Considering a career as a bank teller is a fantastic way to enter the financial services industry. It’s a role that places you at the very heart of a bank's daily operations, offering invaluable experience in customer service, financial transactions, and regulatory compliance. For those looking at major national institutions, a teller position at PNC Bank is a popular and solid choice.

But what can you expect to earn? A teller role at PNC offers a competitive wage that serves as a strong foundation for a banking career. In 2024, a PNC Bank Teller can typically expect to earn an annual salary ranging from $35,000 to $47,000, with an hourly wage generally falling between $17 and $23 per hour.

This article will break down everything you need to know about a PNC teller's salary, the factors that influence it, and the future career outlook for this essential role.

What Does a PNC Bank Teller Do?

A PNC Bank Teller, often referred to by titles like "Financial Services Consultant," is the face of the bank for most customers. Their role has evolved beyond simple cash handling and is now a dynamic blend of customer service, problem-solving, and sales.

Key responsibilities include:

- Processing Transactions: Accurately handling routine customer transactions like deposits, withdrawals, loan payments, and check cashing.

- Customer Service: Answering inquiries, resolving account issues, and providing a positive and professional banking experience.

- Product Knowledge: Educating customers on PNC's products and services, such as checking and savings accounts, credit cards, and digital banking tools.

- Identifying Needs: Recognizing customer needs and referring them to other specialists within the bank, such as personal bankers, mortgage loan officers, or financial advisors.

- Compliance: Adhering to all banking regulations, security procedures, and company policies to protect both the customer and the institution.

Average PNC Bank Teller Salary

When analyzing compensation, it's helpful to look at data from multiple reputable sources to get a well-rounded picture.

According to recent data from Salary.com, the average salary for a Bank Teller at PNC is approximately $38,000 per year, with a typical range falling between $34,100 and $42,600. This translates to an average hourly rate of around $18.27 per hour.

Data from Glassdoor, which is based on anonymously submitted employee salaries, shows a similar trend. For the role of "Financial Services Consultant" (a common title for modern tellers at PNC), the estimated total pay is around $41,000 per year, with a likely range between $35,000 and $47,000 annually.

For a broader industry context, the U.S. Bureau of Labor Statistics (BLS) reported that the median annual wage for all tellers in May 2022 was $36,310 per year, or $17.46 per hour. This indicates that PNC's compensation is competitive and often slightly above the national median for the role.

Key Factors That Influence Salary

Your exact salary as a PNC teller isn't a single fixed number; it's influenced by a combination of personal qualifications, market forces, and specific job duties.

###

Level of Education

For an entry-level teller position, the standard educational requirement is a high school diploma or its equivalent. While a bachelor’s degree in a field like finance, business, or communications is a significant asset, it typically does not result in a dramatically higher *starting* salary for a teller role. However, holding a degree is a powerful accelerator for career advancement into higher-paying positions such as Lead Teller, Assistant Branch Manager, or Personal Banker.

###

Years of Experience

Experience is one of the most direct influencers of a teller's salary. As you gain expertise in handling complex transactions, building customer relationships, and understanding banking products, your value to the organization increases.

- Entry-Level (0-2 years): Tellers in this bracket can expect to earn at the lower end of the salary range, typically between $17 and $19 per hour.

- Mid-Career (2-5 years): With a few years of experience, tellers become more efficient and knowledgeable, often moving toward the median salary for the role, around $19 to $21 per hour.

- Experienced/Senior (5+ years): Veteran tellers, especially those who take on training or leadership responsibilities as a "Lead Teller" or "Senior Teller," can command salaries at the top end of the range, often exceeding $22 per hour.

###

Geographic Location

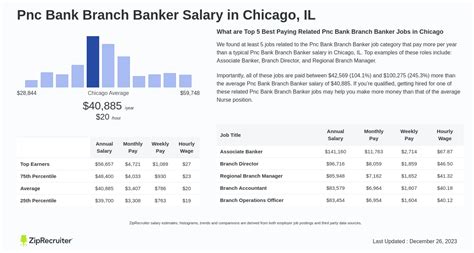

Where you work matters significantly. PNC, like all major corporations, adjusts its pay scales to reflect the local cost of living and market-rate wages. A teller working in a major metropolitan area with a high cost of living will invariably earn more than a teller in a rural community. For example, a PNC teller in Pittsburgh, PA (where PNC is headquartered) might earn near the national average, while a teller in a high-cost market like Washington, D.C., or Chicago, IL, could see their hourly wage be several dollars higher to remain competitive.

###

Company Type

While this article focuses on PNC, it's useful to understand how it fits into the broader landscape. Large, national banks like PNC generally have more structured compensation plans and often offer more robust benefits packages (health insurance, retirement plans, paid time off) than smaller local banks or credit unions. This comprehensive benefits package is a crucial part of the total compensation to consider.

###

Area of Specialization

The modern bank branch is creating hybrid roles that blend traditional teller duties with more advanced responsibilities. This is a direct path to higher earnings. Tellers who advance to a "Universal Banker" or "Financial Specialist" role are trained to handle more than just basic transactions. They may open new accounts, process loan applications, and have specific sales goals. These specialized roles come with higher base pay and, in some cases, opportunities for bonuses or commissions based on performance.

Job Outlook

According to the U.S. Bureau of Labor Statistics (BLS), overall employment for tellers is projected to decline by 12 percent from 2022 to 2032. This decline is largely attributed to the rise of online and mobile banking, which has reduced the need for in-person transactions.

However, this statistic doesn't tell the whole story. While the *number* of traditional teller roles may decrease, the importance of the role is evolving. Banks like PNC are rebranding their branches as "solution centers," where tellers act as financial consultants who build relationships and solve complex problems that automated systems cannot. The focus is shifting from transaction processing to customer engagement and financial guidance.

Furthermore, the role has a relatively high turnover rate, meaning that thousands of job openings will still arise each year from the need to replace workers who transfer to other occupations or exit the labor force.

Conclusion

A teller position at PNC Bank is an excellent entry point into the financial services world, offering a competitive salary and a clear path for professional growth.

Key Takeaways:

- Competitive Pay: Expect an average salary between $35,000 and $47,000 per year, which is competitive with the national average.

- Key Influencers: Your earnings will be shaped by your experience level, geographic location, and any specialized skills you acquire.

- Career Advancement is Key: While the starting pay is solid, the real financial opportunity lies in leveraging the role to advance into higher-paying positions within the bank.

- An Evolving Role: The future of the teller is not in processing transactions but in becoming a trusted financial resource for customers, a skill set that will remain in high demand.

For anyone seeking a stable and rewarding career with opportunities for advancement, starting as a teller at a respected institution like PNC is a strategic and promising first step.