In the exclusive and intellectually demanding world of quantitative finance, few names command as much respect and intrigue as Two Sigma. For aspiring mathematicians, computer scientists, and financial engineers, securing a position at a firm like Two Sigma represents the pinnacle of a long and arduous academic and professional journey. It’s a world where complex algorithms meet colossal capital, and where groundbreaking research translates directly into market impact. But alongside the intellectual prestige lies a question of immense practical interest: What does a Two Sigma salary actually look like?

The compensation packages at elite quantitative hedge funds are the stuff of legend, often far exceeding those in even the most competitive sectors of traditional tech and finance. We're not just talking about a comfortable living; we're talking about compensation that can be genuinely life-altering, with total packages for experienced professionals frequently reaching seven figures. For instance, it's not uncommon for a new graduate with a Ph.D. to start with a total compensation package well over $400,000, while senior quantitative researchers can earn multiple millions per year depending on performance.

I recall a conversation with a former colleague who was interviewing for a quantitative researcher role at a top-tier firm. He described the process less as a job interview and more as a final exam for his entire academic career, with questions spanning probability theory, stochastic calculus, and distributed systems architecture. He said, "They're not just paying for what you know; they're paying for your ability to solve problems that don't have answers yet." This anecdote perfectly captures the essence of a firm like Two Sigma: they are not just hiring employees; they are investing in world-class problem solvers, and they compensate them accordingly.

This guide will demystify the numbers, break down the complex compensation structures, and provide a comprehensive roadmap for anyone aspiring to earn a Two Sigma salary. We will explore not just the figures themselves, but the factors that drive them, the career paths available, and what it truly takes to join this elite echelon of the financial world.

### Table of Contents

- [What is Two Sigma and What Do Its Employees Do?](#what-is-two-sigma-and-what-do-its-employees-do)

- [Two Sigma Salary: A Comprehensive Breakdown](#two-sigma-salary-a-comprehensive-breakdown)

- [Key Factors That Influence a Two Sigma Salary](#key-factors-that-influence-a-two-sigma-salary)

- [Career Trajectory and Long-Term Prospects at Two Sigma](#career-trajectory-and-long-term-prospects-at-two-sigma)

- [How to Land a Job at Two Sigma](#how-to-land-a-job-at-two-sigma)

- [Conclusion: Is the Pursuit Worth the Reward?](#conclusion-is-the-pursuit-worth-the-reward)

What is Two Sigma and What Do Its Employees Do?

Before we can dissect the salary, it's crucial to understand what Two Sigma is and the nature of the work performed there. Founded in 2001, Two Sigma is not a traditional investment bank or asset manager. It is a quantitative hedge fund, often described as a financial technology company, that uses sophisticated mathematical models and vast amounts of data to make investment decisions.

At its core, Two Sigma operates on the belief that a scientific, data-driven approach can uncover patterns and predict movements in global financial markets. The firm employs a community of scientists, engineers, and mathematicians who collaborate to solve some of the most challenging problems in finance. The culture is often compared to that of a top technology company or a university research department, emphasizing innovation, intellectual curiosity, and rigorous analysis.

The work is divided primarily among a few key roles, each with distinct responsibilities that contribute to the firm's overall trading strategy.

#### Core Roles and Responsibilities

1. Quantitative Researcher ("Quant"): This is perhaps the most iconic role at a hedge fund like Two Sigma. Quants are the scientists of the financial world. Their primary responsibility is to research and develop predictive models (often called "signals") that identify trading opportunities. This involves:

- Hypothesis Generation: Coming up with novel ideas about why markets might behave in a certain way. This could be based on anything from weather patterns affecting crop futures to analyzing the sentiment of news articles.

- Data Analysis: Sourcing, cleaning, and analyzing massive, often unstructured, datasets to find statistical evidence for their hypotheses.

- Model Development: Using techniques from statistics, machine learning, and econometrics to build mathematical models that forecast asset prices.

- Backtesting: Rigorously testing these models on historical data to ensure they would have been profitable and are robust enough to work in the future.

2. Software Engineer (SWE): The models developed by quants are useless without a powerful, reliable, and lightning-fast technological infrastructure to execute them. Software Engineers at Two Sigma build and maintain this entire ecosystem. Their projects are incredibly complex and can include:

- Trading Systems: Building the low-latency platforms that execute billions of dollars in trades across global markets in fractions of a second.

- Data Platforms: Creating systems to ingest, store, and process petabytes of data from thousands of sources in real-time.

- Research Platforms: Developing the tools and libraries that quants use to conduct their research, run simulations, and backtest models efficiently.

- Core Infrastructure: Managing the massive computing clusters, networking, and storage that underpin the entire firm's operations.

3. Data Scientist: While there is overlap with the Quant role, Data Scientists at Two Sigma often focus more specifically on the data itself. They are experts in finding, cleaning, and preparing novel datasets for use in models. They might be tasked with turning satellite imagery, shipping manifests, or social media trends into structured data that a quant can then use to build a predictive signal.

#### A "Day in the Life" of a Quantitative Researcher

To make this more concrete, let's imagine a day for a mid-level Quant at Two Sigma:

- 9:00 AM: Arrive and catch up on overnight market movements and the performance of their existing models. Check emails and messages on the internal collaboration platform.

- 9:30 AM: Attend a short team meeting to discuss ongoing research projects. A junior researcher presents findings from a backtest of a new alpha signal derived from options data. The team provides feedback on potential data snooping biases.

- 10:00 AM: Deep work session. The Quant spends the next few hours coding in Python, using Two Sigma’s proprietary libraries to analyze a new, alternative dataset—perhaps credit card transaction data. They're looking for correlations that could predict consumer retail stock performance.

- 12:30 PM: Lunch. Often, this is a catered meal where they might sit with software engineers and discuss a new feature they need for the research platform. These informal conversations often spark new ideas.

- 1:30 PM: Peer review session. They review a research paper written by another quant, providing critical feedback on the statistical methodology and the robustness of their findings before the model is considered for production.

- 3:00 PM: Meet with a data engineering team to discuss the pipeline for a new dataset. They need to ensure the data is being cleaned and normalized correctly to avoid introducing errors into their models.

- 4:00 PM: Return to their research, refining their code and running simulations on the firm's massive compute grid. The initial results look promising, but more analysis is needed to rule out spurious correlations.

- 6:00 PM: Wrap up for the day, jotting down ideas and next steps for tomorrow's work. They might head to the office gym or a company-sponsored tech talk before heading home.

This "day in the life" highlights the blend of solitary research, collaborative feedback, and cross-functional problem-solving that defines the work at Two Sigma. It is an environment built for those who love to tackle intellectually stimulating challenges.

Two Sigma Salary: A Comprehensive Breakdown

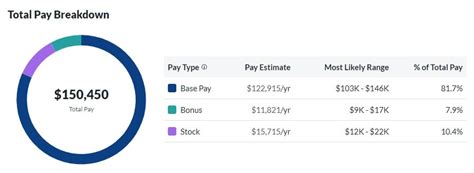

Now we arrive at the central question. Compensation at Two Sigma, like other elite quantitative firms (Jane Street, Citadel Securities, Renaissance Technologies), is structured to attract and retain the absolute best talent in the world. It's crucial to understand that salary is discussed in terms of Total Compensation (TC), which is a combination of three main components:

1. Base Salary: The fixed, annual salary you receive in regular paychecks. This provides a stable and predictable income stream.

2. Annual Bonus: This is a highly variable, performance-based cash payment awarded at the end of the year. For successful employees, the bonus can be a significant multiple of the base salary (e.g., 50% to 200%+). It is tied to both individual and firm performance.

3. Sign-on Bonus / Stock: New hires, especially those coming from competitors or top academic programs, often receive a substantial one-time cash sign-on bonus. While Two Sigma is a private company, compensation can sometimes include forms of deferred compensation or equity-like instruments that vest over time, though the cash bonus component is typically dominant.

The data presented below is aggregated from reputable sources like Levels.fyi and Glassdoor, which rely on user-submitted data. These figures are estimates for roles based primarily in New York City, Two Sigma's headquarters, and are subject to change based on market conditions, individual performance, and negotiation.

*(All data is based on 2023-2024 submissions and should be considered an informed estimate.)*

#### Software Engineer (SWE) Compensation at Two Sigma

Software engineering at Two Sigma is on par with, and often exceeds, compensation at top FAANG (Facebook/Meta, Apple, Amazon, Netflix, Google) companies.

| Experience Level | Base Salary Range | Typical Annual Bonus | Average Total Compensation (Year 1) |

| :--- | :--- | :--- | :--- |

| New Grad (BS/MS) | $175,000 - $225,000 | $100,000 - $175,000 | $350,000 - $450,000 (incl. sign-on) |

| Mid-Level (3-5 years)| $225,000 - $275,000 | $150,000 - $300,000 | $400,000 - $600,000 |

| Senior (5-10 years)| $275,000 - $350,000 | $250,000 - $500,000+ | $550,000 - $850,000+ |

| Staff/Principal | $350,000+ | $400,000 - $1,000,000+ | $800,000 - $2,000,000+ |

*(Source: Aggregated data from Levels.fyi and Glassdoor, 2023-2024. Total Compensation for Year 1 often includes a large sign-on bonus of $50k-$100k.)*

#### Quantitative Researcher (Quant) Compensation at Two Sigma

Quant compensation is even more variable and has a higher ceiling, as a researcher's performance can be more directly tied to the firm's profit and loss (P&L). A Ph.D. is often the standard entry requirement.

| Experience Level | Base Salary Range | Typical Annual Bonus | Average Total Compensation (Year 1) |

| :--- | :--- | :--- | :--- |

| New Grad (Ph.D.) | $200,000 - $275,000 | $150,000 - $250,000 | $450,000 - $600,000 (incl. sign-on) |

| Mid-Level (3-5 years)| $250,000 - $350,000 | $250,000 - $750,000 | $500,000 - $1,100,000 |

| Senior (5-10 years)| $300,000 - $400,000 | $500,000 - $2,000,000+ | $800,000 - $2,500,000+ |

| Portfolio Manager | $350,000+ | Highly variable % of P&L | $2,000,000 - $10,000,000+ |

*(Source: Aggregated data from Levels.fyi, Glassdoor, and industry reports like the H1B visa salary database, 2023-2024. The bonus for Quants is extremely performance-dependent.)*

#### Other Benefits and Perks

Beyond the cash compensation, Two Sigma offers a benefits package commensurate with its status as a top employer. While specific details can change, these benefits generally include:

- World-Class Health Insurance: Premium medical, dental, and vision plans with minimal employee contributions.

- Retirement Savings: A generous 401(k) matching program.

- Catered Meals: Free breakfast, lunch, and dinner, along with fully stocked kitchens.

- On-site Amenities: Access to on-site gyms, wellness centers, and other conveniences.

- Generous Paid Time Off (PTO): A substantial number of vacation days and sick leave.

- Parental Leave: Comprehensive and supportive policies for new parents.

- Professional Development: Budgets for conferences, continuing education, and tuition reimbursement.

The value of these benefits can easily add tens of thousands of dollars to the overall compensation package, not to mention significantly improving work-life quality. The goal is to remove as many daily life stressors as possible so that employees can focus on their intellectually demanding work.

Key Factors That Influence a Two Sigma Salary

The wide ranges in the tables above highlight a critical point: a "Two Sigma salary" is not a single number. It is a complex calculation influenced by a multitude of factors. Understanding these drivers is key for anyone aspiring to maximize their earning potential at the firm. This is the most crucial section for understanding the nuances of compensation.

###

Role and Specialization

This is the single most significant determinant of a compensation package. The responsibilities, required skills, and direct impact on the firm's profitability vary dramatically between roles.

- Quantitative Researcher vs. Software Engineer: As shown in the tables, Quants generally have a higher earning potential, especially at the senior levels. This is because their work—creating profitable trading signals—is directly linked to the firm's revenue (P&L). A successful quant who develops a highly profitable, long-lasting signal is generating immense value, and their bonus will reflect that. A Software Engineer, while absolutely critical, has a more indirect link to P&L. Their value lies in building the stable, scalable, and fast systems that enable the quants' work. While their compensation is extraordinary by any standard, the bonus structure is typically less directly tied to trading profits and more to project delivery, system reliability, and technological innovation.

- Sub-specializations: Within these broad roles, specialization matters. A SWE working on ultra-low-latency C++ trading systems—where every nanosecond counts—may be compensated more than an engineer working on an internal data visualization tool. Similarly, a quant specializing in a highly competitive and profitable area like high-frequency equity options will likely have a higher ceiling than one in a less liquid, developing market.

###

Level of Education and Academic Pedigree

In the world of quantitative finance, your educational background is your foundational credential. It's not just about having a degree; it's about the type of degree, the institution, and the field of study.

- Degree Level (Ph.D. vs. Master's vs. Bachelor's): For Quantitative Researcher roles, a Ph.D. from a top-tier university in a highly quantitative field (e.g., Physics, Mathematics, Statistics, Computer Science, Electrical Engineering) is often the standard, though not an absolute requirement. A Ph.D. signals years of rigorous, independent research, deep subject matter expertise, and the ability to solve unstructured problems—the very definition of a quant's job. This is why new grad Ph.D.s command significantly higher starting packages than those with a Bachelor's or Master's degree. For SWE roles, a Ph.D. is less common but still highly valued, particularly for specialized areas like machine learning research. A Bachelor's or Master's in Computer Science from a top engineering school (like MIT, Stanford, Carnegie Mellon, or UC Berkeley) is the more typical and highly sought-after path.

- Academic Prestige and Accomplishments: The reputation of your university and your academic achievements matter immensely. A candidate with a Ph.D. in theoretical physics from Caltech, a record of publications in top journals, or medals in international competitions like the International Mathematical Olympiad (IMO) or the ACM International Collegiate Programming Contest (ICPC) enters the negotiation process with enormous leverage. These achievements are seen as powerful proxies for raw intellectual horsepower and problem-solving ability, justifying a top-tier compensation offer.

###

Years and Quality of Experience

While academic pedigree opens the door, career progression and salary growth are driven by experience. However, not all experience is created equal.

- Career Stage Trajectory: As seen in the salary tables, compensation grows steeply with experience. A mid-level professional has a proven track record of contributing to complex projects, while a senior or principal-level employee is expected to lead major initiatives, mentor junior members, and define the technical or research direction for their team. This leadership and impact command a significant premium.

- Relevant Industry Experience: Experience at a direct competitor (e.g., Jane Street, Citadel, D.E. Shaw, Hudson River Trading) is the most valuable. A candidate moving from one of these firms has already been vetted by a similar high-bar process and possesses directly applicable skills. They can "hit the ground running," which makes them incredibly valuable. Experience at a top tech firm (Google, Meta, Amazon) is also highly regarded, especially for SWE roles, as these companies are known for their engineering rigor and experience with large-scale distributed systems.

- Performance-Based Growth: At Two Sigma, your salary trajectory is fundamentally tied to your performance. A high-performing quant whose models consistently generate profit will see their bonus, and consequently their total compensation, grow exponentially. An engineer who architects a new system that dramatically improves research productivity or trading efficiency will likewise be rewarded. Conversely, underperformance can lead to stagnant compensation or, in the high-stakes world of finance, an exit from the firm.

###

Geographic Location

While Two Sigma has offices in various locations globally (e.g., London, Houston, Hong Kong, Tokyo), its headquarters and largest office is in New York City.

- NYC as the Epicenter: The salary data provided in this article is heavily benchmarked against the New York City market, which is the highest-paying location for finance in the United States. The high cost of living in NYC is factored into these compensation packages.

- Other Locations: Salaries in other offices like Houston or London are still exceptionally high but may be adjusted based on local market rates and cost of living. For example, according to Glassdoor and Levels.fyi, salaries in Houston might be slightly lower than in NYC, but this is often offset by a significantly lower cost of living. London salaries are competitive within the European market but may be structured differently due to local regulations and tax laws. However, for all locations, the compensation will be at the absolute top of that region's market for tech and finance talent.

###

The Interview Process and Negotiation

The final offer you receive is heavily influenced by your performance during Two Sigma's notoriously difficult interview process.

- Signal of Competence: The interview loop is a multi-stage gauntlet designed to test the absolute limits of your technical and problem-solving abilities. It includes phone screens, take-home challenges, and a full day of on-site (or virtual) interviews with multiple team members. A stellar performance—solving difficult problems elegantly and demonstrating deep conceptual understanding—signals to the hiring committee that you are a top-tier candidate worthy of a top-tier offer.

- Leveling: Your interview performance determines the level at which you are hired (e.g., Mid-Level vs. Senior Engineer), which is the primary determinant of your compensation band.

- Negotiation Leverage: A strong interview performance, combined with competing offers from other elite firms (e.g., Google, Jane Street), gives a candidate significant negotiation leverage. In this hyper-competitive talent market, firms like Two Sigma are often willing to increase an offer to secure a candidate they are highly confident in.

Career Trajectory and Long-Term Prospects at Two Sigma

A job at Two Sigma is more than just a high-paying position; it is a launchpad for an entire career at the highest echelons of technology and finance. The job outlook for quantitative finance professionals remains exceptionally strong, driven by the increasing complexity of financial markets and the continued flood of data into every aspect of the global economy. Unlike some roles that might be tracked by the U.S. Bureau of Labor Statistics (BLS) with a standard growth rate, jobs at elite firms like Two Sigma exist in a micro-economy of their own, where the demand for top 0.1% talent is perpetually high.

#### Internal Growth and Advancement

The career path within Two Sigma is designed to foster continuous learning and impact.

- From Junior to Senior: A junior researcher or engineer will start by working on well-defined components of larger projects under the guidance of a mentor. As they gain experience, they are given more autonomy and ownership. A mid-level professional is expected to independently lead small to medium-sized projects.

- The Principal/Staff Track: At the senior level, the path can diverge. Some may choose a technical leadership track, becoming a Principal or Staff Engineer/Researcher. In this capacity, they are the go-to experts in a specific domain, setting technical direction, mentoring entire teams, and tackling the firm's most ambiguous and challenging problems. Their influence is broad and deep.

- The Management Track: Others may move into a management role, leading a team of researchers or engineers. This path focuses more on strategy, project execution, and people development.

- Portfolio Manager (for Quants): The ultimate goal for many quants is to become a Portfolio Manager (PM). A PM is given a capital allocation and is responsible for managing a portfolio of trading strategies. Their compensation is directly tied to the P&L they generate, which is why their earnings potential is virtually unlimited, often reaching tens of millions of dollars in a good year.

#### Emerging Trends and Future Challenges

The world of quantitative finance is not static. Professionals at Two Sigma must constantly adapt to new trends and challenges to stay ahead.

- The AI and Deep Learning Revolution: While machine learning has been a staple of quant finance for decades, the rapid advancements in deep learning and large language models (LLMs) present new opportunities and challenges. The ability to effectively and responsibly harness these technologies to find new signals is a key area of current research.

- The Data Arms Race: Firms are in a constant race to acquire unique, alternative datasets that provide an edge. The challenge is no longer just analyzing the data, but finding it, cleaning it, and integrating it before competitors do.

- Alpha Decay: A constant challenge in the industry is "alpha decay," the tendency for profitable trading strategies to become less effective over time as more market participants discover and exploit them. This necessitates a culture of continuous innovation and research to constantly replenish the firm's portfolio of signals.

#### How to Stay Relevant and Advance

To build a long and successful career at Two Sigma, one must embrace a mindset of lifelong learning.

1. Stay on the Cutting Edge: Actively read academic papers from fields like computer science, statistics, and mathematics. Attend industry conferences and stay abreast of the latest technological developments.

2. Develop Cross-Disciplinary Skills: The lines between Quant and SWE are blurring. A researcher who can write high-quality, production-level code is more valuable. An engineer who understands the mathematical underpinnings of the models they support is a better partner.

3. Focus on Impact: Advancement is tied to impact. Always be thinking about how your work contributes to the firm's bottom line, whether directly (a new signal) or indirectly (a more efficient research platform).

4. Build Relationships: The culture is collaborative. Building strong relationships with colleagues across different teams is essential for getting things done and for your own learning and development.

The skills and experience gained at Two Sigma are highly portable. An alum of the firm is viewed as a premier talent and has incredible "exit opportunities," whether it's joining another top hedge fund, launching their own firm, taking a leadership role at a major tech company, or returning to academia.

How to Land a Job at Two Sigma

Getting hired at Two Sigma is an achievement in itself. The process is notoriously rigorous, designed to filter for only the most capable and driven candidates. Here is a step-by-step guide for aspiring professionals.

#### Step 1: Build a World-Class Educational Foundation

The journey starts long before you submit an application. Your academic background is the first and most important filter.

- Target a Top-Tier University: Aim for a university with a globally recognized program in a quantitative field. For undergraduate SWE roles, this means top computer science programs (e.g., MIT, Stanford, CMU, Berkeley). For Quant roles, this means top undergraduate or, more typically, Ph.D. programs in STEM fields (Math, Physics, CS, Statistics, etc.).

- Excel Academically: A high GPA