Are you drawn to the dynamic world of commercial real estate? Do you envision yourself as the strategic mind behind a bustling retail center, a state-of-the-art office tower, or a critical industrial logistics hub? The role of a Commercial Property Manager is one of immense responsibility and even greater reward, placing you at the intersection of finance, marketing, operations, and human relationships. But beyond the challenge and prestige lies a critical question for any aspiring professional: what is the true earning potential? What does the salary for a commercial property manager look like, and how can you maximize it?

This guide is your definitive answer. We will move beyond simple averages and delve into the intricate factors that shape your compensation, from your education and certifications to the specific type of property you manage and the city you work in. The financial landscape for this career is robust, with typical salaries ranging from $65,000 for emerging professionals to well over $175,000 for seasoned experts leading large portfolios. It's a career where strategic skill directly translates to financial success.

I once spoke with a senior property manager who oversaw a portfolio of Class-A office buildings in a major downtown core. She described her job not as "managing buildings," but as "curating ecosystems where businesses and people can achieve their best work." That perspective shift—from janitorial contracts to creating value-driven environments—is the secret sauce of a top-earning manager and underscores the profound impact and financial justification for their expertise.

Whether you are just starting to explore this path or are looking to advance your existing career, this comprehensive analysis will provide the data-driven insights and actionable advice you need to navigate your journey and achieve your financial goals.

### Table of Contents

- [What Does a Commercial Property Manager Do?](#what-does-a-commercial-property-manager-do)

- [Average Commercial Property Manager Salary: A Deep Dive](#average-commercial-property-manager-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does a Commercial Property Manager Do?

At its core, a Commercial Property Manager (CPM) is the CEO of a building or a portfolio of properties. They are entrusted by the owner(s) or asset manager to oversee the day-to-day operations and, more importantly, to maximize the profitability and value of that real estate asset. This is a far cry from the residential "landlord" stereotype; the commercial manager is a sophisticated business professional juggling a multitude of complex responsibilities.

Their role can be broken down into five key pillars:

1. Financial Management: This is the bedrock of the job. CPMs are responsible for creating and managing the property's annual budget, which can run into the millions of dollars. This includes forecasting income and expenses, collecting rent and other fees, managing accounts payable and receivable, and preparing detailed monthly financial reports for the owner. Their ultimate financial goal is to increase the Net Operating Income (NOI), a key metric in real estate valuation.

2. Tenant Relations and Retention: A commercial property is worthless without tenants. A great CPM acts as the primary point of contact, building strong relationships to ensure tenant satisfaction and retention. This involves addressing complaints promptly, coordinating tenant move-ins and move-outs, managing lease renewals, and enforcing lease terms. Keeping good tenants happy is far more cost-effective than finding new ones.

3. Operations and Maintenance: The CPM ensures the property is safe, clean, and fully operational. They manage all physical aspects of the building, from the HVAC and elevator systems to landscaping and security. This involves negotiating contracts with third-party vendors (e.g., janitorial, security, engineering), overseeing maintenance staff, conducting regular property inspections, and planning for long-term capital improvements like a new roof or a lobby renovation.

4. Marketing and Leasing: Working closely with leasing brokers, the CPM helps market vacant spaces to attract new, high-quality tenants. They understand the local market, conduct competitor analysis, and help strategize on rental rates and concessions. Their intimate knowledge of the property makes them a key part of the "sales" team, showcasing the building's benefits to prospective occupants.

5. Risk Management and Legal Compliance: Commercial properties are subject to a labyrinth of regulations. The CPM ensures the property adheres to all local, state, and federal laws, including building codes, accessibility standards (ADA), and environmental regulations. They also manage the property's insurance policies and implement risk mitigation strategies to protect the asset and its occupants.

### A Day in the Life of a Commercial Property Manager

To make this tangible, let's walk through a hypothetical day for a manager of a 300,000-square-foot suburban office park.

- 8:00 AM: Arrive at the office. Review the overnight security and maintenance reports. An after-hours water leak was detected and resolved by the on-call engineer; she makes a note to follow up on the damage assessment.

- 9:00 AM: Lead a weekly team meeting with the assistant property manager, building engineer, and administrator. They review outstanding work orders, discuss the upcoming fire alarm testing, and coordinate the schedule for a tenant's office expansion project.

- 10:30 AM: Walk the property. She inspects the recently pressure-washed walkways, checks the cleanliness of the common area restrooms, and stops to chat with the lobby security guard. On her way, she greets a few tenants, informally checking in on their satisfaction.

- 11:30 AM: Meet with a leasing broker and a prospective tenant to tour a vacant suite. She speaks knowledgeably about the building's high-speed fiber connectivity, energy-efficient HVAC system, and nearby amenities, answering detailed operational questions the broker might not know.

- 1:00 PM: Lunch at her desk while reviewing the monthly financial variance report. She analyzes why utility costs were 15% over budget, realizing it was due to an unseasonable heat wave, and drafts a brief explanation for the owner's report.

- 2:30 PM: A tenant calls to complain about noise from the construction of the neighboring suite. The CPM listens empathetically, explains the construction schedule, and promises to ensure the contractors adhere to the "quiet hours" stipulated in their agreement. She immediately calls the construction foreman to reinforce this.

- 3:30 PM: Negotiate the terms of a new landscaping contract. She compares bids from three vendors, focusing not just on price but on their service level agreements, insurance coverage, and references.

- 5:00 PM: Review and approve a stack of invoices from vendors. She then finalizes the agenda for a call with the property's asset manager tomorrow, preparing to discuss lease renewal strategies for two major tenants whose leases expire in 18 months.

This "day in the life" illustrates the constant context-switching required—from financial analyst to customer service expert to contract negotiator—all in a single day.

Average Commercial Property Manager Salary: A Deep Dive

Now, let's get to the numbers. The salary for a commercial property manager is not a single figure but a wide spectrum influenced by the factors we'll explore in the next section. However, by consolidating data from authoritative sources, we can establish a clear and reliable baseline for what you can expect to earn.

It's important to note that different sources may define the role slightly differently or use different data sets, but when viewed together, they paint a consistent picture of a well-compensated profession.

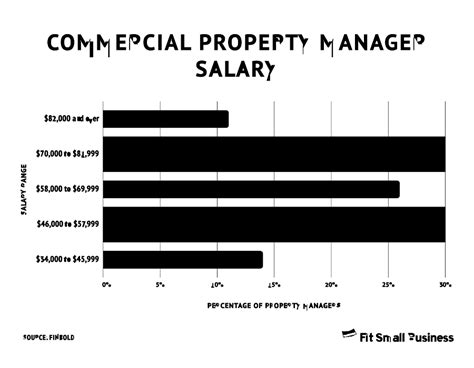

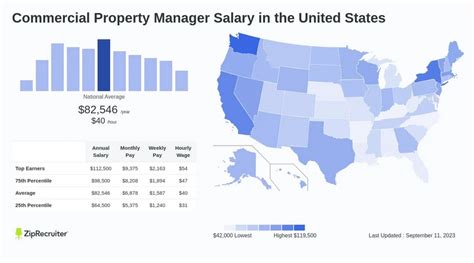

National Averages and Ranges

According to the most recent data, the compensation landscape for a Commercial Property Manager in the United States is as follows:

- U.S. Bureau of Labor Statistics (BLS): The BLS groups Commercial Property Managers under the broader category of "Property, Real Estate, and Community Association Managers." As of May 2023, the median annual wage for this group was $62,490. However, the BLS notes a very wide range, with the lowest 10 percent earning less than $34,970 and the top 10 percent earning more than $138,500. The commercial sector consistently occupies the upper end of this range due to the complexity and value of the assets managed.

- Salary.com: This platform, which provides deep corporate-reported data, offers a more specific view. As of May 2024, the median salary for a Commercial Property Manager I (entry-to-mid-level) is $72,506, while a Commercial Property Manager II (more experienced) has a median of $97,092, and a Commercial Property Manager III (senior level) boasts a median of $122,862. Their typical total range spans from approximately $60,000 to over $150,000.

- Payscale: As of June 2024, Payscale reports the average salary for a Commercial Property Manager at $70,305 per year. Their data shows a range from roughly $49,000 to $105,000 for the base salary, with bonuses potentially adding up to $15,000 or more.

- Glassdoor: Based on user-submitted data, Glassdoor lists the total pay average for a Commercial Property Manager at $96,654 per year (as of June 2024), combining an estimated base pay of $73,191 with approximately $23,463 in additional pay (bonuses, commission, etc.).

Synthesized View: Taking all sources into account, a realistic expectation for a mid-career Commercial Property Manager is a base salary in the $70,000 to $100,000 range, with total compensation often pushing into the $85,000 to $120,000 bracket when bonuses and other incentives are included.

### Salary by Experience Level

Your earning potential grows significantly as you accumulate experience and take on more responsibility. Here’s a typical salary progression:

| Experience Level | Typical Title(s) | Years of Experience | Typical Base Salary Range | Key Responsibilities |

| :--- | :--- | :--- | :--- | :--- |

| Entry-Level | Assistant Property Manager, Property Administrator | 0-3 years | $55,000 - $75,000 | Supporting senior managers, coordinating vendors, processing invoices, handling tenant service requests, assisting with reports. |

| Mid-Career | Commercial Property Manager | 3-8 years | $75,000 - $110,000 | Managing a single large property or a small portfolio of properties, full budget and P&L responsibility, lease administration, direct tenant relations. |

| Senior/Executive | Senior Property Manager, Portfolio Manager, Director of Property Management | 8+ years | $110,000 - $175,000+ | Strategic oversight of a large portfolio of assets, managing a team of property managers, high-level financial planning, relationship with institutional owners/investors. |

*Source: Consolidated data from Salary.com, Payscale, and industry observations.*

### Beyond the Base Salary: Understanding Total Compensation

A savvy professional never looks at salary alone. In commercial property management, total compensation is a critical concept, as a significant portion of your earnings can come from variable pay.

- Annual Performance Bonuses: This is the most common form of additional compensation. Bonuses are typically tied to specific Key Performance Indicators (KPIs) set at the beginning of the year. These can include:

- Meeting Budget Goals: Keeping expenses at or below budget while maximizing income.

- Increasing Net Operating Income (NOI): The holy grail of property management performance.

- Tenant Retention Rate: Achieving a target percentage of lease renewals.

- Property Occupancy Rate: Keeping the building leased up.

- Bonuses can range from 5% of your base salary to over 30% in a very good year for a high-performing manager.

- Leasing Commissions: While dedicated leasing brokers handle the bulk of new leases, some property management roles include commissions for direct involvement in securing new tenants or executing renewals. This is more common in smaller firms or for roles with hybrid responsibilities.

- Profit Sharing: Some private ownership groups or boutique management firms may offer a profit-sharing plan, where a portion of the property's annual profits is distributed to key employees. This provides a powerful incentive to think and act like an owner.

- Standard Benefits: A comprehensive benefits package is a significant part of your compensation. Expect to see:

- Health, dental, and vision insurance.

- 401(k) retirement plans with a company match.

- Paid Time Off (PTO) and holidays.

- Life and disability insurance.

- Perks and Allowances: Depending on the company and role, you might also receive valuable perks like:

- A company car or a car allowance, as travel between properties may be required.

- A mobile phone stipend or company-provided phone.

- Payment of professional association dues (e.g., IREM, BOMA).

- A budget for continuing education and professional development.

When evaluating a job offer, it's essential to calculate the value of this entire package, as a lower base salary with a strong bonus structure and excellent benefits can often be more lucrative than a higher base salary with little else.

Key Factors That Influence a Commercial Property Manager Salary

While national averages provide a useful benchmark, your individual salary is determined by a confluence of specific, interwoven factors. Understanding these levers is the key to strategically navigating your career and maximizing your income. This is where you move from being a passive job seeker to an active career architect.

###

Level of Education & Professional Certifications

Your formal education and, more importantly, your industry-specific credentials, are foundational to your earning potential. They act as signals of competence and dedication to potential employers.

- Educational Foundation:

- High School Diploma or Associate's Degree: It's possible to enter the field in an administrative or assistant role with this background, but upward mobility and salary potential will be limited without further education or significant on-the-job experience.

- Bachelor's Degree: This is the de facto standard for a professional-track career. Degrees in Real Estate, Finance, Business Administration, or Accounting are most directly applicable and highly valued. A bachelor's degree not only provides essential knowledge but also opens the door to higher-level certifications. Employers typically offer a 10-15% higher starting salary to candidates with a relevant bachelor's degree compared to those without.

- Master's Degree: An advanced degree like a Master of Business Administration (MBA) or a Master of Science in Real Estate (MSRE) is a significant differentiator, particularly for those aspiring to executive leadership. These degrees command the highest starting salaries and are often a prerequisite for roles like Vice President of Property Management or Director of Assets, where salaries can easily exceed $200,000.

- The Power of Certifications: In commercial real estate, certifications are often more impactful on salary than a master's degree, especially for management roles. They are a clear indicator of specialized expertise and commitment to the profession.

- Certified Property Manager (CPM®): Offered by the Institute of Real Estate Management (IREM), the CPM is the undisputed gold standard in property management. It is an elite credential recognized globally. Achieving the CPM requires a rigorous curriculum covering finance, ethics, and operations, as well as a comprehensive management plan project and a portfolio of experience. According to IREM, professionals who hold the CPM designation earn, on average, more than twice the salary of those without it. This is the single most powerful salary booster you can pursue.

- Real Property Administrator (RPA®): Offered by BOMI International, the RPA is another highly respected designation, focusing deeply on the operational side of property management—building systems, analytics, and asset management. It is an excellent credential that demonstrates a high level of technical and administrative competence and leads to significant salary increases.

- Certified Commercial Investment Member (CCIM): While more focused on the investment analysis and transaction side of real estate, the CCIM is extremely valuable for property managers who want to advance into asset management or acquisitions. It demonstrates a mastery of financial and market analysis.

- State Real Estate License: In many states, a real estate salesperson or broker license is a legal requirement to perform certain duties like leasing. Even when not legally required, it is highly preferred by employers as a baseline indicator of professional knowledge and ethical standing.

###

Years of Experience & Career Trajectory

Experience is the currency of the real estate world. Your salary will and should grow in distinct phases as you progress from tactical execution to strategic oversight.

- Stage 1: The Foundation (0-3 years) - Assistant PM: In this phase, your primary goal is to learn. You are absorbing information, supporting senior managers, and proving your reliability. Your salary reflects your apprentice status, typically in the $55,000 to $75,000 range. Your value is in your potential and your ability to execute tasks efficiently.

- Stage 2: Ownership (3-8 years) - Property Manager: You now have full responsibility for one or more properties. You are the primary decision-maker on-site, managing the budget, leading the team, and interfacing directly with tenants and owners. Your salary sees a significant jump into the $75,000 to $110,000 range, plus robust bonus potential. Your value is in your ability to independently manage and optimize a multi-million dollar asset.

- Stage 3: Strategic Oversight (8-15 years) - Senior PM / Portfolio Manager: You have graduated from managing a single asset to overseeing a collection of properties (a portfolio). You are now managing other property managers, setting strategy across multiple assets, and interacting with higher-level stakeholders like institutional investors. Your focus shifts from day-to-day operations to long-term value creation. Salaries move firmly into the $110,000 to $150,000+ bracket, with total compensation often reaching much higher.

- Stage 4: Executive Leadership (15+ years) - Director / Vice President: At this level, you are a key executive in the firm. You are responsible for the entire property management division, setting company-wide policy, driving business development, and managing the overall profitability of the department. This is a top-tier role with compensation packages often exceeding $175,000 to $250,000+, including significant long-term incentives.

###

Geographic Location

Where you work is one of the single biggest determinants of your base salary. Compensation is directly tied to the cost of living and, more importantly, the value and complexity of the real estate in that market. A manager of a 40-story skyscraper in Manhattan will naturally command a higher salary than a manager of a three-story office building in a small Midwestern city.

- Top-Tier Markets: Major gateway cities with high property values and a high concentration of institutional-grade real estate offer the highest salaries. These include:

- New York City, NY

- San Francisco Bay Area, CA

- Boston, MA

- Los Angeles, CA

- Washington, D.C.

- Seattle, WA

- In these markets, an experienced CPM can expect to earn a 20-40% premium over the national average. A senior manager role in NYC or San Francisco can easily command a base salary well over $150,000.

- Mid-Tier & High-Growth Markets: Strong secondary cities and rapidly growing Sun Belt markets also offer competitive salaries as demand for skilled managers increases. Examples include:

- Denver, CO

- Austin, TX

- Atlanta, GA

- Dallas-Fort Worth, TX

- Phoenix, AZ

- Salaries here are often close to or slightly above the national average and may offer a better quality of life when adjusted for cost of living.

- Lower-Cost Markets: Smaller cities and rural areas will generally offer lower base salaries, reflecting lower property values and a lower cost of living. However, these roles can still be financially rewarding and offer excellent work-life balance.

Sample City Salary Comparison for a Mid-Career Commercial Property Manager (Base Salary Estimate)

| City | Estimated Median Salary |

| :--- | :--- |

| San Francisco, CA | $125,000 |

| New York, NY | $120,000 |

| Boston, MA | $112,000 |

| Chicago, IL | $98,000 |

| Atlanta, GA | $95,000 |

| Dallas, TX | $92,000 |

| Kansas City, MO | $85,000 |

*Source: Analysis of data from Salary.com, Glassdoor, and cost-of-living indices.*

###

Company Type & Size

The type of company you work for significantly impacts your compensation structure and culture.

- Large Third-Party Management Firms & REITs (e.g., CBRE, JLL, Cushman & Wakefield, Boston Properties): These global giants offer structured career paths, excellent training, and comprehensive benefits. Base salaries are often competitive and well-defined by level and experience. Bonus structures are typically more formalized and may be slightly less volatile than in smaller firms. This is a great path for those who value structure and a clear corporate ladder.

- Boutique/Private Management Firms: Smaller, often privately-owned firms can offer a different kind of financial opportunity. While the base salary might be slightly lower than at a global firm, the potential for variable compensation can be much higher. Bonuses and profit-sharing are often directly tied to the performance of the specific properties you manage, creating a highly entrepreneurial environment.

- Owner/Developer: Working directly for the company that owns and develops the properties provides a deep sense of ownership. Compensation can be very lucrative, as your performance directly impacts the owner's bottom line. These roles often involve you in the development and construction process, broadening your skillset.

- Corporate Real Estate Department: Many large corporations (e.g., Google, Amazon, Bank of America) have massive real estate portfolios and employ their own teams of property managers. These roles often come with excellent corporate benefits, a stable work environment, and salaries that are competitive with the broader market.

###

Area of Specialization (Property Type)

Not all commercial properties are created equal. Specializing in a particular asset class can significantly impact your skill set and your paycheck, especially in niche, high-demand sectors.

- Office (Class A, B, C): This is the most traditional and one of the largest sectors. Managing a trophy-class Class A skyscraper in a central business district is a prestigious and high-paying role. Expertise in tenant improvements, amenities, and creating a modern work "experience" is key.

- Industrial/Logistics: This sector is booming thanks to e-commerce. Managing large distribution centers, warehouses, and logistics parks is in high demand. Knowledge of logistics, clear heights, dock doors, and the needs of third-party logistics (3PL) providers can command premium pay.

- Retail: Managing a shopping mall or a large "power center" requires a unique blend of operational skill and marketing savvy. You're not just managing a building; you're curating a consumer destination. Success is tied to foot traffic, tenant sales, and creating the right tenant mix. This can be a very high-pressure, high-reward specialization.

- Medical Office Buildings (MOBs): This is a highly specialized and lucrative niche. MOBs have unique needs related to sensitive medical equipment, hazardous waste disposal, and compliance with healthcare regulations like HIPAA. Managers with this expertise are rare and highly sought after, commanding some of the highest salaries in the field.

- Life Sciences/Lab Space: Another booming, high-