Are you a meticulous, analytical individual with a passion for bringing order to financial chaos? Do you see numbers not just as data points, but as the very language of business? If so, a career as a Senior Staff Accountant might be the perfect fit, offering a potent combination of intellectual challenge, professional respect, and significant earning potential. This role is the experienced backbone of any finance department, a position where your expertise directly impacts a company's financial health and strategic decisions.

The financial rewards are a compelling part of the story. While salaries vary, a typical senior staff accountant salary in the United States often falls within the robust range of $80,000 to $115,000 per year, with top earners in high-demand areas exceeding this significantly. This figure isn't just a number; it represents the value placed on the precision, integrity, and analytical insight that a seasoned accountant brings to an organization.

I recall a time early in my career, analyzing financial statements for a mid-sized tech company. A senior accountant I was working with paused over a line item that everyone else had overlooked. With a few targeted questions and a deep dive into the general ledger, she uncovered a recurring billing error that was costing the company nearly six figures annually. It was a powerful lesson: a great accountant isn't just a record-keeper; they are a guardian of a company's resources and a driver of its profitability.

This comprehensive guide is designed to be your definitive resource for understanding the Senior Staff Accountant role. We will dissect salary expectations, explore the factors that can maximize your earnings, map out the career trajectory, and provide a step-by-step plan to help you launch or advance your career in this rewarding field.

### Table of Contents

- [What Does a Senior Staff Accountant Do?](#what-they-do)

- [Average Senior Staff Accountant Salary: A Deep Dive](#salary-deep-dive)

- [Key Factors That Influence Your Salary](#salary-factors)

- [Job Outlook and Career Growth](#job-outlook)

- [How to Become a Senior Staff Accountant](#how-to-start)

- [Conclusion: Is This the Right Career for You?](#conclusion)

What Does a Senior Staff Accountant Do?

A Senior Staff Accountant is far more than an entry-level number cruncher. They are the seasoned professionals who handle the more complex and critical accounting duties within an organization. While a Staff or Junior Accountant may focus on day-to-day transactions like accounts payable and receivable, the Senior Staff Accountant takes a broader, more analytical view. They are responsible for ensuring the accuracy and integrity of the company's financial records, preparing key financial reports, and often mentoring junior members of the team.

Think of them as the lieutenants of the accounting department, reporting to the Accounting Manager or Controller. They are hands-on leaders who execute the crucial month-end and year-end closing processes, which are the backbone of all financial reporting. Their work forms the foundation upon which executive leadership—including the CFO and CEO—make critical strategic decisions about budgeting, investment, and growth.

Core Responsibilities and Daily Tasks:

The duties of a Senior Staff Accountant can vary depending on the size and industry of the company, but they generally revolve around a core set of responsibilities:

- Month-End and Year-End Close: This is a primary function. It involves preparing and posting complex journal entries, reconciling all balance sheet accounts (like bank accounts, prepaid expenses, and fixed assets), and ensuring all financial transactions for the period have been accurately recorded.

- Financial Statement Preparation: They are instrumental in preparing the key financial statements: the Balance Sheet, Income Statement, and Statement of Cash Flows. They analyze these statements for accuracy and trends before they are presented to management.

- General Ledger (GL) Management: The Senior Accountant is a steward of the general ledger, ensuring its accuracy, integrity, and compliance with Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

- Variance Analysis: A key analytical task is comparing actual financial results to budgeted or forecasted figures. They investigate significant variances, determine the root causes, and prepare reports for management explaining the differences.

- Audit and Compliance Support: They are a key point of contact for external and internal auditors, providing necessary documentation (known as "PBC" or "Provided by Client" lists) and explaining accounting processes and transactions. They also ensure compliance with regulations like the Sarbanes-Oxley Act (SOX).

- Mentorship and Review: A "senior" title often comes with leadership responsibilities. They review the work of junior accountants, provide guidance and training, and help develop the skills of the entire team.

- Process Improvement: Experienced accountants are expected to identify inefficiencies in accounting processes and recommend improvements, whether it's automating a manual task or redesigning a workflow to improve accuracy and save time.

### A "Day in the Life" of a Senior Staff Accountant (during a non-close week)

- 9:00 AM: Arrive and review emails. Address a query from a department head about a recent charge to their budget. Begin working on the complex reconciliation for a key accrued liability account.

- 10:30 AM: Meet with the IT department to discuss the implementation of a new expense reporting software. Provide input from an accounting perspective to ensure the system has the necessary controls and reporting capabilities.

- 12:00 PM: Lunch.

- 1:00 PM: Review a set of journal entries prepared by a junior accountant for the previous day's cash activity. Provide constructive feedback on the supporting documentation.

- 2:30 PM: Dedicate focused time to performing a flux analysis on selling, general, and administrative (SG&A) expenses, comparing the current month to the prior month and prior year, and documenting explanations for significant changes.

- 4:00 PM: Begin preparing a draft of the monthly financial reporting package for the Controller's review, pulling data from the ERP system and populating key schedules.

- 5:00 PM: Wrap up final tasks, plan priorities for the next day, and head home.

During the month-end close (typically the first 5-10 business days of a month), this schedule becomes much more intense, with a singular focus on closing the books accurately and on schedule.

Average Senior Staff Accountant Salary: A Deep Dive

The senior staff accountant salary is one of the most compelling aspects of the career path, reflecting the critical skills and experience required for the role. Compensation is competitive and multifaceted, consisting of a strong base salary supplemented by bonuses and comprehensive benefits.

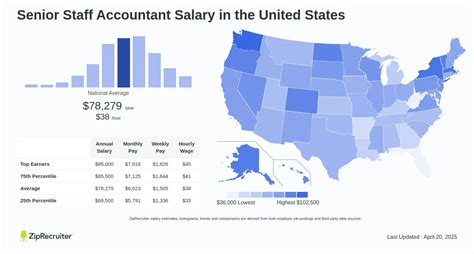

According to data aggregated from leading compensation platforms (as of late 2023/early 2024), the national picture looks like this:

- Salary.com reports the median salary for a Senior Accountant in the United States is approximately $92,690, with a typical range falling between $83,890 and $102,490.

- Payscale indicates a slightly lower average base salary at around $77,500, but shows a total pay range (including bonuses and profit sharing) that can extend from $59,000 to $104,000.

- Glassdoor lists the total pay for a Senior Accountant in the U.S. at an average of $95,600 per year, with a likely range of $81,000 to $114,000.

It's crucial to synthesize this data. A reasonable national average to expect for a qualified Senior Staff Accountant is between $85,000 and $95,000 for base salary alone, with total compensation often pushing well past the $100,000 mark, especially in major metropolitan areas or for those with specialized skills.

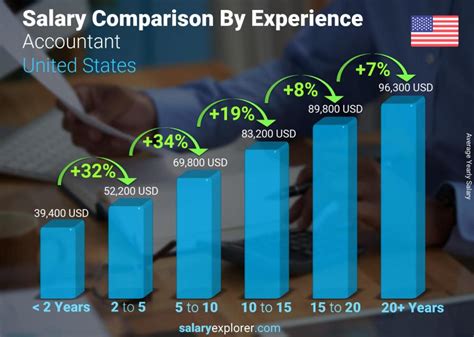

### Salary Growth by Experience Level

Your earning potential as an accountant grows significantly as you accumulate experience and demonstrate expertise. The transition from a junior or staff-level role to a senior position marks a major inflection point in compensation.

Here is a typical salary progression based on experience, compiled from industry data and salary guides like the Robert Half Salary Guide:

| Career Stage | Typical Years of Experience | Typical Base Salary Range (Corporate Accounting, Midsize Company) | Key Responsibilities |

| :--- | :--- | :--- | :--- |

| Staff Accountant | 1 - 3 years | $62,000 - $85,000 | Transactional tasks, basic reconciliations, assisting with month-end close. |

| Senior Staff Accountant | 3 - 6+ years | $80,000 - $115,000+ | Complex reconciliations, financial statement prep, variance analysis, leading close processes, mentoring. |

| Accounting Manager | 6 - 10+ years | $110,000 - $160,000+ | Managing the accounting team, overseeing all accounting operations, final review of financials. |

| Controller | 8 - 15+ years | $135,000 - $250,000+ | Leading the entire accounting function, strategic planning, internal controls, reporting to CFO. |

*Source: Data synthesized from Robert Half 2024 Salary Guide, Payscale, and Salary.com. Ranges are approximate and vary by location and company size.*

As the table shows, the jump to the "Senior" title is substantial, reflecting the shift from task execution to process ownership and analysis.

### Deconstructing Your Total Compensation Package

While base salary is the headline number, it's only one piece of the puzzle. A comprehensive compensation package for a Senior Staff Accountant often includes several other valuable components. When evaluating a job offer, it’s essential to look at the total picture.

#### 1. Base Salary

This is your fixed, annual pay and the largest component of your compensation. It's determined by the factors we'll explore in the next section, such as your experience, location, education, and the size of the company.

#### 2. Annual Bonuses

Bonuses are a significant part of the compensation structure in many companies, particularly in the corporate and public accounting sectors. These are typically tied to:

- Company Performance: If the company meets its revenue or profitability targets, a bonus pool is often funded.

- Individual Performance: Your personal contribution, meeting deadlines, accuracy, and performance on key projects will be assessed.

A typical annual bonus for a Senior Staff Accountant can range from 5% to 15% of their base salary. For a professional earning $90,000, this could mean an extra $4,500 to $13,500 per year.

#### 3. Profit Sharing

Some private companies offer a profit-sharing plan, where a portion of the company's annual profits is distributed among employees. This can be a powerful incentive, directly linking your work to the company's success. The amount varies widely but can add a substantial sum to your annual earnings.

#### 4. Retirement and Health Benefits

These are critical components of your total compensation, even if they aren't direct cash payments.

- 401(k) or 403(b) Matching: Most employers offer a retirement savings plan and will match a percentage of your contributions. A common match is 50% of your contributions up to 6% of your salary, which is essentially a 3% raise that gets invested for your future.

- Health Insurance: The value of an employer-sponsored health, dental, and vision insurance plan cannot be overstated. A good plan can save you thousands of dollars per year in premiums and out-of-pocket costs compared to purchasing insurance on the open market.

- Paid Time Off (PTO): This includes vacation days, sick leave, and paid holidays. A generous PTO policy is a valuable part of your work-life balance and overall compensation.

#### 5. Other Perks and Benefits

- Tuition Reimbursement/CPE Allowance: Many companies will pay for costs associated with obtaining your CPA license or for the Continuing Professional Education (CPE) credits required to maintain it.

- Flexible Work Arrangements: The value of remote or hybrid work options has skyrocketed, offering savings on commuting costs and providing greater flexibility.

- Stock Options/Equity: This is more common in publicly traded companies or startups. Stock options give you the right to buy company stock at a set price, which can become very valuable if the company performs well.

When you add these elements together, the true value of a Senior Staff Accountant position can easily exceed the base salary by 20-30% or more.

Key Factors That Influence a Senior Staff Accountant Salary

Not all Senior Staff Accountant roles are created equal, and neither are their salaries. A wide array of factors can push your potential earnings to the higher or lower end of the national range. Understanding these variables is the key to strategically positioning yourself for maximum compensation throughout your career. This is the most critical section for anyone looking to optimize their earning potential.

###

1. Level of Education and Professional Certifications

Your academic and professional credentials are the foundation of your accounting career and have a direct, measurable impact on your salary.

The Bachelor's Degree: A Bachelor's degree in Accounting is the standard, non-negotiable entry ticket. A degree in Finance, Business Administration with an accounting concentration, or Economics can also be a viable starting point, but an accounting degree is the most direct path. It establishes that you have the foundational knowledge of GAAP, auditing principles, tax, and business law.

The Master's Degree: Pursuing a Master of Accountancy (M.Acc or MACC) or a Master of Science in Accounting (MSA) can provide a salary advantage. More importantly, it is often the most efficient way to meet the 150-credit-hour requirement for the CPA license that most states mandate. Employers see a Master's degree as a signal of advanced technical knowledge and commitment to the profession. While it may not dramatically increase your starting salary as a junior, it can accelerate your path to senior roles and higher pay brackets.

The CPA License: The Gold Standard

If there is one single credential that has the greatest impact on an accountant's salary and career trajectory, it is the Certified Public Accountant (CPA) license.

- Salary Premium: The Robert Half Salary Guide consistently reports that professionals with a CPA license can earn a 5% to 15% salary premium over their non-certified peers. On a $90,000 base salary, that's an extra $4,500 to $13,500 per year, every year.

- Career Access: Many senior and leadership roles (Accounting Manager, Controller, CFO) explicitly list the CPA as a requirement, not just a preference. Without it, your upward mobility can be severely limited.

- Credibility and Trust: The CPA license is a mark of expertise, ethics, and professionalism recognized globally. It instantly communicates to employers, clients, and colleagues that you have met rigorous standards of competence.

Other valuable certifications include the Certified Management Accountant (CMA), which is excellent for those in corporate finance and management accounting, and the Certified Internal Auditor (CIA), which is the premier certification for a career in internal audit. While valuable, the CPA remains the most universally recognized and rewarded credential in the accounting field.

###

2. Years and Quality of Experience

Experience is arguably the most significant driver of salary growth. However, it's not just about the number of years you've worked; it's about the *quality* and *relevance* of that experience.

- Early Career (1-3 Years): At this stage, you're a Staff Accountant learning the ropes. Your focus is on mastering transactional processes, understanding the company's systems, and becoming a reliable team member. Salary growth is steady but modest.

- Mid-Career / Senior Level (3-6+ Years): This is where you make the leap. To earn a top-tier senior staff accountant salary, your experience should demonstrate:

- Ownership of the Month-End Close: You don't just *assist* with the close; you *lead* significant parts of it.

- Mastery of Complex Topics: You can handle difficult reconciliations (e.g., revenue recognition under ASC 606, lease accounting under ASC 842), perform technical accounting research, and draft financial statement footnotes.

- System and Process Improvement: You can show a track record of identifying inefficiencies and implementing solutions that save time or improve accuracy. Quantifying these achievements on your resume (e.g., "Automated a manual reconciliation process, saving 10 hours of work per month") is critical.

- Mentorship: You've started reviewing the work of junior staff and acting as a go-to person for questions.

- Experienced Senior / Manager Track (7+ Years): At this point, you are a subject matter expert. Your salary commands a premium because you can manage complex projects, interface confidently with executives and auditors, and are on a clear path to becoming an Accounting Manager or Controller.

###

3. Geographic Location

Where you work has a massive impact on your paycheck, largely due to variations in cost of living and demand for skilled professionals. Major metropolitan areas with a high concentration of corporate headquarters and financial institutions consistently offer the highest salaries.

High-Paying Metropolitan Areas:

According to data from the Bureau of Labor Statistics (BLS) and salary aggregators, cities like these command the highest salaries for accountants:

- San Francisco / San Jose, CA: Tech industry demand and an extremely high cost of living drive salaries to the top of the national scale.

- New York, NY: As the world's financial center, NYC offers abundant high-paying opportunities in financial services, public accounting, and corporate headquarters.

- Boston, MA: A hub for biotech, finance, and technology.

- Washington, D.C.: A strong market driven by government contracting, non-profits, and consulting firms.

- Los Angeles, CA: A diverse economy with major entertainment, logistics, and manufacturing sectors.

Salary Variation by Location (Illustrative Examples)

| City | Cost of Living Index (US Avg = 100) | Average Senior Accountant Salary (Adjusted) |

| :--- | :--- | :--- |

| San Francisco, CA | 269 | $120,000 - $145,000+ |

| New York, NY | 215 | $110,000 - $135,000+ |

| Boston, MA | 153 | $100,000 - $125,000+ |

| Chicago, IL | 105 | $90,000 - $110,000 |

| Dallas, TX | 101 | $88,000 - $108,000 |

| Kansas City, MO | 86 | $80,000 - $98,000 |

*Source: Salary estimates synthesized from Salary.com and Robert Half with cost-of-living data from sources like Payscale. These are for illustration and can vary.*

It's important to weigh higher salaries against the higher cost of living. A $120,000 salary in San Francisco may not have the same purchasing power as a $95,000 salary in Dallas. However, starting your career in a high-paying market can set a higher baseline for your salary negotiations throughout your entire career.

###

4. Company Type and Size

The type and size of your employer create different work environments, expectations, and compensation structures.

- Public Accounting (The "Big Four" and National Firms): Firms like Deloitte, PwC, EY, and KPMG are known as a prestigious training ground. They often pay a premium for talent, especially at the senior level. The hours can be demanding, but the experience is highly valued and often leads to lucrative exit opportunities in corporate accounting. A Senior Associate in audit or tax at a Big Four firm in a major market can easily command a salary north of $100,000 - $120,000.

- Large Corporations (Fortune 500): These companies have large, sophisticated accounting departments and offer competitive salaries, excellent benefits, and clear career progression. Working for a large public company means you'll gain experience with SEC reporting and SOX compliance, which are highly valuable skills. Salaries are often at or above the national average.

- Small to Mid-Sized Enterprises (SMEs): In a smaller company, a Senior Accountant often wears more hats, gaining broader experience across the entire accounting function. The base salary might be slightly lower than at a Fortune 500 company, but bonuses can be substantial if the company is profitable. This can be a faster path to a Controller role.

- Startups: Compensation at startups is a unique mix. The base salary might be lower than the market rate, but this is often supplemented by a significant equity or stock option package. This is a high-risk, high-reward scenario. The work environment is fast-paced and less structured, which can be exciting for some.

- Non-Profit and Government: These sectors typically offer lower base salaries compared to the for-profit world. However, they often compensate with exceptional job security, excellent benefits (pensions are common in government roles), and a stronger work-life balance.

###

5. Area of Specialization

Within the Senior Accountant title, specializing in a high-demand area can lead to a higher salary.

- Technical Accounting & Financial Reporting (SEC): This is one of the highest-paid specialties. These professionals deal with complex accounting issues (like M&A, derivatives, new accounting standards) and are responsible for preparing public financial filings (10-K, 10-Q). This requires deep GAAP knowledge and is highly valued.

- Internal Audit / SOX Compliance: With a constant focus on risk and controls, skilled internal auditors are always in demand. Those with expertise in Sarbanes-Oxley (SOX) compliance can command a premium.

- Tax Accounting: Specialized tax roles, particularly in areas like international tax or M&A tax, are very lucrative.

- Forensic Accounting: These accountants investigate financial fraud and discrepancies. It's a niche field that requires a unique skillset and often comes with higher pay.

- Financial Systems / ERP Specialist: A Senior Accountant who is also an expert in a specific ERP system (like SAP, Oracle NetSuite, or Workday Financials) is incredibly valuable. They bridge the gap between IT and accounting and can lead system implementations and process improvements.

###

6. In-Demand Skills

Beyond your credentials and experience, specific skills can make you a more attractive candidate and justify a higher salary.

High-Value Technical Skills:

- Advanced Microsoft Excel: This is non-negotiable. You must be a power user, proficient with PivotTables, VLOOKUP/HLOOKUP/XLOOKUP, INDEX/MATCH, SUMIFS, and complex formula creation. Macro/VBA skills are a significant plus.

- Enterprise Resource Planning (ERP) Systems: Deep experience in a major ERP system (SAP, Oracle, Microsoft Dynamics, NetSuite) is a huge advantage.

- Data Analytics and Visualization: Skills in tools like Tableau or Microsoft Power BI are increasingly sought after. The ability to take raw financial data, analyze it, and present it in a clear, visual way for non-accountants is a game-changing skill.

- SQL (Structured Query Language): The ability to pull and manipulate data directly from databases is a powerful skill that sets you apart from most accountants.

Essential Soft Skills:

- Communication: You must be able to clearly explain complex financial concepts to non-financial stakeholders (e.g., department managers, sales teams).

- Problem-Solving: Your job is not just to report the numbers, but to investigate discrepancies and figure out *why* things are happening.

- Business Acumen: The best accountants understand the business operations behind the numbers. They think like business partners, not just scorekeepers.

- Leadership and Mentorship: As a "senior," you are expected to guide and develop junior staff. Demonstrating leadership potential signals you're ready for the next step.

Job Outlook and Career Growth

Investing your time and effort into a career path requires a clear understanding of its long-term viability. For Senior Staff Accountants, the future is bright, stable, and filled with opportunities for advancement. The skills you cultivate in this role are foundational to the entire world of business and finance.

### Job Growth Projections