Introduction

For those with a meticulous eye for detail, a passion for integrity, and a desire for a stable, lucrative, and intellectually stimulating career, the path of an auditor is a compelling one. Within this field, the role of a Senior Auditor represents a critical milestone—a position of significant responsibility, leadership, and, importantly, substantial earning potential. If you're weighing your career options or looking to advance in the accounting world, you've likely asked the central question: "What is a typical senior auditor salary?"

The answer is encouraging. While salaries vary widely, a Senior Auditor in the United States can typically expect to earn a salary between $85,000 and $125,000 per year, with total compensation, including bonuses, often pushing that figure even higher. This role isn't just about a paycheck; it's a gateway to executive leadership, specialized consulting, and a deep understanding of the inner workings of business and finance.

I recall a time early in my professional analysis career when I was observing a corporate audit. The Senior Auditor, calm and methodical amidst a sea of spreadsheets and anxious executives, identified a subtle but critical flaw in the company's revenue recognition process. It wasn't a matter of fraud, but of misunderstanding complex regulations. Her discovery not only prevented a costly restatement of financial reports but also fundamentally improved the company's processes moving forward. In that moment, I saw the Senior Auditor not as a mere "checker," but as a strategic partner and a guardian of corporate health.

This guide is designed to be your definitive resource for understanding the Senior Auditor career path. We will dissect salary expectations, explore the factors that drive compensation, and provide a clear, actionable roadmap for you to follow.

### Table of Contents

- [What Does a Senior Auditor Do?](#what-does-a-senior-auditor-do)

- [Average Senior Auditor Salary: A Deep Dive](#average-senior-auditor-salary-a-deep-dive)

- [Key Factors That Influence a Senior Auditor's Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth for Senior Auditors](#job-outlook-and-career-growth)

- [How to Become a Senior Auditor: Your Step-by-Step Guide](#how-to-get-started-in-this-career)

- [Conclusion: Is a Senior Auditor Career Right for You?](#conclusion)

---

What Does a Senior Auditor Do?

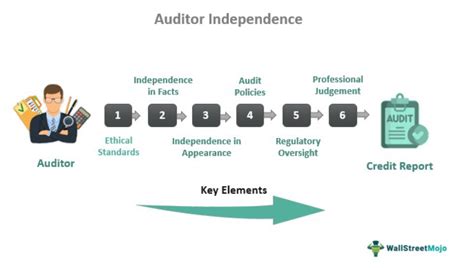

Before we dive into the numbers, it's essential to understand the substance of the role. A Senior Auditor is far more than a junior accountant with a few years of experience. They are the on-the-ground leaders of an audit engagement, responsible for executing the audit plan, supervising staff, and serving as the primary point of contact for the client's management team.

Think of them as the project managers of the financial investigation. While an Audit Partner or Manager sets the overall strategy, the Senior Auditor directs the day-to-day fieldwork, ensuring that every piece of evidence is collected, every control is tested, and every conclusion is sound.

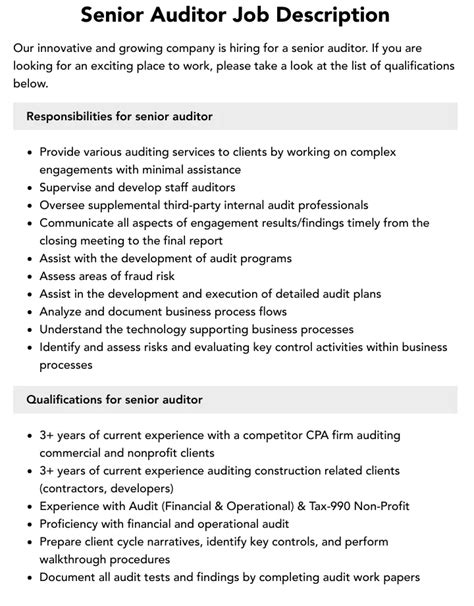

Core Responsibilities of a Senior Auditor:

- Audit Planning & Scoping: Assisting in the development of the audit plan, identifying key risk areas (e.g., revenue, inventory, accounts payable), and determining the nature, timing, and extent of audit procedures.

- Team Leadership and Supervision: Supervising, training, and mentoring junior auditors (Staff Auditors). This includes assigning tasks, reviewing their workpapers for accuracy and completeness, and providing constructive feedback.

- Executing Complex Audit Procedures: Performing the more challenging and high-risk audit tests that require advanced judgment, such as valuing complex financial instruments, assessing goodwill for impairment, or analyzing intricate tax provisions.

- Internal Controls Testing (SOX): For public companies, a significant part of the job involves testing the design and operating effectiveness of internal controls over financial reporting, as mandated by the Sarbanes-Oxley Act (SOX).

- Client Communication: Regularly interacting with the client's accounting and finance personnel, from controllers to CFOs, to request information, discuss findings, and resolve issues.

- Reporting and Documentation: Drafting audit findings, preparing memos on complex accounting issues, and contributing to the final audit report that is presented to the company’s management and board of directors.

### A Day in the Life of a Senior Auditor (During Busy Season)

To make this more tangible, let's walk through a typical day for a Senior Auditor at a public accounting firm during the peak "busy season" (January-March).

- 8:00 AM: Arrive at the client's office. Grab a coffee and have a quick huddle with your team of two staff auditors. You review the plan for the day: Staff A will focus on testing cash controls, Staff B will work on inventory observation procedures, and you will tackle the complex debt covenant calculations.

- 9:00 AM: You meet with the client's Assistant Controller to discuss some pending information requests and clarify a question about their new leasing standard implementation.

- 10:30 AM: You sit down to perform your assigned testing. This involves reviewing loan agreements, building a model to recalculate interest expense, and ensuring the company is in compliance with all its debt covenants. You document every step meticulously in the audit software.

- 12:30 PM: Lunch with the team. This is a chance to decompress but also to informally check in on their progress and answer any questions they were hesitant to ask in a formal setting.

- 1:30 PM: You begin reviewing the workpapers completed by Staff A on cash testing. You find a minor error in their documentation and provide clear, constructive feedback on how to correct it and what to look for next time. This mentoring is a key part of your role.

- 3:30 PM: You join a call with your Audit Manager and the client's CFO to discuss a preliminary finding related to how they've accounted for a recent acquisition. Your role is to clearly and professionally explain the technical accounting guidance and the potential impact on the financial statements.

- 5:00 PM: The staff auditors are wrapping up their work for the day. You do a final check of their progress against the daily plan and set expectations for tomorrow.

- 6:00 PM - 7:30 PM: After the team leaves, you spend some quiet time updating the audit budget, responding to emails from your manager, and drafting a summary of the day's findings. You want to have a clear status update ready for the next morning.

This snapshot illustrates the blend of technical expertise, project management, and interpersonal skills that define the Senior Auditor role.

---

Average Senior Auditor Salary: A Deep Dive

Now for the central question: How much do Senior Auditors earn? The compensation for this role is robust, reflecting the high level of skill, responsibility, and the common requirement for professional certification (like the CPA).

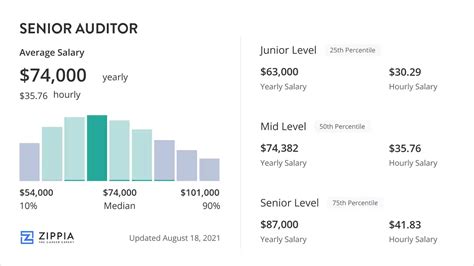

According to Salary.com, as of late 2023, the median annual salary for a Senior Auditor in the United States is $98,168. The typical salary range falls between $89,613 and $107,265. However, this range represents only base salary and can be influenced by numerous factors we'll explore in the next section.

Data from other reputable sources corroborates this, offering a slightly wider lens that includes additional compensation:

- Payscale.com reports an average base salary of around $83,000, but with bonuses, the total pay can extend up to $105,000 or more.

- Glassdoor.com, which aggregates user-submitted data, shows a total pay estimate (including bonuses, stock, etc.) for a Senior Auditor often hovering around $102,000 per year.

It's important to understand the broader context provided by the U.S. Bureau of Labor Statistics (BLS). The BLS groups Senior Auditors within the "Accountants and Auditors" category. For this entire group, the median annual wage was $78,000 in May 2022. The top 10 percent in this category earned more than $132,690. Senior Auditors, by definition, sit comfortably in the upper-middle to top quartile of this broad category, confirming the six-figure potential of the role.

### Salary Progression by Experience Level

A career in audit has a very clear and structured progression, with salary increasing in lockstep with experience and responsibility. A "Senior Auditor" is typically a role held by someone with 3 to 5 years of experience.

Here is a typical salary trajectory in the audit profession:

| Career Stage | Typical Years of Experience | Typical Base Salary Range | Key Responsibilities |

| :--- | :--- | :--- | :--- |

| Staff Auditor / Audit Associate | 0-2 years | $65,000 - $85,000 | Executing detailed testing, preparing workpapers, learning audit methodology. |

| Senior Auditor / Senior Associate | 2-5 years | $85,000 - $125,000 | Leading fieldwork, supervising 1-3 staff, performing complex testing, client interaction. |

| Audit Manager | 5-8 years | $115,000 - $160,000+ | Managing multiple audit engagements, reviewing work, client relationship management, staff development. |

| Senior Audit Manager | 8-12 years | $150,000 - $200,000+ | Overseeing a portfolio of clients, business development, significant firm-level responsibilities. |

| Partner / Director (Public) / Audit Director (Industry) | 12+ years | $250,000 - $1,000,000+ | Ultimate responsibility for audits, signing audit opinions, firm leadership, driving revenue. |

*Salary ranges are estimates based on aggregated data and can vary significantly based on the factors discussed below.*

### Beyond the Base Salary: Understanding Total Compensation

A Senior Auditor's compensation package is more than just their annual salary. This is especially true in public accounting firms and large corporations, which compete fiercely for top talent.

- Annual Bonuses: This is the most significant component of variable pay. In public accounting, bonuses are tied to individual performance, firm performance, and charge-able hours. A typical bonus for a Senior Auditor can range from 5% to 20% of their base salary. In a strong year, this can add $8,000 to $25,000 to their total earnings.

- Profit Sharing: Some firms, particularly private ones or those with partnership structures, may offer a share of the firm's profits to eligible employees.

- CPA Certification Bonus & Support: Many firms offer a one-time bonus for passing the CPA exam, often ranging from $3,000 to $5,000. They also typically pay for CPA review courses (like Becker or Gleim) and exam fees, a benefit worth several thousand dollars.

- Retirement Savings: A 401(k) or 403(b) plan is standard. The key differentiator is the employer match. A competitive match (e.g., 50% of the first 6% of your contributions) is a significant part of the total compensation package.

- Health and Wellness Benefits: Comprehensive health, dental, and vision insurance are standard. Increasingly, firms offer wellness stipends for gym memberships, mental health resources, and other benefits.

- Paid Time Off (PTO): Expect a generous PTO package, though using it during the January-April "busy season" in public accounting can be challenging.

When evaluating a job offer, it is crucial to look at the total compensation package, not just the base salary. A higher base salary with a weak bonus structure and poor benefits may be less attractive than a slightly lower base with a strong bonus potential and excellent retirement and health plans.

---

Key Factors That Influence a Senior Auditor's Salary

While the national averages provide a useful benchmark, a Senior Auditor's actual salary is determined by a complex interplay of factors. Understanding these variables is key to negotiating your worth and maximizing your earning potential throughout your career. This is the most critical section for anyone looking to strategically build a high-earning career in this field.

###

Level of Education & Professional Certifications

Your educational background and, more importantly, your professional certifications are the bedrock of your earning power in auditing.

- Bachelor's Degree: A bachelor's degree in Accounting is the non-negotiable entry ticket. A degree in Finance, Business Administration with an accounting concentration, or Information Systems may also be acceptable, but an Accounting degree is the gold standard. This is the baseline and does not, by itself, command a premium salary.

- Master's Degree (MAcc or MST): A Master of Accountancy (MAcc) or Master of Science in Taxation (MST) can provide a salary bump of 5% to 15% right from the start. The primary driver for this is that most states require 150 semester hours of education to be eligible for the CPA license. A master's program is the most common way to meet this requirement, making graduates "CPA-ready" and more valuable to employers.

- The Certified Public Accountant (CPA) License: This is the single most important factor. Being a licensed CPA is virtually a prerequisite for advancing to Senior Auditor and beyond in public accounting. It signals a verified level of expertise, ethical commitment, and professional dedication. Holding a CPA can increase your salary by 10% to 25% compared to a non-certified peer with the same experience. It also unlocks opportunities for promotion to Manager, Senior Manager, and Partner, where the salary growth is exponential.

- Other Key Certifications: While the CPA is paramount, other certifications can lead to higher salaries, particularly in specialized audit roles:

- Certified Information Systems Auditor (CISA): For those specializing in IT audit, the CISA is the gold standard. Given the high demand for auditors who can assess cybersecurity risks and complex IT systems (like SAP or Oracle), a CISA-certified Senior Auditor can command a significant salary premium, often earning $10,000 to $20,000 more than a traditional financial auditor.

- Certified Internal Auditor (CIA): This is the premier certification for internal auditors (those who work for one company rather than a public accounting firm). It demonstrates expertise in internal control, risk management, and governance. While it may not provide the same broad lift as the CPA, it is essential for career advancement and higher pay within corporate internal audit departments.

- Certified Fraud Examiner (CFE): This is a highly specialized certification for auditors who focus on forensic accounting and fraud investigation. CFEs are in demand in consulting firms, law firms, and government agencies. This niche skill set often leads to higher consulting rates and salaries.

###

Years of Experience

As illustrated in the salary progression table, experience is a primary driver of compensation. The audit career path is highly structured, with clear salary bands associated with each level of experience.

- 0-2 Years (Staff/Associate): This is the learning phase. You're building foundational skills and your value is in your potential. Salary growth is steady but not dramatic.

- 2-5 Years (Senior): This is the "sweet spot" for a major salary jump. The promotion to Senior Auditor is a recognition that you can now manage projects and people. This added responsibility comes with a significant pay increase, often 20% to 30% over a top-performing Staff Auditor's salary. It's at this stage that auditors who have passed the CPA exam see the largest financial return on that investment.

- 5-8 Years (Manager): The leap to Manager is another major inflection point. Your role shifts from "doing" to "managing." You are responsible for the profitability of multiple engagements and managing client relationships. The salary reflects this, often crossing well into the low-to-mid six-figure range.

- 8+ Years (Senior Manager/Director): At this level, you are not just managing projects; you are managing a book of business. Business development, firm strategy, and high-level client negotiations become part of your role. Compensation becomes heavily leveraged with performance-based bonuses and, in public accounting, the potential for a partnership track, where earnings can reach the high six figures or more.

###

Geographic Location

Where you work matters—a lot. Salaries for Senior Auditors are not uniform across the country. They are heavily influenced by the local cost of living and the concentration of large corporations and financial institutions.

High Cost of Living (HCOL) metropolitan areas offer the highest salaries to offset the expense of living there. Conversely, Lower Cost of Living (LCOL) areas will have lower nominal salaries, but your purchasing power may be equivalent or even greater.

Illustrative Senior Auditor Salary by Major U.S. City:

| City | Cost of Living Index (US Avg = 100) | Typical Senior Auditor Salary Range |

| :--- | :--- | :--- |

| San Francisco, CA | ~179 | $115,000 - $150,000+ |

| New York, NY | ~127 | $110,000 - $145,000+ |

| Boston, MA | ~117 | $100,000 - $135,000 |

| Washington, D.C. | ~108 | $98,000 - $130,000 |

| Chicago, IL | ~94 | $90,000 - $120,000 |

| Dallas, TX | ~92 | $88,000 - $115,000 |

| Atlanta, GA | ~92 | $85,000 - $110,000 |

| Cleveland, OH | ~78 | $80,000 - $105,000 |

| St. Louis, MO | ~77 | $78,000 - $100,000 |

*Data is illustrative and compiled from various salary aggregators and cost-of-living indices. Ranges are for a CPA-certified Senior Auditor with ~4 years of experience.*

The takeaway is clear: A Senior Auditor in San Jose or Manhattan will earn a much higher nominal salary than one in Omaha or Kansas City. When considering a job, always factor in the cost of living to understand your true earning power.

###

Company Type & Size

The type and size of your employer create vastly different work environments, career trajectories, and compensation structures.

- Public Accounting Firms (e.g., The "Big Four"):

- The Big Four (Deloitte, PwC, EY, KPMG): These firms are known for paying top-tier salaries, especially at the entry and senior levels, to attract the best talent from universities. They offer structured training, prestigious clients (Fortune 500), and the fastest path to a high salary. The trade-off is often a demanding work-life balance, particularly during busy season. A Senior Auditor at a Big Four firm in a major market is on the higher end of the national salary range.

- Mid-Tier and Regional Firms (e.g., Grant Thornton, BDO, RSM): These firms are also highly respected and offer competitive compensation, sometimes only slightly below the Big Four. They may offer a better work-life balance and more opportunities for specialization in mid-market clients.

- Corporate / Industry (Internal Audit):

- Fortune 500 Companies: Large, publicly-traded companies have sophisticated internal audit departments and pay salaries that are highly competitive with public accounting. The key difference is often better work-life balance, as the "busy season" is more predictable. A Senior Internal Auditor at a large tech or financial services company can be one of the highest-paid in the field.

- Startups and Small/Medium-Sized Businesses (SMBs): Salaries at smaller companies can vary wildly. A pre-IPO tech startup might offer a lower base salary but supplement it with potentially lucrative stock options. A smaller, privately-owned company may offer a lower salary but excellent stability.

- Government:

- Federal Agencies (e.g., GAO, FBI, IRS, DCAA): Government audit roles offer unparalleled job security, excellent benefits (pensions), and a strict 40-hour work week. The base salaries typically start lower than in public accounting but follow a clear and transparent pay scale (the GS scale). Over a full career, the total value of the benefits and work-life balance can be extremely attractive.

- State and Local Government: These roles offer similar benefits to federal positions but with salaries that vary significantly by state and municipality.

- Non-Profit Organizations: Auditors in the non-profit sector are driven by mission. Salaries are generally lower than in the for-profit world, reflecting the organizations' budget constraints.

###

Area of Specialization

Within the audit profession, specialization pays. Developing deep expertise in a high-demand niche can significantly increase your value and salary.

- IT Audit: As mentioned, this is arguably the hottest specialization. Every company relies on complex IT systems, and the risks of data breaches, system failures, and cyberattacks are immense. A Senior IT Auditor with a CISA who can audit ERP systems (SAP, Oracle), cloud environments (AWS, Azure), and cybersecurity controls is in extremely high demand and can command a premium of 15-25% over a generalist financial auditor.

- Financial Services Audit: Auditing banks, insurance companies, and investment funds is incredibly complex due to intricate regulations (e.g., Dodd-Frank) and exotic financial instruments. Auditors who specialize in this "FSO" (Financial Services Organization) group often earn more due to the steep learning curve and high-stakes nature of the work.

- Forensic Audit: Specializing in fraud detection and investigation puts you in a different league. These roles often involve litigation support and require a unique, investigative mindset. Senior Forensic Auditors with a CFE certification can earn salaries comparable to management consultants.

- ESG (Environmental, Social, and Governance) Audit: This is a rapidly emerging field. As investors and regulators demand more transparency about a company's environmental impact and social policies, the need for auditors who can provide assurance over this non-financial data is exploding. Those who get in on the ground floor of this specialization will be well-positioned for high salaries in the coming years.

###

In-Demand Skills

Finally, beyond your certifications and experience, a specific set of skills can make you a more effective—and thus more highly paid—Senior Auditor.

High-Value Technical Skills:

- Data Analytics & Visualization: Proficiency in tools like Alteryx, IDEA, or ACL to analyze entire populations of data (rather than just samples) is no longer a "nice-to-have," it's becoming a requirement. The ability to use visualization tools like Tableau or Power BI to present findings to management is also a huge plus.

- Advanced Excel: You need to be a wizard in Excel. This means mastery of PivotTables, VLOOKUP/XLOOKUP, index-match, and complex logical formulas.

- ERP Systems Knowledge: Deep experience with a major ERP system like SAP, Oracle NetSuite, or Microsoft Dynamics 365 is highly valuable, as you can navigate the system more efficiently and design more effective audit tests.

- U.S. GAAP / IFRS Expertise: A deep, technical understanding of complex accounting standards (e.g., ASC 606 for Revenue Recognition, ASC 842 for Leases) is fundamental.

Crucial Soft Skills:

- Project Management: A Senior Auditor is a project manager. The ability to manage timelines, budgets, and personnel is critical and a key differentiator for promotion to Manager.

- Leadership and Mentoring: You are responsible for the development of your staff. Managers will promote seniors who have demonstrated a talent for teaching and leading their teams effectively.

- Communication & Presence: You must be able to clearly and confidently explain complex technical issues to non-accountants, from the staff level to the C-suite. Strong writing and presentation skills are essential.

- Professional Skepticism: This is the core mindset of an auditor—a questioning mind and a critical assessment of audit evidence. It's an intangible skill that is highly valued.

By strategically developing these factors—pursuing the CPA, gaining experience in a high-paying location or specialization, and honing in-demand skills—you can actively steer your career toward the highest possible salary.

---

Job Outlook and Career Growth

A high salary is attractive, but job security and opportunities for advancement are what build a sustainable career. For Senior Auditors, the outlook is both stable and filled with potential.

### Job Growth Projections

The U.S. Bureau of Labor Statistics (BLS) provides the most authoritative forecast for the profession. In its 2022-2032 projections, the BLS estimates that employment for "Accountants and Auditors" will grow by 4 percent.