A career in venture capital (VC) is one of the most sought-after paths in finance, offering the unique opportunity to invest in and shape the next generation of world-changing companies. It's a role that combines financial acumen, strategic foresight, and deep industry knowledge. But beyond the excitement of funding innovation, a key question for many aspiring professionals is: what are the financial rewards?

The answer is complex and compelling. A venture capitalist's salary is more than just a paycheck; it's a comprehensive package that can range from a solid six-figure income for junior roles to multi-million dollar earnings for senior partners at successful firms. This article will break down the components of VC compensation, explore the key factors that drive earning potential, and provide a realistic look at what you can expect in this dynamic field.

What Does a Venture Capitalist Do?

At its core, a venture capitalist's job is to identify, fund, and nurture high-potential, early-stage companies, often called startups. VCs work for a venture capital firm, where they manage a pool of money, or a "fund," raised from investors (known as Limited Partners or LPs).

Their primary responsibilities include:

- Sourcing Deals: Proactively finding promising startups through networks, industry events, and research.

- Due Diligence: Rigorously evaluating a startup's business model, team, market size, and technology to assess its potential for success.

- Investing: Negotiating the terms of an investment and deploying capital from the fund in exchange for equity (ownership) in the startup.

- Portfolio Management: Taking a seat on the startup's board of directors, providing strategic guidance, and helping the company grow by offering mentorship and access to their network.

- Generating Returns: The ultimate goal is to help their portfolio companies grow to a successful "exit"—either through an acquisition or an Initial Public Offering (IPO)—thereby generating significant financial returns for the fund's investors.

Average Venture Capitalist Salary

VC compensation is not a single number; it's primarily composed of three parts: base salary, an annual bonus, and the most significant component for senior VCs, carried interest.

- Base Salary: This is the guaranteed annual income.

- Bonus: A performance-based cash payment typically awarded annually.

- Carried Interest (or "Carry"): This is the share of the fund's profits that the VC firm's partners receive. It's the primary long-term wealth-creation vehicle in venture capital. Typically, a fund's carry is 20% of the profits after returning the initial capital to investors. This amount is distributed among the firm's partners and, to a lesser extent, other senior professionals.

Here’s a look at typical salary ranges, which vary significantly by role and seniority.

According to data from Glassdoor, the estimated total pay for a Venture Capitalist in the United States is around $209,000 per year, with an average base salary of approximately $163,000 per year. However, this is just a blended average. Salary.com provides a more granular view, showing the salary range for a Venture Capital Associate can fall between $97,411 and $145,958.

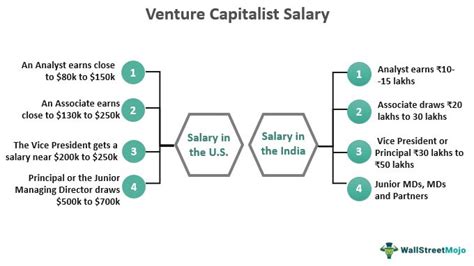

To understand the full picture, it’s best to break it down by seniority:

- VC Analyst / Pre-MBA Associate (Entry-Level): Base salaries typically range from $90,000 to $150,000, plus a bonus of 10-30%. Carried interest is rare at this level.

- Post-MBA Associate / Senior Associate (Mid-Level): Base salaries often range from $150,000 to $220,000, with larger bonuses. Small allocations of carried interest may be introduced.

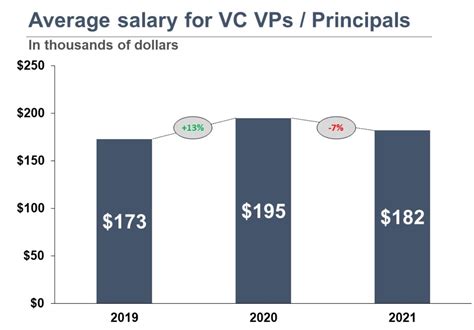

- Principal / Vice President (Senior Level): Base salaries move into the $200,000 to $300,000+ range. Bonuses are substantial, and they receive a meaningful share of the fund's carried interest.

- Partner / General Partner (Executive Level): Base salaries can be $300,000 to over $700,000. However, the base salary becomes less important compared to the carried interest, which can result in multi-million dollar payouts over the life of a successful fund.

Key Factors That Influence Salary

Your earning potential as a VC is not static. It's influenced by a combination of personal qualifications and firm characteristics.

Level of Education

A bachelor's degree in finance, economics, business, or a related field is the standard entry requirement. However, an advanced degree can significantly impact career trajectory and compensation. A Master of Business Administration (MBA), especially from a top-tier university, is a common and often preferred qualification for post-MBA associate roles. It not only provides advanced financial modeling skills but also offers access to a powerful alumni network, which is invaluable for deal sourcing. Increasingly, advanced degrees in technical fields (e.g., a Ph.D. in biotechnology or computer science) are highly valued at funds specializing in deep tech or life sciences.

Years of Experience

Experience is arguably the most critical factor in determining VC compensation. The career path is highly structured, and compensation grows with each step.

- 0-3 Years (Analyst): Professionals at this level, often coming from investment banking or consulting, focus on financial modeling, market research, and due diligence support.

- 3-7 Years (Associate/Senior Associate): With more experience (and often an MBA), associates take on more responsibility in sourcing and evaluating deals.

- 7-12+ Years (Principal/Partner): At this stage, professionals are leading deals, taking board seats, and have a proven track record. Their compensation shifts to be heavily weighted toward the carried interest they earn from successful investments. Prior operational experience, such as being a founder or executive at a tech company, is also highly valued and can accelerate this path.

Geographic Location

As with many high-finance careers, where you work matters. Major VC hubs command the highest salaries due to a high concentration of firms, talent, and a higher cost of living.

- Top-Tier Hubs: The San Francisco Bay Area (Silicon Valley), New York City, and Boston are the epicenters of venture capital and offer the highest compensation packages.

- Emerging Hubs: Cities like Los Angeles, Austin, Seattle, and Miami have burgeoning tech and VC scenes. While salaries are still very competitive, they may be slightly lower than in the top-three hubs. According to Payscale, a venture capitalist in San Francisco earns an average of 33% more than the national average, highlighting the significant impact of location.

Company Type

The type and size of the VC firm you work for is a major determinant of your salary.

- Fund Size (Assets Under Management - AUM): This is a primary driver. A mega-fund with over $1 billion in AUM can afford to pay higher base salaries and bonuses than a small, early-stage fund with $50 million in AUM. However, the potential return multiple on a smaller fund can sometimes be higher, which could lead to a large carried interest payout if the fund is a top performer.

- Fund Strategy: A later-stage or growth equity fund that writes larger checks may offer different compensation structures than an early-stage (seed) fund.

- Corporate Venture Capital (CVC) vs. Traditional VC: CVC arms of large corporations (e.g., Google Ventures, Salesforce Ventures) may offer compensation packages that are more in line with corporate salary bands, which could mean higher base salaries and strong bonuses but potentially less upside from carried interest compared to a top-performing traditional VC firm.

Area of Specialization

In an increasingly specialized world, deep domain expertise is highly valuable. A VC who is a recognized expert in a high-growth sector can command a premium salary. Hot areas of specialization today include Artificial Intelligence/Machine Learning, FinTech, HealthTech and Biotechnology, Enterprise SaaS, and Climate Tech. A professional with a Ph.D. in immunology working for a biotech fund, or a former FinTech founder working for a fund in that space, brings unique value that translates directly into higher compensation.

Job Outlook

The U.S. Bureau of Labor Statistics (BLS) does not track "Venture Capitalist" as a distinct profession. However, it can be viewed as a specialization within related fields. For Financial Managers, the BLS projects a job growth of 16% from 2022 to 2032, which is much faster than the average for all occupations.

This strong growth reflects the expanding role of private markets and the continued importance of innovation in the global economy. While the venture capital industry is cyclical and can be affected by economic downturns, the long-term outlook remains positive. As long as technology and new ideas continue to emerge, there will be a need for savvy investors to fund them. It is important to note, however, that breaking into the industry is highly competitive, with a small number of positions available each year.

Conclusion

A career as a venture capitalist offers a unique blend of intellectual challenge, industry influence, and significant financial reward. While headlines often focus on the massive carried interest payouts of top partners, the reality is a structured and rewarding compensation path for professionals at all levels.

Your earning potential will be shaped by your education, your years of dedicated experience, your physical location, the size and strategy of your firm, and your chosen area of expertise. For those with the passion, network, and analytical rigor to succeed, it is a career path that not only offers substantial financial returns but also places you at the very heart of innovation.