Reaching the level of Managing Director (MD) at a prestigious investment bank like Goldman Sachs is often considered the pinnacle of a career in finance. It represents decades of dedication, sharp intellect, and an unparalleled drive to succeed. With this level of seniority comes significant responsibility and, as many rightly assume, extraordinary compensation. While the exact figures are kept private, a close look at industry data reveals that total annual compensation often exceeds $1 million, making it one of the most lucrative positions in the corporate world.

This article will break down the compensation structure for a Goldman Sachs MD, explore the key factors that dictate earnings, and provide a realistic view of what it takes to reach this coveted role.

What Does a Managing Director at Goldman Sachs Do?

A Managing Director is not just an employee; they are a senior leader responsible for driving revenue and shaping the firm's strategy. They are the primary relationship managers for the firm's most important clients, including CEOs, CFOs, and institutional investors. The role is a high-stakes blend of sales, strategy, and management.

Key responsibilities include:

- Deal Origination: Leveraging their extensive network and industry expertise to source and win new business, whether it's a multi-billion dollar merger, a landmark IPO, or a complex financing deal.

- Client Relationship Management: Acting as the trusted senior advisor to C-suite executives and major institutional clients.

- Team Leadership: Managing and mentoring large teams of Vice Presidents, Associates, and Analysts, holding ultimate responsibility for their group's performance.

- P&L Responsibility: Overseeing the profit and loss for their specific division or product group, directly impacting the firm's bottom line.

In essence, an MD's value is measured by the business they bring in. This performance-driven reality is directly reflected in their compensation.

Average Managing Director at Goldman Sachs Salary

When discussing compensation at this level, it is crucial to distinguish between base salary and total compensation. The base salary provides a stable, predictable income, but the majority of an MD's earnings come from their annual bonus.

- Base Salary: According to data from reputable sources like Glassdoor and Levels.fyi, the base salary for a Managing Director at Goldman Sachs typically falls within the range of $400,000 to $600,000 per year. Levels.fyi reports a median base salary closer to $500,000.

- Total Compensation (Base + Bonus + Stock): This is the figure that truly defines an MD's earnings. The annual bonus is highly variable and depends on three main factors: the overall performance of the firm, the performance of the MD's division, and the individual's contribution to revenue.

- In a typical year, total compensation packages for MDs often range from $900,000 to over $2 million.

- Data from Glassdoor suggests an average total pay around $1.1 million, while user-reported data on Levels.fyi shows packages frequently exceeding $1.5 million when combining base, stock, and bonus.

- In exceptionally strong market years, it is not uncommon for top-performing MDs in high-revenue divisions to earn multi-million dollar bonuses, pushing their total compensation well beyond this range.

*Source: Data synthesized from Glassdoor, Levels.fyi, and industry compensation reports as of 2023.*

Key Factors That Influence Salary

Compensation for a Goldman Sachs MD isn't a single, fixed number. It's a complex calculation influenced by several key factors.

###

Years of Experience

The path to Managing Director is a marathon, not a sprint. It is a title earned after a long and rigorous career progression, typically taking 12 to 15+ years of exceptional performance. The journey usually follows this ladder: Analyst > Associate > Vice President (VP) > Managing Director. Each step requires a proven track record of success. The immense experience, deep client relationships, and institutional knowledge built over this time are what command such a high salary.

###

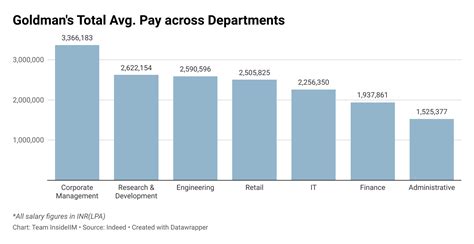

Area of Specialization

Not all divisions within an investment bank are created equal in terms of revenue generation. An MD's specialization has a direct impact on their bonus potential.

- High-Revenue Divisions: MDs in divisions like Mergers & Acquisitions (M&A), a top-performing industry group (like Technology or Healthcare), or lucrative trading desks often see the highest bonuses due to the large fees and profits their teams generate.

- Support & Operational Roles: MDs in functions like Compliance, Human Resources, or Operations, while still compensated extremely well, typically have a lower bonus ceiling compared to their client-facing, revenue-generating counterparts.

###

Geographic Location

Where an MD is based plays a significant role in their salary, primarily driven by the concentration of financial activity and cost of living.

- Top Tier Hubs: New York City and London are the epicenters of global finance and command the highest compensation packages.

- Other Major Hubs: Other key financial centers like Hong Kong, San Francisco (especially for technology-focused banking), and Tokyo also offer highly competitive salaries, though the exact compensation structure may vary due to local market practices and tax laws.

###

Level of Education

By the time a professional reaches the MD level, their on-the-job track record far outweighs their academic credentials. However, a top-tier education is often a critical factor in getting a foot in the door and accelerating one's early career. A significant percentage of senior leaders at Goldman Sachs hold undergraduate or MBA degrees from elite institutions like Harvard, Wharton, Stanford, and Columbia. An MBA is not a requirement, but it can help build the network and analytical foundation necessary for a fast-track career.

###

Company Type

While this article focuses on Goldman Sachs, it's helpful to understand where it sits in the financial landscape. Goldman Sachs is a "bulge bracket" investment bank, and its compensation structure is highly competitive with peers like J.P. Morgan and Morgan Stanley. Pay at these firms is generally comparable at the senior level. However, compensation can differ at other types of firms. For instance, MD-equivalent partners at "elite boutique" advisory firms (e.g., Evercore, Lazard) or partners at major private equity funds may see an even greater portion of their compensation tied to firm equity and deal performance, leading to potentially higher, albeit more volatile, earnings.

Job Outlook

The career path to Managing Director is, by design, exceptionally competitive. It is a pyramid structure with a wide base of analysts and very few spots at the top. Therefore, the "job outlook" for this specific role is more about individual career trajectory than general market growth.

However, the broader financial industry remains a robust and dynamic sector. The U.S. Bureau of Labor Statistics (BLS) projects that overall employment for financial managers will grow 16% from 2022 to 2032, which is much faster than the average for all occupations. This indicates a sustained demand for skilled financial expertise, which fuels the entire investment banking ecosystem. While the number of MD positions will always be limited, the underlying industry's health suggests that opportunities for rewarding careers in finance will continue to be plentiful.

*Source: U.S. Bureau of Labor Statistics, Occupational Outlook Handbook, Financial Managers.*

Conclusion

The role of a Managing Director at Goldman Sachs represents the apex of the investment banking profession. The compensation is a direct reflection of the immense value, revenue, and leadership these individuals bring to the firm.

Key Takeaways:

- Focus on Total Compensation: Base salaries are high, but the annual bonus is where true earning potential is realized, with total pay frequently exceeding $1 million.

- Performance is Everything: Earnings are directly tied to individual, divisional, and firm-wide performance, making bonuses highly variable.

- It's a Long-Term Goal: Reaching MD is the result of a 12-15+ year journey marked by relentless dedication and a proven ability to generate business.

- Specialization and Location Matter: Your area of expertise and physical location within the firm's global footprint will significantly influence your compensation.

For ambitious students and finance professionals, this career path remains a powerful motivator. It is a testament to the fact that for those with the intellect, stamina, and strategic vision to navigate the demanding world of finance, the rewards—both professional and financial—are unparalleled.