Introduction

Are you a numbers-driven professional with a vision for strategy? Do you aspire to a leadership role where you can shape a company's financial future and drive its growth? If you find yourself at the intersection of financial acumen and executive leadership, the role of Vice President of Finance might be your ultimate career destination. This prestigious position is not just a title; it's the strategic core of an organization, demanding a unique blend of analytical prowess, leadership, and foresight. Consequently, the vice president of finance salary reflects this immense responsibility, often reaching well into the six figures, complemented by substantial bonuses and long-term incentives.

The journey to this executive level is demanding, but the rewards—both financial and professional—are immense. The average total compensation can soar past $300,000, and for those at the helm of large, public corporations, it can be significantly higher. But beyond the impressive numbers lies a role of profound impact. I once had a mentor, a seasoned VP of Finance at a mid-sized tech firm, who described his job not as "counting the beans," but as "helping the company decide which fields to plant, how to grow them, and when to harvest." During the 2008 financial crisis, his strategic cash flow management and calm, data-driven leadership didn't just save jobs; it positioned the company to acquire a struggling competitor and emerge stronger than ever. That anecdote crystalized for me that this role is the true engine of business resilience and opportunity.

This guide is designed to be your definitive resource on the path to becoming a VP of Finance. We will dissect every component of the vice president of finance salary, explore the critical factors that influence your earning potential, and provide a clear, step-by-step roadmap to help you navigate this challenging and rewarding career.

### Table of Contents

- [What Does a Vice President of Finance Do?](#what-does-a-vice-president-of-finance-do)

- [Average Vice President of Finance Salary: A Deep Dive](#average-vice-president-of-finance-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion: Is the VP of Finance Role Right for You?](#conclusion-is-the-vp-of-finance-role-right-for-you)

What Does a Vice President of Finance Do?

The Vice President of Finance is far more than an accountant with a corner office. This executive is a key strategic partner to the Chief Financial Officer (CFO) and the Chief Executive Officer (CEO), responsible for the overall financial health and direction of the organization. While the CFO often focuses on external-facing duties like investor relations and long-term capital strategy, the VP of Finance typically manages the internal financial engine of the company. Their purview is vast, encompassing everything from day-to-day financial operations to long-range economic forecasting.

Their core responsibilities can be broken down into several key domains:

- Strategic Financial Planning & Analysis (FP&A): This is the heart of the role. The VP of Finance leads the budgeting, forecasting, and long-range planning processes. They analyze financial data to identify trends, opportunities, and risks, providing critical insights that inform C-suite decisions about new market entry, product launches, capital investments, and corporate strategy.

- Team Leadership and Department Management: A VP of Finance oversees multiple financial departments, which may include accounting, treasury, tax, financial planning, and audit. They are responsible for hiring, mentoring, and developing a high-performing finance team, ensuring that the department has the skills and resources to meet the company's needs.

- Financial Reporting and Compliance: They ensure the accuracy, integrity, and timeliness of all financial reporting. This includes preparing financial statements for internal and external stakeholders, ensuring compliance with regulations like GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards), and managing relationships with external auditors.

- Treasury and Cash Management: This involves managing the company's liquidity, debt, and investments. The VP of Finance optimizes the company's capital structure, manages banking relationships, and develops strategies to ensure the company has the cash flow necessary to fund operations and growth initiatives.

- Risk Management: They identify and mitigate financial risks facing the company, which could range from interest rate fluctuations and currency exchange volatility to credit risk and operational inefficiencies.

### A Day in the Life of a VP of Finance

To make this tangible, let's walk through a hypothetical day for a VP of Finance at a $500 million manufacturing company:

- 8:00 AM - 9:00 AM: Huddle with the CFO and CEO. Review yesterday's key performance indicators (KPIs), discuss the latest market intelligence, and align on priorities for the day. Today's big topic: a preliminary analysis of a potential acquisition target.

- 9:00 AM - 11:00 AM: Lead the quarterly budget review meeting with department heads. The VP challenges assumptions, asks probing questions about variances, and facilitates a discussion on reallocating resources to a high-growth product line. This isn't just about numbers; it's about business strategy.

- 11:00 AM - 12:00 PM: One-on-one meeting with the Director of FP&A. They review the new five-year financial model, stress-testing it against different economic scenarios (e.g., a recession, a supply chain disruption).

- 12:00 PM - 1:00 PM: Working lunch with the company's primary investment banker to discuss current debt markets and potential refinancing options to lower the company's cost of capital.

- 1:00 PM - 3:00 PM: Deep-dive session with the corporate controller and tax manager to review the draft 10-Q report ahead of the quarterly earnings release. They meticulously scrub the numbers and the management discussion and analysis (MD&A) section.

- 3:00 PM - 4:00 PM: Call with the General Counsel and head of HR to discuss the financial implications of a new proposed executive compensation plan.

- 4:00 PM - 5:30 PM: The VP dedicates this time to their team. They might conduct a performance review with the Treasury Manager, mentor a promising senior financial analyst, and walk the floor to connect with junior staff.

- 5:30 PM Onward: The official day might be over, but the VP often spends time catching up on emails, reading industry reports, and thinking strategically about the challenges and opportunities on the horizon.

This example illustrates the dynamic nature of the role—it's a constant blend of high-level strategy, detailed operational oversight, and people leadership.

Average Vice President of Finance Salary: A Deep Dive

The vice president of finance salary is one of the most compelling aspects of the career, reflecting the critical importance and complexity of the role. Compensation is multifaceted, extending far beyond a simple base salary to include a rich tapestry of bonuses, equity, and benefits.

### National Averages and Typical Salary Ranges

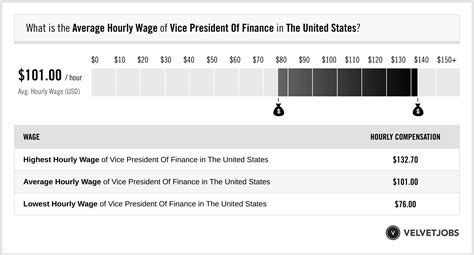

When analyzing compensation, it's crucial to consult multiple authoritative sources to get a complete picture.

- According to Salary.com, as of late 2023, the median base salary for a Vice President of Finance in the United States is approximately $253,599. The typical salary range falls between $224,598 and $290,298. However, this range represents the middle 50% and doesn't account for the substantial variable pay components or salaries at top-tier companies.

- Payscale.com reports a slightly lower average base salary of around $160,000 but highlights the significant impact of bonuses (median of $26,000) and profit-sharing (median of $15,000), which brings the total pay into a much higher range.

- Glassdoor, which aggregates user-reported data, shows a total pay estimate with a median of $267,000 per year in the United States, with a likely range between $201,000 and $362,000. This figure includes base salary and other forms of cash compensation.

The U.S. Bureau of Labor Statistics (BLS) provides data for the broader category of "Financial Managers." While this includes roles like controllers and finance directors, it offers a valuable baseline. As of May 2022, the median annual wage for financial managers was $139,790. The top 10% of earners in this category—where VPs of Finance firmly sit—earned more than $208,000 in base salary alone. This underscores that the VP title represents the upper echelon of financial professionals.

Key Takeaway: A realistic base salary expectation for a newly appointed VP of Finance at a mid-sized company would be in the $180,000 to $240,000 range. For a seasoned VP at a large corporation, base salaries can easily exceed $300,000, with total compensation reaching $500,000 or more.

### Salary Growth by Experience Level

Salary progression is steep and directly correlated with experience and proven impact. Here’s a typical trajectory:

| Experience Level | Typical Title Path | Average Base Salary Range | Typical Total Compensation Range |

| :--- | :--- | :--- | :--- |

| Early-Career (0-5 years) | Financial Analyst, Senior Analyst | $70,000 - $110,000 | $75,000 - $125,000 |

| Mid-Career (5-10 years) | Finance Manager, Senior Manager | $110,000 - $160,000 | $130,000 - $200,000 |

| Experienced (10-15 years) | Director of Finance/FP&A | $160,000 - $220,000 | $200,000 - $300,000+ |

| Senior/Executive (15+ years) | Vice President of Finance | $220,000 - $350,000+ | $300,000 - $750,000+ |

*Note: These are national averages and can vary significantly based on the factors discussed in the next section.*

### Deconstructing the Compensation Package

The vice president of finance salary is rarely just a salary. Total compensation is a package designed to attract, retain, and motivate top executive talent.

1. Base Salary: This is the fixed, guaranteed portion of your pay. It's determined by the factors we'll explore below, such as company size, location, and your individual experience. It typically makes up 50-70% of the total compensation package.

2. Annual Bonus / Short-Term Incentive (STI): This is a variable cash payment tied to performance. It's usually based on a combination of company performance (e.g., meeting revenue or EBITDA targets) and individual performance (e.g., successful system implementation, cost-saving initiatives). A typical bonus target for a VP of Finance can range from 30% to 60% of their base salary. For a VP with a $250,000 base salary, this could mean an additional $75,000 to $150,000 in cash annually.

3. Long-Term Incentives (LTI): This is where compensation can truly skyrocket, especially at public companies or high-growth startups. LTIs are designed to align the executive's interests with long-term shareholder value.

- Stock Options: Give the holder the right to buy company stock at a predetermined price in the future. The value is realized if the stock price increases.

- Restricted Stock Units (RSUs): A grant of company shares that vest over a period of time (typically 3-4 years). Once vested, they are owned outright by the executive.

- Performance Share Units (PSUs): Similar to RSUs, but the number of shares that vest depends on the company achieving specific long-term performance goals (e.g., total shareholder return vs. a peer group).

LTI grants can be substantial, often equaling 50% to 150% or more of base salary on an annualized basis for senior VPs at large public companies.

4. Profit Sharing: Common in privately held companies, a portion of the company's annual profits is distributed to eligible employees. For a VP, this can be a significant addition to their cash compensation.

5. Benefits and Perks: Beyond the direct pay, executive packages include premium benefits:

- Executive Health Plans: Comprehensive health, dental, and vision insurance with low or no premiums.

- Generous Retirement Plans: Enhanced 401(k) matching, and potentially access to non-qualified deferred compensation (NQDC) plans, which allow for tax-advantaged savings beyond 401(k) limits.

- Car Allowance / Company Car: Often provided for senior executives.

- Generous Paid Time Off (PTO).

- Relocation Assistance: Substantial packages if the role requires a move.

When evaluating an offer for a VP of Finance position, it is critical to look at the total compensation and understand the structure and potential of the variable components.

Key Factors That Influence Salary

A headline average for a vice president of finance salary is just a starting point. Your actual earnings will be determined by a complex interplay of factors. Understanding these levers is crucial for negotiating your compensation and maximizing your career-long earning potential.

###

Level of Education

Your educational background is the foundation upon which your finance career is built. While a bachelor's degree is a minimum requirement, advanced degrees and certifications are what truly unlock the highest salary tiers.

- Bachelor's Degree: A bachelor's in Finance, Accounting, Economics, or a related business field is the standard entry point. This provides the essential knowledge of financial principles, accounting standards, and economic theory.

- Master of Business Administration (MBA): This is often the single most impactful educational credential for aspiring VPs of Finance. An MBA, particularly from a top-tier business school (e.g., Wharton, Harvard, Stanford, Booth), provides advanced training in strategy, leadership, marketing, and operations, in addition to finance. It signals a high level of ambition and analytical rigor to employers. An MBA can add a $30,000 to $50,000+ premium to a starting executive salary and significantly accelerates a career trajectory. The network gained from a top MBA program is also an invaluable, lifelong asset.

- Certified Public Accountant (CPA): While more common for those on the Controller/Chief Accounting Officer track, a CPA license is highly respected for any senior finance role. It demonstrates a mastery of accounting principles, financial reporting, and tax law. For a VP of Finance, it provides immense credibility, especially in matters of compliance and audit. It is often a de facto requirement in companies with complex accounting environments.

- Chartered Financial Analyst (CFA): The CFA charter is the gold standard for investment management professionals but is also highly valued for corporate finance VPs. It signifies deep expertise in investment analysis, portfolio management, and quantitative financial modeling. A VP with a CFA is particularly valuable in companies that are highly acquisitive (M&A focus) or have complex treasury and investment functions.

Impact on Salary: Professionals with an MBA or a key certification like the CPA or CFA consistently command higher salaries. The combination of an MBA *and* a CPA is particularly powerful, often placing a candidate at the very top of the pay scale for a given role.

###

Years of Experience

Experience is perhaps the most significant determinant of a VP of Finance's salary. The title "Vice President" is not an entry-level or even mid-career position; it is the culmination of at least a decade, and more often 15-20 years, of progressive experience.

- 10-15 Years (The Path to VP): Professionals in this range are typically in Director-level roles (e.g., Director of FP&A, Corporate Controller). They have moved beyond individual contribution and are managing teams, owning major processes like the annual budget, and presenting to senior leadership. Their salaries are already robust, often in the $160,000 to $220,000 range, with total compensation pushing $300,000.

- 15-20 Years (First-Time and Mid-Level VP): This is the sweet spot for ascending to the VP level. At this stage, you have a proven track record of leading large teams, managing complex financial projects, and acting as a strategic business partner. A first-time VP at a mid-sized company might command a base salary of $220,000 to $270,000.

- 20+ Years (Senior/Divisional VP): With two decades or more of experience, you are a seasoned executive. You may be the VP of Finance for a very large corporation or a major division of a global enterprise. You have likely navigated economic cycles, led M&A integrations, and managed international finance teams. Base salaries here can easily reach $300,000 to $400,000+, and total compensation, driven by substantial LTI grants, can be $750,000 to over $1,000,000. The depth of your strategic impact directly correlates with your pay.

###

Geographic Location

Where you work matters—a lot. Salaries for VPs of Finance are not uniform across the country; they are heavily influenced by the local cost of living and the concentration of corporate headquarters.

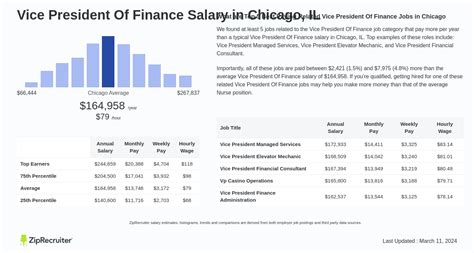

High-paying metropolitan areas command a significant premium over the national average.

Top-Tier Cities (20-40%+ above national average):

- New York, NY: The financial capital of the world. VPs here can expect top-tier salaries, often starting at $280,000+ base.

- San Francisco Bay Area, CA (including Silicon Valley): The hub of the tech industry. The high cost of living and competition for talent in tech and biotech drive salaries sky-high, with total compensation packages often heavily weighted towards stock options.

- Boston, MA: A major center for biotech, pharma, and financial services.

- Los Angeles, CA: A diverse economy with major media, entertainment, and logistics companies.

Second-Tier Cities (5-15%+ above national average):

- Chicago, IL: A hub for Fortune 500 companies in manufacturing, CPG, and financial services.

- Dallas & Houston, TX: Booming economies driven by energy, logistics, and corporate relocations. No state income tax is also a major draw.

- Seattle, WA: Home to tech giants like Amazon and Microsoft.

- Washington, D.C.: A center for government contracting, non-profits, and associations.

Cities Near or Below the National Average:

- Salaries in the Midwest and Southeast, outside of major metropolitan hubs, will generally be closer to or slightly below the national median. While the absolute dollar amount is lower, the purchasing power may be equivalent or even greater due to a lower cost of living. A $220,000 salary in Kansas City may afford a similar or better lifestyle than a $280,000 salary in New York City.

###

Company Type & Size

The size, structure, and industry of your employer have a profound impact on the vice president of finance salary and compensation structure.

- Startups (High-Growth, Pre-IPO):

- Salary: Base salaries are often lower than the market average to preserve cash ($150,000 - $220,000).

- Compensation Mix: The real prize is equity. VPs of Finance receive a significant grant of stock options or RSUs, which could be worth millions if the company has a successful IPO or acquisition. The role is high-risk, high-reward, demanding a tolerance for ambiguity and a hands-on approach.

- Mid-Sized Companies ($50M - $2B in revenue):

- Salary: This is where you find the most "typical" salary ranges, often aligning with the data from Salary.com ($200,000 - $280,000 base).

- Compensation Mix: A balanced mix of a competitive base salary, a solid annual cash bonus (30-50%), and potentially some form of LTI or profit sharing, especially if the company is private equity-owned.

- Large Public Corporations (Fortune 500):

- Salary: Base salaries are at the top of the market ($280,000 - $400,000+).

- Compensation Mix: Highly structured and lucrative. In addition to a high base, expect large annual bonuses and very substantial LTI grants (RSUs/PSUs) that can often exceed the base salary in value. The roles are often more specialized (e.g., VP of Finance for a specific division) and demand navigating complex corporate bureaucracy.

- Non-Profit Organizations:

- Salary: Salaries are generally lower than in the for-profit sector. A VP of Finance at a large non-profit might earn $150,000 - $220,000.

- Compensation Mix: Compensation is primarily base salary with modest bonus potential. The reward is often mission-driven work rather than financial windfall.

- Industry Impact: Industry also plays a role. VPs in high-margin, high-growth industries like Technology, Pharmaceuticals, and Financial Services typically earn more than those in lower-margin sectors like Retail or Manufacturing.

###

Area of Specialization

Within the broader VP of Finance role, a background in a specific, high-demand area can increase your value.

- Financial Planning & Analysis (FP&A): This is the most common and direct path. A deep background in building financial models, forecasting, and serving as a business partner is foundational.

- Mergers & Acquisitions (M&A): VPs with experience leading due diligence and post-merger integration for acquisitions are highly sought after and can command a premium, especially in acquisitive industries or for private equity-backed companies.

- Treasury: Expertise in capital markets, debt financing, and international cash management is critical for large, global companies.

- Investor Relations (IR): While often a separate function, a VP of Finance with strong IR skills—the ability to communicate the company's financial story to Wall Street—is invaluable at public companies.

###

In-Demand Skills

Beyond your resume, specific skills can make you a more effective VP and a more valuable candidate.

Hard Skills:

- Advanced Financial Modeling: The ability to build complex, dynamic, three-statement financial models from scratch is non-negotiable.

- ERP Systems Expertise: Deep knowledge of major enterprise resource planning systems like SAP, Oracle, or NetSuite is crucial for managing financial operations.

- Data Analytics and Business Intelligence (BI): Proficiency with BI tools like Tableau or Power BI is no longer a "nice-to-have." The ability to translate vast amounts of data into actionable insights is a key differentiator.

- Capital Budgeting and Valuation: Mastery of techniques like DCF, NPV, and IRR to evaluate major investment decisions.

Soft Skills:

- Strategic Thinking: The ability to see the big picture, understand market dynamics, and connect financial data to overarching business strategy.

- Leadership and Communication: You must be able to lead and inspire a large team and communicate complex financial information clearly and concisely to non-financial audiences, including the board of directors.

- Influence and Negotiation: The ability to influence key stakeholders and negotiate effectively with banks, vendors, and partners is critical to driving value.

- Business Acumen: A deep understanding of the company's operations, market, and competitive landscape. The best VPs of Finance are business leaders first, and finance experts second.

Job Outlook and Career Growth

The long-term career prospects for senior financial leaders are exceptionally strong. As business becomes more global and data-driven, the need for strategic financial guidance has never been greater.

### Job Growth Projections

The U.S. Bureau of Labor Statistics (BLS) projects robust growth for the "Financial Managers" occupational group, which includes VPs of Finance. According to the 2022-2032 projections:

- Projected Growth Rate: Employment of financial managers is projected to grow 16 percent from 2022 to 2032, which is much faster than the average for all occupations.

- Number of New Jobs: This growth is expected to result in about 77,800 new jobs over the decade.

- Driving Factors: The BLS cites several reasons for this strong outlook, including the need for financial expertise to manage cash and risks, the increasing complexity of global commerce, and the growing importance of financial planning and analysis in corporate decision-making