The name Goldman Sachs is synonymous with Wall Street, power, and immense financial reward. For ambitious students and young professionals, securing a position as an Analyst at this prestigious investment bank is often seen as the "golden ticket"—a launchpad into a high-powered, high-earning career in finance. The whispers of six-figure starting salaries, staggering bonuses, and unparalleled exit opportunities create a powerful allure. But what is the reality behind the legend? What can a first-year analyst truly expect to earn, and what factors determine their compensation?

This guide is designed to cut through the noise and provide a comprehensive, data-driven look at the salary of a Goldman Sachs analyst. We will dissect the entire compensation package, from base salary and signing bonuses to the coveted year-end performance bonus. More than just numbers, we will explore the demanding nature of the role, the incredible career trajectory it enables, and the precise steps you need to take to have a chance at landing this life-changing job.

I've spent over a decade in career analysis and professional development, coaching countless individuals aiming for the top tiers of the financial industry. I recall one particularly bright student who, after months of relentless preparation—late nights spent mastering LBO models and early mornings practicing mock interviews—finally received his offer from Goldman Sachs. The look of pure exhaustion mixed with elation on his face perfectly captured the essence of this career path: the sacrifice is immense, but the rewards, both financial and professional, can be extraordinary. This guide is built on that understanding—to give you the complete, unvarnished truth.

---

### Table of Contents

- [What Does a Goldman Sachs Analyst Actually Do?](#what-does-a-goldman-sachs-analyst-actually-do)

- [Goldman Sachs Analyst Salary: A Deep Dive into Compensation](#goldman-sachs-analyst-salary-a-deep-dive-into-compensation)

- [Key Factors That Influence Your Goldman Sachs Salary](#key-factors-that-influence-your-goldman-sachs-salary)

- [Job Outlook and Career Growth: Life At and After Goldman](#job-outlook-and-career-growth-life-at-and-after-goldman)

- [How to Become a Goldman Sachs Analyst: Your Step-by-Step Blueprint](#how-to-become-a-goldman-sachs-analyst-your-step-by-step-blueprint)

- [Conclusion: Is the Goldman Sachs Analyst Path Right for You?](#conclusion-is-the-goldman-sachs-analyst-path-right-for-you)

---

What Does a Goldman Sachs Analyst Actually Do?

Before we dive into the lucrative compensation, it's crucial to understand what the job entails. The title "Analyst" at Goldman Sachs is an entry-level position, typically held for two to three years by recent university graduates. While the specifics can vary by division (e.g., Investment Banking vs. Sales & Trading vs. Asset Management), the quintessential Analyst role, and the one most associated with the firm's reputation, is within the Investment Banking Division (IBD).

An IBD Analyst is the workhorse of the deal team. They are at the bottom of the hierarchy, reporting to Associates, Vice Presidents (VPs), and Managing Directors (MDs). Their primary function is to provide the analytical firepower that underpins every major financial transaction the firm undertakes, whether it's a multi-billion dollar merger, an Initial Public Offering (IPO), or a major debt financing.

Core Responsibilities and Daily Tasks:

- Financial Modeling: This is the bedrock of the analyst's work. They spend countless hours in Microsoft Excel building complex financial models to forecast a company's future performance. This includes Discounted Cash Flow (DCF) models, Leveraged Buyout (LBO) models for private equity deals, and accretion/dilution models for mergers and acquisitions (M&A).

- Valuation Analysis: Using the models they build, analysts perform various valuation techniques to determine a company's worth. This involves analyzing comparable public companies ("Comps"), precedent transactions, and the intrinsic value derived from a DCF.

- Creating Pitch Books and Presentations: Analysts are responsible for creating the polished, data-heavy presentations (known as "pitch books") that senior bankers use to pitch ideas to clients. This requires an obsessive attention to detail in PowerPoint, ensuring every slide is perfectly formatted, factually correct, and visually compelling.

- Due Diligence: When a deal is in progress, analysts are deep in the weeds of due diligence. This involves combing through a company's financial statements, internal documents, and market data to verify information and identify potential risks.

- Market and Industry Research: They constantly conduct research on specific companies, industries, and market trends to support deal origination and provide insights for clients.

A "Day in the Life" of a First-Year IBD Analyst:

The lifestyle is famously grueling, often involving 80-100 hour work weeks. A typical day is unpredictable and often dictated by the demands of senior bankers and clients.

- 9:00 AM: Arrive at the office (though work may have continued from home until 3 AM). Check emails for overnight "fire drills" or urgent requests from VPs.

- 10:00 AM - 1:00 PM: Work on updating a financial model for an M&A deal. A VP stops by to review the progress and asks for several new scenarios to be run.

- 1:00 PM: Grab a quick lunch at your desk, often paid for by the firm (a common perk).

- 2:00 PM - 6:00 PM: Focus on creating slides for a pitch book for a potential IPO. This involves pulling data from financial terminals like Bloomberg, creating charts, and writing descriptive text.

- 6:30 PM: A Managing Director needs a new pitch book for a meeting tomorrow morning. The original timeline is scrapped. This becomes the top priority.

- 7:00 PM - 9:00 PM: Conference call with the deal team (Associate, VP) to align on the strategy for the new pitch book. The analyst is tasked with building a new valuation analysis and several slides from scratch.

- 9:00 PM - 2:00 AM: "Grinding." This is head-down work in Excel and PowerPoint. The analyst coordinates with the firm's presentation center to get the book professionally polished. An Associate will review the work multiple times, sending back comments ("turns") for revision.

- 2:30 AM: The final version of the pitch book is sent to the VP. The analyst might take a firm-sponsored car service home, only to be back in the office in a few hours.

This intense environment is designed to forge highly skilled finance professionals in a very short period. The steep learning curve and immense pressure are considered a trade-off for the exceptional compensation and career opportunities that follow.

---

Goldman Sachs Analyst Salary: A Deep Dive into Compensation

The compensation for a Goldman Sachs analyst is far more than just a base salary. It’s a multi-faceted package designed to attract and retain the best talent globally. The "all-in" number—base plus bonus—is what makes this one of the most lucrative entry-level jobs in the world.

It is important to note that Wall Street compensation is cyclical and highly dependent on both firm-wide and market performance. The numbers below represent the most recent and publicly available data, but are subject to change. Our data is aggregated from authoritative sources including Bloomberg News, financial industry report aggregators like Litquidity, and crowdsourced salary platforms such as Levels.fyi and Wall Street Oasis (WSO), which provide up-to-date, user-reported figures for top investment banks.

### Deconstructing the Total Compensation Package

An analyst's pay is composed of several key elements:

1. Base Salary: This is the fixed, predictable portion of your income, paid bi-weekly. In recent years, competition for talent has driven base salaries up across Wall Street.

2. Signing Bonus (Sign-on): A one-time bonus paid to new analysts upon signing their full-time offer, usually received before the start date. This is intended to help with relocation costs and as an incentive to accept the offer.

3. End-of-Year (EOY) Performance Bonus: This is the highly variable, and often largest, component of an analyst's compensation. It is typically paid out in the summer following the first full year of work. It is determined by three main factors: the firm's overall profitability, the performance of your specific division/group, and your individual performance rating.

### Average Goldman Sachs Analyst Salary & Compensation Progression

Here is a breakdown of what a typical Investment Banking Division (IBD) analyst at Goldman Sachs can expect to earn in a major financial hub like New York.

Compensation Structure for IBD Analysts (New York Hub)

| Career Stage | Base Salary (Annual) | Signing Bonus | Year-End Bonus (Range) | Total Year 1 "All-In" Comp (Est.) |

| :--- | :--- | :--- | :--- | :--- |

| First-Year Analyst | $110,000 | $15,000 - $25,000 | $70,000 - $110,000 | $195,000 - $245,000 |

| Second-Year Analyst | $125,000 | N/A | $90,000 - $140,000 | $215,000 - $265,000 |

| Third-Year Analyst | $150,000 | N/A | $100,000 - $160,000+ | $250,000 - $310,000+ |

*Sources: Data compiled and synthesized from 2022/2023 reports on Levels.fyi, Wall Street Oasis Salary Report, and reporting from Business Insider and Bloomberg on investment banking compensation trends.*

Important Context for the Numbers:

- Base Salary Increases: As of 2021-2022, most top-tier banks, including Goldman Sachs, standardized the first-year analyst base salary to $110,000 to remain competitive. This figure has become the new industry standard for bulge-bracket firms.

- Bonus Variability: The bonus ranges are significant. An analyst who receives a "top-bucket" performance review in a strong year for the firm can see their bonus exceed their base salary. Conversely, an analyst with a lower performance rating in a weak market year will be at the bottom end of the range, or potentially even lower. For example, after a banner year in 2021, bonuses were exceptionally high. In 2022, as deal flow slowed, bonuses saw a marked decrease across the street, illustrating this volatility.

- "Stub" Year: Analysts typically start in the summer (e.g., July 2023). Their first bonus, received in summer 2024, is for a full year of work. The bonus they receive in their second summer (2025) will reflect their work as a second-year analyst.

### Beyond the Cash: Other Financial Benefits

While the headline numbers are staggering, the total value proposition includes a suite of benefits that contribute significantly to an analyst's financial well-being. These often include:

- 401(k) Plan: A generous matching program. Goldman Sachs typically offers a company match on employee contributions, for example, matching a certain percentage of the employee's contribution up to a cap.

- Health and Wellness: Comprehensive medical, dental, and vision insurance. Goldman Sachs is also known for its extensive wellness programs, including on-site fitness centers (in major offices) and mental health support resources, which gained prominence post-pandemic.

- Meal Stipends and Car Service: Given the long hours, firms like Goldman provide a nightly meal allowance (often through services like Seamless) for employees working past a certain hour (e.g., 7 PM) and will pay for a taxi or Uber/Lyft home for those working late into the night (e.g., after 10 PM). While seemingly small, this can save analysts thousands of dollars per year.

- Relocation Assistance: In addition to the signing bonus, a separate relocation package may be offered to analysts moving from a different city or country.

When evaluating the salary of a Goldman Sachs analyst, it's essential to consider this "total rewards" philosophy. The combination of a high base, a massive bonus potential, and robust benefits makes it one of the most competitive compensation packages available to a recent graduate.

---

Key Factors That Influence Your Goldman Sachs Salary

While the figures above provide a strong baseline, an analyst's "all-in" compensation is not a monolith. Several critical factors can dramatically influence earnings, particularly the all-important year-end bonus. Understanding these variables is key to understanding the nuances of Wall Street pay.

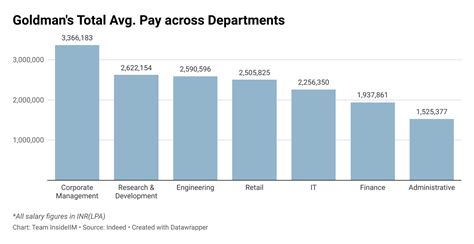

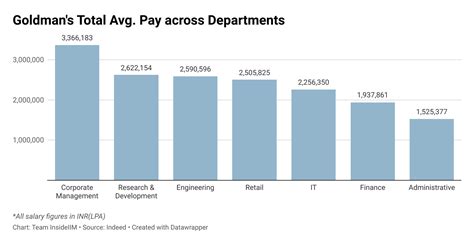

### 1. Division and Group Performance

This is arguably the most significant factor beyond individual performance. Goldman Sachs is a vast organization with many divisions, and not all are created equal in terms of revenue generation and, consequently, bonus pools.

- Investment Banking Division (IBD): Traditionally the most prestigious and one of the highest-paying divisions for analysts. Within IBD, the specific industry group you belong to matters immensely. "Top-tier" groups like Technology, Media, & Telecom (TMT), Financial Institutions Group (FIG), and Healthcare tend to work on the largest, most complex deals. When these sectors are hot (e.g., a tech M&A boom), their bonus pools swell, directly benefiting their analysts.

- Global Markets (Sales & Trading): Compensation here is also very high but can be even more volatile than in IBD. An analyst on a trading desk that has a phenomenally profitable year can earn a massive bonus. Conversely, a desk that loses money may see bonuses slashed. Pay is tied very directly to the "P&L" (Profit & Loss) you help generate.

- Asset & Wealth Management (AWM): While still highly compensated, analysts in this division generally have slightly lower total compensation than their counterparts in IBD or Global Markets. The work is often less transaction-driven, leading to a more stable but less explosive bonus structure.

- Other Divisions (e.g., Platform Solutions, Global Investment Research): These roles are critical to the firm, but analyst compensation typically falls below the top-tier front-office roles in IBD and Markets.

### 2. Individual Performance and the "Bucket" System

At the end of each review cycle, analysts are ranked against their peers. This relative ranking, often referred to as "bucketing," is the primary determinant of an individual's bonus.

- Top Bucket: Reserved for the top 10-20% of analysts. These are the undisputed stars who consistently produce flawless work, demonstrate a positive attitude, and require minimal supervision. They are rewarded with a bonus at the very top of the range, sometimes significantly higher.

- Mid Bucket: The majority of analysts (around 60-70%) fall into this category. They are competent, reliable, and meet expectations. Their bonus will be in the middle of the established range for that year.

- Bottom Bucket: The lowest 10-20% of performers. These analysts may have struggled with the technical aspects of the job, had a poor attitude, or made costly errors. Their bonus will be at the low end of the range, and this ranking often serves as a signal that they should consider other opportunities, either inside or outside the firm.

This system creates a highly competitive internal environment where analysts are constantly aware that their bonus is directly tied to outperforming their colleagues.

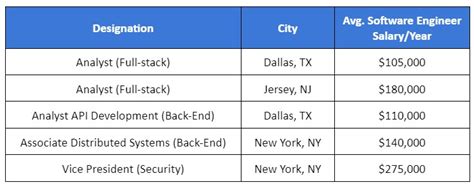

### 3. Geographic Location

Where you work for Goldman Sachs has a direct impact on your salary and bonus, primarily driven by cost of living and market competitiveness.

- Top-Tier Hubs (New York, London, Hong Kong): These cities command the highest salaries and bonuses. New York is the benchmark, and a first-year analyst's all-in compensation of ~$200K+ is standard here. London compensation is similarly structured, though currency fluctuations can affect direct comparisons.

- Tier-Two Hubs (e.g., Chicago, San Francisco, Los Angeles): Base salaries in these U.S. offices are typically the same as in New York to maintain a national standard. However, bonuses *may* be slightly lower than in NYC, reflecting the deal flow and market size of those specific offices. San Francisco, with its proximity to Silicon Valley and high cost of living, often sees compensation that rivals New York.

- Strategic Locations (e.g., Salt Lake City, Dallas, Bengaluru): Goldman Sachs has significantly expanded its presence in these lower-cost locations. While roles here are vital, compensation is adjusted for the local market. An analyst in Salt Lake City or Dallas will have a lower base salary and bonus compared to their New York counterpart. For example, according to data on Glassdoor, an analyst role in Salt Lake City might have a base salary 15-25% lower than the same role in New York. However, the purchasing power in these cities can make the overall financial outcome very attractive.

Illustrative Salary Variation by Location (First-Year Analyst Base Salary)

| Location | Estimated Base Salary | Cost of Living Index (vs. NYC) |

| :--- | :--- | :--- |

| New York, NY | $110,000 | 100 |

| San Francisco, CA | $110,000 | 91.8 |

| London, UK | ~£70,000 (~$88,000) | 69.4 |

| Salt Lake City, UT| ~$85,000 - $95,000 | 50.1 |

| Bengaluru, India | Varies Significantly (local scale) | 16.6 |

*Note: Base salaries for U.S. front-office roles are often standardized. Variations are more pronounced in bonuses and in non-U.S. or non-front-office roles. Cost of living data from sources like Numbeo for illustrative purposes.*

### 4. Experience Level and the Analyst-to-Associate Promotion

The most significant pay jump in an analyst's early career comes with the promotion to Associate. This typically happens after completing two or three years in the analyst program.

- Analyst Program (Years 1-3): As detailed previously, base salary sees structured increases each year (e.g., $110k -> $125k -> $150k). The bonus potential also grows with each year of experience.

- Promotion to Associate: This is a major career milestone. A newly promoted Associate can expect a significant jump in base salary (e.g., to $175,000 - $200,000) and a much larger bonus potential. The total "all-in" compensation for a first-year Associate can easily exceed $350,000-$400,000 in a good year, according to WSO and Levels.fyi data. This trajectory demonstrates the firm's commitment to rewarding those who successfully navigate the demanding analyst years.

### 5. How Goldman Sachs Compares to the "Street"

While Goldman Sachs is a leader, it operates in a competitive ecosystem. Understanding how its pay stacks up against other types of firms is crucial.

- Bulge Bracket Banks (e.g., J.P. Morgan, Morgan Stanley): Compensation across these large, diversified investment banks is extremely similar. The firms watch each other closely and adjust base salaries and bonus expectations in lockstep to avoid losing talent. A GS analyst and a JPM analyst with similar performance in similar groups will likely have very comparable pay.

- Elite Boutique Banks (e.g., Evercore, Centerview, Lazard): These firms specialize purely in advisory services (like M&A) and don't have the large balance sheets of the bulge brackets. Because they have lower overhead, they can sometimes pay their analysts *more* than bulge brackets, especially in the form of higher year-end bonuses. It is not uncommon for top-performing analysts at elite boutiques to out-earn their peers at Goldman Sachs in a given year.

- Middle Market Firms (e.g., Baird, Houlihan Lokey, William Blair): These firms work on smaller deals than the bulge brackets. Consequently, their compensation is typically lower. Base salaries might be slightly less, but the more significant difference is in the bonus, which will generally be a smaller percentage of the base.

### 6. In-Demand Skills That Drive Top-Bucket Bonuses

While all analysts must master the core toolkit, certain skills separate the good from the great and directly impact performance reviews and bonuses.

- Technical Excellence: Going beyond the basics. An analyst who can build a highly complex, error-free LBO model from scratch or who deeply understands the nuances of a niche valuation method will be indispensable to their team.

- Exceptional Communication and Poise: The ability to clearly articulate the story behind the numbers to an Associate or VP is critical. Analysts who can be trusted to speak with clients or other advisors earlier in their careers are highly valued.

- Proactivity and "Owning" Your Work: Top analysts don't just follow instructions; they anticipate the next step. They might run an extra analysis they think a VP will ask for later or identify a potential issue in the data before anyone else does. This proactive ownership is a hallmark of a top-bucket performer.

- Speed and Efficiency: In a job where time is the most valuable commodity, the ability to turn work around quickly and accurately without sacrificing quality is a superpower. Mastery of Excel shortcuts and efficient workflow management is key.

---

Job Outlook and Career Growth: Life At and After Goldman

The salary is only part of the story. The true value of a Goldman Sachs analyst position lies in its power as a career accelerator. The job outlook is twofold: the potential for growth within the firm and the unparalleled "exit opportunities" it provides.

### The Broader Industry Outlook

First, let's look at the market context. According to the U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook, employment for "Financial and Investment Analysts" is projected to grow 8 percent from 2022 to 2032, which is much faster than the average for all occupations. The BLS cites a growing range of financial products and the need for in-depth analysis of geographic regions as key drivers of this growth.

While this data applies to the entire industry, roles at elite firms like Goldman Sachs remain fiercely competitive regardless of market growth. There will always be thousands of applicants for a very limited number of spots.

Emerging Trends and Future Challenges:

The role of the financial analyst is evolving. Aspiring Goldman analysts should be aware of these trends:

- Automation and AI: Routine tasks like data gathering and basic chart creation are increasingly being automated. The future analyst will need to focus more on higher-level thinking, strategic interpretation of data, and client-facing skills.

- Data Science Integration: The ability to work with large datasets and apply programming skills (like Python) for financial analysis is becoming a significant advantage.

- Rise of ESG: A deep understanding of Environmental, Social, and Governance (ESG) factors and how they impact valuation and investment decisions is no longer a niche skill but a core competency.

### Career Growth *Within* Goldman Sachs

For those who choose to stay, Goldman Sachs offers a clear, albeit demanding, career path. The hierarchy is well-defined, and promotions are based on a combination of performance and time-in-seat.

- Analyst (2-3 years): The entry-level role focused on execution and analytical work.

- Associate (3-4 years): After the analyst program, top performers are promoted. Associates take on more project management, mentor analysts, and have more client interaction.

- Vice President (VP) (4+ years): VPs are the primary project managers and day-to-day client relationship contacts. They are responsible for leading the deal team and ensuring the quality of all analytical work.

- Director / Managing Director (MD): These are the senior leaders of the firm. Their focus shifts from execution to business generation (origination). They are responsible for building relationships with CEOs and boards, pitching for new business, and setting the strategic direction of their group. Reaching MD is the pinnacle of a banking career, with compensation often running into the millions of dollars.

### The Golden Handshake: Exit Opportunities