For ambitious professionals in finance, a position at Goldman Sachs represents a career pinnacle. It’s a name synonymous with prestige, power, and, of course, significant financial reward. Among the most coveted roles within this storied institution is that of the Associate. This position is a critical stepping stone on the path to Wall Street's senior ranks, serving as the engine room for major deals and strategies. But what does this demanding career truly entail, and what is the reality behind the legendary compensation packages? The query "salary of associate at goldman sachs" is more than just a search for a number; it's a search for a future, a validation of immense effort, and a glimpse into one of the most exclusive careers in the world.

This guide will provide an exhaustive, data-driven analysis of the Goldman Sachs Associate role. We will dissect not only the salary and bonus figures but also the intricate factors that shape them, from your educational background to the specific desk you sit at. We'll explore the demanding day-to-day responsibilities, the long-term career outlook, and a step-by-step plan for how you can position yourself to land this very role.

I've spent over two decades as a career analyst, guiding hundreds of aspiring financiers through the labyrinthine recruitment processes of bulge-bracket banks. I once coached a brilliant candidate who was laser-focused on the prestige of the Goldman Sachs name but hadn't fully grasped the immense personal and professional pressures that accompany the seven-figure potential. Helping them understand the complete picture—the salary, the lifestyle, the exit opportunities, and the personal cost—was the key that unlocked not just a job offer, but a sustainable and successful career. This guide is built on that same principle: providing you with the total, unvarnished truth.

---

### Table of Contents

- [What Does an Associate at Goldman Sachs Do?](#what-does-an-associate-do)

- [Goldman Sachs Associate Salary: A Deep Dive](#salary-deep-dive)

- [Key Factors That Influence an Associate's Salary](#key-factors)

- [Job Outlook and Career Growth](#job-outlook)

- [How to Become an Associate at Goldman Sachs](#how-to-get-started)

- [Is a Career as a Goldman Sachs Associate Right for You?](#conclusion)

---

What Does an Associate at Goldman Sachs Do?

While often discussed as a single role, the "Associate" title at Goldman Sachs encompasses a variety of functions across the firm's different divisions. The experience and responsibilities can vary dramatically depending on where you land. An Associate is typically a post-MBA hire or a professional promoted after several years as an Analyst. They serve as the mid-level execution force, bridging the gap between the junior Analysts who perform the initial grunt work and the senior Vice Presidents (VPs) and Managing Directors (MDs) who manage client relationships and drive strategy.

The core of the Associate role is project management and execution. They are entrusted with a higher level of responsibility than Analysts, expected to not only perfect the technical details but also begin to understand the bigger strategic picture. They manage the workflow of Analysts, ensure the quality and accuracy of all materials, and increasingly, gain exposure to clients.

Let's break down the role across Goldman's major revenue-generating divisions:

- Investment Banking Division (IBD): This is the classic, high-profile role most people envision. IBD Associates work in industry groups (like TMT - Technology, Media, and Telecom, or Healthcare) or product groups (like M&A or Leveraged Finance). Their primary job is to help corporations and governments raise capital and execute mergers and acquisitions. Key responsibilities include:

- Building and refining complex financial models (DCF, LBO, merger models).

- Creating extensive pitch books and presentations for client meetings.

- Conducting in-depth due diligence on companies.

- Managing and mentoring a team of 1-3 Analysts on a deal team.

- Coordinating with lawyers, accountants, and other advisors during a live transaction.

- Gradually taking on more client-facing communication.

- Global Markets: This division houses the firm's Sales & Trading (S&T) and structuring functions. The pace is faster and tied directly to the live markets.

- Sales Associates: Build and maintain relationships with institutional clients (like hedge funds and pension funds), pitch trade ideas, and facilitate transactions.

- Trading Associates: Help manage a trading book, analyze market risks, and execute trades under the guidance of a senior trader. The role is highly quantitative and requires split-second decision-making.

- Asset & Wealth Management: Here, Associates help manage the firm's and its clients' capital.

- Private Wealth Management: Associates work with financial advisors to serve high-net-worth individuals and families, helping with portfolio allocation, investment analysis, and client reporting.

- Asset Management: Associates operate more like buy-side investors, researching and analyzing potential investments (stocks, bonds, real estate, etc.) for the firm's large institutional funds.

### A Day in the Life of an IBD Associate

To make this tangible, here is a realistic, albeit compressed, look at a typical weekday for an Associate in the M&A group.

- 7:30 AM: Arrive at the office (or log in from home). Scan the Wall Street Journal, Financial Times, and Bloomberg for overnight market news and any updates on clients or target companies.

- 8:00 AM: Check emails and a barrage of instant messages. A VP has left feedback overnight on a pitch book for a potential acquisition. Review the comments and create a to-do list for the Analyst on the team.

- 9:00 AM: Team sync-up call. The VP and Managing Director discuss strategy for an upcoming client meeting. As the Associate, you're expected to contribute, answer detailed questions about the financial model, and take charge of follow-up actions.

- 10:00 AM - 1:00 PM: "Work-in-progress" session with your Analyst. You're not just delegating; you're teaching. You review their valuation analysis, correcting assumptions and refining the outputs. You explain the "why" behind the numbers, not just the "how."

- 1:00 PM: Lunch is usually a quick affair, eaten at the desk while reviewing a data room for a live deal. You're looking for red flags in a target company's financials or contracts.

- 2:00 PM - 5:00 PM: Conference call with the client's management team to ask clarifying questions for the due diligence process. As the Associate, you might lead a portion of this call, demonstrating your growing command of the transaction.

- 5:00 PM - 8:00 PM: The VP needs a new set of analyses for the pitch book by morning. This involves modeling different scenarios (e.g., higher interest rates, lower growth). This is "turning comments" – a core part of the job. You work with the Analyst to get it done.

- 8:00 PM: Dinner arrives at the office, paid for by the firm. You eat at your desk while continuing to refine the presentation slides.

- 8:30 PM - 11:00 PM: The final push. You perform a final, meticulous check of every number, every footnote, and every slide in the pitch book before sending it to the VP for review. Your personal seal of approval is on this work.

- 11:30 PM: You get the "pencils down" email from the VP with minimal changes. You package up the final version and send it out.

- 11:45 PM: A quick check of emails to ensure no other urgent fires have started. If clear, you head home (or log off), knowing you'll be back in less than eight hours to do it all again.

This grueling schedule is the trade-off for the immense learning opportunities and, as we'll explore next, the extraordinary compensation.

---

Goldman Sachs Associate Salary: A Deep Dive

When analyzing compensation for a Goldman Sachs Associate, looking at the base salary alone is misleading. The true financial picture is "all-in compensation," which is a combination of a competitive base salary and a highly variable, performance-based annual bonus.

It's crucial to understand that these figures are not static. They are subject to market conditions, firm performance, group performance, and individual contribution. A boom year on Wall Street means larger bonus pools, while a downturn can significantly curtail them.

Authoritative Data Insights: For roles as specific as a Goldman Sachs Associate, firm-specific data from salary aggregators and industry reports are more precise than broad government data.

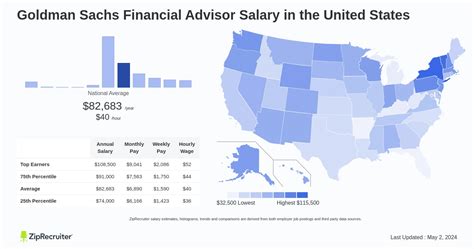

- According to data from Levels.fyi, a highly respected source for compensation in tech and finance, the median total compensation for a first-year (Associate 1) Investment Banking Associate at Goldman Sachs in New York City is approximately $350,000. This is typically broken down into a $175,000 base salary and a $175,000 bonus.

- Glassdoor reports a similar range, with the average total pay for an Associate at Goldman Sachs in the US listed as $274,385 per year. This average includes a base salary of around $169,000 and additional pay (bonus, stock) of around $105,000. The wider range reflects the inclusion of various divisions and locations beyond front-office IBD in NYC.

- Industry reporting from sources like *Bloomberg* and the *Wall Street Journal* consistently confirms that bulge-bracket banks, including Goldman Sachs, have synchronized their base salary increases for Associates. As of 2023-2024, the standard base salaries for IBD Associates in major hubs are:

- Year 1 Associate: $175,000

- Year 2 Associate: $200,000

- Year 3 Associate: $225,000

The bonus is the wild card and the key differentiator.

### The All-Important Bonus

The annual bonus is where Associates truly make their money. It is typically paid out in January or February for the previous calendar year's performance. Unlike the fixed base salary, the bonus is discretionary and can range from 50% to over 150% of the base salary.

Here’s how it generally works:

1. Firm & Divisional Performance: The overall profitability of Goldman Sachs and the specific division (e.g., IBD) sets the size of the total bonus pool.

2. Individual Performance Review: At year-end, Associates undergo a rigorous 360-degree review process. They are "ranked" against their peers. This ranking, often informally known as "bucketing" (top, middle, bottom bucket), is the single most significant determinant of their bonus percentage.

3. Bonus Calculation: A top-bucket Associate in a good year might receive a bonus of 120-150% of their base salary, while a middle-bucket Associate might see 80-100%, and a bottom-bucket Associate could receive 50% or less.

### Compensation Progression Table for an IBD Associate (NYC)

The following table provides a realistic, estimated range of total compensation for a typical Investment Banking Associate at Goldman Sachs in a major financial hub like New York.

| Experience Level | Base Salary (est.) | Bonus Range (est. % of Base) | Total Compensation Range (est.) |

| :--- | :--- | :--- | :--- |

| Associate - Year 1 | $175,000 | 80% - 120% | $315,000 - $385,000 |

| Associate - Year 2 | $200,000 | 90% - 130% | $380,000 - $460,000 |

| Associate - Year 3 | $225,000 | 100% - 150% | $450,000 - $562,500 |

*Sources: Data synthesized from Levels.fyi, Wall Street Oasis forums, and industry news reports (e.g., eFinancialCareers, Bloomberg).*

### Other Compensation Components

Beyond salary and bonus, the package includes other valuable elements:

- Signing Bonus: Post-MBA hires who interned at another bank or are coming from a different industry are often offered a signing bonus. This can range from $50,000 to $75,000, sometimes with a portion paid upon signing and the rest upon starting.

- Stub Bonus: Associates who start in the summer will receive a pro-rated "stub" bonus for their first ~5 months of work during their first bonus season.

- 401(k) and Retirement: Goldman Sachs offers a competitive 401(k) plan, typically with a company match. For example, they might match a certain percentage of employee contributions up to a cap, which represents significant tax-advantaged savings.

- Health and Wellness Benefits: Comprehensive medical, dental, and vision insurance are standard. Additionally, firms like Goldman have invested heavily in wellness programs, including mental health support, gym subsidies, and generous parental leave policies, which add significant non-monetary value.

- Perks: While the days of lavish excess are toned down, perks still exist, such as a nightly meal stipend, chauffeured car service for late nights, and corporate travel benefits.

---

Key Factors That Influence an Associate's Salary

The compensation ranges provided above are a benchmark, but an individual Associate's actual pay can swing dramatically based on a confluence of factors. Understanding these variables is critical for anyone trying to maximize their earnings potential within the firm. This is where the nuance of a "salary of associate at goldman sachs" becomes clear—it is not a single number, but a complex equation.

### `

` Division and Role Specialization `

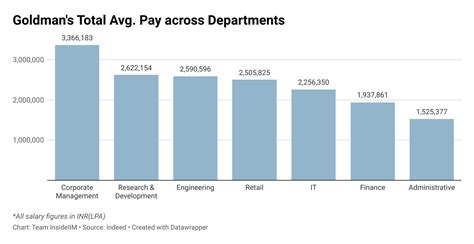

`This is arguably the most significant factor after individual performance. Compensation structures vary widely across the firm, directly tied to how close the role is to revenue generation.

- Front Office (Highest Paying): These are the client-facing, revenue-generating roles.

- Investment Banking Division (IBD) and Private Equity (e.g., Merchant Banking): Traditionally, these are the highest-paid divisions. The large fees from M&A deals and capital raises fund massive bonus pools. Associates here work on long, complex projects, and their compensation reflects the high-stakes nature of the work.

- Global Markets (Sales & Trading): Compensation here is also very high but can be more volatile. A trader's bonus is often directly linked to their P&L (Profit & Loss), while a salesperson's bonus is tied to the revenue they generate from clients. A star trader can have an incredible year, potentially out-earning an IBD peer, but a bad year can lead to a much smaller bonus.

- Middle Office: These roles support the front office and manage risk. They are essential to the firm but are viewed as cost centers rather than revenue centers, which is reflected in their pay.

- Risk Management, Compliance, Treasury: Associates in these areas have more predictable hours and a better work-life balance, but their total compensation is significantly lower. A bonus might be in the 30-60% range of their base salary, rather than the 100%+ seen in IBD.

- Back Office (Operations & Technology): These divisions provide the infrastructure that allows the firm to function.

- Operations, Technology (Non-Quant), Corporate Services: Compensation here is more in line with standard corporate roles at large companies. While still well-paid, an Associate in Operations might have total compensation that is 50-60% lower than their IBD counterpart.

### `

` Geographic Location `

`Where you work matters immensely. Compensation is tiered globally based on cost of living, market competition for talent, and the importance of the office.

- Tier 1: New York City, London, Hong Kong: These are the global financial centers with the highest salaries and bonuses. NYC sets the benchmark for US compensation. An Associate in London will have a similar base salary (converted to GBP) but may face different tax implications and bonus structures.

- Tier 2: Major US Hubs (San Francisco, Chicago, Houston): Compensation in these cities is very competitive and close to New York levels, especially in lucrative sectors like tech banking in SF or energy banking in Houston. The base salary is often identical to NYC, with potentially slightly smaller bonuses.

- Tier 3: Near-Shore & Regional Offices (Salt Lake City, Dallas, Warsaw): Goldman Sachs has strategically expanded its presence in lower-cost locations. An Associate in Salt Lake City, a major hub for the firm, will perform similar work but with a lower compensation package. For example, according to Glassdoor data, an Associate's base salary in SLC might be 15-20% lower than in NYC, and the bonus potential is also scaled down. However, the significantly lower cost of living can make the real-terms take-home pay very attractive.

- International Variations: Offices in emerging markets or smaller financial centers will have compensation tailored to the local market rates, which are typically lower than in the major global hubs.

### `

` Performance and Ranking `

`As mentioned, the year-end performance review is the moment of truth. Goldman, like its peers, uses a forced-ranking system. Even in a team of high-achievers, some will be ranked top, some middle, and some bottom.

- Top Bucket: These are the undisputed stars. They consistently exceed expectations, manage projects flawlessly, and are seen as future leaders. They receive the highest bonuses and are on the fast track for promotion to Vice President.

- Middle Bucket: The majority of Associates fall here. They are solid, reliable performers who meet expectations. Their bonuses are strong and reflect a successful year.

- Bottom Bucket: These Associates have underperformed relative to their peers. This could be due to mistakes, a poor attitude, or struggling to handle the workload. They receive the lowest bonuses and may be "counseled out" or encouraged to find a new role, reflecting the "up-or-out" culture prevalent in the industry.

### `

` Educational Background and Entry Path `

`The traditional path to becoming a Goldman Sachs Associate is through a top-tier MBA program.

- MBA Program Prestige: While Goldman recruits from a range of excellent schools, graduating from a program with a powerhouse finance reputation (e.g., Wharton, Chicago Booth, Columbia, Harvard Business School) provides a significant advantage. These schools have deep alumni networks within the firm and a well-oiled recruiting pipeline. While it doesn't directly set the salary *after* you're hired (all first-year Associates in a given group/location start at the same base), it heavily influences your chances of getting the interview and securing the offer in the first place.

- Analyst to Associate Promotion: A top-performing Analyst who receives a promotion to Associate bypasses the MBA route. They have a deep, firm-specific knowledge advantage but may start with a slightly different compensation trajectory initially compared to their MBA peers, though it typically evens out quickly.

- Lateral Hires: An experienced professional hired from another bank or industry (e.g., a lawyer from a top law firm or a consultant) will have their compensation negotiated based on their years of relevant experience. They will be "slotted" into the existing Associate year structure (e.g., coming in as a "second-year Associate").

### `

` The Firm's and Group's Annual Performance `

`No Associate is an island. Your bonus is directly tied to the health of the overall business.

- A Bull Market: In a year with high deal flow, strong trading revenues, and a booming stock market, Goldman's overall profits soar. This translates into a much larger bonus pool to be distributed among employees. In these "good years," even mid-ranked Associates can receive bonuses exceeding 100% of their base.

- A Bear Market: In a year marked by recession, market volatility, and a drought in M&A activity, the firm's profits will fall. The bonus pool will shrink accordingly. In these "bad years," bonuses can be severely cut across the board. Top performers will still be rewarded, but their bonus will be smaller than it would have been in a good year. This is a key risk of a career in finance.

### `

` In-Demand Skills That Boost Your Value `

`While base pay is standardized, developing certain skills can place you in a higher-demand group or help you achieve a top-bucket ranking, thus maximizing your bonus.

- Advanced Financial Modeling and Valuation: Mastery of LBO and M&A modeling is table stakes. Being the go-to person for complex, esoteric modeling challenges makes you invaluable.

- Industry-Specific Expertise: Developing a deep understanding of a specific sector (e.g., renewable energy, software-as-a-service, biopharma) allows you to add more strategic value than a generalist.

- Data Science and Programming: While not required for all IBD roles, skills in Python, R, or SQL are increasingly valuable for analyzing large datasets, automating tasks, and providing unique insights. This is especially critical in quantitative trading and some asset management roles.

- Client Communication and Presence: As Associates progress, their ability to communicate confidently and effectively with clients becomes crucial. Those who can be trusted to join a client meeting and speak intelligently are given more responsibility and are viewed more favorably during reviews.

- Project Management and Leadership: The ability to effectively manage Analysts, delegate tasks, and keep a project on track without constant oversight from a VP is a core competency that separates top- and middle-bucket Associates.

---

Job Outlook and Career Growth

A career as a Goldman Sachs Associate is not just a job; it is an accelerant. The compensation is a primary draw, but the long-term career trajectory and exit opportunities are an equally powerful part of its value proposition.

### Industry-Wide Job Outlook

To understand the context for roles at Goldman Sachs, we can look at the broader industry projections from the U.S. Bureau of Labor Statistics (BLS).

For "Financial and Investment Analysts," the BLS projects job growth of 8 percent from 2022 to 2032, which is much faster than the average for all occupations. The BLS states, "Growth is expected to be driven by an increase in the complexity of investments and the need for in-depth knowledge to navigate the securities markets." This suggests a sustained demand for skilled financial professionals who can analyze complex data and guide investment decisions, which is the bedrock of an Associate's role.

Similarly, for "Securities, Commodities, and Financial Services Sales Agents," which aligns with roles in Global Markets, the BLS projects growth of 11 percent over the same period. This indicates a robust outlook for professionals who can manage client relationships and facilitate trading.

While these broad statistics are positive, it's important to note that competition for roles at elite institutions like Goldman Sachs will always remain exceptionally fierce, regardless of macro trends. These firms attract a far larger pool of qualified applicants than they have positions available.

### The Career Path at Goldman Sachs: Up or Out

Goldman Sachs, like other bulge-bracket banks, has a well-defined and demanding career ladder. The culture is often described as "up or out," meaning that individuals are expected to continually perform at a high level and earn promotions, or they will likely be encouraged to seek opportunities elsewhere.

The typical progression looks like this:

1. Analyst (2-3 years): Typically hired straight from an undergraduate program. Focuses on technical execution.

2. Associate (3-4 years): Hired post-MBA or promoted from Analyst. Manages projects and Analysts. This is the stage where you prove you have senior-level potential.

3. Vice President (VP): The first "senior officer" title. VPs are primarily responsible for deal execution and begin to source new business and manage client relationships more independently. Promotion from Associate to VP is a major career milestone.

4. Director / Executive Director (ED): A senior VP-level role, often for highly skilled individual contributors or managers who are on the path to Managing Director.

5. **Managing Director (