Introduction

For those with ambitions forged in the competitive crucibles of finance, the title "Managing Director at Goldman Sachs" represents more than just a job; it is the summit of a mountain many aspire to climb but few ever reach. It signifies a career of immense impact, strategic influence, and, of course, extraordinary financial reward. The pursuit of this role is a marathon of intellect, resilience, and ambition. But what does it truly mean to hold this position, and what is the tangible value—the salary of a Goldman Sachs Managing Director—that accompanies such prestige?

The compensation for this role is legendary, often reaching into the seven figures. While the specific numbers are closely guarded, credible industry data suggests a total compensation package that can range from $1 million to well over $5 million annually, with top performers in exceptional years exceeding this significantly. This figure isn't just a salary; it's a complex package of base pay, performance-based bonuses, and long-term incentives designed to reward those who drive the firm's success.

Throughout my career advising senior executives, I once worked with a Vice President at a competing investment bank who was on the cusp of an MD promotion. He described the transition not as a step up, but as "crossing a chasm." On one side was execution—being the best at building models and running deals. On the other side was origination—being the person clients trust to solve their most complex problems. It's this leap, from brilliant technician to trusted strategic advisor, that defines the Managing Director role and justifies its exceptional rewards.

This guide will demystify the journey. We will dissect the role, delve deep into the compensation structure, analyze the factors that shape an MD's earnings, and lay out the strategic roadmap required to reach this pinnacle of the financial world.

### Table of Contents

- [What Does a Goldman Sachs Managing Director Do?](#what-does-a-goldman-sachs-managing-director-do)

- [Average Goldman Sachs Managing Director Salary: A Deep Dive](#average-goldman-sachs-managing-director-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does a Goldman Sachs Managing Director Do?

The title of Managing Director (MD) at Goldman Sachs, or any top-tier investment bank, marks a fundamental shift in professional responsibility. While junior bankers (Analysts, Associates) and mid-level officers (Vice Presidents) are primarily focused on the *execution* of deals, a Managing Director’s world revolves around *origination* and *strategy*. They are the firm's senior leaders, relationship cultivators, and primary revenue generators.

An MD's core mandate is to leverage their extensive network and deep industry expertise to win new business for the firm. This could mean convincing a Fortune 500 CEO to trust Goldman Sachs with a multi-billion dollar acquisition, leading the initial public offering (IPO) for a disruptive tech unicorn, or advising a sovereign wealth fund on a complex portfolio restructuring. They are the face of the firm to its most important clients.

Their responsibilities can be broken down into several key domains:

- Client Relationship Management and Business Origination: This is the lifeblood of the role. MDs spend a significant portion of their time building and nurturing C-suite relationships. They are expected to understand a client's business so deeply that they can anticipate needs and proactively propose strategic solutions, whether that's raising capital, executing a merger, or hedging risk.

- Strategic Leadership and Team Management: MDs lead large teams of VPs, Associates, and Analysts. They set the strategic direction for their group or "desk," allocate resources, and are ultimately responsible for the team's profit and loss (P&L). A crucial part of their role is mentoring the next generation of leaders, identifying talent, and fostering a high-performance culture.

- Deal Stewardship and High-Level Negotiation: While VPs and Associates handle the day-to-day execution of a deal (e.g., financial modeling, due diligence), the MD provides senior oversight and strategic guidance. They are brought in for the most critical negotiations, leveraging their experience and the firm's reputation to navigate complex deal points and bring the transaction to a successful close.

- Firm-Wide Contribution and Risk Management: As senior partners in the firm, MDs are expected to contribute to the broader health of the organization. This involves participating in firm-wide committees, championing diversity and inclusion initiatives, and, critically, acting as a key line of defense in risk management. They must ensure that the deals they pursue align with the firm's risk appetite and regulatory obligations.

### A "Day in the Life" of a Managing Director

To make this tangible, consider a hypothetical day for an MD in the Technology, Media, and Telecom (TMT) Investment Banking group:

- 7:00 AM - 8:30 AM: Start the day reading global market news (Wall Street Journal, Financial Times, Bloomberg) while scanning overnight emails from European and Asian teams. Field a call with the London office to discuss a cross-border M&A pitch.

- 8:30 AM - 10:00 AM: Lead a deal team meeting for an upcoming IPO. The team (VPs, Associates) presents updates on the S-1 filing and financial models. The MD provides strategic feedback on the investor narrative and pricing strategy.

- 10:00 AM - 12:00 PM: High-stakes client meeting. The MD and a VP pitch a strategic acquisition idea to the CEO and CFO of a major software company. The focus is not on the weeds of the model but on the strategic rationale, synergy potential, and market impact.

- 12:00 PM - 1:30 PM: Lunch with a contact from a major private equity fund. The conversation is about deal flow, market trends, and potential future collaborations. This is pure relationship building.

- 1:30 PM - 3:00 PM: Internal strategy session with the head of the TMT group and other MDs. They discuss the business pipeline, allocate resources for the coming quarter, and debate market trends and potential new business avenues.

- 3:00 PM - 5:00 PM: A series of back-to-back calls. One is to mentor a newly promoted VP. Another is with the firm's capital markets desk to discuss the feasibility of a debt financing package for a client. A third is with legal counsel to navigate a tricky regulatory issue on a live deal.

- 5:00 PM - 6:30 PM: Review a pitchbook prepared by the junior team for a meeting the next day. Provide critical feedback, ensuring the message is sharp, client-focused, and meets Goldman's standards of excellence.

- 7:00 PM onwards: Host a dinner with a long-standing client and their spouse. The conversation is a mix of business and personal, further cementing a relationship built on years of trust. After dinner, scan emails one last time before preparing for an early flight the next day.

This schedule highlights the essence of the MD role: it is less about spreadsheets and more about strategy, relationships, and leadership.

Average Goldman Sachs Managing Director Salary: A Deep Dive

Dissecting the compensation of a Goldman Sachs Managing Director requires looking beyond a simple salary figure. The true earnings power of this role lies in its variable, performance-driven components. While Goldman Sachs, like its peers, is notoriously private about its compensation structure, a clear picture can be assembled from industry reports, compensation data aggregators, and insider forums.

At this level, compensation is bifurcated into two main parts: a base salary and an annual bonus. The combination of these two is referred to as total compensation.

### Base Salary

The base salary for a Managing Director at Goldman Sachs is a substantial figure, designed to provide a high and stable standard of living, but it represents only a fraction of the total potential earnings.

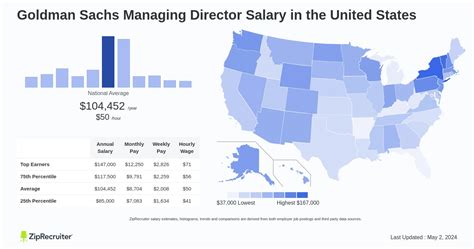

- According to data from sources like Glassdoor and Salary.com, which aggregate self-reported user data, the base salary for a Managing Director at Goldman Sachs typically falls within a range of $500,000 to $1,000,000 per year.

- Reports from specialized financial services compensation consultants like Johnson Associates often place the figure for a newly promoted MD at the lower end of this spectrum, around $500,000 to $750,000. More tenured MDs or those in leadership positions (e.g., group heads) command base salaries closer to the $1 million mark.

The primary purpose of the base salary is to provide predictability. The real incentive, however, comes from the bonus.

### The All-Important Bonus

The annual bonus is where the legend of Wall Street compensation is born. It is highly variable and determined by a complex formula that weighs three levels of performance:

1. Individual Performance: Did the MD meet or exceed their revenue targets? How many deals did they originate and close? How critical were those deals to the firm's bottom line? This is often called the "eat what you kill" component.

2. Group/Divisional Performance: How did the MD's specific group (e.g., TMT M&A, Healthcare, Global Markets) perform as a whole? A rising tide lifts all boats, and strong divisional performance creates a larger bonus pool for everyone in that group.

3. Firm-Wide Performance: How did Goldman Sachs perform globally? In a banner year for the firm, the overall bonus pool is larger, benefiting all employees. Conversely, in a challenging year, even top-performing MDs will see their bonuses compressed.

The bonus itself is not always delivered as a simple cash payment. To encourage long-term thinking and align the MD's interests with those of the firm's shareholders, the bonus is often paid out as a mix of:

- Cash: The immediate, liquid portion of the bonus.

- Deferred Compensation: A portion of the bonus (often in cash or stock) that is paid out over a period of several years (e.g., 3-5 years). This encourages retention.

- Stock Awards / Restricted Stock Units (RSUs): A significant portion of the bonus is typically awarded as company stock, which vests over a multi-year schedule. This directly ties the MD's personal wealth to the long-term performance of Goldman Sachs's stock price.

### Total Compensation: The Full Picture

When you combine base salary and the bonus, you get the total compensation figure. This is where the numbers become truly significant.

- For a first-year Managing Director in a solid, but not spectacular, year, total compensation typically lands in the $1 million to $2 million range.

- For a mid-tenure, high-performing MD who is consistently originating significant business, total compensation can range from $2 million to $5 million.

- For a top-tier MD—a "rainmaker" who is a leader in their field or the head of a highly profitable group—in a strong market year, total compensation can exceed $10 million. These are the outliers, but they demonstrate the immense upside potential of the role.

It's crucial to cite that these are estimates based on aggregated data. Wall Street Oasis (WSO), a popular forum for finance professionals, corroborates these ranges through anonymous user-submitted data. For instance, their 2023 Investment Banking Compensation Report shows MD-level all-in compensation frequently crossing the seven-figure mark, with significant variance based on the factors we'll explore next.

### Compensation Comparison by Seniority Level (Illustrative)

To put the MD role in context, here is an illustrative table of the compensation progression at a top-tier investment bank. Note that these are approximations and can vary widely.

| Title | Years of Experience | Typical Base Salary Range | Typical All-In Compensation Range |

| :--- | :--- | :--- | :--- |

| Analyst | 0-3 | $100,000 - $125,000 | $175,000 - $250,000+ |

| Associate | 3-6 | $175,000 - $225,000 | $300,000 - $500,000+ |

| Vice President (VP) | 6-10 | $250,000 - $350,000 | $500,000 - $900,000+ |

| Director / Exec. Dir. | 10-15 | $350,000 - $500,000 | $800,000 - $1,500,000+ |

| Managing Director | 15+ | $500,000 - $1,000,000 | $1,500,000 - $5,000,000+ |

*Source: Synthesized from Glassdoor, Salary.com, Wall Street Oasis reports, and industry knowledge.*

This steep, exponential curve illustrates why the role of Managing Director is so coveted. It's the point where an individual's earning potential transitions from being primarily tied to their labor to being tied to their strategic impact, network, and ability to generate massive revenue streams.

Key Factors That Influence Salary

The wide range in a Goldman Sachs Managing Director's salary—from $1 million to over $10 million—is not random. It is driven by a confluence of specific, quantifiable factors. An MD's final compensation package is a meticulously calculated reflection of their value to the firm. Understanding these levers is critical for anyone aspiring to maximize their earnings at the highest echelons of finance.

### ### Level of Education

By the time a professional reaches the MD level, their undergraduate institution is less important than their track record. However, education plays a foundational role in getting onto the path in the first place. The most common and influential educational credential for a future MD is a Master of Business Administration (MBA) from a top-tier program.

- The M7 MBA Premium: The "M7" schools (Harvard, Stanford, Wharton, Kellogg, Booth, Columbia, and MIT Sloan) are powerful launchpads. A significant percentage of MDs at firms like Goldman Sachs hold an MBA from one of these institutions. The value is threefold:

1. Elite Recruiting Access: These schools are core recruiting grounds for investment banks looking for Associate-level talent.

2. Powerful Alumni Network: The alumni network from an M7 school provides a built-in Rolodex of C-suite executives, private equity partners, and other influential figures that is invaluable for business origination later in one's career.

3. Credentialing: The degree itself is a powerful signal of intellectual horsepower, ambition, and commitment, which helps in securing promotions and gaining client trust.

- The Non-MBA Path: While the MBA is the most traditional path, it's not the only one. Some individuals rise directly through the ranks from Analyst. This is often seen in Sales & Trading divisions or with individuals who demonstrate exceptional "rainmaking" potential early on. However, they may face a steeper climb to build the broad strategic network that an MBA provides.

- Advanced Degrees & Certifications (CFA, JD): While not required, other credentials can add value. A Chartered Financial Analyst (CFA) charter signals deep expertise in investment management and can be highly valuable in Asset Management divisions. A Juris Doctor (JD) can be an advantage in specialized areas like restructuring or activism defense, where legal and financial strategies are tightly intertwined. These certifications don't guarantee a higher MD salary, but they enhance the expertise that allows an MD to win more complex, lucrative business.

### ### Years of Experience

Experience is arguably the most dominant factor in the MD compensation equation. In investment banking, experience translates directly into network size, deal-making wisdom, and client trust—the primary drivers of revenue.

The salary growth is not linear; it's exponential, with the most significant leaps occurring at senior promotion points.

- First-Year MD (Years 1-3 as MD): The focus is on proving their business case. They are transitioning from supporting roles to leading client relationships. Their compensation, while substantial (e.g., $1.5M - $2.5M), is often benchmarked against their initial revenue targets. The firm is making a significant investment in them, and they are expected to start generating a return.

- Mid-Tenure MD (Years 4-10 as MD): These MDs have an established track record and a deep book of business. They are reliable revenue generators for the firm. Their network is mature, and they are seen as industry experts. Compensation in this bracket is more stable and robust, often falling in the $3M - $5M range, with upside in strong years. They are the backbone of the firm's senior leadership.

- Senior MD / Group Head / Partner (Years 10+ as MD): This is the pinnacle. These individuals are not just running their own book of business; they are often responsible for the P&L of an entire industry group or region. Their compensation is heavily tied to the performance of the division they lead. They are "player-coaches"—originating the firm's largest deals while also setting strategy for dozens of other bankers. It's at this level that compensation can soar past $5M and into the eight-figure range during bull markets. This progression is clearly visible in compensation data from sites like Payscale, which show a dramatic increase in earnings for "Top Executives" with over 20 years of experience.

### ### Geographic Location

While finance is a global industry, compensation is not uniform. It is heavily concentrated and inflated in the world's primary financial centers, where the largest deals and capital pools reside.

- New York City: As the undisputed center of the global financial universe, New York commands the highest salaries and bonuses. It is the benchmark against which all other locations are measured. The density of clients, capital, and competing banks creates an intensely competitive talent market, driving compensation upward.

- London: Historically the second-largest hub, London salaries are very competitive with New York, though sometimes slightly lower depending on currency fluctuations and market conditions. Post-Brexit, some activity has shifted to other European centers, but London remains a top-tier location for MD compensation.

- Hong Kong & Singapore: As gateways to Asia's booming economies, these cities offer compensation packages that are often on par with or, for certain specializations (like covering Chinese tech IPOs), even exceed London's. Bonuses can be exceptionally high, but the market can also be more volatile.

- Other U.S. Hubs (San Francisco, Chicago, Houston): These cities have strong, industry-focused banking sectors. An MD in San Francisco specializing in technology will be compensated at a level near or equal to a New York counterpart. Similarly, an energy-focused MD in Houston will command top-tier pay. Compensation is tied to the revenue potential of the local industry.

- Tier 2 & 3 Cities: An MD in a regional office (e.g., Atlanta, Dallas) will still earn an exceptional living, but their total compensation will generally be lower than in the major money centers. The deals are typically smaller, and the bonus pools are sized accordingly. A salary aggregator might show a 15-25% lower total compensation package for an equivalent role outside a primary hub.

### ### Company Type & Size

While this guide focuses on Goldman Sachs, it's crucial to understand the competitive landscape, as it directly impacts compensation. An MD's pay is a function of the firm's platform, prestige, and business model.

- Bulge Bracket Banks (e.g., Goldman Sachs, J.P. Morgan, Morgan Stanley): These firms offer the most diverse platforms, covering M&A, capital markets, wealth management, and more. They have the largest balance sheets and global reach. MDs here have the potential for massive compensation due to the sheer scale of the deals they can execute. However, the bonus pools are shared across a vast organization, and compensation can be influenced by performance in divisions outside of their own.

- Elite Boutique Banks (e.g., Evercore, Centerview Partners, Lazard): These firms specialize almost exclusively in advisory services (primarily M&A). They do not have large balance sheets or trading desks. This focused model means that in years with a hot M&A market, MDs at elite boutiques can often earn *more* than their bulge-bracket counterparts. All of the firm's revenue is generated by advisory fees, and the bonus pools are concentrated among a smaller number of senior bankers.

- Middle Market Banks (e.g., Baird, Houlihan Lokey, William Blair): These firms focus on deals for mid-sized companies (typically valued below $1 billion). An MD in this space will have a lower absolute compensation package than at a bulge bracket, but potentially a better work-life balance. Total compensation might range from $800,000 to $2 million, still a phenomenal sum, but reflecting the smaller deal sizes.

### ### Area of Specialization (Division)

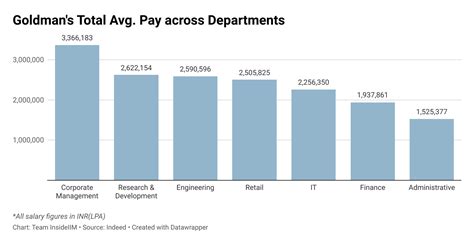

Within a firm as large as Goldman Sachs, not all MDs are created equal when it comes to compensation. Pay is directly linked to the revenue-generating potential and risk profile of the division.

- Investment Banking Division (IBD): This is the classic "investment banker" role focused on M&A advisory and capital raising (equity and debt). MDs in IBD, particularly those in high-volume sectors like TMT or Healthcare, are consistently among the highest-paid at the firm. Their compensation is driven by large, success-based advisory fees.

- Global Markets (Sales & Trading): Compensation for an MD in this division is highly volatile and directly tied to their desk's P&L. A star trader who has an exceptional year can be one of the highest-paid people at the firm. Conversely, a trader who has a flat or down year could receive a zero bonus. The mantra is "you eat what you kill."

- Asset & Wealth Management: An MD in this division, particularly in private wealth, has compensation tied to the assets under management (AUM) they attract and retain. It's a more stable, annuity-like revenue stream, leading to very high but perhaps less volatile compensation compared to trading.

- Support & Control Functions (e.g., Technology, Operations, Legal, HR): MDs in these divisions are essential to the firm's operation but are not direct revenue generators. They are considered a cost center, not a profit center. Their compensation is still extraordinary by any normal standard, but it is on a different (and lower) scale than their front-office counterparts. An MD in a control function might have a total compensation package in the $700,000 to $1.2 million range, reflecting their critical role in managing the firm's platform and risk.

### ### In-Demand Skills

Beyond role and division, a specific set of skills separates the average MD from the top 1% "rainmaker." Cultivating these skills directly translates to a larger P&L and, therefore, a larger bonus.

1. Rainmaking / Business Origination: This is the single most important skill. It is the proven ability to source, pitch, and win new, profitable business from scratch. It requires a powerful network, a reputation for excellence, and relentless hustle.

2. C-Suite Relationship Management: The ability to move beyond a transactional relationship and become a trusted, strategic advisor to CEOs and boards of directors. This is what leads to repeat business and sole-advised mandates.

3. Complex Negotiation: Mastery in navigating high-stakes, multi-party negotiations to achieve the best possible outcome for the client and the firm.

4. Strategic Vision: The ability to understand deep industry trends (e.g., the impact of AI, ESG considerations, geopolitical shifts) and translate that insight into actionable, revenue-generating ideas for clients.

5. Leadership & Talent Development: The skill of building and leading a high-performing team. A great MD multiplies their impact by developing successful VPs and junior MDs, which ultimately grows the firm's franchise.

Job Outlook and Career Growth

The career path of an investment banking Managing Director is not one tracked by traditional labor statistics. The U.S. Bureau of Labor Statistics (BLS) does not have a specific category for "Goldman Sachs Managing Director." However,