Ever stared at your payslip, a mix of pride and confusion, wondering where a significant chunk of your hard-earned money went? You see the gross pay, a figure that sparks joy, followed by a list of deductions—federal taxes, state taxes, Social Security, Medicare, 401(k), health insurance—that leads to a much smaller net pay. This net figure, your take-home pay, is the reality of your financial life. While millions of Marylanders use a take home salary calculator Maryland to get a quick estimate, a select group of highly skilled professionals are the ones who master the complex systems behind that calculator. They are the architects of payroll, the guardians of compensation, and the strategists who ensure every dollar is accounted for, compliant, and correctly delivered.

This guide is not just about a simple online tool; it's about the rewarding and stable career path for those who operate behind the scenes. We're diving deep into the world of Payroll, Compensation, and Benefits professionals in Maryland—the human experts who make sense of the numbers. The average salary for these roles is highly competitive, ranging from $65,000 for experienced specialists to well over $150,000 for senior managers and analysts, according to data from Salary.com and the U.S. Bureau of Labor Statistics. When I landed my first corporate job, my initial paycheck was a shock. The difference between what I was told I'd "make" and what actually hit my bank account was a lesson in financial reality, sparking a deep respect for the meticulous work of the payroll department. This article is for anyone who, like me, is fascinated by the numbers and is considering a career dedicated to mastering them.

If you are a detail-oriented problem-solver with a knack for numbers and a desire for a stable, in-demand career in the heart of Maryland's thriving economy, this comprehensive guide is your first step.

### Table of Contents

- [What Does a Payroll and Compensation Professional in Maryland Do?](#what-does-a-payroll-and-compensation-professional-in-maryland-do)

- [Average Salary for Payroll and Compensation Professionals: A Deep Dive](#average-salary-for-payroll-and-compensation-professionals-a-deep-dive)

- [Key Factors That Influence Your Salary in Maryland](#key-factors-that-influence-your-salary-in-maryland)

- [Job Outlook and Career Growth in Maryland](#job-outlook-and-career-growth-in-maryland)

- [How to Get Started in a Payroll and Compensation Career](#how-to-get-started-in-a-payroll-and-compensation-career)

- [Conclusion: Is This Maryland Career Path Right for You?](#conclusion-is-this-maryland-career-path-right-for-you)

What Does a Payroll and Compensation Professional in Maryland Do?

At its core, a career in payroll and compensation is about ensuring one of the most critical business functions runs flawlessly: paying employees accurately and on time. These professionals are the indispensable backbone of an organization's financial and human resources operations. They are the human intelligence that powers any reliable take home salary calculator Maryland, translating complex legal and company policies into a simple, final number on a paycheck.

Their responsibilities are far more strategic and multifaceted than simply cutting checks. They are guardians of compliance, data analysts, and employee-facing problem-solvers. Their work ensures the company avoids costly penalties from the IRS and the Comptroller of Maryland, while also maintaining employee trust and morale. A single payroll error can cause significant distress for an employee and create a ripple effect of administrative headaches.

Core Responsibilities and Daily Tasks:

- Payroll Processing: This is the foundational duty. It involves collecting and verifying timekeeping data, calculating wages, and processing payments via direct deposit or check. They manage the regular payroll cycle, whether it's weekly, bi-weekly, or semi-monthly.

- Tax Compliance: This is where expertise becomes critical, especially in a state like Maryland. Professionals must calculate, withhold, and remit federal, state, and Social Security/Medicare (FICA) taxes. Crucially, they must also manage Maryland's unique system of county-level income taxes, which vary from 2.25% in Frederick County to 3.20% in counties like Baltimore City, Montgomery, and Prince George's. This complexity makes Maryland-specific knowledge highly valuable.

- Deductions and Garnishments: They administer all pre-tax and post-tax deductions. This includes 401(k) or 403(b) contributions, health, dental, and vision insurance premiums, flexible spending accounts (FSAs), and health savings accounts (HSAs). They also handle legally mandated wage garnishments for things like child support or tax levies.

- Reporting and Reconciliation: After each payroll run, they create detailed reports for the accounting department. They reconcile payroll data with general ledger accounts and resolve any discrepancies. They also prepare and file quarterly (Form 941) and annual (Form 940, W-2s) tax reports.

- Compensation and Benefits Analysis: More senior roles move beyond processing to strategy. A Compensation Analyst researches and analyzes salary data to ensure the company's pay scales are competitive within the industry and the Maryland job market. They help design bonus structures, commission plans, and salary bands for different roles.

- System Management: Modern payroll is managed through sophisticated Human Resource Information Systems (HRIS) like ADP, Paychex, Workday, or UKG. Professionals must be experts in configuring and maintaining these systems, ensuring all tax rates and company policies are up-to-date.

- Employee Support: They are the primary point of contact for employees with questions about their pay, deductions, tax withholdings (W-4 forms), or paid time off (PTO) balances. This requires strong communication and problem-solving skills.

### A Day in the Life of a Maryland Payroll Manager

To make this tangible, let's imagine a "Day in the Life" of a Payroll Manager at a mid-sized biotech firm in Montgomery County, Maryland, the week payroll is due.

- 8:30 AM: Arrives and immediately logs into the HRIS (Workday). The first task is to review a system-generated report flagging timecard exceptions from the previous day—missed punches, unapproved overtime, etc. They spend an hour coordinating with department managers to get these resolved before the final processing cutoff.

- 9:30 AM: Receives an urgent email from HR. A new hire's signing bonus needs to be processed on this payroll. The manager calculates the gross-up amount to ensure the employee receives the full promised bonus after taxes, a calculation far more complex than a standard take home salary calculator Maryland can handle.

- 10:30 AM: Runs a preliminary payroll register for all 350 employees. They begin the meticulous audit process, spot-checking a dozen employee records to verify correct salary rates, overtime calculations, and benefit deductions. They notice an employee's local tax is still set to the Frederick County rate, but their address was updated to Baltimore City last month. They correct it, preventing a year-end tax headache for the employee.

- 12:00 PM: Lunch break, spent reading a newsletter from the American Payroll Association about upcoming changes to federal per diem rates, which will affect their traveling sales team.

- 1:00 PM: Joins a video call with the HR Director and a benefits broker. They are discussing the open enrollment period for next year's health insurance. The Payroll Manager provides critical data on current employee contribution costs and models the payroll impact of a proposed 8% increase in premiums.

- 2:30 PM: The audit is complete. They run a final series of reports and send the total payroll funding request, including tax liabilities and 401(k) contributions, to the finance department for approval.

- 3:30 PM: While waiting for funding approval, they field calls from two employees. One is asking how to change their W-4 withholdings online. The other is disputing their PTO balance. The manager patiently walks both through the process, resolving their issues.

- 4:30 PM: Finance confirms the funding. With a final, careful review, the manager hits the "Submit" button. Payroll for 350 employees is transmitted to the bank. A wave of relief and satisfaction washes over them.

- 5:00 PM: Before logging off, they prepare for the post-payroll tasks: generating reports for accounting, scheduling the 401(k) contribution transfer, and making a note to update the company's internal guide on understanding a payslip.

This day illustrates that the role is a dynamic blend of technical precision, analytical thinking, strategic input, and human interaction.

Average Salary for Payroll and Compensation Professionals: A Deep Dive

Compensation is naturally a top consideration for anyone exploring a new career. For professionals who specialize in this very subject, the earning potential is strong, stable, and well-defined. The salary for a payroll or compensation expert in Maryland reflects the high level of responsibility, the demand for precision, and the specialized knowledge required to navigate complex tax laws.

It's important to differentiate between roles. A "Payroll Clerk" or "Specialist" is often focused on the processing and administrative side, while a "Compensation Analyst" or "Payroll Manager" takes on more strategic, analytical, and leadership responsibilities. This distinction is the primary driver of salary ranges. All data presented is based on recent information from authoritative sources to provide a realistic picture of earning potential.

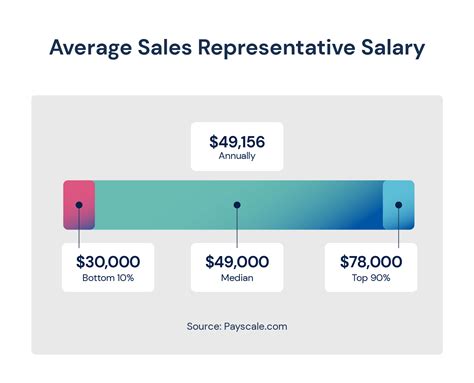

### National Salary Averages

Before zoning in on Maryland, it's helpful to understand the national landscape.

- Payroll and Timekeeping Clerks: According to the U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook, the median annual wage for payroll and timekeeping clerks was $49,650 in May 2023. The lowest 10 percent earned less than $37,130, and the highest 10 percent earned more than $71,460. This typically represents entry-level to mid-level processing roles.

- Compensation, Benefits, and Job Analysis Specialists: This category, which includes Compensation Analysts, is more strategic. The BLS reports a much higher median annual wage of $74,540 in May 2023. The lowest 10 percent earned less than $49,150, and the highest 10 percent earned more than $124,190.

- Payroll Managers: This senior-level role commands a higher salary. According to Salary.com, a highly reputable aggregator, the median salary for a Payroll Manager in the United States as of May 2024 is $124,302. The typical range falls between $109,885 and $141,135, but can be significantly higher based on the factors we'll discuss later.

### Maryland-Specific Salary: The Local Advantage

Maryland's strong economy, high cost of living (especially in the Baltimore-Washington corridor), and large number of federal government, defense contracting, and biotech employers contribute to salaries that often exceed national averages. The complexity of its state and local tax system also places a premium on qualified professionals.

Here is a breakdown of typical salary brackets you can expect in Maryland, synthesized from data from Salary.com, Glassdoor, and Payscale as of late 2023 and 2024.

| Experience Level | Job Title Examples | Typical Maryland Salary Range | Notes |

| :--- | :--- | :--- | :--- |

| Entry-Level (0-2 years) | Payroll Clerk, Payroll Coordinator, Junior HR/Payroll Admin | $48,000 - $62,000 | Focus on data entry, verification, and answering basic employee queries. Often requires an Associate's or Bachelor's degree. |

| Mid-Career (3-7 years) | Payroll Specialist, Senior Payroll Specialist, Compensation Analyst | $65,000 - $85,000 | Handles full-cycle payroll, tax reporting, reconciliations, and system maintenance. May have FPC or CPP certification. |

| Senior/Experienced (8-15 years) | Payroll Manager, Senior Compensation Analyst, HRIS Payroll Lead | $85,000 - $125,000 | Manages a payroll team, oversees compliance, implements new systems, and contributes to compensation strategy. CPP certification is highly common. |

| Executive/Director Level (15+ years) | Director of Payroll, Director of Total Rewards, Senior Payroll Manager | $120,000 - $175,000+ | Sets strategic direction for the entire payroll and compensation function for a large organization. Manages multi-state/global payroll. |

*(Sources: Salary.com, Glassdoor.com, Payscale.com, U.S. BLS Occupational Employment and Wage Statistics. Data accessed May 2024.)*

As these figures show, a career that begins with understanding the inputs of a take home salary calculator Maryland can evolve into a six-figure leadership position with significant strategic influence.

### Beyond the Base Salary: Understanding Total Compensation

A savvy compensation professional knows that base salary is only one piece of the puzzle. Total compensation is a more accurate measure of financial reward and includes several other components:

- Annual Bonuses: Performance-based bonuses are common, especially in manager and analyst roles. These can range from 5% to 20% of the base salary, tied to individual performance, department goals (like payroll accuracy rates), and overall company profitability.

- Profit Sharing: Some companies, particularly in the private sector, offer profit-sharing plans where a portion of the company's profits is distributed among employees.

- Stock Options/RSUs: In publicly traded companies or well-funded startups, stock options or Restricted Stock Units (RSUs) can be a significant part of the compensation package for senior-level professionals, aligning their success with the company's long-term growth.

- Retirement Contributions: A strong employer 401(k) or 403(b) match is essentially extra salary. A company that matches 100% of your contributions up to 6% of your salary is giving you a significant financial boost.

- Health and Wellness Benefits: The value of a comprehensive, low-cost health, dental, and vision insurance plan cannot be overstated. Other benefits like wellness stipends, gym memberships, and generous paid time off (PTO) policies also contribute to the overall value of a job offer.

- Professional Development: Many employers will pay for the cost of obtaining and maintaining critical certifications like the CPP, as well as for attending industry conferences and workshops. This investment in your skills is a valuable form of compensation.

When evaluating an opportunity in this field, it's crucial to look beyond the base salary and consider the complete compensation and benefits package.

Key Factors That Influence Your Salary in Maryland

While the averages provide a solid baseline, your individual earning potential is determined by a combination of specific, interconnected factors. For aspiring and current payroll and compensation professionals in Maryland, understanding these levers is key to maximizing your career and financial growth. This is the most critical section for planning your career trajectory.

### `

`1. Level of Education`

`Your formal education provides the foundation for your career and directly impacts your starting salary and long-term potential.

- High School Diploma or Associate's Degree: It is possible to enter the field in a Payroll Clerk or Coordinator role with a high school diploma and some relevant experience, or an Associate's degree in Accounting or Business. However, upward mobility may be limited without further education. The starting salary will typically be on the lower end of the entry-level spectrum, around $45,000 - $52,000.

- Bachelor's Degree: A Bachelor's degree is the standard requirement for most Payroll Specialist, Analyst, and Manager roles. The most relevant majors are Accounting, Finance, Business Administration, and Human Resources. A degree in one of these fields signals to employers that you have a strong grasp of business principles, financial controls, and regulatory concepts. Graduates can expect to start in the $55,000 - $65,000 range and have a clear path to advancement.

- Master's Degree (MBA, M.S. in HR/Accounting): While not required for most payroll roles, a master's degree can be a significant differentiator for senior leadership positions like Director of Total Rewards or VP of HR. An MBA with a finance concentration or a Master of Science in Human Resource Management provides the strategic, analytical, and leadership skills necessary for these top-tier roles, pushing salaries well into the $150,000+ range.

The Power of Certifications:

In the world of payroll, professional certifications are often valued as much, if not more, than advanced degrees. They are a direct testament to your specific expertise. The primary certifying body is the American Payroll Association (APA).

- Fundamental Payroll Certification (FPC): This is the entry-level certification, ideal for those new to the field. It demonstrates a baseline knowledge of payroll processing, calculations, and compliance. Holding an FPC can help a candidate stand out for a specialist role and may add a $3,000 - $5,000 premium to their salary.

- Certified Payroll Professional (CPP): This is the gold standard. The CPP is a rigorous exam covering advanced topics like taxation, benefits, payroll accounting, management, and global payroll. It is highly sought after for Payroll Manager and senior analyst roles. According to the APA, professionals holding a CPP earn, on average, 10-20% more than their non-certified peers. In Maryland, a Payroll Manager with a CPP can easily command a salary north of $100,000.

### `

`2. Years of Experience`

`Experience is perhaps the single most significant factor in salary growth. The field rewards a proven track record of accuracy, problem-solving, and increasing responsibility.

- 0-2 Years (Entry-Level): At this stage, you are learning the ropes. Your focus is on mastering the fundamentals: accurate data entry, understanding the payroll cycle, and learning the company's specific HRIS. Salary: $48,000 - $62,000.

- 3-7 Years (Mid-Career): You are now a proficient, independent professional. You can manage the entire payroll cycle for a small-to-medium-sized company, handle tax filings, and troubleshoot complex issues. You may be training junior staff. This is the stage where you might specialize and pursue your CPP. Salary: $65,000 - $85,000.

- 8-15 Years (Senior Level): You have moved into a management or senior analytical role. You're not just processing payroll; you're managing the team, optimizing the process, implementing new systems, and providing strategic input on compensation design. Your experience navigating complex issues like mergers and acquisitions, multi-state tax nexus, or executive compensation plans is highly valuable. Salary: $85,000 - $125,000.

- 15+ Years (Executive Level): You are a strategic leader, overseeing the entire compensation and payroll function, often on a national or global scale. You are a key advisor to the C-suite on all matters related to total rewards. Your deep expertise in compliance, systems, and strategy is what protects the company and attracts top talent. Salary: $120,000 - $175,000+.

### `

`3. Geographic Location within Maryland`

`"Location, location, location" applies as much to salaries as it does to real estate. In Maryland, there is a distinct salary divide between the high-cost-of-living counties in the Baltimore-Washington D.C. metropolitan area and the more rural parts of the state.

- High-Paying Areas: The highest salaries are concentrated in the counties bordering Washington D.C. and in the affluent suburbs of Baltimore.

- Montgomery County (Bethesda, Rockville, Gaithersburg): Home to a massive biotech corridor and numerous federal agencies and contractors, this is arguably the highest-paying region in the state. Salaries here can be 10-15% above the state average.

- Howard County (Columbia): A hub for technology and professional services with a highly educated workforce, commanding salaries comparable to Montgomery County.

- Anne Arundel County (Annapolis, Fort Meade): A mix of state government, the U.S. Naval Academy, and a massive cybersecurity and defense contracting industry centered around Fort Meade creates high demand and high salaries.

- Baltimore City & County (Baltimore, Towson): Home to major healthcare systems like Johns Hopkins and the University of Maryland Medical System, as well as financial and professional services firms. Salaries are strong and well above the national average.

- Mid-Range Areas: Counties like Frederick, Carroll, and Harford have growing economies but a slightly lower cost of living. Salaries here are competitive but may be 5-10% lower than in the D.C. suburbs.

- Lower-Paying Areas: The more rural areas of the Eastern Shore (e.g., Wicomico, Talbot counties) and Western Maryland (e.g., Allegany, Garrett counties) have a much lower cost of living and economies based more on agriculture, tourism, and small businesses. Salaries here will be closer to the national average and may be 15-25% lower than in Montgomery County.

An experienced Payroll Manager might earn $115,000 in Bethesda but closer to $90,000 for a similar scope of work in Salisbury.

### `

`4. Company Type & Size`

`The type and size of your employer have a profound impact on both your salary and the nature of your work.

- Large Corporations (5,000+ employees): Companies like Lockheed Martin, Marriott International, or T. Rowe Price have massive, complex payroll operations, often spanning multiple states or even countries. Roles here are often highly specialized (e.g., "Payroll Tax Specialist" or "International Payroll Analyst"). They offer the highest salaries, excellent benefits, and cutting-edge HRIS systems, but the work can be more siloed. A Senior Payroll Manager at a large Maryland-based corporation could earn $130,000+.

- Mid-Sized Companies (250-5,000 employees): This is often a sweet spot. Think of regional banks, successful biotech firms, or manufacturing companies. The pay is very competitive, and professionals often have broader responsibilities, gaining experience across payroll, benefits, and HRIS management. A Payroll Manager here might make $95,000 - $120,000.

- Startups and Small Businesses (<250 employees): These environments offer the broadest experience. The "payroll person" might also handle HR, benefits administration, and bookkeeping. The work is dynamic and impactful. Base salaries may be lower ($60,000 - $85,000 for a manager role), but this can be offset by equity or stock options, which carry high potential reward if the company succeeds.

- Government (Federal, State, Local): Maryland is home to countless government agencies. These jobs are known for their exceptional job security, robust benefits (pensions are common), and a strong work-life balance. While the base salaries may not always reach the absolute peaks of the private sector, the total compensation package is often superior. A state government Payroll Supervisor might earn $80,000 - $100,000 but with unparalleled benefits.

- Non-Profits and Healthcare/Education: Organizations like Johns Hopkins University or large hospital systems are major Maryland employers. Their compensation structure is often very formal and data-driven. Salaries are competitive and stable, falling somewhere between government and for-profit corporate roles. The mission-driven aspect of the work is also a major draw for many professionals.

### `

`5. Area of Specialization`

`As you advance in your career, you can develop specialized expertise that makes you a more valuable—and higher-paid—asset.

- HRIS/Systems Specialization: Becoming the go-to expert on a complex platform like Workday, SAP SuccessFactors, or UKG is a lucrative niche. An "HRIS Payroll Analyst" who can implement modules, write custom reports, and ensure data integrity can command a premium salary.

- Tax and Compliance Specialization: For large, multi-state employers, a "Payroll Tax Specialist" is a critical role. This professional is an expert on nexus issues, local tax law variations (a key skill for Maryland!), and reporting requirements. Their expertise saves the company from massive fines.

- Global/Expat Payroll: For Maryland-based international companies, managing payroll for employees in other countries or for expatriates working in the U.S. is incredibly complex. It involves understanding tax treaties, visa implications, and different currency and banking systems. This is a rare and highly compensated specialty.

- Compensation Analysis: Moving from payroll processing to pure compensation analysis is a common and profitable career path. These analysts use market data to design competitive salary structures, incentive plans, and executive compensation packages. Senior Compensation Analysts in Maryland can earn $90,000 - $130,000.

### `

`6. In-Demand Skills`

`Beyond degrees and titles, specific, demonstrable skills can directly increase your paycheck. Cultivating these will make you a top candidate.

- Advanced Excel Proficiency: This is non-negotiable. You must be a master of VLOOKUPs, pivot tables, and complex formulas to audit and analyze payroll data effectively.

- HRIS/Payroll Software Expertise: Proficiency in specific, widely used platforms (ADP Workforce Now, Paylocity, UKG Pro, Workday) is often listed as a hard requirement in job descriptions. Experience with a system implementation is a huge plus.

- Data Analysis and Reporting: The ability to not just process data, but to analyze it for trends, create insightful dashboards, and present findings to leadership is what separates a processor from a strategist. Skills in SQL or business intelligence tools like Tableau can add significant value.

- Knowledge of State and Local Tax Law: As repeatedly mentioned, deep knowledge of Maryland's county-level tax system is a key differentiator. The ability to correctly configure an HRIS to handle this complexity is a highly valued skill. Being able to explain this to an employee is just as important. Your expertise is what makes a generic online tool a truly accurate take home salary calculator Maryland for your company's employees.

- Communication and Customer Service: You are dealing with people's livelihoods. The ability to explain a complex deduction clearly and empathetically, and to resolve issues patiently and professionally, is a soft skill that has a hard impact on your success and reputation.

By strategically developing these six areas, you can take control of your career path and progress from a competent processor to a highly compensated, strategic leader in the field.