For individuals with an entrepreneurial spirit and a passion for helping others, a career as a State Farm agent presents a unique and compelling opportunity. It’s a path that blends sales, business management, and community leadership. But beyond the promise of being a "good neighbor," what is the realistic earning potential?

The truth is, there is no single answer. A State Farm agent's income is not a fixed salary but a direct reflection of their effort, business acumen, and the success of their agency. While entry-level earnings may be modest, established and successful agents can achieve six-figure incomes, with top performers earning significantly more. This article will break down the numbers, explore the key factors that influence your income, and provide a clear picture of what you can expect financially.

What Does a State Farm Agent Do?

Before diving into the salary figures, it's crucial to understand the role. A State Farm agent is more than just a salesperson; they are an independent contractor and a small business owner who represents State Farm exclusively.

Their primary responsibilities include:

- Prospecting and Sales: Actively seeking out new clients and selling a wide range of insurance products, including auto, home, life, health, and property insurance, as well as financial services.

- Client Consultation: Assessing clients' needs, explaining complex policies, and recommending appropriate coverage to protect their assets and families.

- Customer Service and Retention: Acting as the primary point of contact for their policyholders, handling claims, answering questions, and building long-term relationships to ensure client retention.

- Agency Management: Running a small business, which involves hiring and training a team, managing a budget, marketing the agency within the local community, and handling day-to-day operations.

As captive agents, they leverage the powerful branding and support of State Farm while building their own local business from the ground up.

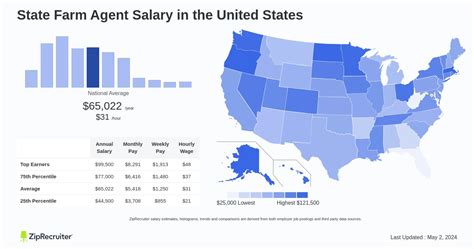

Average State Farm Agent Salary

Because State Farm agents are independent business owners whose income is primarily commission-based, defining an "average salary" can be complex. Your earnings are a combination of new business commissions, renewal commissions from existing policies, and potential bonuses from financial services.

To provide a comprehensive view, we can look at data from multiple authoritative sources:

- General Industry Benchmark: The U.S. Bureau of Labor Statistics (BLS) reports that the median annual wage for all "Insurance Sales Agents" was $57,860 in May 2023. The lowest 10 percent earned less than $31,520, while the top 10 percent earned more than $131,980. This figure serves as a good baseline for the industry as a whole.

- Company-Specific Data: Salary aggregators provide a more specific look at State Farm roles.

- Salary.com reports that the average salary for a State Farm Agent in the United States is approximately $48,771, with a typical range falling between $44,524 and $54,989. It is critical to note this likely reflects a base salary or the earnings of newer agents, not the total compensation of established business owners.

- Glassdoor indicates a higher potential, reporting an estimated total pay for a State Farm Agent at around $89,657 per year, combining an estimated base pay of $49,150 with an estimated additional pay (commissions, bonuses) of $40,507.

- Payscale shows a very wide range, from $32,000 to $162,000 in total pay, reinforcing the performance-based nature of the role.

The key takeaway is that initial earnings may align with the lower end of these ranges as you build your "book of business." Over time, as renewal commissions become a significant and stable portion of your income, your earning potential grows exponentially.

Key Factors That Influence Salary

Your income as a State Farm agent is not static. It's a dynamic figure influenced by several key variables. Understanding these factors is essential for maximizing your earning potential.

### Years of Experience

Experience is arguably the most significant driver of income. The career has a distinct earnings trajectory:

- New Agents (0-2 Years): During the initial training period (often called the Agent Aspirant program), you may receive a temporary base salary or financial support. Your primary focus is on learning the business and generating new policies. Income is typically at its lowest during this phase.

- Established Agents (3-10 Years): By this point, you have a solid book of business. The renewal commissions from policies sold in previous years create a stable income floor. You continue to add new clients, and your earnings see substantial growth.

- Veteran Agents (10+ Years): These agents often have a very large and mature book of business, generating significant and reliable renewal income. Many become top performers in their regions, earning well into the six figures by focusing on high-value products and excellent client retention.

### Area of Specialization

While most agents start by selling auto and home insurance, the most successful ones diversify. The type of products you sell has a direct impact on your commissions.

- Property & Casualty (Auto/Home): These are high-volume, foundational products that build your client base.

- Life & Health Insurance: These policies often carry much higher commission rates than auto or home insurance. Agents who are skilled at selling life and disability insurance can dramatically increase their income.

- Financial Services: Licensed agents who can offer financial products like mutual funds and retirement planning can tap into an entirely new and lucrative revenue stream, earning commissions and fees on assets under management.

### Geographic Location

Where you establish your agency matters. According to the BLS, the top-paying states for insurance agents include the District of Columbia, Massachusetts, New York, and California. This is often due to a combination of factors:

- Higher Premiums: A higher cost of living generally translates to higher insurance premiums, which in turn means higher commission dollars per policy.

- Population Density: Urban and dense suburban areas offer a larger pool of potential clients for home, auto, and business insurance.

- Economic Activity: Thriving local economies mean more new businesses, new car sales, and home purchases—all of which are opportunities for an agent.

### Agency Model (Company Type)

As a State Farm agent, you operate as an independent contractor, not a corporate employee. This business model is the defining factor of your salary structure. Unlike a salaried employee at an insurance carrier's headquarters, your gross income is tied directly to your agency's sales performance. However, you are also responsible for all business expenses, including office rent, utilities, marketing costs, and staff salaries. A well-managed agency minimizes overhead and maximizes net profit for the agent owner.

### Level of Education

While a bachelor's degree is not a strict requirement to become an insurance agent, it is highly recommended and can provide a significant advantage. A degree in business, finance, marketing, or communications equips you with the foundational knowledge needed to run a business, manage finances, and effectively communicate with clients.

The non-negotiable educational requirement is state licensing. You must pass state-mandated exams to be licensed to sell specific types of insurance (e.g., Property & Casualty, Life & Health). Acquiring multiple licenses broadens your product portfolio and, therefore, your earning potential.

Job Outlook

The future for insurance professionals is bright. The U.S. Bureau of Labor Statistics projects that employment for insurance sales agents will grow 8% from 2022 to 2032, which is much faster than the average for all occupations.

Despite the rise of online insurance platforms, the demand for knowledgeable and trustworthy agents remains strong. Many consumers still prefer a personal advisor to help them navigate complex life events like buying a home, planning for retirement, or protecting their family's financial future. An agent provides a level of service and expertise that an algorithm cannot replicate.

Conclusion

A career as a State Farm agent offers a path of immense professional and financial growth for the right individual. While the initial years require dedication and hard work to build a client base, the long-term rewards are substantial.

Here are the key takeaways:

- Your Income is Performance-Based: Your salary is a direct result of your ability to sell policies and manage your agency effectively.

- Experience is Key: Earning potential grows significantly over time as stable renewal commissions build upon new business sales.

- Diversification Drives Profit: Top earners are those who master cross-selling and become licensed to offer a full suite of products, especially high-value life insurance and financial services.

- You Are a Business Owner: Success depends just as much on your business management skills as your sales ability.

For those who are self-motivated, community-oriented, and ready to take control of their financial destiny, becoming a State Farm agent is a challenging but exceptionally rewarding career choice.