Decoding Your Paycheck: Understanding the New Federal Overtime Law for Salaried Employees in 2024

A landmark federal rule change in 2024 is set to redefine what it means to be a "salaried" employee in the United States, potentially making millions of workers newly eligible for overtime pay. For professionals in the early-to-mid stages of their careers, this change could mean a significant increase in earnings or a shift in work-hour expectations. Understanding this new law is crucial for accurately valuing your time, negotiating your compensation, and planning your career trajectory.

What Does the New Federal Law for Salaried Employees Do?

The "new federal law" in question is a final rule issued by the U.S. Department of Labor (DOL) that updates the Fair Labor Standards Act (FLSA) overtime regulations. At its core, the law changes who is eligible for overtime pay.

For decades, employers could classify salaried employees as "exempt" from overtime if they met two primary criteria:

1. Salary Basis Test: The employee is paid a fixed salary, not an hourly wage.

2. Duties Test: The employee's primary job duties are executive, administrative, or professional (often referred to as the "EAP" exemption).

The new rule primarily and significantly changes a third component: the Salary Threshold Test. To be exempt from overtime, an employee must not only meet the duties test but also earn a salary *above* a specific, federally mandated amount. The 2024 rule dramatically increases this salary threshold.

In essence, the new law does this: It raises the minimum salary required for an employer to classify an employee as exempt from overtime. If you are a salaried worker performing EAP duties but your annual income is below this new threshold, your employer must now pay you overtime (1.5 times your regular rate of pay) for any hours you work beyond 40 in a week.

The New Salary Thresholds: A Game-Changer for Compensation

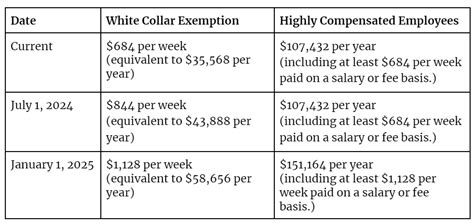

Prior to this rule, the federal salary threshold for overtime exemption was $35,568 per year. The new law implements a phased increase, creating new benchmarks for what salaried professionals must earn to be considered exempt.

According to the Department of Labor, the new salary thresholds are:

- Effective July 1, 2024: The threshold rises to $43,888 per year (equivalent to $844 per week).

- Effective January 1, 2025: The threshold rises again to $58,656 per year (equivalent to $1,128 per week).

The rule also increases the salary threshold for "Highly Compensated Employees" (HCEs), who are subject to a more lenient duties test, from $107,432 to $132,964 on July 1, 2024, and to $151,164 on January 1, 2025.

This means a manager, a non-profit program coordinator, or a graphic designer earning $55,000 a year, who was previously exempt, will become non-exempt and eligible for overtime pay on January 1, 2025.

Key Factors That Influence Salary and Your New Overtime Status

Your eligibility under this new rule is directly tied to your earnings, which are influenced by a combination of personal and market factors. Here’s how they intersect with the new law.

### Level of Education

While the law doesn't distinguish by education, your degree level strongly correlates with your starting and mid-career salary. Professionals with lower levels of education in salaried roles are more likely to fall under the new threshold.

- Impact: An employee with a high school diploma or associate's degree in an administrative supervisor role may earn a salary between $45,000 and $55,000. Under the new rule, they are very likely to become overtime-eligible. Conversely, a salaried professional with a Master's or Ph.D. in a specialized field will likely start with a salary well above the $58,656 threshold, making them less likely to be affected.

### Years of Experience

Experience is one of the most significant drivers of salary growth. Early-career professionals are the group most impacted by this new rule.

- Impact: An entry-level Marketing Coordinator with 1-2 years of experience might earn an average of $52,100, according to Salary.com (2024). This professional would be exempt under the old rule but will become overtime-eligible under the 2025 threshold. A Senior Marketing Manager with 10+ years of experience, earning upwards of $130,000, will remain firmly in the exempt category. This law effectively provides a new financial protection floor for salaried employees who have not yet reached senior-level earning potential.

### Geographic Location

Where you live and work plays a massive role in your salary, and thus your overtime eligibility. Salaries in high-cost-of-living (HCOL) areas are often significantly higher than in low-cost-of-living (LCOL) areas.

- Impact: An Operations Manager in New York, NY, has an average base salary of $88,500, according to Glassdoor (2024). They will likely remain exempt. However, the same role in Omaha, NE, might have a median salary closer to $65,000. While still above the new threshold, it's much closer to the line. For roles like an Assistant Store Manager, the geographic disparity is even more stark. The role might pay $55,000 in a rural area (making them newly eligible for overtime) but $75,000 in a major metropolitan center (keeping them exempt).

### Company Type and Industry

The type of company you work for—its size, industry, and for-profit status—heavily influences its compensation strategy.

- Impact: Employees at small non-profits, in retail management, and in the hospitality industry are among the most likely to be affected. For instance, the U.S. Bureau of Labor Statistics (BLS) reports the median pay for Food Service Managers was $63,970 in 2023, placing many in this field squarely in the zone of impact. In contrast, salaried employees in the tech and finance industries often have starting salaries that far exceed the new $58,656 threshold, making them less likely to see a change in their classification.

### Area of Specialization

Your specific role and its market demand will determine your salary. The duties test still applies, so roles must be genuinely "executive, administrative, or professional" to be considered for exemption in the first place.

- Impact: A specialized IT professional, such as a Cybersecurity Analyst, has a median salary of $120,360 per year (BLS, 2023) and will not be affected by the threshold change. However, a generalist role like an Office Manager, with a median salary of $58,450 (Payscale, 2024), is right on the bubble. Many in this role will find their status changing, especially in LCOL areas or at smaller companies.

Job Outlook: How the Law May Reshape the Workplace

This new rule will not change the overall job growth projections for specific careers, but it will change the nature of the jobs themselves. The BLS projects steady growth for management and professional occupations. However, employers will respond to this law in several ways:

1. Salary Increases: Some employers may raise the salaries of employees who are near the new threshold (e.g., from $56,000 to $59,000) to keep them exempt and avoid tracking hours.

2. Reclassification: Many employers will reclassify formerly exempt employees as non-exempt. This will require these employees to track their hours meticulously and will entitle them to overtime pay.

3. Stricter Hour Management: To control costs, companies may implement stricter policies against working more than 40 hours per week for their newly non-exempt employees.

This could lead to a better work-life balance for some, but it may also limit the earning potential of those who relied on working extra hours (unpaid) to get ahead.

Conclusion: Empower Yourself with Knowledge

The 2024 DOL overtime rule represents a fundamental shift in the American workplace. For salaried professionals, particularly those earning under ~$60,000, it's a critical development.

Key Takeaways:

- Know the Numbers: The new overtime exemption thresholds are $43,888 (July 2024) and $58,656 (Jan 2025).

- Assess Your Situation: Consider how your experience, location, and industry position your salary relative to these new thresholds.

- Anticipate Change: Be prepared for a conversation with your employer about your classification. They may raise your salary or transition you to an hourly-equivalent, overtime-eligible status.

- Value Your Time: This law reinforces the principle that your time is valuable. If you are asked to work more than 40 hours a week, you are now more likely to be compensated for it.

By understanding this law, you can better navigate your career, advocate for fair compensation, and ensure you are being paid legally and appropriately for your hard work and dedication.