Table of Contents

- [What Does a Vice President at JP Morgan Actually Do?](#what-does-a-vice-president-at-jp-morgan-actually-do)

- [Average VP Salary at JP Morgan: A Deep Dive into Compensation](#average-vp-salary-at-jp-morgan-a-deep-dive-into-compensation)

- [Key Factors That Influence Your Salary at JP Morgan](#key-factors-that-influence-your-salary-at-jp-morgan)

- [Job Outlook and Career Growth for a Wall Street VP](#job-outlook-and-career-growth-for-a-wall-street-vp)

- [How to Become a Vice President at JP Morgan: Your Step-by-Step Blueprint](#how-to-become-a-vice-president-at-jp-morgan-your-step-by-step-blueprint)

- [Is the Climb to VP at JP Morgan Worth It?](#is-the-climb-to-vp-at-jp-morgan-worth-it)

The title "Vice President" at a titan of finance like JPMorgan Chase evokes images of corner offices, high-stakes deals, and, of course, a substantial seven-figure income. For ambitious students in elite business schools and junior bankers burning the midnight oil, achieving the rank of VP is a career-defining milestone. It signifies a transition from pure execution to a role of significant responsibility, client ownership, and strategic influence. The compensation package is a direct reflection of this immense value. While the specific numbers can be opaque, the all-in compensation for a Vice President at JP Morgan typically ranges from $450,000 to over $700,000 annually, with some top performers in lucrative divisions surpassing this.

But this figure is more than just a salary; it's the culmination of a demanding, multi-year journey requiring exceptional intellect, relentless work ethic, and masterful interpersonal skills. I recall mentoring a young analyst who was brilliant with financial models but struggled with client presentations. We spent hours dissecting not just the numbers, but the *narrative* behind them—how to build trust and convey confidence under pressure. Seeing her eventually make VP, not just because she was smart, but because she learned to connect and lead, was a profound reminder that this career is as much about people as it is about profit.

This guide is designed to pull back the curtain on what it truly means to be a Vice President at one of the world's most prestigious financial institutions. We will dissect the compensation structure, explore the myriad factors that can dramatically influence your earnings, and lay out a strategic roadmap for those aspiring to reach this coveted position. Whether you're a student mapping out your future or a professional contemplating a career pivot, this comprehensive analysis will provide the authoritative, in-depth insights you need to understand the reality behind the title.

---

What Does a Vice President at JP Morgan Actually Do?

The title "Vice President" in investment banking is one of the most misunderstood in the corporate world. Unlike a typical corporate structure where a VP might oversee a large department of hundreds, a VP at JP Morgan is a mid-senior level professional who serves as the primary engine of deal execution and client management. They are the crucial link between the junior team (Analysts and Associates), who handle the granular modeling and research, and the senior leadership (Managing Directors and Executive Directors), who are primarily responsible for originating business.

A VP at JP Morgan is no longer just "in the weeds." Their role elevates to a level of project management, mentorship, and significant client interaction. They are the day-to-day lead on deals, responsible for ensuring the pitch books are flawless, the financial models are sound, and the client's needs are being met promptly and professionally. They orchestrate the entire workflow of a deal, from initial pitch to final closing.

Core Responsibilities and Daily Tasks:

- Deal Execution & Project Management: The VP is the quarterback of live transactions, whether it's a merger, acquisition, IPO, or debt financing. They manage timelines, delegate tasks to Associates and Analysts, and ensure all materials are client-ready.

- Client Relationship Management: VPs are often the primary point of contact for clients on active deals. They build trust, manage expectations, and are expected to have a deep understanding of the client's business and industry.

- Review and Quality Control: A significant portion of a VP's time is spent reviewing the work of the junior team. This includes scrutinizing complex financial models, editing pitch book presentations, and ensuring every single number and statement can withstand intense scrutiny from both clients and senior bankers.

- Mentorship and Training: VPs play a critical role in developing the next generation of bankers. They provide on-the-job training to Associates and Analysts, teaching them the technical skills and professional etiquette required to succeed.

- Business Development Support: While Managing Directors are the primary rainmakers, VPs are expected to support these efforts. This can involve identifying potential deal opportunities, building relationships with junior-to-mid-level contacts at client companies, and contributing strategic ideas to pitches.

### A Day in the Life of an Investment Banking VP

To make this tangible, let's walk through a hypothetical day for a VP in the Mergers & Acquisitions (M&A) group at JP Morgan in New York.

- 7:00 AM: Arrive at the office. The first hour is spent catching up on overnight emails from European and Asian colleagues, reading the Wall Street Journal and Financial Times, and checking market-moving news relevant to active deals or key clients.

- 8:30 AM: Team meeting for a live sell-side M&A deal. The VP leads the discussion, getting status updates from the Associate on the financial model and the Analyst on due diligence progress. They set the priorities for the day and troubleshoot any roadblocks.

- 10:00 AM: Client Call. The VP, along with a Managing Director, joins a call with the CFO of the client company. The VP walks the client through the updated valuation analysis, confidently answering detailed questions about assumptions and market comparables.

- 12:30 PM: Quick lunch at the desk while reviewing a pitch book for a new potential client. The VP uses a red pen (or digital equivalent) to mark up slides, refine the narrative, and flag questions for the junior team.

- 2:00 PM: Internal Strategy Meeting. The VP meets with other VPs and Directors from different industry and product groups to discuss potential cross-selling opportunities and market trends.

- 4:00 PM: Pitch Book Review Session. The VP sits down with the Analyst and Associate, going through their marked-up comments page-by-page. This is an intense teaching moment, explaining not just *what* to change, but *why*.

- 7:00 PM: The Managing Director stops by the VP's desk to get a final update before heading home. The VP provides a concise summary of the day's progress on all active projects.

- 7:30 PM - 10:00 PM (or later): This is often when the "real work" gets done without the interruption of calls and meetings. The VP might do a final review of a critical financial model, draft a key email to a client, or begin outlining the structure for a new presentation. The day ends when the work is in a good place for the next morning.

This demanding schedule underscores why the compensation is so high. A VP is not just an employee; they are a hub of commercial activity, responsible for executing the multi-billion dollar deals that define JP Morgan's reputation and profitability.

---

Average VP Salary at JP Morgan: A Deep Dive into Compensation

The compensation for a Vice President at JP Morgan is a complex package, often referred to as "all-in comp." It's a combination of a substantial base salary and a highly variable, performance-driven annual bonus that often exceeds the base. Understanding this structure is key to grasping the true earning potential of the role.

It's crucial to note that finance compensation is notoriously guarded. Firms do not publicly release detailed salary bands. The data presented here is aggregated from reputable industry sources, including Glassdoor, Levels.fyi, Litquidity's annual compensation reports, and discussions on professional forums like Wall Street Oasis. These figures are recent estimates and can fluctuate based on market conditions and firm performance.

Total Compensation Range (All-In): $450,000 - $700,000+

A new VP (often called "VP 1") will be at the lower end of this range, while a seasoned, high-performing VP in their third or fourth year ("VP 3" or "Senior VP") can push into the upper echelons, especially in a strong market year.

Let's break down the components.

### 1. Base Salary

The base salary provides the foundation of the VP's income. It is the predictable, bi-weekly paycheck that covers living expenses. For VPs at bulge bracket banks like JP Morgan, the base salary is fairly standardized across Wall Street to remain competitive.

- Average Base Salary for a VP at JP Morgan: $250,000 to $300,000 per year.

According to Glassdoor, the estimated base pay for a VP at JPMorgan Chase is around $275,000 per year, aligning with general market consensus [Source: Glassdoor, 2024]. This figure tends to see modest increases with each year of tenure in the role. For instance, a first-year VP might start at $250,000, moving to $275,000 in their second year, and $300,000 in their third.

### 2. The All-Important Bonus

The bonus is where the real wealth creation happens. It is a highly variable component that is paid out once a year (typically in January or February) and is based on a combination of three factors:

1. Firm Performance: The overall profitability of JPMorgan Chase for the year. In a record-breaking year for the bank, the bonus pool will be larger.

2. Group/Division Performance: The success of the specific group the VP works in (e.g., Technology M&A, Healthcare Capital Markets). If a particular sector is "hot" and the team closes many lucrative deals, their bonus pool will be disproportionately larger.

3. Individual Performance: This is the most critical factor. VPs are rated on a number of metrics: their contribution to deal execution, the quality of their work, client feedback, their ability to mentor junior staff, and their perceived potential for future leadership. A "top bucket" VP can receive a bonus that is multiples of a "bottom bucket" performer, even within the same group.

- Average Annual Bonus Range: $200,000 to $450,000+

This bonus is typically paid as a mix of cash and deferred compensation (stock awards that vest over a period of several years). The deferred component is designed to retain talent and align the VP's long-term interests with those of the firm's shareholders. A typical split for a $350,000 bonus might be 60% cash ($210,000) and 40% in deferred stock ($140,000 vesting over 3 years).

### Compensation by Experience Level (Illustrative)

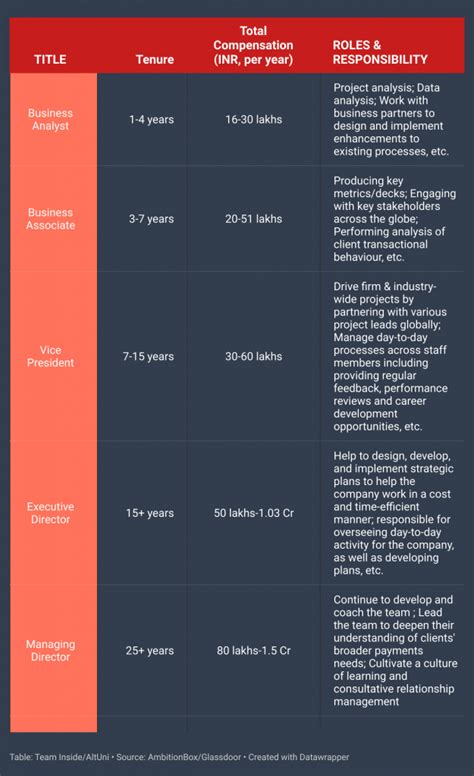

To visualize the progression, here is a typical compensation trajectory for a front-office investment banking professional at a firm like JP Morgan.

| Title | Years of Experience | Typical Base Salary | Typical All-In Compensation |

| :--- | :--- | :--- | :--- |

| Analyst | 0-3 years | $100,000 - $125,000 | $190,000 - $250,000 |

| Associate | 3-6 years (post-MBA) | $175,000 - $225,000 | $300,000 - $500,000 |

| Vice President (VP) | 6-10 years | $250,000 - $300,000 | $450,000 - $700,000+ |

| Executive Director (ED) / Director | 10-14 years | $300,000 - $400,000 | $700,000 - $1,200,000 |

| Managing Director (MD) | 14+ years | $400,000 - $600,000+ | $1,000,000 - $10,000,000+ |

*(Source: Aggregated data from Wall Street Oasis, Litquidity, and Levels.fyi, 2023-2024 reports. These are estimates and subject to market fluctuations.)*

### 3. Other Benefits and Perks

Beyond the cash and stock, the total compensation package at JP Morgan includes a comprehensive suite of benefits that add significant value.

- Top-Tier Health Insurance: Comprehensive medical, dental, and vision plans for the employee and their family.

- 401(k) Retirement Plan: A generous company match on employee contributions, often around 5-6% of base salary. For a VP with a $275,000 base, this is an additional ~$15,000 in retirement savings per year.

- Wellness Programs: Subsidies for gym memberships, access to mental health resources (crucial in a high-stress environment), and other wellness initiatives.

- Paid Time Off (PTO): While the culture often makes taking long vacations difficult, the official policy is typically generous, with 4-5 weeks of vacation time.

- Other Perks: Depending on the role and seniority, this can include meal stipends for late nights, chauffeured car service after a certain hour, and other conveniences designed to maximize productivity.

In summary, the salary of a VP at JP Morgan is far more than a simple number. It's a carefully constructed package of base salary, a high-stakes performance bonus, and excellent benefits, designed to attract, retain, and motivate the elite talent required to operate at the pinnacle of global finance.

---

Key Factors That Influence Your Salary at JP Morgan

While the general compensation range for a VP at JP Morgan is well-established, individual pay can vary dramatically. Two VPs sitting on the same floor could have a total compensation difference of over $200,000. Understanding the levers that drive this variance is critical for anyone looking to maximize their earning potential on Wall Street. This is the most granular and impactful part of the compensation equation.

###

1. Area of Specialization (Division and Group)

This is arguably the single most important factor. JP Morgan is a massive, diversified financial institution, and a "VP" title exists across many different divisions. The compensation power lies in the divisions closest to revenue generation, commonly known as "front office" roles.

- Investment Banking Division (IBD): This is the classic, high-powered division focused on Mergers & Acquisitions (M&A) and Capital Markets (raising equity and debt). VPs in IBD, particularly within top-performing industry groups like Technology, Media & Telecom (TMT), Healthcare, or Financial Institutions Group (FIG), consistently command the highest compensation packages. The direct link between their deal execution and the firm's largest fees drives this premium.

- Sales & Trading (S&T): VPs on the trading floor also have extremely high earning potential. Their bonuses are often more directly tied to their individual "P&L" (Profit and Loss). A VP in a volatile, high-volume market like rates or commodities trading can have an exceptional year, while one in a quieter market may see a more modest bonus. The risk-reward profile is often starker here than in IBD.

- Asset & Wealth Management (AWM): This division includes Private Banking and Investment Management. VPs here manage money for high-net-worth individuals and institutions. While still highly lucrative, compensation for a VP in AWM is typically lower than in IBD or S&T. A VP in the Private Bank might have a total compensation in the $300,000 - $500,000 range. The work-life balance is often perceived as being better.

- Corporate & Commercial Banking: These VPs manage lending and treasury relationships with large corporations. It's a crucial part of the bank, but the revenue model is less transaction-driven than IBD. Compensation is solid but generally a step below the top front-office divisions.

- "Middle Office" & "Back Office" (e.g., Risk, Compliance, Technology, Operations): These functions are essential to the bank's operation but are considered cost centers, not revenue generators. A VP in a role like Risk Management or Technology Strategy will have a very respectable corporate salary, but it will not include the massive performance-based bonuses seen in the front office. A VP in a tech role might earn $200,000 - $350,000 all-in, which is excellent by general corporate standards but different from the front-office scale.

###

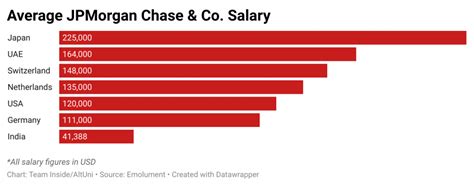

2. Geographic Location

Where you sit in the world has a major impact on your paycheck, driven by both market size and cost of living.

- Tier 1: New York City. As the undisputed headquarters of global finance, NYC commands the highest salaries. The largest deals are typically centered here, the talent pool is most competitive, and the cost of living is exorbitant. A VP in the New York office will represent the top end of the compensation scale.

- Tier 1.5: London and Hong Kong. These are the other major global financial hubs. Compensation is very strong and broadly comparable to New York, though currency fluctuations and different tax structures can affect take-home pay. A VP in London might see a slightly lower base/bonus in USD terms but benefit from different lifestyle factors.

- Tier 2: Major U.S. Hubs (San Francisco, Chicago, Houston). These offices house significant industry-focused teams. San Francisco is a hub for technology banking, Houston for energy, and Chicago for industrials. Salaries here are very competitive and close to New York levels, as banks need to attract top talent to these key markets. The slight discount, if any, is often offset by a lower (though still high) cost of living compared to NYC.

- Tier 3: Growing U.S. Hubs (Charlotte, Salt Lake City, Dallas). Banks have been increasingly moving certain functions to these "high-growth" or "low-cost" locations. While VPs in these offices are still well-compensated, their all-in pay may be 10-20% lower than their New York counterparts. A VP in Salt Lake City might have an all-in package of $400,000 - $550,000, which still provides an exceptional quality of life given the lower cost base.

###

3. Level of Education

In investment banking, your educational pedigree is a powerful signal, especially early in your career.

- The MBA Premium: The most common path to becoming a VP is by first joining as an Associate after completing a full-time MBA program. Banks heavily recruit from a select list of elite business schools, often called the "M7" (Harvard, Stanford, Wharton, etc.) and other top-15 programs. An MBA from a top-tier school is seen as a rigorous filter for intellect, ambition, and foundational business knowledge. Associates hired from these programs start at a high compensation base, which carries through to their VP promotion.

- Undergraduate to VP (Direct Promote): A less common but highly respected path is for an Analyst to be promoted directly to Associate and then to VP without an MBA. These individuals, often called "direct promotes," are typically star performers. While they may not have the MBA "stamp," their proven track record within the firm gives them immense credibility. Their compensation as a VP is generally on par with their post-MBA peers. The firm saves on the MBA-level recruiting costs and retains proven talent.

- Certifications (CFA, etc.): While not a requirement for IBD, holding the Chartered Financial Analyst (CFA) charter can be a significant differentiator, especially in Asset Management, Equity Research, or for demonstrating a deep commitment to the finance profession. It won't necessarily trigger an automatic salary bump at the VP level in IBD, but it enhances credibility and technical authority.

###

4. Years of Experience (Tenure as VP)

The VP title itself has internal tiers that directly correlate with compensation.

- VP 1 (First Year): A newly promoted or hired VP. They are proving they can handle the new level of responsibility. Their compensation will be at the bottom of the VP range (e.g., $250k base, $200k-$250k bonus).

- VP 2 (Second Year): Has a year under their belt, has managed deals from start to finish as the lead, and has built more trust with clients and senior bankers. Their compensation will see a meaningful step-up.

- VP 3 / Senior VP (Third Year+): This is a seasoned VP who operates with significant autonomy. They may be starting to source smaller deals or add-on acquisitions for existing clients. They are seen as being on the cusp of a promotion to Director/Executive Director. Their performance is critical, and they are compensated accordingly, pushing the upper end of the VP range. A top-performing Senior VP's pay can begin to overlap with that of a junior Director.

###

5. In-Demand Skills

At the VP level, technical skills are table stakes. Everyone can build a model. The skills that command a premium are the more nuanced, client-facing abilities.

- Technical Mastery: While expected, exceptional mastery of complex financial modeling (LBOs, merger models, accretion/dilution), valuation techniques, and deal structuring is the foundation. A VP who is the go-to person for the most complex analytical challenges will be highly valued.

- Client Communication & "Presence": The ability to lead a client meeting, present complex ideas clearly and concisely, and build a relationship of trust is paramount. A VP who can command a room and instill confidence in a CFO is far more valuable than one who is merely a good analyst.

- Team Leadership & Mentorship: A VP who can effectively manage and mentor their junior team is a "force multiplier." They get the best work out of their Analysts and Associates, reduce errors, improve morale, and are essentially grooming the firm's future talent. Senior leaders notice and reward this.

- Commercial Acumen & Strategic Thinking: This is the ability to think like a business owner, not just an employee. It involves understanding industry trends, identifying potential opportunities for clients before they do, and contributing value-added ideas during pitches and deal negotiations. This skill is what separates a good VP from a great one and is a clear indicator of future potential as a Managing Director.

By understanding these five key factors, one can see that the "salary of a VP at JP Morgan" is not a single number but a dynamic outcome of division, location, education, experience, and a sophisticated set of skills.

---

Job Outlook and Career Growth for a Wall Street VP

The career path of a financial professional, especially at the level of a Vice President, is subject to both broad economic trends and the specific, often cyclical, nature of the investment banking industry. While the allure of a high salary is strong, a long-term perspective on job security, growth prospects, and evolving industry demands is essential.

### The Broader Economic Outlook

The U.S. Bureau of Labor Statistics (BLS) provides a useful macro-level perspective. The BLS groups investment bankers and other high-level finance roles under the category of "Financial Managers." For this occupation, the BLS projects a robust growth rate of 16 percent from 2022 to 2032, which is much faster than the average for all occupations. The BLS states, "About 77,800 openings for financial managers are projected each year, on average, over the decade." [Source: U.S. Bureau of Labor Statistics, Occupational Outlook Handbook, Financial Managers].

This strong growth is attributed to several factors, including the increasing complexity of the global financial environment, the need for expert management of cash and investments, and a growing demand for financial analysis to inform business strategy. While this data applies broadly, it underscores the continued, fundamental need for skilled financial expertise in the economy—the very expertise honed by an investment banking VP.

### Industry-Specific Outlook and Cyclicality

The world of investment banking, however, operates on a more volatile cycle than the general economy. The primary driver of hiring and compensation is deal flow.

- M&A and Capital Markets Activity: When the economy is strong, interest rates are stable, and CEO confidence is high, M&A activity booms. Companies are more willing to pursue acquisitions, and favorable market conditions encourage IPOs and debt issuance. During these periods (like 2021), banks like JP Morgan hire aggressively and pay massive bonuses.

- Economic Downturns: Conversely, during recessions or periods of high uncertainty and interest rates (like 2022-2023), deal flow can slow to a trickle. This leads to hiring freezes, smaller bonus pools, and, in some cases, layoffs.

A successful VP must be able to navigate these cycles. The path is not one of guaranteed, linear progression. The structure of the career ladder is an "up-or-out" pyramid. At each stage—Analyst, Associate, VP—there is an expectation of promotion within a certain timeframe. Those who don't make the cut are often "counseled out" and must find opportunities elsewhere. This creates a highly competitive environment where consistent high performance is not just desired, but required for survival.

### Emerging Trends and Future Challenges

The role of a VP is not static. Several key trends are reshaping the skills and knowledge required to succeed in the long term.

1. Technological Disruption (AI and Automation): Artificial intelligence and machine learning are increasingly being used to automate routine tasks like data gathering, basic financial spreading, and even initial drafts of presentation materials. A future-proof VP will not be replaced by AI but will leverage it. They must focus on the skills AI cannot replicate: high-level strategic advice, nuanced client relationship management, creative deal structuring, and leadership.

2. The Rise of Private Credit: The growth of massive private credit funds has created a powerful alternative to the traditional leveraged finance markets run by banks. A modern VP needs to understand this landscape and how it impacts financing options for their clients.

3. ESG (Environmental, Social, and Governance) Integration: ESG factors are no longer a niche concern. They are a core part of due diligence, investment decision-making, and client strategy. VPs must be conversant in ESG frameworks and able to advise clients on how these factors impact valuation and market perception.

4. Increased Regulatory Scrutiny: Since the 2008 financial crisis, the banking industry has operated under a much stricter regulatory regime. VPs must have a working knowledge of these regulations and ensure their deals are compliant, adding another layer of complexity to their work.

### Advice for Career Advancement and Staying Relevant

For an ambitious professional at the VP level, staying put is not an option. The goal is to advance to Executive Director (ED) and then the coveted role of Managing Director (MD).

- Begin to Build Your Own "Book": Transition from being a pure "execution" VP to one who thinks about business development. Start to build your own network of contacts at client companies, private equity firms, and law firms. Proactively bring ideas to your senior bankers.

- **Develop a "Spike":