Introduction

Have you ever considered a career that sits at the powerful intersection of high-level corporate strategy and profound human impact? Imagine being the architect behind the financial security of thousands of individuals, shaping the retirement plans that will support them for decades. This is the world of a Vice President of Retirement Services. It's a role that demands exceptional financial acumen, strategic leadership, and a deep understanding of complex regulations, but it rewards you with not only a significant leadership position but also a highly competitive compensation package.

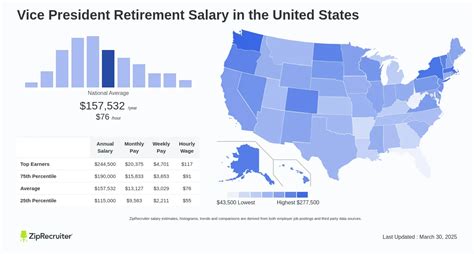

The query "vice president retirement salary" points to a role of immense responsibility and, consequently, substantial earning potential. While compensation varies widely, a Vice President in this field can typically expect a total compensation package ranging from $180,000 to over $350,000 annually, with top executives at major firms exceeding this considerably. This figure is a combination of a strong base salary, performance-based bonuses, and long-term incentives.

I once had the privilege of working with a senior benefits executive who was redesigning her company’s 401(k) plan. She spoke not in terms of expense ratios and fund lineups, but about enabling a factory worker to retire with dignity and helping a young engineer start saving confidently for a future 40 years away. That conversation crystallized for me that this career isn't just about managing assets; it's about stewarding futures.

This comprehensive guide will illuminate every facet of this rewarding career path. We will dissect the role's responsibilities, provide a forensic analysis of salary expectations, explore the factors that drive compensation, and lay out a clear roadmap for how you can ascend to this executive level.

### Table of Contents

- [What Does a Vice President of Retirement Services Do?](#what-does-a-vice-president-of-retirement-services-do)

- [Average Vice President of Retirement Services Salary: A Deep Dive](#average-vice-president-of-retirement-services-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does a Vice President of Retirement Services Do?

A Vice President of Retirement Services is a senior executive responsible for the strategy, management, and oversight of retirement plans and services. This role can exist in several contexts: within a large financial services company that provides retirement plans to other businesses (like Fidelity, Vanguard, or Principal), inside a large corporation's Human Resources or Benefits department, or at a specialized benefits consulting firm (like Mercer or Aon).

Regardless of the setting, the core mission is the same: to ensure the retirement programs are competitive, compliant, financially sound, and effectively meet the needs of the plan participants or clients. This is not a hands-on, day-to-day administrative role; it is a high-level strategic position focused on leadership and long-term vision.

Core Responsibilities and Daily Tasks:

- Strategic Planning & Plan Design: The VP leads the development and evolution of retirement plan offerings. This involves analyzing market trends, evaluating the competitiveness of current plans (e.g., 401(k), 403(b), defined benefit/pension plans), and designing changes or new features to attract and retain talent or clients. They answer big-picture questions: Should we add an ESG fund lineup? Is our employer match competitive? How can we incorporate financial wellness tools to improve employee outcomes?

- Financial Oversight & Fiduciary Duty: This is a critical function. The VP is often a named fiduciary on the plan, meaning they have a legal obligation to act in the best interests of the plan participants. This includes overseeing the plan's investment portfolio, monitoring fund performance, negotiating fees with recordkeepers and asset managers, and ensuring the plan's assets are managed prudently.

- Regulatory Compliance: The retirement industry is governed by a labyrinth of complex laws, most notably the Employee Retirement Income Security Act of 1974 (ERISA). The VP is the ultimate owner of compliance, ensuring the plan adheres to all IRS and Department of Labor (DOL) regulations, including nondiscrimination testing, reporting (Form 5500), and participant disclosures. A single compliance failure can result in massive fines and legal liability.

- Vendor & Partner Management: VPs don't do everything themselves. They manage relationships with external partners, including recordkeepers, third-party administrators (TPAs), investment advisors, auditors, and legal counsel. A huge part of the job is selecting these partners, negotiating contracts, and holding them accountable for service level agreements (SLAs).

- Leadership & Team Management: The VP leads a team of retirement professionals, which may include benefits managers, financial analysts, compliance specialists, and communications experts. They set the team's goals, mentor junior staff, and foster a culture of excellence and participant-centric service.

- Communication & Education Strategy: A brilliant plan is useless if employees don't understand or use it. The VP oversees the strategy for communicating the value of the retirement benefits to employees or clients, ensuring educational materials are clear, engaging, and drive positive action (like increasing savings rates).

### A Day in the Life of a VP of Retirement Services

To make this tangible, let's follow a fictional VP, "Maria," who works for a large technology company with 15,000 employees.

- 8:30 AM - 9:30 AM: Maria starts her day with her leadership team. They review the key performance indicators (KPIs) for their 401(k) plan: participation rates, average deferral percentages, and recent call center volume. They discuss an upcoming communication campaign about the new student loan matching feature they are launching next quarter.

- 10:00 AM - 11:30 AM: Maria joins a quarterly investment review meeting with the company's external investment advisor. They are a named fiduciary on the plan. They scrutinize the performance of each fund in the 401(k) lineup, discuss the advisor's market outlook, and debate whether to place one of the small-cap funds on a "watch list" due to underperformance.

- 12:00 PM - 1:00 PM: Working lunch with the company's general counsel. They are preparing for an upcoming audit by the Department of Labor and are reviewing all plan documentation to ensure their fiduciary files are in perfect order. This is a high-stakes meeting focused on risk mitigation.

- 2:00 PM - 3:00 PM: Maria meets with the Head of Talent Acquisition. They are discussing how to better leverage the company's generous retirement plan as a key selling point in their recruitment efforts. They brainstorm ideas for new collateral for job candidates.

- 3:30 PM - 5:00 PM: Final contract negotiation call with a new financial wellness vendor they've selected to provide one-on-one coaching for employees. Maria leads the negotiation, pushing for better pricing and more robust reporting capabilities before signing the multi-year, six-figure contract.

- 5:00 PM - 5:30 PM: Maria spends the last part of her day reviewing a draft of the annual retirement plan report that will be presented to the C-suite and the Board of Directors' compensation committee next month. She adds her strategic commentary and highlights key achievements from the past year.

As you can see, the role is a dynamic blend of financial analysis, legal oversight, strategic negotiation, and people leadership.

Average Vice President of Retirement Services Salary: A Deep Dive

The compensation for a Vice President of Retirement Services is multifaceted and highly rewarding, reflecting the immense responsibility and specialized expertise required. It's not just a salary; it's a comprehensive package designed to attract and retain top-tier executive talent.

According to data from Salary.com, a highly reliable source for compensation data, the median base salary for a Top Benefits Executive (a role highly synonymous with a VP of Retirement Services) in the United States is approximately $226,368 as of late 2023. However, the typical range is quite broad, generally falling between $197,378 and $262,458.

It is crucial to understand that this is just the base salary. The total compensation, which includes annual bonuses, incentives, and benefits, is significantly higher.

### Salary by Experience Level

The journey to the Vice President level is a long one, and compensation grows substantially with each step. While there is no "entry-level" VP, we can look at the typical career progression and the associated salary bands.

| Career Stage | Typical Title(s) | Years of Experience | Typical Base Salary Range | Total Compensation Insight |

| :--- | :--- | :--- | :--- | :--- |

| Early Career Professional | Benefits Analyst, Retirement Specialist, Financial Analyst | 2-5 | $65,000 - $95,000 | Smaller bonus, standard benefits. Focus is on gaining technical skills. |

| Mid-Career Manager | Retirement Plan Manager, Benefits Manager | 5-10 | $100,000 - $150,000 | Moderate bonus (10-20% of base). May have some profit sharing. |

| Senior Leader / Director | Director of Retirement, Director of Benefits | 10-15 | $150,000 - $200,000 | Significant bonus potential (20-35%). May be eligible for some long-term incentives. |

| Vice President | VP, Retirement Services; VP, Total Rewards | 15+ | $200,000 - $275,000+ | Large annual bonus (30-50%+), significant long-term incentives (stock, RSUs). |

| Senior Vice President / Top Executive | SVP, Head of Global Benefits | 20+ | $275,000 - $400,000+ | Executive-level compensation with substantial equity and performance-based rewards. |

*(Sources: Data synthesized from Salary.com, Payscale, Glassdoor, and Robert Half Salary Guides for 2023/2024. Ranges are illustrative and can vary significantly.)*

### Deconstructing the Total Compensation Package

A VP's paycheck is far more than just their bi-weekly salary. Here’s a breakdown of the typical components that make up their total earnings:

1. Base Salary: This is the foundational, guaranteed portion of their pay. As shown above, this alone is substantial, typically well into the six figures, providing financial stability. For a VP, this will likely be in the $200,000 to $275,000 range.

2. Annual Performance Bonus: This is a critical and highly variable component. It is typically tied to both individual and company performance.

- Individual Goals: Did the VP successfully implement a new plan design? Did they negotiate a significant fee reduction with a vendor, saving the plan millions? Did their team meet all its compliance deadlines?

- Company Goals: Company profitability, revenue growth, or stock performance.

- Potential: A VP's bonus can be substantial, often ranging from 30% to 50% of their base salary, and sometimes even higher in a great year at a high-performing company. For a VP with a $225,000 base, this could mean an additional $67,500 to $112,500 in cash each year.

3. Long-Term Incentive Plans (LTIPs): This is what separates executive compensation from the rest. LTIPs are designed to align the VP's interests with the long-term health of the company and to retain them for multiple years.

- Stock Options: The right to buy company stock at a predetermined price in the future. Their value increases if the company's stock price goes up.

- Restricted Stock Units (RSUs): A grant of company shares that vest over a period of time (typically 3-4 years). Once vested, they are owned by the executive.

- Value: The annual value of these grants can be significant, often adding another 20% to 40% of base salary to the total compensation package over the vesting period.

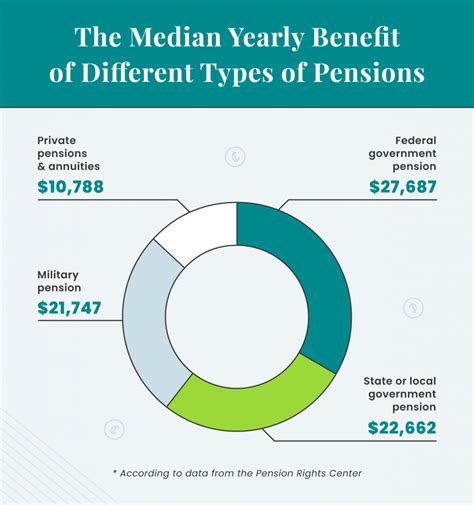

4. Profit Sharing & 401(k) Contributions: VPs, of course, participate in the very plans they help manage. This includes a company match on their 401(k) contributions and, in many companies, an additional annual profit-sharing contribution. These contributions can easily add up to $20,000 - $30,000+ in tax-advantaged retirement savings per year.

5. Executive-Level Perquisites ("Perks"): While less common than in the past, some roles may still include perks such as:

- Executive health insurance plans with lower deductibles.

- Financial planning and tax preparation services.

- Deferred compensation plans (non-qualified plans that allow for extra tax-deferred savings).

- Sometimes, a car allowance or club membership.

When you add these components together, it's clear how a role with a base salary of $225,000 can easily result in a total annual compensation package valued at $350,000 or more. This high earning potential is a direct reflection of the role's strategic importance, legal liability, and the specialized expertise required to succeed.

Key Factors That Influence Salary

The vast salary range for a Vice President of Retirement Services isn't arbitrary. It's a complex calculation based on a multitude of factors. For anyone aspiring to this role, understanding these levers is key to maximizing your own earning potential throughout your career. This section provides an in-depth analysis of the six primary drivers of compensation.

### ### Level of Education

While experience often trumps education at the executive level, your academic foundation sets the stage for your entire career trajectory and initial earning potential.

- Bachelor's Degree (The Prerequisite): A bachelor's degree is the non-negotiable entry ticket. The most relevant and respected majors are Finance, Economics, Business Administration, Human Resources, and Mathematics/Actuarial Science. A degree in one of these fields provides the fundamental quantitative and analytical skills necessary for the role.

- Master of Business Administration (MBA) (The Accelerator): An MBA, particularly from a top-tier business school, is a significant differentiator. It signals a higher level of strategic thinking, financial modeling expertise, and leadership training. VPs with MBAs often command a salary premium of 10-15% or more. More importantly, an MBA accelerates the career path to the VP level, opening doors to leadership development programs and senior roles much earlier than for those without one.

- Specialized Master's Degrees (The Niche Expert): A Master's in Finance (MSF), a Master's in Human Resources (MHR), or a law degree (Juris Doctor or JD) with a focus on tax or labor law can also be incredibly valuable. A JD, in particular, is highly prized for navigating the complexities of ERISA and other regulations, often leading to roles that blend legal and strategic benefits oversight.

- Professional Certifications (The Mark of Expertise): In the retirement industry, professional certifications are arguably as important as advanced degrees. They demonstrate a commitment to the profession and a mastery of specific, technical knowledge. Holding multiple, relevant certifications is a direct lever for higher pay and promotion. Key certifications include:

- Certified Employee Benefit Specialist (CEBS): Considered the gold standard in the benefits world, this comprehensive certification covers health and retirement plans. It is highly respected and often a prerequisite for senior roles.

- Qualified 401(k) Administrator (QKA) / Qualified Pension Administrator (QPA): Offered by the American Society of Pension Professionals & Actuaries (ASPPA), these certifications prove deep technical expertise in the administration and compliance of defined contribution and defined benefit plans.

- Certified Financial Planner (CFP): While more focused on individual financial planning, a CFP designation is valuable for VPs on the client-facing side of the business (e.g., at a financial services firm), as it shows a holistic understanding of participant needs.

- SHRM-CP / SHRM-SCP: The Society for Human Resource Management certifications are valuable for VPs operating within a corporate HR structure, demonstrating broad HR competency.

### ### Years of Experience

This is perhaps the single most significant factor in determining salary. The path to a VP role is a marathon, not a sprint, and compensation grows in lockstep with increasing responsibility.

- 0-5 Years (Analyst/Specialist Level: ~$65k - $95k): In these early years, the focus is on execution and learning the technical ropes. You're mastering nondiscrimination testing, processing distributions, helping with compliance filings, and learning the plan documents inside and out. Your value is in your accuracy and diligence.

- 5-10 Years (Manager Level: ~$100k - $150k): You're now managing a small team or a major process (like vendor oversight or employee communications). You're moving from "doing" to "managing." You're responsible for project outcomes and are starting to have input on plan design and strategy. Your salary increases as you take on people-management and project-management responsibilities.

- 10-15 Years (Director Level: ~$150k - $200k): As a Director, you likely own the entire retirement function for a division or a mid-sized company. You're a key player in strategic discussions, regularly presenting to senior leadership, and managing a significant budget. You are the primary contact for auditors and top-level vendors. Your compensation reflects your strategic ownership and risk management responsibilities.

- 15+ Years (Vice President Level: ~$200k - $275k+): At this stage, you have a proven track record of strategic leadership, complex problem-solving, and successful financial management of large-scale plans. You are no longer just managing the plan; you are setting its long-term vision and aligning it with the overall business strategy. Your compensation is at the executive level because the financial and legal impact of your decisions is enormous. You are paid for your judgment and leadership, which have been honed over decades.

### ### Geographic Location

Where you work matters immensely. Salaries are adjusted for the local cost of living and the concentration of corporate headquarters and financial institutions.

- Top-Tier, High-Cost-of-Living (HCOL) Cities: Metropolitan areas like New York City, San Francisco Bay Area, Boston, and Los Angeles offer the highest salaries, often 20-35% above the national average. These are epicenters of finance and technology with a high concentration of large corporations that need and can afford top benefits talent. A VP in NYC might earn a base of $270,000, while the same role in a smaller city might pay $210,000.

- Major Economic Hubs (Mid-to-High Cost): Cities like Chicago, Dallas, Atlanta, Seattle, and Washington D.C. also offer very competitive salaries, typically 5-15% above the national average. They have a robust mix of Fortune 500 companies and financial services firms.

- Lower-Cost-of-Living (LCOL) Areas: Salaries will be closer to or slightly below the national average in smaller cities and regions across the Midwest and Southeast. However, the lower cost of housing and living can mean that a salary of $185,000 in, for example, Kansas City or Charlotte can provide a quality of life equivalent to a much higher salary in New York.

- The Rise of Remote Work: The pandemic has somewhat flattened these geographic differences, but a location-based pay strategy is still common. Companies may hire a VP to work remotely but adjust the salary based on where the employee lives. However, a highly sought-after candidate may be able to negotiate a top-tier salary regardless of their location.

### ### Company Type & Size

The type and scale of the organization you work for has a profound impact on both the salary and the nature of the compensation.

- Large Public Corporations (e.g., Fortune 500): These companies typically offer very competitive base salaries and robust benefits. The most significant differentiator here is the heavy emphasis on long-term incentives (RSUs, stock options). A VP of Total Rewards at a company like Microsoft or Johnson & Johnson will have a substantial portion of their compensation tied to the company's stock performance.

- Major Financial Services Firms (e.g., Fidelity, T. Rowe Price, Vanguard): These firms, which sell and administer retirement plans, often have some of the highest total compensation packages. The role here may be more client-facing or product-focused. Bonuses can be extremely high and directly tied to business unit performance, sales goals, or asset retention.

- Benefits Consulting Firms (e.g., Mercer, Aon, Willis Towers Watson): Compensation here is also very strong. VPs (often called Principals or Senior Consultants) are paid for their expertise and their ability to advise multiple large corporate clients. The role is highly demanding, and compensation is tied to client satisfaction, billable hours, and bringing in new business.

- Startups & Tech Companies (Pre-IPO): Base salaries might be slightly lower than at established public companies. However, the potential upside from stock options or equity grants can be immense if the company is successful and goes public or is acquired. This is a high-risk, high-reward environment.

- Non-Profits & Government: These sectors will almost always pay less than the for-profit corporate world. A VP of HR at a large university or hospital system will have a very respectable salary, but it's unlikely to reach the levels seen in finance or tech. The trade-off is often better work-life balance and a strong sense of mission.

### ### Area of Specialization

"Retirement Services" is a broad field. Specializing in a high-demand niche can significantly increase your value.

- Defined Benefit / Pension Risk Management: With traditional pension plans becoming a major financial liability for many companies, experts who can manage plan de-risking strategies (e.g., liability-driven investing, lump-sum buyouts, pension plan terminations) are in extremely high demand and can command premium salaries.

- Investment & Fiduciary Governance: A VP who is a deep expert in investment selection, manager due diligence, and creating ironclad fiduciary processes is invaluable. This specialization requires a strong background in finance and investments (often a CFA charterholder).

- Executive Compensation & Non-Qualified Plans: Specializing in the unique retirement and deferred compensation plans for a company's top executives is a lucrative niche. This requires expertise in complex tax laws (e.g., IRC 409A) and the design of plans that can attract and retain C-suite talent.

- Mergers & Acquisitions (M&A): VPs who specialize in benefits diligence during M&A are critical. They analyze the target company's plans, identify liabilities, and create the strategy for merging the plans post-acquisition. This is project-based, high-stakes work that pays very well.

### ### In-Demand Skills

Beyond your title and experience, a specific set of high-value skills will make you a more attractive candidate and give you leverage in salary negotiations.

- Hard Skills:

- Deep ERISA & Regulatory Knowledge: This is non-negotiable. You must be an expert in the legal framework governing retirement plans.

- Financial Modeling & Data Analytics: The ability to model the financial impact of plan changes, analyze large datasets on participant behavior, and use data to tell a compelling story to leadership is crucial.

- Investment Analysis: A strong understanding of asset allocation, investment theory, and different fund structures (mutual funds, ETFs, collective investment trusts).

- Vendor Negotiation & Contract Management: The ability to negotiate favorable terms and pricing with multi-million dollar vendors directly impacts the company's bottom line and plan expenses.

- Soft Skills:

- Strategic Thinking: Moving beyond day-to-day administration to see how the retirement program fits into the company's broader goals for talent, finance, and risk management.

- Executive Presence & Communication: The ability to confidently and clearly present complex information to the C-suite and Board of Directors.

- Leadership & Influence: Inspiring your own team and influencing other senior leaders across the organization (e.g., CFO, Chief Legal Officer) to support your initiatives.

- Change Management: Successfully guiding an organization and its employees through significant changes to their benefits, such as a pension freeze or a new 401(k) recordkeeper.

Job Outlook and Career Growth

For those investing the time and effort to reach the executive level, the job outlook for a Vice President of Retirement Services is stable and promising. While specific data for this niche executive role isn't tracked individually by the U.S. Bureau of Labor Statistics (BLS), we can gain powerful insights by examining the broader categories under which this role falls: Top Executives and Financial Managers.

The BLS projects that employment for Top Executives is expected to grow by 3 percent from 2022 to 2032, which is about as fast as the average for all occupations. This translates to about 213,900 projected job openings each year, on average, over the decade. Many of those openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire (Source: U.S. Bureau of Labor Statistics, Occupational Outlook Handbook, Top Executives).

Similarly, the outlook for Financial Managers, a role that often serves as