The title "Vice President" at an elite investment bank like Goldman Sachs signifies a significant milestone in a finance professional's career. It represents years of dedication, deep expertise, and the potential for substantial financial reward. For those aspiring to climb the ranks of Wall Street, understanding the compensation structure for this role is crucial. A Vice President (VP) position at Goldman Sachs is a highly sought-after role, with total compensation packages that often range from $350,000 to over $600,000 annually, and sometimes even higher.

This article provides a data-driven analysis of a VP's salary at Goldman Sachs, exploring the key components of their compensation and the factors that influence their earning potential.

What Does a Vice President at Goldman Sachs Do?

First, it's essential to understand that "Vice President" in investment banking is a mid-level managerial rank, not an executive board position as it is in many other industries. The typical hierarchy at a firm like Goldman Sachs is Analyst -> Associate -> Vice President -> Managing Director -> Partner.

A VP acts as the primary project manager on deals and client interactions. Their responsibilities are a significant step up from the Associate level and typically include:

- Managing Deal Teams: Overseeing the work of Analysts and Associates, ensuring the quality and accuracy of financial models, pitch books, and due diligence.

- Client Relationship Management: Serving as a key point of contact for clients, participating in meetings, and helping to build and maintain long-term relationships.

- Transaction Execution: Playing a critical role in the day-to-day execution of mergers and acquisitions (M&A), initial public offerings (IPOs), and other financing deals.

- Business Development: Assisting Managing Directors in pitching new ideas and winning business from prospective clients.

A VP is the engine of the deal team, blending analytical prowess with developing managerial and client-facing skills.

Average VP Salary at Goldman Sachs

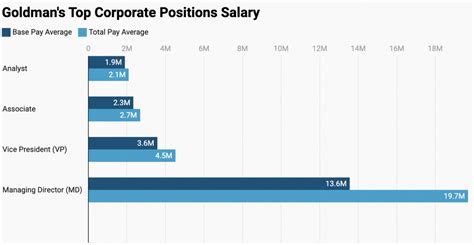

Compensation for a Goldman Sachs VP is composed of two main parts: a base salary and a significant year-end bonus (variable compensation) tied to both individual and firm performance.

According to recent data from authoritative sources, the compensation for a Vice President at Goldman Sachs breaks down as follows:

- Average Base Salary: Data from Salary.com places the typical base salary for a Vice President at Goldman Sachs in the range of $201,154 to $277,532, with an average around $231,901 as of late 2023.

- Average Total Compensation (Base + Bonus): The bonus is what truly defines the earning potential. Glassdoor reports an estimated total pay of $396,000 per year, with a likely range between $290,000 and $559,000. Data from Levels.fyi, which focuses on verified professionals, often shows total compensation for first-year VPs starting around $400,000 and climbing well past $500,000 for more senior VPs.

It is crucial to note that the bonus component can vary dramatically year-to-year based on the economic climate, deal flow, and the firm's overall profitability.

Key Factors That Influence Salary

A VP's salary is not a single, fixed number. It's influenced by a combination of factors, from individual background to market forces.

### Years of Experience

In the structured world of investment banking, experience is directly correlated with compensation. A first-year VP, typically with 5-7 years of total industry experience, will be at the lower end of the compensation band. In contrast, a third-year or senior VP who is being considered for promotion to Managing Director will command a significantly higher base salary and a larger bonus, often exceeding the $600,000 mark in total compensation.

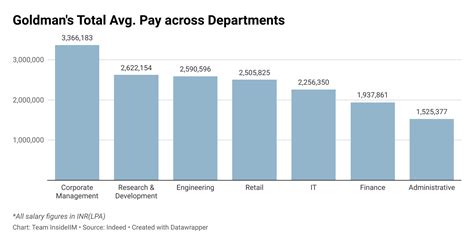

### Area of Specialization / Division

This is arguably the most significant factor. Goldman Sachs is a multi-faceted firm with several divisions, and compensation varies greatly between them.

- Front-Office (Revenue-Generating) Roles: VPs in the Investment Banking Division (IBD), particularly in high-deal-flow groups like M&A or Technology, Media, and Telecom (TMT), and those in Global Markets (Sales & Trading) typically earn the highest bonuses. Their compensation is directly linked to the revenue they help generate.

- Asset & Wealth Management: VPs in these divisions also have strong earning potential, but bonuses may be structured differently, often tied to assets under management (AUM) and investment performance.

- Back-Office and Middle-Office Roles: VPs in functions like Technology, Operations, Compliance, or Human Resources have competitive and robust salaries but will generally have a lower variable compensation (bonus) component compared to their front-office counterparts. Their bonus is tied more to firm-wide and divisional performance rather than specific deal metrics.

### Geographic Location

Where a VP is based plays a major role in their base salary and, to a lesser extent, their bonus.

- Major Financial Hubs: New York City, London, and Hong Kong are the top-tier locations. VPs in these cities receive the highest base salaries to account for the high cost of living and the concentration of deal activity.

- Secondary Hubs: Offices in cities like Salt Lake City, Dallas, or Chicago offer very competitive salaries but may have a slightly lower base than New York. However, the lower cost of living in these locations can result in a higher disposable income. For example, a VP in New York may have a base of $250,000, while a counterpart in Salt Lake City might have a base of $200,000, but the difference in cost of living makes the comparison more complex than the numbers suggest.

### Level of Education

While performance and experience are paramount at the VP level, education plays a key role in the career path. The most common path to becoming an Associate (and subsequently a VP) is by obtaining a Master of Business Administration (MBA) from a top-tier business school. While it's possible to be promoted directly from Analyst to Associate without an MBA, the MBA path is a well-trodden and highly respected route that can accelerate career progression and earning potential.

Job Outlook

While the U.S. Bureau of Labor Statistics (BLS) does not track "Investment Banking Vice President" as a distinct profession, the outlook for related, senior financial roles is very strong. The BLS projects that employment for Financial Managers will grow 16 percent from 2022 to 2032, a rate described as "much faster than the average for all occupations."

This indicates a robust and sustained demand for skilled financial professionals who can manage capital, advise on investments, and navigate complex financial landscapes. While the industry is notoriously competitive and cyclical, top performers at elite institutions like Goldman Sachs will always be in high demand.

Conclusion

A career as a Vice President at Goldman Sachs represents the pinnacle of ambition for many in the finance industry. The path is demanding, but the rewards are substantial.

Here are the key takeaways for any aspiring professional:

- Expect High Total Compensation: While the base salary is strong, the performance-based bonus is what drives the exceptional earning potential, with total packages frequently landing in the $350,0.00 - $600,000+ range.

- Performance and Division are Key: Your specific role within the firm—whether in a front-office IBD group or a back-office technology team—will be the single biggest determinant of your bonus.

- Experience Matters: Compensation grows significantly as you progress from a first-year VP toward the Managing Director track.

- The Outlook is Strong: Despite economic cycles, the demand for high-caliber financial expertise remains robust, ensuring that a career path at a top-tier firm is a sound long-term investment in your professional future.

For those with the drive, analytical skill, and resilience to succeed, the role of a VP at Goldman Sachs is not just a job—it's a launchpad for a powerful and rewarding career in global finance.