Welcome to the definitive guide on the salary of a leasing agent. If you're drawn to a dynamic career that blends sales, marketing, and human connection—one where your success is directly tied to your effort—then becoming a leasing agent might be your ideal path. This role is the engine of the real estate industry, connecting people and businesses with the spaces where they will live, work, and thrive. But beyond the satisfaction of handing over a new set of keys, what is the real earning potential?

This article dives deep into the financial realities of this profession. We won't just scratch the surface with a single average number. We will dissect every component of a leasing agent's compensation, from base salary and commission structures to the bonuses that reward high achievers. We’ll explore the critical factors that can dramatically increase your income, from your geographic location and level of experience to the specific skills that make you indispensable.

I once knew a leasing agent for a newly developed luxury apartment building that was struggling to meet its occupancy targets. While others saw empty units, she saw a community waiting to be built. By hosting innovative events, creating targeted social media campaigns, and building genuine relationships with prospective tenants, she didn't just fill the building; she created a vibrant, sought-after place to live. Her commission checks reflected that success, but more importantly, her story illustrates the immense impact and earning potential of a truly great leasing agent.

Whether you are just starting to consider this career or are a current agent looking to maximize your earnings, this guide is your comprehensive roadmap. We will provide authoritative data, actionable advice, and a clear-eyed view of what it takes to succeed financially in this rewarding field.

### Table of Contents

- [What Does a Leasing Agent Do?](#what-does-a-leasing-agent-do)

- [Average Leasing Agent Salary: A Deep Dive](#average-leasing-agent-salary)

- [Key Factors That Influence a Leasing Agent's Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Become a Leasing Agent](#how-to-become-a-leasing-agent)

- [Conclusion: Is a Career as a Leasing Agent Right for You?](#conclusion)

What Does a Leasing Agent Do? A Look Behind the Title

At its core, a leasing agent—also known as a leasing consultant or leasing professional—is a specialized sales professional for the real estate industry. Their primary goal is to market and lease rental properties to prospective tenants, ensuring high occupancy rates and a stable revenue stream for property owners. While this often involves giving property tours, the role is far more multifaceted and strategic than many realize.

A leasing agent is the public face of a property. They are the first point of contact for potential renters and are responsible for creating a positive and compelling impression from the initial inquiry to the moment the lease is signed. Their responsibilities span marketing, sales, customer service, and administration.

Core Responsibilities and Daily Tasks:

- Marketing and Lead Generation: Proactively advertising available units through various channels, including online listing services (Zillow, Apartments.com), social media, company websites, and local outreach. They create compelling property descriptions and use high-quality photos and videos to attract interest.

- Responding to Inquiries: Promptly and professionally handling incoming calls, emails, and online inquiries from prospective tenants, answering questions, and scheduling property tours.

- Conducting Property Tours: Guiding prospective tenants through available units and community amenities. This is a critical sales opportunity where the agent highlights the property's key features and benefits, tailoring their presentation to the prospect's specific needs and desires.

- Screening Applicants: Collecting rental applications, running credit and background checks, verifying employment and income, and checking references to ensure potential tenants meet the property's qualification criteria. This requires a strong understanding of fair housing laws.

- Preparing and Executing Leases: Drafting lease agreements, explaining all terms and conditions to the new tenant, collecting security deposits and initial rent payments, and ensuring all legal documents are completed and signed correctly.

- Resident Relations: Assisting with the move-in process, addressing tenant concerns, and contributing to a positive community environment to encourage lease renewals.

- Market Research: Staying informed about competing properties, local market trends, and pricing to help management set competitive rental rates.

- Administrative Duties: Maintaining accurate records of traffic, leases, and availability in property management software (like Yardi or RealPage), and preparing weekly or monthly leasing reports.

### A Day in the Life of a Leasing Agent

To make this tangible, let's walk through a typical day for a leasing agent at a mid-sized apartment community.

- 9:00 AM: Arrive at the leasing office. The first order of business is to check emails and voicemails for any new leads that came in overnight. Log all new prospects into the Customer Relationship Management (CRM) system and respond to each one with a personalized message.

- 9:30 AM: "Walk the tour path." The agent physically walks the route they will take with prospective tenants, ensuring the model apartment is pristine, common areas are clean, and everything is show-ready.

- 10:00 AM: First scheduled tour of the day. A young professional is looking for a one-bedroom apartment. The agent has already reviewed their initial inquiry and knows they work from home, so they highlight the unit's den area as a perfect home office space and mention the high-speed internet included in the amenities package.

- 11:00 AM: Follow-up calls. The agent calls prospects who toured the property yesterday, answering any lingering questions and creating a sense of urgency by mentioning that the unit they liked has another application pending.

- 12:30 PM: Lunch break.

- 1:30 PM: An applicant who was approved yesterday comes in to sign their lease. The agent carefully walks them through the 30-page document, explaining key clauses about rent, security deposits, and community rules. They collect the move-in funds and officially welcome the new resident.

- 3:00 PM: Walk-in tour. A couple relocating to the city stops by unannounced. The agent quickly builds rapport, assesses their needs (two-bedroom, pet-friendly, near a park), and conducts a compelling tour of a suitable vacant unit. They provide a brochure and application, promising to email a follow-up with a virtual tour link.

- 4:00 PM: Administrative block. The agent processes a new application, running the necessary background and credit checks. They then update their weekly leasing report for the property manager, detailing traffic, new leases, and move-out notices.

- 5:00 PM: Prepare for tomorrow. The agent reviews the schedule for the next day, preps tour packets, and sends out confirmation emails to scheduled appointments before tidying the office and heading home.

This "day in the life" showcases the blend of skills required: proactive marketing, consultative sales, diligent administration, and excellent customer service.

Average Leasing Agent Salary: A Deep Dive

Understanding the compensation for a leasing agent requires looking beyond a single number. The salary is typically a combination of a stable base pay and a variable, performance-driven component, which is where the significant earning potential lies. This structure rewards hard work, sales acumen, and the ability to close deals.

### National Averages and Typical Ranges

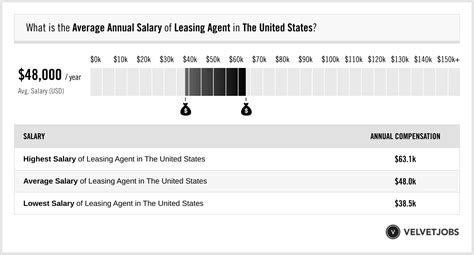

To establish a baseline, we'll consult several authoritative sources. It's important to note that the U.S. Bureau of Labor Statistics (BLS) groups Leasing Agents under the broader category of "Real Estate Sales Agents." As of May 2023, the BLS reports the median annual wage for real estate sales agents was $52,030. However, this category includes residential real estate agents whose income is often 100% commission-based, so it's crucial to look at salary aggregators that focus specifically on the "leasing agent" title.

Here's a more targeted breakdown from leading salary data providers (data retrieved in late 2023/early 2024):

- Salary.com: Reports the median salary for a Leasing Agent in the United States is $41,605, with a typical range falling between $37,429 and $47,208. This figure often represents the base salary component.

- Payscale: States the average base salary for a Leasing Agent is $16.51 per hour, which translates to an annual base salary of approximately $34,340. However, Payscale also reports that commissions can add up to $12,000 per year and bonuses can add another $6,000 on average, bringing the potential total compensation much higher.

- Glassdoor: Places the total estimated pay for a Leasing Agent at $56,878 per year in the United States, with an average base salary of $41,313. The "additional pay," estimated at $15,565 per year, can include cash bonuses, commissions, and profit sharing.

Consensus: A realistic expectation for a leasing agent's total annual compensation is between $45,000 and $60,000. Entry-level positions may start closer to $35,000-$40,000, while experienced, high-performing agents in prime markets can easily surpass $75,000 or more, especially those in commercial leasing.

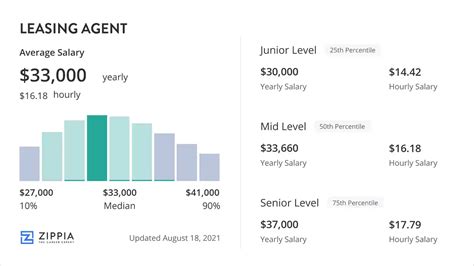

### Salary by Experience Level

Like most professions, compensation for leasing agents grows significantly with experience. As you build a track record of success, develop advanced skills, and demonstrate your value to a property, your earning potential increases.

Here is a typical salary progression, combining base salary with expected variable pay:

| Experience Level | Typical Years of Experience | Average Annual Base Salary Range | Average Total Compensation Range (with commission/bonus) |

| -------------------------- | --------------------------- | -------------------------------- | -------------------------------------------------------- |

| Entry-Level Leasing Agent | 0-2 years | $32,000 - $40,000 | $38,000 - $50,000 |

| Mid-Career Leasing Agent | 2-5 years | $38,000 - $48,000 | $50,000 - $65,000 |

| Senior/Lead Leasing Agent | 5+ years | $45,000 - $55,000+ | $60,000 - $80,000+ |

*Source: Analysis and synthesis of data from Salary.com, Payscale, and Glassdoor, reflecting both base and variable pay components.*

Entry-Level Agents are typically focused on learning the ropes, mastering the tour process, and understanding leasing paperwork. Their commissions are often smaller, fixed amounts per lease.

Mid-Career Agents have a proven track record. They are more efficient, require less supervision, and may handle more complex situations. Their commission structure might be more lucrative, and they are often eligible for higher performance bonuses.

Senior or Lead Agents may take on mentorship roles, assist with training new hires, or handle high-value leases. They may be promoted to Assistant Property Manager or take on a role as a floating agent for a portfolio of properties. Their compensation reflects their added responsibilities and consistent high performance.

### Dissecting the Compensation Package

A leasing agent's paycheck is rarely just a salary. Understanding the different components is key to evaluating a job offer and maximizing your income.

1. Base Salary/Hourly Wage: This is your guaranteed income. Most leasing agent positions offer an hourly wage (e.g., $16-$22/hour) or a modest annual salary. This provides financial stability, especially during slower leasing seasons.

2. Commissions: This is the variable, performance-based component and the primary driver of high earnings. Commission structures vary widely:

- Flat Fee Per Lease: The most common structure. You receive a set amount for each new lease you sign (e.g., $100 - $300 per lease). Luxury properties often offer higher flat fees.

- Percentage of Rent: More common in commercial leasing but sometimes seen in residential. You might earn a percentage of the first month's rent or even a percentage of the total lease value.

- Tiered Commissions: This structure incentivizes volume. For example, you might earn $150 for your first 5 leases in a month, $200 for leases 6-10, and $250 for any lease beyond that.

- Renewal Commissions: Some companies reward agents for retaining residents by offering a smaller commission or bonus for each lease renewal they facilitate.

3. Bonuses: These are typically tied to overall property or team performance, rather than just individual leases.

- Occupancy Bonus: A bonus paid to the entire leasing team when the property maintains a certain occupancy rate (e.g., 95% or higher) for a quarter or a year.

- Performance Bonus: An individual bonus based on meeting specific goals (Key Performance Indicators or KPIs), such as the number of tours conducted, leads converted to applications, or positive online reviews generated.

- Annual/Holiday Bonus: A discretionary bonus given at the end of the year based on individual and company performance.

4. Other Perks and Benefits: These non-cash benefits can add significant value to your compensation package.

- Rent Discounts: This is a highly valuable and common perk. Many property management companies offer their employees a significant discount on rent (e.g., 20-50% off) if they live on-site, which can be worth thousands of dollars a year.

- Standard Benefits: Health, dental, and vision insurance, 401(k) retirement plans, and paid time off.

When considering a job, it's crucial to look at the *entire* compensation structure. A role with a lower base salary but a highly aggressive commission and bonus plan might offer far greater earning potential for a motivated individual than a role with a higher base salary and minimal variable pay.

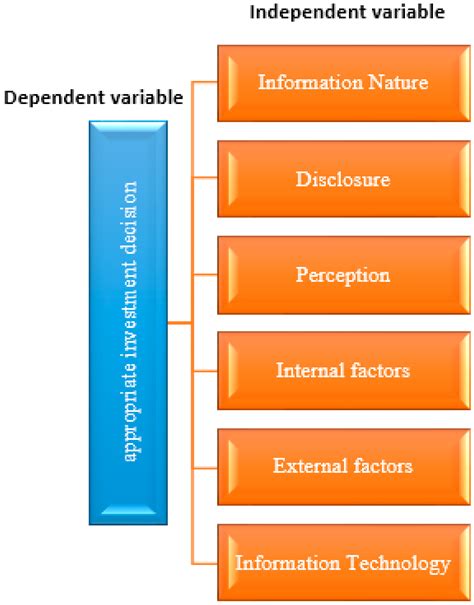

Key Factors That Influence a Leasing Agent's Salary

While national averages provide a useful benchmark, a leasing agent's actual earnings are determined by a complex interplay of factors. Understanding these variables is the key to strategically navigating your career and maximizing your income. This section delves into the six most critical elements that dictate your paycheck.

### 1. Geographic Location

Where you work is arguably the single most powerful factor influencing your salary. The cost of living and the local real estate market's health create vast disparities in compensation across the country. An agent in a high-cost-of-living urban center with a booming rental market will almost certainly earn more than an agent in a low-cost rural area.

- High-Paying Metropolitan Areas: Cities with robust job markets, high population density, and expensive rental rates naturally lead to higher salaries and commissions for leasing agents. This is due to both higher base wages to cover the cost of living and larger commission potential from higher rents.

- Examples of Top-Paying Cities: According to data from salary aggregators like Indeed and Zippia, cities like San Jose, CA; San Francisco, CA; New York, NY; Boston, MA; and Washington, D.C. consistently rank among the highest paying for leasing professionals. In these markets, total compensation can be 20-50% higher than the national average. A senior agent in San Francisco could potentially earn over $90,000.

- Lower-Paying Regions: Conversely, states and cities with a lower cost of living and less competitive rental markets tend to offer salaries below the national average.

- Examples of Lower-Paying States: States in the Southeast and Midwest, such as Alabama, Mississippi, Arkansas, and South Dakota, often report lower average salaries. While the base pay might be lower, it's essential to weigh this against the significantly reduced cost of living.

- The Urban vs. Suburban/Rural Divide: Even within a single state, there can be a significant difference. A leasing agent in downtown Chicago will earn substantially more than one in a small town in southern Illinois due to the vast difference in property values and rental demand.

Actionable Insight: If maximizing income is your top priority, target your job search in major metropolitan areas with strong economies. However, always research the cost of living to understand your true purchasing power.

### 2. Area of Specialization & Property Type

The type of property you lease is a close second to location in its impact on your earnings. The skills, knowledge, and transaction values differ dramatically between property types, directly affecting compensation.

- Residential (Multifamily) Leasing: This is the most common path.

- Class A (Luxury): Leasing for new, high-end apartment buildings with extensive amenities. These roles often come with higher base salaries and more substantial commission potential because the rents are higher. The clientele is also more demanding, requiring a polished, professional demeanor.

- Class B/C (Workforce Housing): Leasing for older, more affordable properties. The commissions per lease might be smaller, but the volume of traffic can be higher, and the role is crucial for providing essential housing.

- Niche Residential: Specializing in areas like student housing (high-volume, fast-paced seasonal leasing) or senior living/active adult communities (requires a more consultative, empathetic sales approach) can also offer unique compensation structures.

- Commercial Leasing: This is where the highest earning potential in the profession lies, but it also has the highest barrier to entry. Commercial leasing agents help businesses find office, retail, or industrial space.

- Why it Pays More: Leases are much longer (5-10+ years), transaction values are in the hundreds of thousands or millions of dollars, and commissions are calculated as a percentage of the total lease value. A single large deal can result in a five- or six-figure commission.

- Required Skills: This field demands deep knowledge of business finance, market analysis, zoning laws, and complex contract negotiation. A bachelor's degree in finance, real estate, or business is often required, as is a state real estate license. Top commercial agents at firms like CBRE, JLL, or Cushman & Wakefield are among the highest earners in the entire real estate industry.

Actionable Insight: While residential leasing offers a stable and accessible career path, aspiring to move into commercial leasing after gaining several years of experience is the most direct route to a six-figure income.

### 3. Years of Experience and Proven Track Record

Experience is more than just time on the job; it's about building a portfolio of success. Property owners and management companies pay for results, and a proven track record of keeping buildings full is the most valuable asset a leasing agent can have.

- 0-2 Years (The Foundation Phase): Your focus is on learning the fundamentals: fair housing laws, property management software, and the art of the tour. Your compensation will be heavily weighted towards your base salary as you build your skills.

- 2-5 Years (The Growth Phase): You've mastered the basics and are now a reliable closer. You understand how to overcome objections, build rapport quickly, and manage your time effectively. Your variable compensation (commissions and bonuses) should start to make up a more significant portion of your total earnings. You might earn an average total compensation of $50,000 to $65,000.

- 5+ Years (The Expert Phase): You are a top performer, possibly a Senior or Lead Leasing Agent. You may be involved in training new hires, developing marketing strategies, and handling VIP clients or difficult negotiations. Your reputation precedes you, and you may be recruited by competing properties. Your total compensation can regularly exceed $70,000-$80,000 in a strong residential market, with no ceiling in commercial real estate.

Actionable Insight: Meticulously track your performance metrics from day one. Keep a record of your closing ratios, leases per month, and any role you played in increasing occupancy rates. Use this hard data to negotiate raises and promotions.

### 4. In-Demand Skills

In today's competitive market, a specific set of skills separates an average leasing agent from a top-earning superstar. Cultivating these skills will directly translate into more leases signed and a higher income.

- Hard Skills:

- CRM/Property Management Software Proficiency: Expertise in industry-standard software like Yardi, RealPage, Entrata, or AppFolio is non-negotiable. This shows you can manage leads, track performance, and operate efficiently.

- Digital Marketing Savvy: Understanding how to leverage social media (Instagram, Facebook), create compelling online listings, and even run basic digital ad campaigns can dramatically increase your lead flow.

- Legal Knowledge: A deep and practical understanding of the Fair Housing Act (FHA) and local landlord-tenant laws is critical for mitigating risk and is highly valued by employers.

- Data Analysis: The ability to read leasing reports, understand traffic sources, and analyze conversion rates allows you to identify what's working and what's not, making you a strategic asset.

- Soft Skills:

- Consultative Sales & Negotiation: The best agents don't just "sell" an apartment; they act as a consultant, listening to a prospect's needs and solving their problems. Strong negotiation skills are crucial for closing deals and handling objections.

- Exceptional Communication: This includes everything from writing a professional, typo-free email to building instant rapport in person and actively listening to a prospect's concerns.

- Resilience and Persistence: You will face rejection. Prospects will ghost you. The ability to remain positive, persistent, and bounce back from a "no" is fundamental to success in a sales-driven role.

- Time Management and Organization: Juggling tours, paperwork, follow-ups, and marketing requires impeccable organizational skills.

Actionable Insight: Actively seek to develop these skills. Take an online course in digital marketing. Ask for more training on your property's CRM. Read books on sales and negotiation. Every new skill you master makes you more valuable.

### 5. Company Type and Size

The type of company you work for also shapes your role and compensation.

- Large National Property Management Firms (e.g., Greystar, Lincoln Property Company): These companies typically offer more structured career paths, excellent benefits, and formal training programs. The compensation might be more standardized, with clear tiers for base pay and commissions. There are often more opportunities for advancement into regional or corporate roles.

- Small, Local, or Private Owners: Working for a smaller "mom-and-pop" landlord can offer more flexibility and a family-like atmosphere. The pay structure might be less formal and potentially more negotiable. However, benefits and opportunities for advancement may be more limited.

- Real Estate Investment Trusts (REITs): These publicly traded companies that own portfolios of properties often have robust, corporate-style compensation packages that can include stock options or more significant profit-sharing plans.

Actionable Insight: Evaluate what matters most to you. If you value structure, training, and a clear ladder for promotion, a large firm is an excellent choice. If you prefer autonomy and a more direct impact on a smaller portfolio, a local owner could be a better fit.

### 6. Level of Education and Certifications

While a four-year degree is not always a strict requirement for residential leasing, education and professional certifications can provide a significant edge, especially for advancing your career and increasing your salary.

- Minimum Education: A high school diploma or GED is the standard entry-level requirement.

- Bachelor's Degree: A degree in Business, Marketing, Communications, or Hospitality can make you a more competitive candidate and is often a prerequisite for management-level positions or entry into commercial real estate. It demonstrates a foundation in relevant professional skills.

- Real Estate License: While not always required for agents who work directly for a property owner (as they operate as an owner's employee), many states and companies do require it. Holding a real estate license broadens your opportunities and is essential for commercial leasing or if you ever want to become a broker.

- Professional Certifications: This is one of the best ways to signal your expertise and increase your value. The premier certification in the industry is the Certified Apartment Leasing Professional (CALP) offered by the National Apartment Association (NAA). Earning your CALP designation demonstrates a commitment to the profession and a mastery of its core competencies. Employers often favor certified candidates and may offer higher starting pay or a promotion upon completion.

Actionable Insight: If you plan to make leasing a long-term career, obtaining your CALP certification is a strategic investment that can pay dividends in salary and opportunities.

Job Outlook and Career Growth

Choosing a career path isn't just about the starting salary; it's about long-term stability, opportunities for advancement, and the profession's future trajectory. For leasing agents, the outlook is closely tied to the health of the real estate market and evolving housing trends, offering a landscape of both opportunities and challenges.

### Job Growth Projections

The U.S. Bureau of Labor Statistics (BLS) projects employment for Real Estate Brokers and Sales Agents to grow by 3 percent from 2022 to 2032. While this is about as fast as the average for all occupations, it translates to approximately 51,500 openings each year, on average, over the decade. Most of these openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire.

This steady demand is underpinned by fundamental societal needs. People will always need places to live and work. The rental market, in particular, remains a robust sector of the economy. Factors like population growth, urbanization, and changing preferences towards renting over buying in many demographics continue to fuel the demand for well-managed rental properties and, by extension, the skilled leasing professionals who keep them occupied.

### Emerging Trends Shaping the Future of Leasing

The role of a leasing agent is not static. Technology and shifting consumer expectations are reshaping the profession. Staying ahead of these trends is crucial for long-term relevance and success.

1. The Rise of Technology and Automation: The leasing process is becoming increasingly digital.

- Virtual and Self-Guided Tours: Accelerated by the pandemic, the ability to offer high-quality virtual tours, 3D floor plans, and even self-guided tours using smart lock technology is becoming standard. Agents who are comfortable with this technology will have a competitive advantage.

- AI-Powered Chatbots and CRMs: Artificial intelligence is being used to handle initial inquiries 24/7, schedule tours, and nurture leads, freeing up agents to focus on high-value interactions like conducting compelling tours and closing deals.

- Digital Lease Signing: The entire leasing process, from application to signing, is moving online. Proficiency with platforms like DocuSign and property management