When planning your career, evaluating a potential salary is about more than just the number on an offer letter. It's about understanding its real-world power—what kind of life can it afford you? One of the most critical metrics for measuring your financial health and making informed career decisions is the salary-to-rent ratio. This guide will break down this vital concept, explore the salary benchmarks that define it, and show you how your career choices directly impact your financial well-being.

What is the Salary-to-Rent Ratio and Why Does It Matter?

While "salary-to-rent ratio" is not a job title, it is a fundamental financial-planning tool used by everyone from recent graduates to seasoned professionals. In essence, it’s a simple calculation that determines what percentage of your income is spent on housing.

The Role of the Ratio: The primary purpose of this ratio is to help you maintain a balanced budget and avoid becoming "house poor"—a situation where an excessive portion of your income goes toward rent or mortgage, leaving little for savings, debt repayment, and discretionary spending.

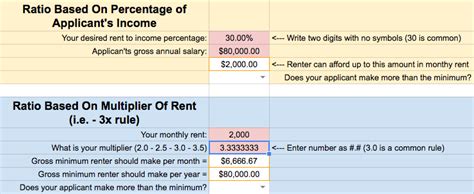

The 30% Rule: A long-standing rule of thumb in personal finance is the 30% rule, which suggests that you should spend no more than 30% of your *gross monthly income* (your salary before taxes) on rent.

- Example: If your annual salary is $60,000, your gross monthly income is $5,000.

- Calculation: $5,000 x 0.30 = $1,500.

- Conclusion: According to this rule, your target rent should be $1,500 per month or less.

While the 30% rule is a helpful starting point, its relevance can change based on your location, student loan debt, and financial goals. For many, especially in high-cost-of-living areas, this benchmark can feel unrealistic.

Applying the Ratio: Salary Benchmarks and Rental Costs

To understand the ratio in practice, we need to look at real-world salary and rent data. Your ability to maintain a healthy ratio is a direct result of your earning potential versus the cost of housing in your area.

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for all full-time wage and salary workers in the United States was $59,540 in the fourth quarter of 2023. This translates to a gross monthly income of approximately $4,962.

Meanwhile, national rent data varies, but recent reports from sources like Zumper and Rent.com place the median rent for a one-bedroom apartment in the U.S. between $1,500 and $1,750 per month.

Let's see how the ratio works for the median American worker:

- Median Gross Monthly Income: $4,962

- Median Monthly Rent (using a $1,600 average): $1,600

- Calculation: ($1,600 / $4,962) x 100 = 32.2%

This shows that the average American worker is already slightly above the recommended 30% threshold, highlighting the economic pressures many face today. An entry-level salary will face an even tighter ratio, while a senior-level salary provides much more flexibility.

Key Factors That Influence Your Salary-to-Rent Ratio

Your personal salary-to-rent ratio isn't static. It's influenced by a combination of career decisions and market forces. Here are the key factors that determine your earning power and, consequently, your housing affordability.

### Level of Education

Education remains one of the strongest predictors of earning potential. Higher educational attainment typically unlocks access to higher-paying jobs, directly improving your salary-to-rent ratio. The BLS consistently reports a clear correlation between education and income.

- High School Diploma: Median weekly earnings of $853

- Bachelor's Degree: Median weekly earnings of $1,432

- Master's Degree: Median weekly earnings of $1,661

- Doctoral or Professional Degree: Median weekly earnings of $2,083 or more

Achieving a higher level of education can significantly increase your salary, giving you more options in any rental market.

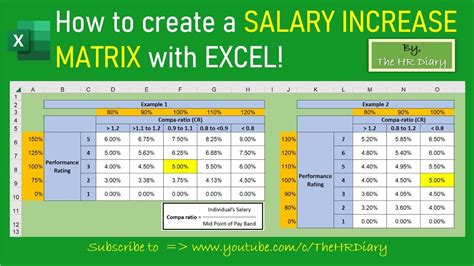

### Years of Experience

As you progress in your career, your salary should increase with experience. Companies pay a premium for seasoned professionals who require less supervision and bring a history of proven success.

- Entry-Level (0-2 years): Typically earns at or slightly below the market average for a role. The salary-to-rent ratio is often at its tightest during this period.

- Mid-Career (5-10 years): Often sees significant salary growth, providing more breathing room in the budget.

- Senior/Lead-Level (10+ years): Commands the highest salaries, often creating a very favorable salary-to-rent ratio that allows for greater savings and investment.

According to data from Payscale, an employee with over 20 years of experience can earn, on average, more than double the salary of an entry-level worker in the same field.

### Geographic Location

Location is arguably the most critical factor influencing your salary-to-rent ratio. A high salary in one city might feel average in another due to a vast difference in housing costs.

High Cost of Living (HCOL) Areas:

Cities like New York, San Francisco, and Boston offer some of the highest salaries in the country but also have exorbitant rental markets.

- Example: San Francisco, CA

- Median Salary: Approximately $98,000 (Payscale)

- Median 1-BR Rent: Approximately $3,000/month (Zumper)

- Ratio: At $8,167/month gross income, a $3,000 rent consumes 36.7% of income.

Low Cost of Living (LCOL) Areas:

Cities like Kansas City, St. Louis, and Cleveland offer lower median salaries but much more affordable housing.

- Example: Kansas City, MO

- Median Salary: Approximately $70,000 (Payscale)

- Median 1-BR Rent: Approximately $1,250/month (Zumper)

- Ratio: At $5,833/month gross income, a $1,250 rent consumes only 21.4% of income.

Choosing a location where salary growth outpaces housing costs can dramatically improve your financial health. The rise of remote work has become a powerful strategy, allowing some professionals to earn an HCOL-area salary while living in an LCOL city.

### Company Type

The type and size of the company you work for can have a major impact on your compensation.

- Large Tech Corporations (e.g., Google, Meta): Known for offering top-tier salaries, stock options, and bonuses that can create an excellent salary-to-rent ratio, even in HCOL areas.

- Startups: May offer lower base salaries but compensate with equity, which holds future potential. This can mean a tighter budget in the short term.

- Non-profits and Government: Often provide lower salaries than the private sector but may offer better work-life balance and benefits like pensions.

- Fortune 500 Companies: Generally offer competitive, stable salaries and strong benefits packages.

### Area of Specialization

Within any field, certain specializations are more lucrative than others. In-demand skills command higher pay.

- Technology: A Software Engineer specializing in Artificial Intelligence or Cybersecurity will earn significantly more than a generalist IT support technician.

- Healthcare: An Anesthesiologist or Surgeon earns a multiple of what a general practitioner does.

- Business: A professional in investment banking will have a higher earning potential than one in human resources.

Focusing your career on a high-demand, high-value specialization is a direct path to improving your salary.

Future Outlook: The Evolving Landscape of Rent and Wages

The relationship between salaries and rent is constantly in flux. According to BLS projections, total employment is expected to grow by 4.7 million jobs from 2022 to 2032. While wages are projected to rise, the key question for professionals will be whether that growth can keep pace with inflation and housing costs.

Trends like remote and hybrid work are reshaping the landscape, giving employees more geographic flexibility than ever before. This trend empowers workers to optimize their salary-to-rent ratio by decoupling their place of work from their place of residence.

Conclusion: Putting the Ratio to Work for You

The salary-to-rent ratio is more than a financial formula; it's a strategic framework for making smarter career and life decisions. While "Salary to Rent Ratio Analyst" isn't a profession, becoming an analyst of your *own* ratio is one of the most empowering steps you can take for your future.

Key Takeaways:

- It's a Personal Finance Tool, Not a Job: Use the ratio to assess your financial health and guide your decisions.

- The 30% Rule is a Guideline: Aim for it, but be prepared to adjust based on your location, debt, and financial goals.

- Location is King: Where you live has a massive impact on your ratio. A high salary means little if it's consumed by high rent.

- Invest in Your Earning Power: Continuously improving your education, experience, and specialized skills is the most effective way to increase your salary and give yourself more financial freedom.

By strategically navigating these factors, you can build a rewarding career that not only pays well but also supports a healthy, sustainable, and prosperous life.