outlook for this challenging and rewarding career path.

What Does an Analyst at Goldman Sachs Do?

While the title "analyst" is used across various divisions within the firm, it most famously refers to the entry-level role in the Investment Banking Division (IBD). This is the quintessential, high-stakes role that many aspiring financiers dream of.

An investment banking analyst is the engine room of deal-making. Their responsibilities are intense and foundational to the firm's success. Key duties include:

- Financial Modeling: Building complex spreadsheets to forecast a company's future performance and analyze the impact of potential transactions like mergers, acquisitions, or IPOs.

- Valuation Analysis: Using methodologies like Discounted Cash Flow (DCF), Comparable Company Analysis (Comps), and Precedent Transactions to determine a company's worth.

- Due Diligence: Conducting exhaustive research into a company's financial health, operational stability, and market position to identify risks and opportunities.

- Creating Pitch Books: Developing detailed presentations and marketing materials used to pitch ideas and deals to current and potential clients.

- Market Research: Staying on top of industry trends, economic news, and competitive landscapes.

The work is characterized by long hours, tight deadlines, and an incredibly steep learning curve, but it provides unparalleled exposure to the mechanics of global finance.

Average Salary for an Analyst at Goldman Sachs

Compensation for an analyst at Goldman Sachs is typically broken down into two main components: a base salary and a performance-based bonus. It's crucial to consider both to understand the full earning potential.

- Base Salary: For a first-year analyst in the United States, the base salary has seen significant increases in recent years to attract top talent. According to data from Glassdoor and industry reports, you can expect a base salary in the range of $110,000 to $125,000. This figure is generally standardized for the incoming analyst class in major financial centers.

- Performance Bonus: This is the variable—and often largest—part of the compensation. The year-end bonus is highly dependent on three factors: the firm's overall profitability, the performance of your specific division and team, and your individual contribution. For a first-year analyst, this bonus can range from $50,000 to over $100,000, according to figures reported on platforms like Salary.com and specialized forums like Wall Street Oasis.

- Total Compensation: When combined, the total first-year compensation package for an analyst at Goldman Sachs typically falls between $160,000 and $225,000+. This figure can fluctuate annually based on market conditions and deal flow.

Key Factors That Influence Salary

While the entry-level band is relatively consistent, several factors influence an analyst's compensation, especially as they progress in their career.

### Level of Education

A bachelor's degree from a top-tier university is the standard entry requirement. While the specific starting salary isn't typically higher for a candidate from one school over another, graduating from a "target school" (e.g., Ivy League universities, MIT, Stanford, UChicago) significantly increases your chances of securing an interview and, ultimately, the job offer. Majors in finance, economics, mathematics, and other STEM fields are highly favored due to their quantitative rigor. An MBA is typically required for a direct entry at the "Associate" level, which comes with a significantly higher compensation package.

### Years of Experience

Experience is the most direct driver of salary growth within the analyst program. The program is typically a two- to three-year commitment, with compensation increasing each year.

- First-Year Analyst: Total compensation of $160,000 - $225,000+.

- Second-Year Analyst: With a year of experience, base salaries may see a modest bump, but the bonus potential increases significantly. Total compensation can climb to $250,000 or more.

- Associate (Post-Analyst Program): After completing the analyst program, top performers are often promoted to the Associate level. This leap comes with a substantial pay increase, with total compensation often starting in the $350,000 - $450,000 range and growing from there.

### Geographic Location

Goldman Sachs operates globally, but compensation is highest in major financial hubs where the cost of living and competition for talent are most intense.

- New York City: As the firm's headquarters and the world's financial capital, NYC typically sets the benchmark for US salaries.

- Other Major Hubs (San Francisco, London, Hong Kong): These cities also offer highly competitive compensation packages, though they may be adjusted for local market rates, currency exchange, and cost of living. Salaries in satellite offices in smaller US cities will generally be lower.

### Company Type

While this article focuses on Goldman Sachs, it's helpful to understand where they sit in the broader landscape. Goldman Sachs is a bulge-bracket investment bank.

- Bulge Bracket vs. Elite Boutique: Compensation at Goldman is very similar to its direct competitors like J.P. Morgan and Morgan Stanley. Interestingly, top-performing analysts at elite boutique firms (e.g., Evercore, Centerview Partners) can sometimes earn even higher bonuses in strong market years due to lower overhead costs.

- vs. Middle Market: Compensation at middle-market banks is typically lower than at bulge-bracket firms, though still very generous compared to most other industries.

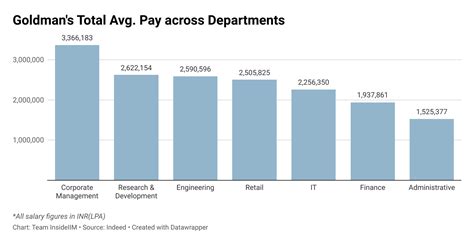

### Area of Specialization

The "analyst" title exists in divisions beyond Investment Banking, and compensation varies accordingly.

- Investment Banking Division (IBD): As discussed, this division generally offers the highest compensation due to the direct link to revenue-generating M&A and financing deals.

- Global Markets (Sales & Trading): Analysts in S&T also have extremely high earning potential. Their bonuses are often more directly tied to their desk's trading performance (P&L), making their compensation potentially more volatile but with a very high ceiling.

- Asset Management, Risk, and Technology: These divisions are still highly prestigious and offer excellent pay. However, their compensation structure, particularly the bonus component, is generally lower than in the front-office IBD and Markets roles. An analyst in these divisions might still earn a six-figure salary, but the total compensation package will likely be less than their IBD counterparts.

Job Outlook

According to the U.S. Bureau of Labor Statistics (BLS), employment for Financial Analysts is projected to grow 4 percent from 2022 to 2032, which is about as fast as the average for all occupations. The BLS reported the median annual wage for financial analysts was $99,890 in May 2023.

However, it is critical to add context. These BLS figures represent the entire field of financial analysis, not the hyper-competitive niche of investment banking at an elite firm like Goldman Sachs. Competition for these roles is, and will remain, incredibly intense. The number of applicants far exceeds the number of available positions each year. While the broader financial industry is stable, securing a spot at the very top requires exceptional academic performance, relevant internship experience, and stellar networking skills.

Conclusion

A career as an analyst at Goldman Sachs is a formidable undertaking that promises both significant challenges and extraordinary rewards. The financial compensation is among the highest available to recent graduates, driven by a strong base salary and a substantial performance-based bonus.

For those considering this path, here are the key takeaways:

- Expect High Total Compensation: First-year earnings often exceed $200,000, but this comes at the cost of extremely long hours and high pressure.

- Experience is King: Your earnings will grow substantially as you gain experience and progress from an analyst to an associate.

- Location and Specialization Matter: Roles in the Investment Banking Division in New York City represent the peak of earning potential, but other divisions and locations still offer highly competitive careers.

- Competition is Fierce: While the outlook for financial professionals is positive, landing a role at Goldman Sachs requires dedication, preparation, and a standout resume.

Ultimately, a job as an analyst at Goldman Sachs is more than just a paycheck; it's an accelerator for your career, equipping you with a world-class skill set and opening doors to opportunities in private equity, hedge funds, corporate leadership, and beyond.