Breaking Down the Numbers: A Financial Analyst's Salary in 2024

A career as a Financial Analyst offers a dynamic and intellectually stimulating path for those with a passion for numbers, strategy, and market dynamics. It's a role that places you at the heart of corporate decision-making, offering significant potential for growth and a highly competitive salary. For aspiring professionals, understanding the earning potential is a critical first step. On average, a Financial Analyst in the United States can expect to earn a median salary of approximately $99,890 per year, with top earners in specialized fields commanding well over $170,000 annually. This guide will break down what the role entails, the key factors that drive salary, and the promising future of this profession.

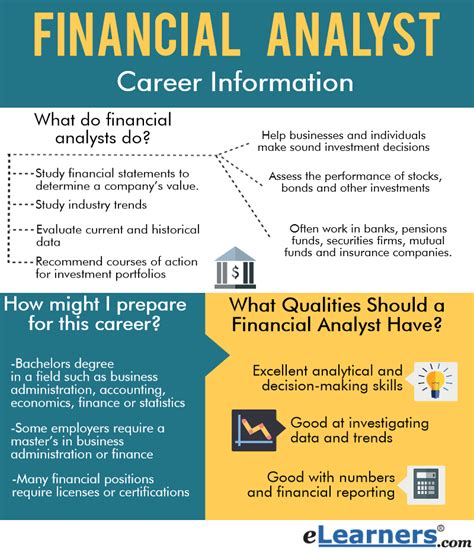

What Does a Financial Analyst Do?

At its core, a Financial Analyst is a financial detective and storyteller. They evaluate financial data to help businesses and individuals make strategic decisions. Their primary responsibilities often include:

- Analyzing Financial Statements: Scrutinizing income statements, balance sheets, and cash flow statements to assess a company's financial health.

- Financial Modeling: Building complex spreadsheets to forecast future earnings, revenue, and economic trends.

- Making Recommendations: Advising management on whether to pursue an investment, sell a stock, or restructure a company's finances.

- Valuation: Determining the value of a company or an asset, a critical function in mergers, acquisitions, and initial public offerings (IPOs).

- Reporting: Creating detailed reports and presentations to communicate their findings clearly to senior leadership and clients.

They are the experts who translate raw data into actionable business intelligence, guiding everything from budgeting and long-term planning to major investment strategies.

Average Financial Analyst Salary

The compensation for a Financial Analyst is strong, reflecting the high level of skill and responsibility required. While salaries can vary widely, we can establish a clear baseline using data from leading sources.

- The U.S. Bureau of Labor Statistics (BLS) reports the median annual wage for financial and investment analysts was $99,890 as of May 2023. The lowest 10 percent earned less than $62,110, while the highest 10 percent earned more than $176,570.

- According to Salary.com, the typical salary range for a Financial Analyst in the United States falls between $86,707 and $104,892 as of early 2024.

- Glassdoor reports a total pay average of $95,066 per year, which includes a base salary average of $82,601 and additional pay like cash bonuses and profit sharing.

This data illustrates that while a starting salary might be in the $60,000s or $70,000s, there is significant upward mobility, with experienced and specialized analysts reaching six-figure base salaries plus substantial bonuses.

Key Factors That Influence Salary

Your specific salary as a Financial Analyst is not a single number but a spectrum influenced by several key variables. Understanding these factors is crucial for maximizing your earning potential.

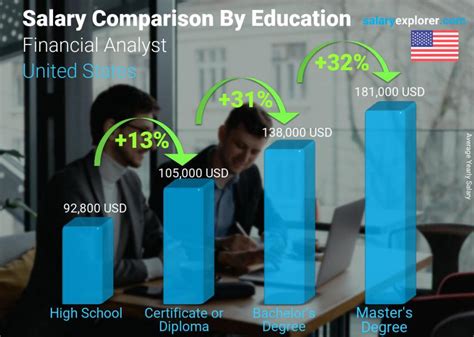

### Level of Education

Education is the foundation of a Financial Analyst's career. A bachelor's degree in finance, economics, accounting, or a related field is the standard entry requirement. However, advanced credentials can dramatically increase your salary.

- Master's Degree: An MBA or a Master of Science in Finance (MSF) can open doors to more senior roles and significantly higher starting salaries. Employers see these degrees as a mark of advanced analytical and strategic thinking.

- Professional Certifications: The Chartered Financial Analyst (CFA) designation is the gold standard in the investment management profession. Earning the CFA charter often leads to a substantial salary increase and is a prerequisite for many high-level portfolio management and equity research roles.

### Years of Experience

Experience is arguably the most significant driver of salary growth. As analysts gain more expertise, they take on more complex projects and greater responsibility.

- Entry-Level (0-2 years): Analysts focus on data gathering, maintaining financial models, and preparing basic reports. Salaries typically fall in the $65,000 to $85,000 range.

- Mid-Career (3-8 years): Now often a "Senior Financial Analyst," these professionals build their own models, present findings to management, and may mentor junior analysts. Salaries move into the $85,000 to $120,000 range.

- Senior/Managerial (8+ years): At this stage, analysts often become managers, directors, or VPs of finance. They oversee teams, drive financial strategy, and work on high-stakes projects like mergers and acquisitions. Compensation can easily exceed $125,000 to $200,000+, especially with bonuses.

### Geographic Location

Where you work matters. Major financial hubs offer higher salaries to compensate for a higher cost of living and intense competition for top talent. Based on BLS data, states with the highest annual mean wages for financial analysts include:

1. New York: ~$137,770

2. District of Columbia: ~$124,190

3. Connecticut: ~$122,860

4. Massachusetts: ~$121,570

5. California: ~$116,910

Working in a major metropolitan area like New York City, San Francisco, Boston, or Chicago will almost always result in a higher salary than working in a smaller city or rural area.

### Company Type

The type of company you work for has a massive impact on your compensation structure.

- Investment Banking & Private Equity: These are the most lucrative sectors. Analysts at bulge-bracket banks and private equity firms often earn the highest salaries and receive very large annual bonuses that can equal or exceed their base pay.

- Corporate Finance (FP&A): Financial Planning & Analysis (FP&A) roles within large Fortune 500 companies offer very competitive salaries, strong benefits, and better work-life balance compared to investment banking.

- Asset Management & Hedge Funds: These roles involve managing investment portfolios and come with high-performance expectations and compensation tied to the fund's success.

- Government: Government agencies offer lower base salaries but provide exceptional job security, robust benefits, and a predictable work schedule.

### Area of Specialization

Within the field, specializing in a high-demand area can boost your value.

- Investment Banking Analyst: Specializes in M&A, underwriting, and capital raising. This is a high-pressure, high-reward specialization.

- Equity Research Analyst: Focuses on analyzing public companies and making stock recommendations (buy, sell, hold) for clients.

- FP&A Analyst: A more internally focused role that handles budgeting, forecasting, and financial planning for a corporation.

- Quantitative Analyst ("Quant"): Uses complex mathematical and statistical models to identify trading opportunities. Requires advanced skills in math, computer science, and finance.

Job Outlook

The future for Financial Analysts is bright. The BLS projects employment for financial analysts to grow 8 percent from 2022 to 2032, which is much faster than the average for all occupations. This growth is driven by several factors, including the increasing complexity of financial products, the growing need for in-depth data analysis across all industries, and continued globalization. As more data becomes available, companies will rely even more heavily on skilled analysts to interpret it and guide their path forward.

Conclusion

A career as a Financial Analyst is a rewarding choice for driven, analytical individuals. The path offers a competitive salary that grows substantially with experience, education, and specialization. For those considering this field, the key takeaways are clear:

- Strong Earning Potential: With a median salary near six figures and top earners making much more, the financial rewards are significant.

- Growth is Key: Your salary is not static. Pursuing advanced degrees like an MBA or prestigious certifications like the CFA can unlock higher levels of compensation.

- Location and Industry Matter: Choosing to work in a major financial center and targeting high-paying sectors like investment banking can dramatically accelerate your earnings.

With a strong job outlook and a clear path for advancement, the role of a Financial Analyst remains one of the most compelling and lucrative careers in the modern business world.