Understanding "Salary in Lieu of Notice": A Comprehensive Guide for Professionals

Navigating the end of an employment relationship, whether planned or unexpected, involves understanding key financial terms. One of the most important is "salary in lieu of notice," also known as Payment in Lieu of Notice (PILON). This isn't a career path but a crucial form of compensation that can provide a significant financial cushion during a transition. The amount you receive is directly tied to your salary, meaning a high-earning professional could receive a substantial five-figure payment.

This guide will break down what salary in lieu of notice is, how it's calculated, and the key factors that determine the final amount you might receive.

What is Salary in Lieu of Notice?

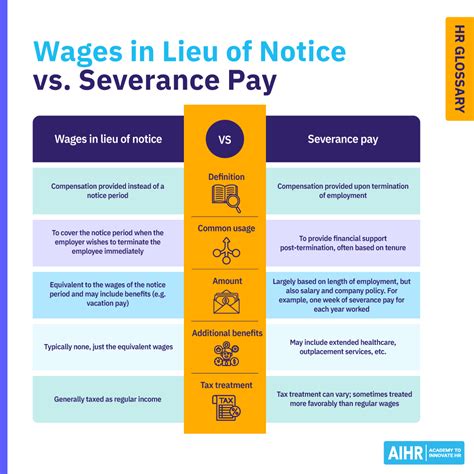

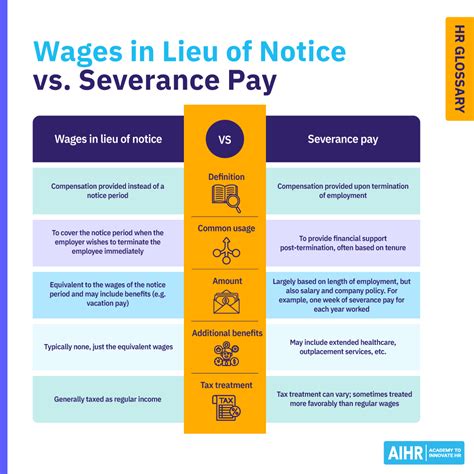

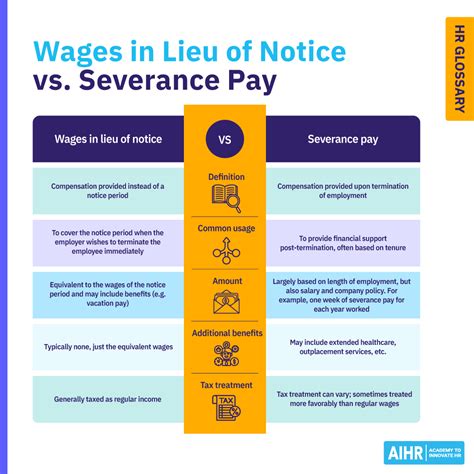

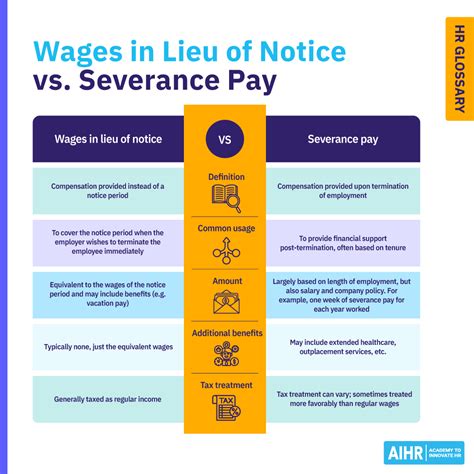

Salary in Lieu of Notice, or Payment in Lieu of Notice (PILON), is a payment made by an employer to an employee who is terminated without being required to work their contractual notice period.

In a typical separation, an employee resigns or is let go and continues to work for a set period (e.g., two, four, or more weeks). This is the "notice period." It allows the employer to transition duties and the employee to finalize their work.

However, sometimes an employer prefers an immediate separation. This could be for various reasons:

- Data Security: To prevent a departing employee from accessing sensitive company information.

- Team Morale: To avoid a negative or disruptive presence in the workplace.

- Redundancy: The employee's role has been eliminated, and there is no work for them to do.

In these cases, the employer pays the employee the wages and benefits they *would have earned* had they worked the notice period. This allows for a clean and immediate break while still fulfilling the employer's contractual obligation.

How Is Salary in Lieu of Notice Calculated?

The calculation for PILON is generally straightforward, but it depends entirely on an individual's specific compensation and notice period. There is no "average" PILON amount, as it is a direct reflection of your own earnings.

The basic formula is:

(Your regular earnings for a pay period) x (The number of pay periods in your notice period)

Let's look at two examples using real-world salary data:

Example 1: A Mid-Career Software Developer

A software developer has a two-week notice period outlined in their contract.

- Median Annual Salary: According to the U.S. Bureau of Labor Statistics (BLS), the median salary for software developers was $132,270 per year as of May 2023.

- Weekly Salary Calculation: $132,270 / 52 weeks = ~$2,544 per week.

- PILON Calculation: $2,544 x 2 weeks = $5,088

In this scenario, the developer would receive a gross payment of approximately $5,088 instead of working their final two weeks.

Example 2: A Senior Marketing Manager

A senior marketing manager has a one-month (four-week) notice period.

- Average Senior Salary: Data from Salary.com places the typical salary for a senior marketing manager in the U.S. between $145,000 and $190,000. Let's use an average of $165,000.

- Weekly Salary Calculation: $165,000 / 52 weeks = ~$3,173 per week.

- PILON Calculation: $3,173 x 4 weeks = $12,692

This payment is typically made as a lump sum and is subject to standard payroll taxes.

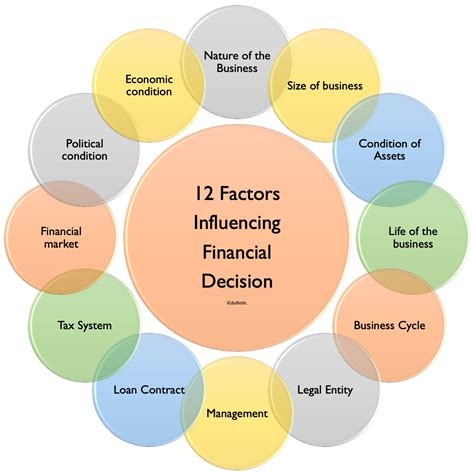

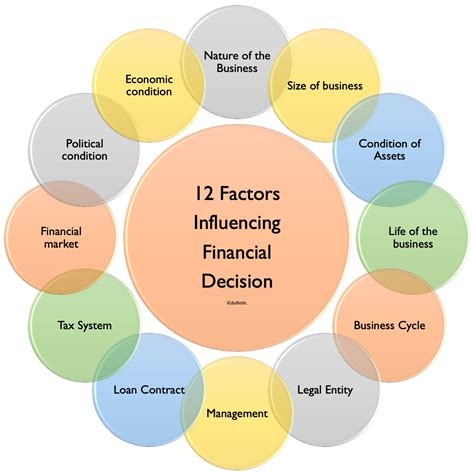

Key Factors That Influence the PILON Amount

The amount of salary paid in lieu of notice is not arbitrary. It is determined by several concrete factors.

The Employment Contract or Company Policy

This is the most critical factor. Your employment agreement or employee handbook should explicitly state the length of your notice period. Common periods are two weeks for junior to mid-level roles and four weeks or more for senior executives. The PILON clause, if it exists, will also be in this document. If your contract guarantees a notice period, your employer is generally obligated to let you work it or pay you in lieu of it.

Your Base Salary and Compensation Structure

As demonstrated in the examples, your current salary is the primary driver of the PILON amount. Higher earnings directly translate to a higher payment. This is why factors that boost your salary—such as education, experience, and specialization—indirectly increase your potential PILON. Importantly, the calculation usually includes your base salary. Whether it includes other compensation like average commissions, guaranteed bonuses, or the value of benefits (like health insurance premiums) depends on the specific wording of your employment contract and state laws.

Geographic Location and State Law

Your location plays a significant role, primarily through state and federal employment laws. While the U.S. does not have a federally mandated notice period for most terminations, some situations are protected. The Worker Adjustment and Retraining Notification (WARN) Act is a key federal law requiring employers with 100 or more employees to provide 60 days' advance notice of mass layoffs or plant closings. If an employer fails to provide this notice, they may be required to pay employees for those 60 days—a powerful form of salary in lieu of notice. Some states have their own "mini-WARN" acts with different thresholds.

Company Type and Size

Larger, more established corporations are often more likely to have formal PILON policies and offer it as a standard part of their offboarding process, especially for senior-level employees. They typically have sophisticated HR departments and legal teams that manage these separations by the book. Startups and smaller businesses may handle terminations on a more case-by-case basis, and their ability to offer PILON may be more limited unless contractually obligated.

Negotiation and Severance

Salary in lieu of notice is often included as part of a larger severance package. A severance package is not always legally required but is often offered in exchange for the employee signing a release of claims against the company. This is where negotiation comes in. If you are a long-tenured or high-level employee, you may have leverage to negotiate a severance payment that *includes* your salary in lieu of notice, plus an additional amount based on your years of service.

Legal and Tax Implications

It is crucial to understand that PILON is not a tax-free windfall. The Internal Revenue Service (IRS) generally treats salary in lieu of notice as wages. This means it is subject to federal and state income taxes, as well as Social Security and Medicare (FICA) taxes, just like your regular paycheck.

Because it's a lump-sum payment, it could temporarily push you into a higher tax bracket for that pay period, resulting in higher-than-usual withholding. You should always consult with a tax professional to understand the full financial impact. If your termination is complex, consider a consultation with an employment attorney to review your agreement before signing anything.

Conclusion

For anyone navigating their career, "salary in lieu of notice" is more than just HR jargon—it's a concept that directly impacts your financial stability during a job change. Understanding this term empowers you to better advocate for yourself and plan for your future.

Key Takeaways:

- It's Your Earned Salary, Paid Upfront: PILON is not a bonus; it is the compensation you are owed for your notice period, paid so you don't have to work it.

- Your Contract is King: The terms of your notice period and potential for PILON are almost always defined in your employment agreement. Read it carefully when you start a new job.

- Your Value Determines the Amount: Your experience, skills, and career level dictate your salary, which in turn dictates the size of your PILON.

- Know Your Rights: Be aware of federal and state laws like the WARN Act, which can provide significant protections in layoff situations.

By understanding how salary in lieu of notice works, you can approach any career transition with confidence, ensuring you are compensated fairly and are financially prepared for your next professional chapter.