For ambitious professionals drawn to the epicenter of global finance, a career in accounting in New York City represents more than just a job; it's a gateway to a world of opportunity, complexity, and significant financial reward. You're likely here because you're considering this path, weighing the demanding environment against the potential for a lucrative and stable career. You want to know the bottom line: what is the salary of an accountant in New York? The answer is not a single number, but a dynamic range influenced by a fascinating interplay of experience, specialization, and strategic career choices.

This guide will demystify the compensation landscape for accountants in the Empire State. We will move beyond simple averages to provide a granular, data-backed analysis of what you can expect to earn at every stage of your career. We'll explore the factors that can add tens of thousands of dollars to your annual income and lay out a clear roadmap for achieving your professional and financial goals. I've spent over two decades analyzing career trajectories and have seen firsthand how informed decisions can shape a professional's journey. I once advised a young graduate who felt accounting was just "bean counting." After we mapped out the path from staff accountant to a specialized forensic accounting role in a top NYC firm, their perspective shifted entirely—they saw it as becoming a financial detective in the world's most exciting city. That's the power of this profession.

This article is your comprehensive playbook. We will dissect salary data from the most trusted sources, explore the nuances of the New York market, and provide you with the actionable intelligence needed to not only enter but thrive in this competitive field.

### Table of Contents

- [What Does an Accountant in New York Do?](#what-does-an-accountant-do)

- [Average Accountant Salary in New York: A Deep Dive](#average-salary-deep-dive)

- [Key Factors That Influence Your Salary](#key-factors)

- [Job Outlook and Career Growth in New York](#job-outlook)

- [How to Become an Accountant in New York](#how-to-get-started)

- [Conclusion: Is a New York Accounting Career Worth It?](#conclusion)

What Does an Accountant in New York Do?

To understand the salary, you must first understand the role. An accountant is the financial backbone of a business, responsible for ensuring the accuracy, integrity, and compliance of all financial records. In the high-stakes, fast-paced environment of New York, this role takes on heightened importance. Accountants here aren't just recording history; they are actively shaping business strategy, mitigating risk, and enabling growth for entities ranging from Wall Street investment banks and iconic fashion houses to groundbreaking tech startups and sprawling non-profit organizations.

The core responsibilities of an accountant revolve around three primary functions: recording, reporting, and analyzing. This translates into a diverse set of daily, monthly, and annual tasks.

Core Responsibilities & Typical Projects:

- Financial Reporting: Preparing key financial statements, including the income statement, balance sheet, and cash flow statement. This is the cornerstone of the role, providing a clear picture of a company's financial health. In New York, this often involves complex reporting for public companies subject to SEC regulations.

- Bookkeeping & General Ledger Management: Overseeing the day-to-day recording of all financial transactions (accounts payable, accounts receivable, payroll). They ensure the general ledger is accurate and reconciled, forming the foundation for all financial reports.

- Tax Preparation and Compliance: A critical function, especially given the multi-layered tax landscape of New York State and City. This includes preparing federal, state, and local tax returns, ensuring timely payments, and strategizing to minimize tax liability legally.

- Budgeting and Forecasting: Collaborating with management to create annual budgets and financial forecasts. This involves analyzing past performance to project future revenue and expenses, guiding strategic decisions.

- Auditing (Internal & External): Internal auditors review a company's own processes for efficiency and compliance, while external auditors (often from public accounting firms) provide an independent opinion on the fairness and accuracy of a company's financial statements. New York is home to the "Big Four" public accounting firms, which are major employers of auditors.

- Financial Analysis: Going beyond the numbers to provide insights. This could involve variance analysis (comparing actual results to the budget), cost analysis, or evaluating the financial viability of a new project.

### A Day in the Life: Staff Accountant in a NYC Media Company

To make this tangible, let's imagine a day for "Alex," a staff accountant with two years of experience at a mid-sized digital media company in Manhattan.

- 9:00 AM - 10:30 AM: Alex starts the day by reviewing the previous day's transactions. They check the accounts payable inbox, process vendor invoices in the accounting software (like NetSuite or SAP), and review employee expense reports for compliance with company policy.

- 10:30 AM - 11:30 AM: It's the fifth business day of the month, so Alex focuses on the month-end close process. Today's task is to prepare bank reconciliations for several corporate accounts and record journal entries for prepaid expenses and accrued liabilities.

- 11:30 AM - 12:00 PM: Team meeting with the Senior Accountant and Controller to discuss progress on the close. They troubleshoot a variance in the marketing budget and assign tasks for the final review.

- 12:00 PM - 1:00 PM: Lunch. In NYC, this might be a quick bite at a local deli or a networking lunch with a colleague.

- 1:00 PM - 3:30 PM: Alex works on a special project assigned by the Controller: analyzing advertising revenue by different client tiers. They export data from the sales system, manipulate it in Excel using PivotTables, and begin drafting a summary report to identify the most profitable segments.

- 3:30 PM - 4:30 PM: A request comes in from the external audit team, who are conducting their year-end review. Alex needs to pull supporting documentation for a sample of large revenue transactions and upload it to the auditors' secure portal.

- 4:30 PM - 5:30 PM: Alex wraps up the day by responding to emails, updating their task list for tomorrow, and doing a final check on any urgent payment approvals before heading home.

This "day in the life" illustrates that the modern accountant's role is a blend of meticulous detail, analytical problem-solving, and cross-functional collaboration—skills that are highly valued and well-compensated in the New York market.

Average Accountant Salary in New York: A Deep Dive

Now, let's get to the core of your query. The salary of an accountant in New York is significantly higher than the national average, a reflection of the city's high cost of living and the concentration of high-value industries.

Nationally, the U.S. Bureau of Labor Statistics (BLS) reports that the median annual wage for accountants and auditors was $78,000 in May 2022. The lowest 10 percent earned less than $48,560, and the highest 10 percent earned more than $132,690.

However, in the New York-Newark-Jersey City, NY-NJ-PA metropolitan area, the figures are substantially more robust. According to the same May 2022 BLS data, the annual mean wage for accountants and auditors in this region was $107,330. This figure represents one of the highest metropolitan area salaries for this profession in the entire United States.

Salary aggregators, which collect real-time, user-reported data, provide an even more current and granular view.

- Salary.com, as of late 2023, reports the median base salary for an entry-level Accountant I in New York, NY, is around $78,101, with a typical range falling between $71,118 and $85,913.

- Glassdoor places the average base salary for an accountant in New York, NY, at approximately $88,000 per year, with a likely range between $71,000 and $114,000, based on thousands of user-submitted profiles.

- Payscale.com indicates a similar average base salary of around $80,500 for accountants in New York, NY, with a range typically from $63,000 to $111,000.

It's important to recognize that these figures often represent base salary. The total compensation package in New York is frequently augmented by other valuable components.

### Salary Progression by Experience Level in New York

Your earning potential grows significantly as you gain experience and take on more responsibility. Here is a breakdown of typical salary brackets in New York City, compiled from an analysis of BLS, Salary.com, and Glassdoor data.

| Experience Level | Years of Experience | Typical Base Salary Range (NYC) | Common Titles |

| :--- | :--- | :--- | :--- |

| Entry-Level | 0-2 years | $70,000 - $88,000 | Staff Accountant, Audit Associate, Junior Accountant |

| Mid-Career | 3-6 years | $88,000 - $115,000 | Senior Accountant, Senior Auditor, Financial Analyst |

| Senior/Experienced | 7-10 years | $115,000 - $150,000 | Accounting Manager, Senior Audit Manager, Controller (Small Co.)|

| Leadership/Executive| 10+ years | $150,000 - $250,000+ | Controller, Director of Finance, VP of Finance, Partner |

*Source: Synthesized data from BLS, Salary.com, and Robert Half Salary Guide 2024.*

### Beyond the Base Salary: Understanding Total Compensation

In a competitive market like New York, total compensation is a critical part of the picture. Companies use these additional incentives to attract and retain top talent.

- Annual Bonuses: This is the most common form of additional cash compensation. For staff and senior accountants, bonuses might range from 5% to 15% of their base salary, often tied to individual and company performance. For manager-level and above, this percentage can climb to 20-30% or more. In high-performing sectors like finance or at Big Four firms, these bonuses can be substantial.

- Profit Sharing: Some companies, particularly private firms or partnerships, offer a share of the company's profits to employees. This can add a significant, albeit variable, amount to annual earnings.

- Stock Options/Equity (RSUs): Highly prevalent in the tech startup scene and at large public corporations. Receiving Restricted Stock Units (RSUs) or stock options can be a massive wealth-building opportunity, though it's tied to the company's stock performance.

- Retirement Savings: A strong 401(k) or 403(b) plan with a generous employer match (e.g., matching 100% of your contribution up to 5-6% of your salary) is a key part of the compensation package.

- Health & Wellness Benefits: Comprehensive health, dental, and vision insurance is standard. NYC firms often compete on the quality of these plans, offering low-deductible options. Many also provide wellness stipends for gym memberships, mental health support, and other benefits.

- Paid Time Off (PTO): Competitive PTO policies, including vacation, sick days, and personal days, are essential for work-life balance in a demanding city.

- Professional Development: Many firms will pay for CPA exam fees, review courses, and the annual continuing professional education (CPE) credits required to maintain the license. This is a non-trivial benefit that can be worth thousands of dollars.

When evaluating a job offer in New York, it's crucial to look at the entire compensation package, as a role with a slightly lower base salary but a massive bonus potential and excellent benefits could be more lucrative in the long run.

Key Factors That Influence Your Salary

The ranges provided above are a starting point. Your specific salary will be determined by a combination of powerful factors. Mastering these levers is the key to maximizing your earning potential throughout your career. This is the most critical section for anyone looking to build a high-income career in accounting in New York.

### 1. Education & Professional Certifications: The Foundation and the Accelerator

Your educational background is your entry ticket, but your certifications are what propel you into higher earning brackets.

- Bachelor's Degree: A bachelor's degree in accounting is the standard, non-negotiable requirement for almost any professional accounting role. It provides the fundamental knowledge of accounting principles, taxation, audit, and business law.

- Master's Degree (M.Acc / MST): A Master of Accountancy (M.Acc) or a Master of Science in Taxation (MST) can provide a competitive edge, especially for specialized roles. More importantly, most states, including New York, require 150 semester hours of education to become a licensed Certified Public Accountant (CPA). Since a standard bachelor's degree is only 120 hours, a master's program is the most common way to bridge this gap. This advanced degree can command a starting salary premium of 5-10%.

- The Certified Public Accountant (CPA) License: This is the single most impactful factor you can control to increase your salary. The CPA is the gold standard in the accounting industry. It signifies a high level of expertise, ethical standing, and commitment to the profession.

- Salary Impact: According to the American Institute of Certified Public Accountants (AICPA) and various salary surveys like the Robert Half Salary Guide, CPAs earn, on average, a 10-15% salary premium over their non-certified peers. In New York, this can translate to an extra $10,000 to $25,000 annually, a gap that widens with experience.

- Career Impact: Many senior and leadership roles (Accounting Manager, Controller, CFO, Partner) explicitly require a CPA license. Lacking it will close doors to the highest echelons of the profession.

- Other Valued Certifications:

- Certified Management Accountant (CMA): Ideal for those in corporate or industry accounting, focusing on financial planning, analysis, and decision support. It can significantly boost salaries for internal finance roles.

- Certified Internal Auditor (CIA): The premier certification for professionals in internal audit, demonstrating expertise in risk, control, and governance.

- Certified Fraud Examiner (CFE): Essential for forensic accountants who investigate financial discrepancies and fraud. This is a highly specialized and lucrative niche.

- Chartered Financial Analyst (CFA): While more finance-focused, it's highly valuable for accountants working in investment management, equity research, or other areas of Wall Street.

### 2. Years of Experience: The Proven Path to Higher Pay

Experience is a direct proxy for competence and value. The salary growth trajectory in accounting is clear and predictable.

- Entry-Level (0-2 years): At this stage, you are learning the ropes. Your focus is on executing tasks accurately, learning the company's systems, and absorbing as much as possible. Salaries are in the $70,000 - $88,000 range. The biggest salary jump often occurs when you move from an entry-level to a senior role.

- Mid-Career (3-6 years): As a Senior Accountant, you are no longer just executing. You are reviewing the work of junior staff, handling more complex areas of the financial close, and beginning to interface with business leaders. You are a reliable, independent contributor. Salaries move firmly into the $88,000 - $115,000 range. This is also the period where obtaining your CPA has a massive impact.

- Senior/Manager Level (7-10+ years): At this stage, you transition from "doing" to "managing." As an Accounting Manager or Senior Manager, you are responsible for the entire accounting function or a large team. You are involved in strategic planning, process improvement, and are a key partner to executive leadership. Salaries climb substantially, often reaching $115,000 - $175,000+.

- Executive Level (Controller, VP Finance, Partner): At the top, you are setting the financial strategy for the entire organization. Your expertise guides the company's direction. Compensation is heavily weighted towards bonuses and equity, with base salaries often starting at $180,000 and easily exceeding $250,000 or $300,000, especially in large corporations or as a partner in a public accounting firm.

### 3. Company Type & Size: Where You Work Matters

The context in which you work has a profound effect on your salary, work-life balance, and career path. New York offers the full spectrum of options.

- Public Accounting (especially the "Big Four"): The Big Four firms (Deloitte, PwC, EY, KPMG) and other large national firms are known for offering very competitive starting salaries to attract the top university graduates. However, this comes with the expectation of long hours, especially during busy season. The "up-or-out" culture fosters rapid learning and career progression. A few years in the Big Four is often seen as a "golden ticket," opening doors to high-level corporate roles.

- *Salary Profile:* High starting pay, structured raises, and significant bonuses, but demanding work-life balance.

- Corporate/Industry Accounting (Private Sector): This involves working directly for a company in its internal accounting department. The salary range here is enormous and depends on the company's size and industry.

- Fortune 500 Companies: These large, public corporations (e.g., Pfizer, JPMorgan Chase, Verizon) offer compensation packages that are highly competitive with public accounting, including strong salaries, bonuses, and equity.

- Tech Startups: Can offer lower base salaries but compensate with potentially lucrative stock options. The environment is often fast-paced and less structured.

- Small to Mid-Sized Businesses (SMBs): Salaries may be slightly lower than at large corporations, but they can offer better work-life balance and a broader range of responsibilities, as you might be one of only a few accountants on staff.

- Government: Working for federal, state, or city agencies (like the IRS, the NYS Department of Taxation and Finance, or the NYC Comptroller's Office) offers a different value proposition.

- *Salary Profile:* Lower starting and top-end salaries compared to the private sector. However, this is offset by exceptional job security, excellent government benefits (pensions), and a much better work-life balance. For example, a senior accountant in a government role might earn $90,000-$110,000, less than their corporate peer, but with a strict 40-hour work week.

- Non-Profit: Driven by mission rather than profit, these organizations (hospitals, universities, charities) typically offer lower salaries than the for-profit sector. However, the work can be incredibly rewarding, and the benefits and work-life balance are often very good.

### 4. Area of Specialization: Carving Your Lucrative Niche

General accountants are always in demand, but specialized accountants command the highest salaries.

- Advisory/Consulting: This is often the most lucrative path. Accountants in these roles help clients with M&A (mergers and acquisitions) due diligence, business valuation, process improvement, and IT risk. These roles require strong analytical and communication skills and can pay significantly more than traditional audit or tax roles.

- Tax Accounting: A perennially in-demand field. Specializing in complex areas like international tax, state and local tax (SALT), or M&A tax can be extremely profitable, especially in a city with a complex tax code like New York.

- Forensic Accounting: These financial detectives investigate fraud, embezzlement, and other financial crimes. It's a high-stakes, high-skill niche that commands a premium salary.

- Information Technology (IT) Audit: As businesses become more reliant on technology, IT auditors who can assess the risks and controls within complex ERP systems (like SAP or Oracle) are in high demand and are compensated accordingly.

- Real Estate Accounting: New York is a real estate mecca. Accountants specializing in property accounting, development project finance, and real estate investment trusts (REITs) have a very lucrative and stable career path.

### 5. Geographic Location (Within New York)

While we're focusing on "New York," where you are *in* New York matters.

- Manhattan: Unsurprisingly, this is the epicenter and commands the highest salaries due to the concentration of corporate headquarters, financial institutions, and major accounting firms. The high cost of living is directly factored into compensation.

- Brooklyn, Queens, The Bronx: Salaries in the other boroughs are still very strong but may be slightly lower than in Manhattan. Many companies are now based in these boroughs, offering competitive pay with potentially easier commutes for residents.

- Long Island & Westchester County: These suburban areas have many corporate offices and offer high salaries, often rivaling the city itself, while providing a different lifestyle.

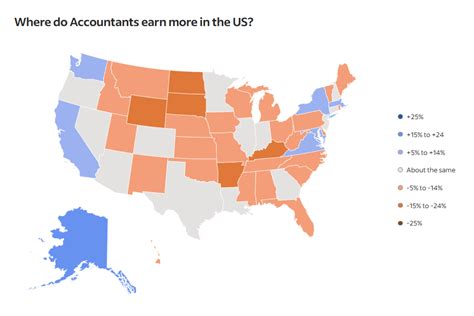

- Upstate New York (e.g., Albany, Buffalo, Rochester): Salaries in upstate metropolitan areas are significantly lower than in the NYC metro area, reflecting a much lower cost of living. An accountant's salary in Buffalo might be 25-35% lower than in Manhattan for a comparable role.

### 6. In-Demand Skills: The Salary Boosters

In today's market, traditional accounting skills are the baseline. The following skills will make you a more valuable candidate and justify a higher salary.

- Enterprise Resource Planning (ERP) System Proficiency: Deep knowledge of major ERP systems like SAP, Oracle NetSuite, Microsoft Dynamics 365, or Workday is a huge plus. Companies will pay a premium for accountants who can navigate and leverage these complex systems effectively.

- Data Analytics and Visualization: The ability to use tools like SQL to query databases, and Tableau or Microsoft Power BI to create insightful data visualizations, is transforming the accounting profession. Accountants who can turn raw financial data into clear, actionable business intelligence are highly sought after.

- Advanced Excel Skills: This goes beyond SUMIFs. Mastery of PivotTables, Power Query, and VBA (Visual Basic for Applications) to automate tasks is still a highly valued and practical skill.

- Business Acumen and Communication: Soft skills are paramount. The ability to communicate complex financial information clearly to non-financial stakeholders (like marketing or sales teams) is what separates a good accountant from a great business partner.

Job Outlook and Career Growth

The future for accountants, especially in a financial hub like New York, is bright and stable, though it is evolving.

The U.S. Bureau of Labor Statistics projects that employment of accountants and auditors is expected to grow 4 percent from 2022 to 2032, about as fast as the average for all occupations. The BLS anticipates about 126,500 openings for accountants and auditors each year, on average, over the decade. Most of those openings are expected to result from the need to replace workers who transfer