If you're looking for a career in finance that blends customer service, sales, and strategic financial guidance, the role of a Relationship Banker is an excellent entry point with significant growth potential. But what can you expect to earn? While the answer varies, Relationship Bankers in the United States can expect a competitive salary, often with a total compensation package that falls between $50,000 and $75,000 per year, with top earners and those in senior positions earning significantly more.

This guide will break down a Relationship Banker's salary, the factors that influence it, and the future outlook for this dynamic profession.

What Does a Relationship Banker Do?

Before diving into the numbers, it’s important to understand the role. A Relationship Banker is not just a teller; they are the primary point of contact for a portfolio of bank clients. Their goal is to build long-term, trusted relationships by understanding a client's complete financial picture and proactively offering solutions.

Key responsibilities include:

- Building Client Relationships: Engaging with new and existing customers to understand their financial goals and challenges.

- Sales and Cross-Selling: Identifying needs and recommending appropriate products and services, such as checking and savings accounts, credit cards, personal loans, mortgages, and investment referrals.

- Problem-Solving: Assisting clients with complex issues, account maintenance, and fraud prevention.

- Meeting Performance Goals: Achieving specific targets for sales, client acquisition, and customer satisfaction.

- Financial Guidance: Providing foundational advice on personal finance and connecting clients with specialized experts (like financial advisors or mortgage specialists) when necessary.

In essence, a Relationship Banker acts as a financial concierge, driving bank profitability by deepening client loyalty and engagement.

Average Relationship Banker Salary

A Relationship Banker's compensation is typically composed of a base salary plus variable pay, which can include commissions, bonuses, and incentives tied to performance. This structure means that total earnings can vary significantly from person to person.

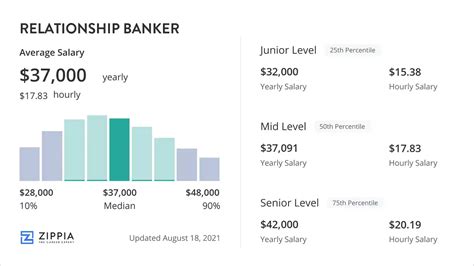

Here’s a look at the data from leading sources:

- Salary.com: As of early 2024, the median salary for a Relationship Banker I in the United States is $52,190, with a typical range falling between $45,719 and $59,512. This often represents base pay, with bonuses adding to the total compensation.

- Glassdoor: This platform, which aggregates self-reported user data, shows an average total pay of $60,247 per year for a Relationship Banker, which includes an estimated additional pay (bonus, commission, etc.) of around $8,375 per year.

- Payscale: According to Payscale, the average base salary for a Relationship Banker is approximately $52,000 per year. Their data highlights that bonuses can reach up to $10,000 annually, with profit-sharing also being a possibility at some institutions.

Key takeaway: While a base salary often starts in the $45,000 to $55,000 range, strong performance in meeting sales goals can push total compensation well into the $60,000s or even $70,000s, especially for experienced professionals.

Key Factors That Influence Salary

Your specific salary as a Relationship Banker will be determined by several critical factors. Understanding these can help you maximize your earning potential throughout your career.

###

Level of Education

While a bachelor's degree is not always a strict requirement, it is highly preferred by most major banks and can directly impact your starting salary and career trajectory.

- High School Diploma/Associate's Degree: You can secure a Relationship Banker position with a high school diploma, especially if you have prior customer service or sales experience. However, your starting salary may be at the lower end of the scale.

- Bachelor's Degree: Candidates with a four-year degree in fields like Finance, Business, Economics, or Communications are often more competitive. They typically command a higher starting salary and are often fast-tracked for promotions into roles like Senior Relationship Banker, Assistant Branch Manager, or specialized financial roles.

###

Years of Experience

Experience is arguably the most significant factor in salary growth. As you build a track record of success, your value—and compensation—increases.

- Entry-Level (0-2 years): A new Relationship Banker can expect to earn at the lower end of the national range, typically $45,000 to $53,000 in base salary. The focus at this stage is on learning the products and building foundational client management skills.

- Mid-Career (3-8 years): With several years of experience and a proven ability to meet and exceed sales targets, a Relationship Banker can expect a base salary in the $55,000 to $65,000 range, with total compensation often exceeding $70,000.

- Senior/Lead (8+ years): Senior Relationship Bankers who manage larger client portfolios or take on mentorship responsibilities can earn base salaries of $65,000+. At this stage, many transition into higher-paying roles like Branch Manager, Private Banker, or Small Business Specialist.

###

Geographic Location

Where you work matters immensely. Salaries are adjusted based on the cost of living and the demand for financial professionals in a specific market.

- High Cost-of-Living Areas: Metropolitan hubs like New York City, San Francisco, Boston, and Los Angeles will offer the highest salaries to offset expensive living costs. In these cities, it is not uncommon for experienced Relationship Bankers to earn a total compensation package approaching or exceeding $80,000.

- Lower Cost-of-Living Areas: In smaller cities and rural regions, salaries will be closer to the lower end of the national average. However, the purchasing power of that salary may be equivalent or even greater.

Use online salary calculators and filter by your city or state to get a more precise estimate for your location.

###

Company Type

The type and size of the financial institution you work for also play a crucial role in your compensation structure.

- Large National Banks (e.g., JPMorgan Chase, Bank of America, Wells Fargo): These institutions typically offer competitive base salaries, structured training programs, and comprehensive benefits. They have clear career paths but may also have more aggressive sales goals.

- Regional Banks and Credit Unions: While their base salaries may sometimes be slightly lower than those of the national giants, they might offer a better work-life balance, a stronger connection to the local community, and potentially more attainable bonus structures.

###

Area of Specialization

As you advance, you can specialize to significantly increase your earning potential. A generalist Relationship Banker is valuable, but a specialist is indispensable.

- Small Business Banking: Relationship Bankers who focus on small business clients handle more complex products like business loans and cash management services, which often come with higher commission potential.

- Affluent Banking (Premier/Select): Many banks have a dedicated tier for high-net-worth clients. Relationship Bankers serving this segment manage larger portfolios and are expected to provide a higher level of service, which is rewarded with higher salaries and bonuses.

- Licensed Bankers: Obtaining financial licenses, such as the FINRA SIE, Series 6, and Series 63, allows you to discuss and sell investment products. Licensed bankers are far more valuable to an institution and see a substantial increase in their earning potential. Similarly, obtaining a Notary Public or NMLS (Nationwide Multistate Licensing System & Registry) license for mortgages can also boost your pay.

Job Outlook

The future for financial professionals who can build relationships is bright. While automation and online banking are handling simple transactions, the need for skilled, empathetic advisors to guide clients through complex financial decisions is growing.

According to the U.S. Bureau of Labor Statistics (BLS), employment for "Financial Services Sales Agents"—a category that closely aligns with the responsibilities of a Relationship Banker—is projected to grow 11 percent from 2022 to 2032. This is much faster than the average for all occupations. The BLS notes that this demand is driven by a growing population needing financial planning and the increasing complexity of financial products.

Conclusion

The role of a Relationship Banker offers a promising and financially rewarding career path. While your starting salary may be modest, your earning potential is directly tied to your performance, experience, and willingness to grow.

Key Takeaways for Aspiring Relationship Bankers:

- Expect a Total Compensation Package: Focus on the combination of base salary and variable pay, which typically ranges from $50,000 to $75,000.

- Experience and Performance are Key: Your ability to build relationships and meet goals will be the biggest driver of your income.

- Location Matters: Salaries are highest in major metropolitan areas.

- Pursue Specialization: Obtaining licenses (like FINRA or NMLS) and specializing in areas like small business or affluent banking will unlock higher earning potential.

- Strong Job Outlook: This career offers stability and growth, making it an excellent long-term choice for those passionate about finance and helping others succeed.