Considering a career in the financial world? The role of a personal banker is a frequent and highly rewarding entry point, offering a direct path to helping people manage their financial lives. But beyond job satisfaction, what is the real earning potential? This article provides a data-driven look at personal banker salaries, the key factors that influence your pay, and the future outlook for this dynamic profession.

While starting salaries are competitive, the path for a successful personal banker can lead to significant financial rewards, with experienced, licensed professionals in high-demand markets often earning well over $70,000 annually when including bonuses and commissions.

What Does a Personal Banker Do?

A personal banker is the face of the bank for many customers, serving as a primary point of contact for individual clients. More than just a transaction processor, a personal banker is a relationship manager and a financial guide. Their core responsibilities typically include:

- Client Relationship Management: Building and maintaining long-term relationships with clients to understand their financial goals.

- Account Services: Opening and managing checking accounts, savings accounts, certificates of deposit (CDs), and other banking products.

- Needs-Based Selling: Identifying client needs and recommending or "cross-selling" relevant financial products and services, such as credit cards, personal loans, auto loans, mortgages, and investment services.

- Problem Resolution: Assisting clients with account issues, fraudulent activity, or complex requests.

- Financial Guidance: Providing basic financial advice and connecting clients with specialized experts like financial advisors or mortgage loan officers when necessary.

Average Personal Banker Salary

The compensation for a personal banker is often a mix of a base salary and variable pay, such as commissions or bonuses tied to sales and performance goals. This structure means your total earnings can significantly exceed your base pay.

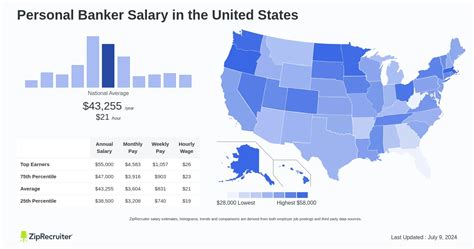

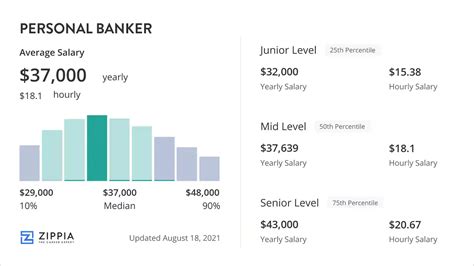

According to data from several authoritative sources, the average salary for a personal banker in the United States reflects a solid entry into the professional workforce.

- Salary.com reports that the median base salary for a Personal Banker I (entry-level) is around $43,730 per year, with a typical range falling between $39,095 and $48,683 as of late 2023.

- Glassdoor places the average total pay (including base salary and additional compensation like bonuses) higher, at approximately $57,400 per year.

- The U.S. Bureau of Labor Statistics (BLS) groups personal bankers under the category "Financial Services Sales Agents." The median annual wage for this group was $68,140 as of May 2022, though this category also includes roles that may require more advanced licensing.

This data illustrates that while a starting base salary may be in the low-to-mid $40,000s, performance-based incentives are a critical component of total compensation, pushing the average total earnings much higher.

Key Factors That Influence Salary

Your salary as a personal banker is not a fixed number. It’s influenced by a combination of your skills, choices, and environment. Here are the most significant factors that will impact your paycheck.

### Level of Education

While a bachelor’s degree is not always a strict requirement, it is highly preferred by most major banks and can directly impact your starting salary and career trajectory.

- High School Diploma or GED: This is typically the minimum requirement, often sufficient for entry-level positions at some community banks or credit unions, especially if you have strong customer service or sales experience.

- Associate's or Bachelor's Degree: Candidates with a degree in finance, business, economics, or a related field are more competitive. They often command a higher starting salary and are placed on a faster track for promotions to roles like Senior Personal Banker, Branch Manager, or specialized lending positions.

### Years of Experience

Experience is arguably the most powerful driver of salary growth in this role. As you build a track record of success, your value—and your compensation—will increase.

- Entry-Level (0-2 years): A Personal Banker I will focus on learning the bank's products, building foundational client relationships, and meeting initial sales goals. Earnings will typically be closer to the base salary range of $40,000 to $48,000.

- Mid-Career (2-5 years): A Personal Banker II has a proven ability to manage a larger portfolio of clients and consistently meet or exceed sales targets. Their base salary increases, and their commission potential grows. Total compensation can realistically move into the $55,000 to $65,000 range.

- Senior/Lead Personal Banker (5+ years): With extensive experience, these professionals handle high-value clients, mentor junior bankers, and manage more complex financial situations. According to Salary.com, a Personal Banker III can earn a median base salary of over $56,000, with total compensation, especially with investment licenses, often exceeding $75,000.

### Geographic Location

Where you work matters. Salaries are adjusted based on the local cost of living and the demand for financial professionals in that market. Major metropolitan areas with significant financial hubs typically offer the highest salaries.

For example, personal bankers in cities like New York, NY, San Francisco, CA, and Boston, MA, can expect to earn 15-25% above the national average to compensate for a higher cost of living. Conversely, salaries in smaller towns and rural areas will likely be closer to the lower end of the national range.

### Company Type

The type of institution you work for plays a role in your compensation structure and overall benefits.

- Large National Banks (e.g., JPMorgan Chase, Bank of America): These institutions often offer higher base salaries, highly structured training programs, and comprehensive benefits packages. They provide clear career paths but may have more aggressive sales goals.

- Regional and Community Banks: These smaller banks may offer slightly lower base salaries but can sometimes provide a better work-life balance, a strong sense of community, and potentially more attainable bonus structures.

- Credit Unions: As non-profit, member-owned institutions, credit unions are known for their strong focus on member service. Compensation is competitive and may be heavily weighted toward providing excellent service rather than pure sales volume.

### Area of Specialization

The most significant way to accelerate your earning potential as a personal banker is to specialize and become licensed to offer more sophisticated products.

- Licensed Personal Banker: This is the key to unlocking higher income brackets. By obtaining FINRA licenses like the Series 6 or Series 7 and the Series 63, you become legally authorized to sell investment products like mutual funds and annuities. This specialization directly translates into a higher base salary and, more importantly, opens the door to substantial commission and bonus opportunities. A licensed banker can easily earn $20,000+ more per year than their non-licensed peers.

- Small Business Banking: Some personal bankers specialize in serving the needs of small business owners, handling business checking, credit lines, and merchant services.

- Mortgage Origination: While often a separate role, some personal bankers get certified to originate mortgages, which comes with a lucrative commission structure.

Job Outlook

The U.S. Bureau of Labor Statistics (BLS) projects that employment for "Financial Services Sales Agents" will see a 3% decline from 2022 to 2032. However, this statistic requires important context.

The decline is largely driven by the automation of routine transactions and the rise of digital and mobile banking. The need for bankers who simply open accounts or process deposits is shrinking.

Conversely, the demand for skilled, relationship-focused personal bankers is expected to remain steady or even grow. Banks need professionals who can navigate complex client needs, provide tailored advice, and build trust—skills that cannot be automated. The future of the role lies in becoming a licensed financial advisor, a trusted problem-solver, and a manager of client relationships.

Conclusion

A career as a personal banker offers a stable and promising entry into the financial services industry. While an entry-level position provides a solid salary, the true earning potential is in your hands.

Key takeaways for maximizing your salary include:

- Pursue Higher Education: A bachelor's degree in a relevant field gives you a competitive edge.

- Gain Experience: Build a strong track record of sales performance and client satisfaction to advance.

- Get Licensed: Obtaining your Series 6/7 and 63 licenses is the single most effective way to dramatically increase your total compensation.

- Consider Location: Working in a major financial market can provide a significant salary boost.

For individuals with strong interpersonal skills, a drive to help others, and an interest in finance, the personal banker career path is not just a job—it's a gateway to a prosperous and impactful future.