In the intricate financial ecosystem of any corporation, the treasury department is the vital, beating heart. It's the command center that ensures the organization's financial lifeblood—cash—is managed with precision, foresight, and strategic acumen. For those drawn to the high-stakes world of corporate finance, a career as a Treasury Analyst offers a unique blend of analytical rigor, strategic influence, and tangible impact. But beyond the intellectual challenge lies a crucial question for any aspiring professional: What is the salary for a Treasury Analyst, and what does the career's financial trajectory truly look like?

This guide is designed to be your definitive resource, moving beyond simple salary averages to provide a granular, multi-faceted understanding of compensation in the treasury field. We will dissect every factor that shapes your paycheck, from your educational background and geographic location to the specific skills that can add thousands to your annual earnings. My first brush with the sheer importance of this role came while working with a rapidly expanding tech company. A sudden currency fluctuation in an overseas market threatened to wipe out the profit margin on a massive new contract. It was the calm, data-driven strategy of a senior treasury analyst, who had preemptively put currency hedges in place, that turned a potential disaster into a managed event, saving the company millions. That moment crystallized for me that treasury isn't just a back-office function; it's a strategic pillar of corporate resilience and growth.

Whether you are a student mapping out your future, a finance professional considering a career pivot, or a current analyst aiming for the next level, this article will provide the data, insights, and actionable advice you need to navigate and maximize your career as a Treasury Analyst.

### Table of Contents

- [What Does a Treasury Analyst Do?](#what-does-a-treasury-analyst-do)

- [Average Treasury Analyst Salary: A Deep Dive](#average-treasury-analyst-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does a Treasury Analyst Do?

Before we delve into the numbers, it's essential to understand the substance of the role. A Treasury Analyst is the guardian of a company's cash. Their primary objective is to ensure the company has the right amount of cash, in the right currency, in the right place, at the right time, while managing any associated financial risks. They operate at the intersection of accounting, finance, and economics, providing critical support that enables the company to meet its financial obligations, fund its operations, and invest in its future.

The role is far more dynamic and strategic than simply tracking bank balances. It involves a sophisticated set of responsibilities that can be broken down into several core functions:

- Cash Management: This is the bedrock of treasury. Analysts are responsible for monitoring daily cash positions, consolidating balances from various bank accounts (often globally), and ensuring sufficient liquidity for daily operations like payroll, vendor payments, and debt service. This includes executing wire transfers, ACH payments, and managing the company's various banking relationships.

- Cash Forecasting: Looking beyond the present, treasury analysts create short-term and long-term cash flow forecasts. By analyzing historical data, business projections, and accounts payable/receivable cycles, they predict future cash inflows and outflows. This forecasting is crucial for strategic planning, helping leadership decide when to borrow, when to invest surplus cash, and how to fund major capital expenditures.

- Risk Management: Companies face a variety of financial risks, and the treasury analyst is on the front lines of mitigating them. This includes:

- Foreign Exchange (FX) Risk: For multinational corporations, analysts monitor currency fluctuations and may execute hedging strategies (like forward contracts or options) to protect the value of international revenues and expenses.

- Interest Rate Risk: They analyze the company's exposure to changing interest rates on its debt and investments and may recommend strategies to lock in favorable rates.

- Counterparty Risk: They assess the financial stability of the banks and other financial institutions the company partners with.

- Investment and Debt Management: When the company has excess cash, the treasury analyst helps manage a portfolio of short-term, low-risk investments (like money market funds or commercial paper) to earn a return. Conversely, when the company needs to borrow, they assist in managing credit lines and ensuring compliance with debt covenants.

- Reporting and Compliance: Analysts produce regular reports for senior management on cash positions, investment performance, and risk exposures. They also ensure the company's treasury activities comply with internal policies and external regulations, such as anti-money laundering (AML) rules and Sarbanes-Oxley (SOX) controls.

### A Day in the Life of a Treasury Analyst

To make this tangible, let's walk through a typical day for an analyst at a mid-sized multinational corporation.

- 8:00 AM - 9:30 AM: The Morning Cash Position. The day begins with a critical task: establishing the company's global cash position. The analyst logs into various online banking portals and the company's Treasury Management System (TMS) to pull in balance and transaction data from the previous day. They consolidate this information in a master Excel spreadsheet or TMS dashboard, identifying the available cash in dozens of accounts across North America, Europe, and Asia.

- 9:30 AM - 11:00 AM: Funding and Liquidity Management. The analyst identifies any accounts that are low on funds and need to be replenished to cover upcoming payments. They also identify accounts with excess cash. They prepare and execute the necessary wire transfers or intercompany loans to move money where it's needed, ensuring every operating entity has sufficient liquidity for the day.

- 11:00 AM - 1:00 PM: Forecasting and Analysis. The analyst updates the 13-week cash flow forecast with the latest actuals. They communicate with the Accounts Payable and Accounts Receivable teams to get updated projections on payments and collections. They notice that a large customer payment from Europe is due next week. They check the current EUR/USD exchange rate and consult with the Treasury Manager about whether to execute a hedge to lock in the rate.

- 1:00 PM - 2:00 PM: Lunch.

- 2:00 PM - 4:00 PM: Special Projects and Bank Relations. Today, the analyst is working on a project to analyze the bank fees the company has paid over the last quarter. They pull reports, identify discrepancies, and prepare a summary to discuss with their banking relationship manager. They also respond to an email from the internal audit team requesting documentation for a recent series of large transactions.

- 4:00 PM - 5:00 PM: Reporting and End-of-Day Wrap-Up. The analyst finalizes the daily treasury dashboard for senior management, which includes key metrics like total cash, investment balances, and debt outstanding. They ensure all of the day's transactions are properly recorded and file away the supporting documentation before planning their key tasks for the following day.

This blend of routine precision and ad-hoc analytical problem-solving makes the role both challenging and rewarding.

Average Treasury Analyst Salary: A Deep Dive

Now for the central question: how is this critical work compensated? The salary for a Treasury Analyst is competitive and reflects the high level of responsibility and specialized knowledge required. It's important to look at compensation not just as a single number, but as a range influenced by several factors we will explore in the next section.

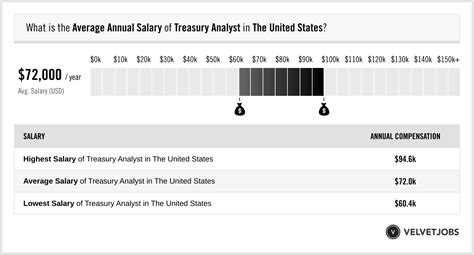

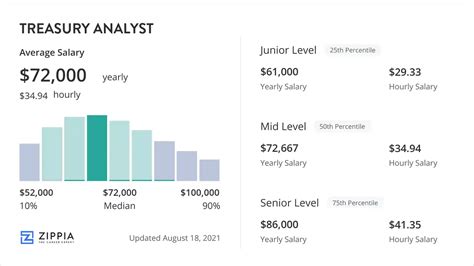

First, let's establish a baseline using data from trusted industry sources. It's crucial to cross-reference multiple data points, as methodologies can vary.

According to Salary.com, as of early 2024, the median base salary for a Treasury Analyst I in the United States is $68,801, with a typical range falling between $62,569 and $75,695. For a more experienced Treasury Analyst II, the median jumps to $83,277, with a range of $75,720 to $91,559.

Glassdoor, which incorporates user-submitted data, reports a slightly higher average. As of early 2024, the estimated total pay for a Treasury Analyst in the U.S. is $86,939 per year, with an average base salary of $76,116. The "likely range" for total pay is cited as $70,000 to $108,000 per year.

Payscale provides similar figures, indicating an average base salary of approximately $68,500 per year. Their data shows a range from about $54,000 on the low end for entry-level roles to over $89,000 for experienced analysts.

Finally, while the U.S. Bureau of Labor Statistics (BLS) does not have a separate category for "Treasury Analyst," it groups them within the broader "Financial and Investment Analysts" category. The median annual wage for this group was $96,220 in May 2022, the most recent data available. The lowest 10 percent earned less than $59,570, and the highest 10 percent earned more than $172,490. This wider category includes higher-paying roles like buy-side equity research, which can pull the average up, but it confirms that treasury is part of a high-earning professional class.

Synthesizing this data, we can establish a reliable picture of the salary landscape.

### Treasury Analyst Salary by Experience Level

Compensation grows significantly with experience. As an analyst gains expertise, takes on more complex responsibilities, and demonstrates strategic value, their earning potential increases accordingly.

| Experience Level | Typical Title | Years of Experience | Typical Base Salary Range (USA) | Typical Total Compensation Range (incl. Bonus) |

| :--- | :--- | :--- | :--- | :--- |

| Entry-Level | Treasury Analyst I, Junior Treasury Analyst | 0-2 years | $60,000 - $75,000 | $65,000 - $85,000 |

| Mid-Career | Treasury Analyst II, Senior Treasury Analyst | 3-7 years | $75,000 - $100,000 | $85,000 - $120,000 |

| Senior/Lead | Senior/Lead Treasury Analyst, Treasury Manager | 8+ years | $100,000 - $140,000+ | $115,000 - $170,000+ |

*Note: These are national averages. Salary ranges can be significantly higher in high-cost-of-living (HCOL) financial centers and for roles at large, complex multinational corporations.*

### Dissecting Total Compensation: More Than Just a Base Salary

A Treasury Analyst's compensation package is rarely just a flat salary. Understanding the different components is key to evaluating a job offer and appreciating the full earning potential of the career.

- Base Salary: This is the fixed, guaranteed portion of your annual pay. It forms the foundation of your compensation and is what the figures cited above primarily reflect.

- Annual Bonus: This is the most common form of variable pay. It's typically a percentage of your base salary, awarded based on a combination of company performance, department performance, and individual performance.

- For an entry-level analyst, a bonus might be in the 5% to 10% range.

- For a mid-career or senior analyst, this can increase to 10% to 20% or more.

- In a very profitable year at a large company, these bonuses can be substantial and significantly boost total earnings.

- Profit Sharing: Some companies, particularly privately held ones, offer a profit-sharing plan where a portion of the company's annual profits is distributed among employees. This can be a powerful incentive and a significant addition to income.

- Stock Options and Restricted Stock Units (RSUs): Common in publicly traded companies, especially in the tech sector, long-term incentive plans (LTIPs) grant employees equity.

- RSUs are grants of company stock that vest over a period of time (e.g., 25% per year over four years). They have a direct cash value once vested.

- Stock Options give you the right to buy company stock at a predetermined price in the future. Their value depends on the stock price increasing.

- Equity can be a massive component of wealth creation over the long term, particularly if the company performs well.

- Benefits: While not direct cash, the value of a strong benefits package should not be underestimated. This includes:

- Health Insurance: Comprehensive medical, dental, and vision plans.

- Retirement Savings: A 401(k) or similar plan, with a company match being a critical factor. A common match is 50% or 100% of your contributions up to a certain percentage of your salary (e.g., 6%). This is essentially "free money" and a core part of total compensation.

- Paid Time Off (PTO): Vacation days, sick leave, and holidays.

- Other Perks: Tuition reimbursement (for an MBA or certification), wellness stipends, and commuter benefits can add thousands of dollars in value per year.

When evaluating an offer, it is crucial to look at the total compensation package. A job with a $90,000 base salary and a 15% target bonus ($103,500 total) plus a strong 401(k) match is superior to a role with a $95,000 base salary and no bonus or retirement match.

Key Factors That Influence Treasury Analyst Salary

The national averages provide a useful benchmark, but your personal earning potential is determined by a specific set of variables. Understanding these factors is the key to strategically positioning yourself for maximum compensation throughout your career. This section will provide the granular detail you need to chart your course.

###

1. Level of Education and Professional Certifications

Your academic and professional credentials are the foundation upon which your career is built. They signal to employers that you have the requisite theoretical knowledge and a commitment to the profession.

Educational Background:

- Bachelor's Degree (The Prerequisite): A bachelor's degree is the standard entry requirement. The most relevant and desirable majors are Finance, Accounting, and Economics. These programs provide the core understanding of financial statements, corporate finance principles, financial markets, and quantitative analysis that are essential for the role. A degree in a related field like Mathematics or Business Administration can also be a viable entry point, especially if supplemented with relevant coursework or internships.

- Master's Degree (The Accelerator): While not typically required for an entry-level analyst position, a master's degree can significantly accelerate your career and salary trajectory.

- Master of Business Administration (MBA): An MBA, particularly from a top-tier program, is a powerful asset for those aiming for leadership roles like Treasury Manager, Assistant Treasurer, or Treasurer. It equips you with a broader strategic perspective, leadership skills, and a valuable professional network. An MBA can command a substantial salary premium, often leading to roles that start well above $120,000, but the return on investment depends heavily on the school's reputation and the cost of tuition.

- Master's in Finance (MFin) or Quantitative Finance: These specialized degrees provide deep technical expertise in financial modeling, derivatives, risk management, and econometrics. They are particularly valuable for roles in more specialized areas of treasury, such as capital markets or financial risk management, and can lead to higher starting salaries than a bachelor's degree alone.

Professional Certifications (The Differentiator):

Certifications are arguably one of the most direct ways to increase your value and salary as a treasury professional. They validate your specific expertise in the field.

- Certified Treasury Professional (CTP): This is the gold standard certification for the treasury profession. Sponsored by the Association for Financial Professionals (AFP), the CTP designation demonstrates comprehensive competency in cash management, risk management, capital markets, and working capital. Earning the CTP requires passing a rigorous exam and having a minimum of two years of relevant professional experience. Holding a CTP can lead to a salary that is, on average, 15-20% higher than that of non-certified peers, according to AFP data. It signals to employers a serious commitment to the field and a mastery of its core principles. Many senior treasury job descriptions list the CTP as a preferred or even required qualification.

- Chartered Financial Analyst (CFA): While more commonly associated with investment management and equity research, the CFA charter is highly respected in treasury, especially in larger, more sophisticated departments that actively manage investment portfolios or deal heavily in capital markets. The CFA curriculum provides an unparalleled depth of knowledge in investment tools, asset valuation, and portfolio management. An analyst with a CFA charter is well-positioned for roles focused on corporate investment strategy and can command a significant salary premium.

- Certified Public Accountant (CPA): For treasury roles that are closely integrated with the accounting department, a CPA license is a valuable asset. It demonstrates a deep understanding of accounting principles, financial reporting, and internal controls, which is highly relevant for compliance and reporting aspects of the treasury function.

###

2. Years of Experience and Career Progression

Experience is the single most powerful driver of salary growth in the treasury field. As you move from executing tasks to managing processes and eventually setting strategy, your compensation will rise in tandem.

- Entry-Level (0-2 Years): Treasury Analyst I

- Salary Range: $60,000 - $75,000

- Focus: At this stage, you are learning the ropes. Your work is heavily focused on daily operational tasks: preparing the daily cash position, executing payments, basic data entry into the TMS, and generating standard reports. You work under close supervision. The goal is to develop accuracy, reliability, and a foundational understanding of the company's cash cycle.

- Mid-Career (3-7 Years): Treasury Analyst II / Senior Treasury Analyst

- Salary Range: $75,000 - $100,000

- Focus: You have mastered the daily operations and now take on more analytical and project-based work. You might be responsible for managing the cash flow forecast, analyzing bank fees, assisting with FX hedging analysis, or helping implement a new treasury technology. You work more independently and may begin to mentor junior analysts. This is often the stage where analysts pursue the CTP certification.

- Senior Level (8+ Years): Senior Treasury Analyst / Treasury Manager

- Salary Range: $100,000 - $140,000+

- Focus: This is a transition point from analyst to manager. As a senior analyst or newly promoted manager, you take ownership of entire treasury functions, such as global cash management or the debt compliance program. You develop and recommend strategies, manage key banking relationships, and present findings to senior leadership. Your work becomes more strategic and less transactional.

- Leadership (10-15+ Years): Assistant Treasurer, Treasurer, VP Finance

- Salary Range: $150,000 - $300,000+ (plus significant bonus and equity)

- Focus: At the executive level, you are responsible for the entire treasury function globally. You set the company's capital structure strategy, oversee all financing and investment activities, manage enterprise-level financial risk, and are a key strategic advisor to the CFO and the board of directors. Compensation at this level is heavily weighted towards performance-based bonuses and long-term equity incentives.

###

3. Geographic Location

Where you work has a dramatic impact on your salary. Companies in high-cost-of-living (HCOL) areas, particularly major financial hubs, must offer higher salaries to attract talent. However, it's important to consider the cost of living when comparing offers. A higher salary in New York City may not translate to more disposable income than a slightly lower salary in a city like Dallas or Charlotte.

Here is a comparative look at estimated average base salaries for a mid-career Treasury Analyst (3-5 years experience) in various U.S. metropolitan areas, based on aggregated data from sites like Salary.com and Glassdoor:

| Metropolitan Area | Cost of Living Index (US Avg = 100) | Estimated Average Base Salary | Analysis |

| :--- | :--- | :--- | :--- |

| New York, NY | ~220 | $105,000 - $125,000 | The epicenter of finance. Highest salaries but also the highest cost of living. Offers unparalleled opportunities in large, complex corporate treasuries and financial institutions. |

| San Francisco, CA | ~190 | $100,000 - $120,000 | Driven by the tech industry, which offers competitive pay and significant equity potential. Very high cost of living, particularly housing. |

| Boston, MA | ~150 | $90,000 - $110,000 | A strong hub for finance, biotech, and technology, offering robust salaries to match its high cost of living. |

| Chicago, IL | ~105 | $85,000 - $100,000 | A major financial center with a more moderate cost of living than the coastal hubs. Home to many Fortune 500 headquarters, offering excellent opportunities. |

| Charlotte, NC | ~98 | $80,000 - $95,000 | A rapidly growing banking and finance hub. Offers salaries that are very competitive when adjusted for its relatively low cost of living. |

| Houston, TX | ~95 | $80,000 - $95,000 | The heart of the energy industry. Corporate treasury roles here are plentiful and well-compensated, with the benefit of no state income tax. |

| Atlanta, GA | ~101 | $80,000 - $95,000 | A major corporate hub in the Southeast with a growing number of Fortune 500 companies. |

| Mid-Sized City (e.g., Kansas City, MO) | ~86 | $70,000 - $85,000 | Salaries are lower in absolute terms, but the significantly lower cost of living can mean greater purchasing power. |

The rise of remote work has added a new dimension to this. Some companies now offer location-agnostic pay, while others adjust salaries based on the employee's location, even if they are remote. This is a critical factor to clarify during the interview process for any remote or hybrid role.

###

4. Company Type, Size, and Industry

The type of organization you work for is another major determinant of your salary.

- Large Corporations (e.g., Fortune 500): These companies typically offer the highest base salaries and most structured compensation packages. Their global operations create complex treasury challenges (e.g., managing dozens of currencies and hundreds of bank accounts), requiring sophisticated talent. They offer well-defined career paths, generous benefits, and substantial bonus potential. Industries like technology, pharmaceuticals, and energy often pay at the top end of the scale.

- Mid-Sized Companies: Compensation here is still competitive but may be slightly lower than at the largest corporations. The benefit of working at a mid-sized company is often broader exposure. An analyst might touch everything from cash management to risk and capital markets, whereas in a larger company, roles are more specialized.

- Startups (High-Growth Tech): Startups may offer a lower base salary compared to established corporations. However, they often compensate for this with potentially lucrative stock options or equity grants. The work environment is fast-paced and less structured, which can be appealing to some. The risk is higher, but so is the potential reward if the company succeeds.

- Non-Profit and Government: These sectors generally offer lower salaries than the private sector. A Treasury Analyst at a large university, hospital system, or government agency will have a stable, mission-driven career but will likely earn less in direct compensation. However, these roles often come with excellent benefits, particularly strong pension plans and generous paid time off.

###

5. Area of Specialization

Within the treasury department, certain specializations are more complex and in higher demand, and thus command higher salaries.

- Capital Markets / Corporate Finance: Analysts who specialize in raising debt, managing the company's capital structure, and executing share buyback programs operate at a highly strategic level. This requires deep financial modeling skills and market knowledge and is one of the highest-paying areas within treasury.

- Financial Risk Management: This specialization focuses on quantifying and hedging complex financial risks, particularly foreign exchange (FX) and interest rate risk. Analysts skilled in using derivatives (forwards, swaps, options) are highly valued, especially in volatile market environments.

- International Treasury: For multinational corporations, managing global liquidity, navigating cross-border payments, and dealing with international banking regulations is a major challenge. Analysts with experience in international cash pooling, intercompany lending, and managing relationships with global banks can command a premium.

- Treasury Technology / Systems: As treasury becomes more automated, there is a growing demand for analysts who are experts in Treasury Management Systems (TMS) like Kyriba, SAP S/4HANA Treasury, or FIS Integrity. These "power users" who can lead implementations, optimize workflows, and integrate the TMS with other company systems bridge the gap between finance and IT and are highly sought after.

###

6. In-Demand Skills

Finally, your specific, demonstrable skills can directly impact your salary negotiations and career progression. Beyond the basics, these are the skills that top-tier employers are willing to pay a premium for.

High-Value Hard Skills:

- Advanced Microsoft Excel: This is non-negotiable. You must be a power user, comfortable with complex formulas, PivotTables, Power Query, and ideally, VBA macros for automating repetitive tasks.

- Financial Modeling: The ability to build robust, three-statement financial models and cash flow forecasts from scratch is a critical skill that separates top analysts.

- Treasury Management System (TMS) Expertise: Deep experience with a specific, widely used TMS (Kyriba, ION, SAP Treasury) is a huge differentiator.

- Data Analytics and Visualization: Skills in tools like Tableau or Power BI allow you to transform raw treasury data into insightful dashboards and reports for senior leadership, demonstrating strategic value beyond day-to-day operations.

- Knowledge of Banking Systems and Products: A deep understanding of SWIFT messaging, payment formats (ACH, Fedwire), and bank products like virtual accounts and cash pooling structures.

Essential Soft Skills:

- Attention to Detail: In a world of multi-million dollar transactions, a single misplaced decimal can have catastrophic consequences. Meticulous accuracy is paramount.

- Communication Skills: You must be able to clearly explain complex financial concepts to both financial and non-financial stakeholders, from your manager to teams in accounting or sales.

- Problem-Solving: When a payment fails, a forecast is off, or a market moves unexpectedly, you need to be able to quickly diagnose the problem, evaluate options, and recommend a course of action.

- Negotiation: While more critical at the manager level, even analysts are involved in discussions with banks about fees and services. Developing this skill early is valuable.

- Proactive Mindset: The best analysts don't just report the numbers; they question them. They look for inefficiencies, identify potential risks, and propose solutions before they are asked.

By strategically developing these factors—pursuing a CTP, gaining experience in a high-demand specialization, and mastering key technical skills—you can actively steer your career towards the upper end of the salary spectrum.