In the complex landscape of employment law, few topics create more confusion—and more significant financial and legal risk—for both employers and employees than the distinction between "exempt" and "non-exempt" status. In Washington State, this distinction has become even more critical. With some of the most progressive and protective labor laws in the nation, Washington has established a minimum salary threshold for exempt employees that is dramatically higher than the federal standard. Understanding this threshold for 2024 isn't just a matter of compliance; it's a fundamental aspect of fair compensation, business sustainability, and career management.

Whether you are a business owner trying to classify your team correctly, an HR professional tasked with navigating this intricate legal framework, or a salaried professional wondering if your compensation aligns with state law, this guide is for you. We will dissect the rules, explore the financial implications, and provide a clear roadmap for navigating Washington's exempt salary requirements. The 2024 minimum annual salary for an exempt employee in Washington is $67,724.80, a figure that often surprises those accustomed to federal guidelines. But the number itself is only the beginning of the story.

I once consulted for a fast-growing tech startup where the founders, brilliant in their technical field, had promoted several early employees to "manager" roles. They gave them a flat salary, thinking this was the hallmark of a "professional" position. However, these managers spent over 80% of their time on the same frontline tasks as their teams, and their salary fell just short of the state's rising threshold. The subsequent wage and hour audit was a painful, expensive lesson in the importance of understanding not just the salary test, but the "duties test" as well. This guide is designed to help you avoid such pitfalls and master this crucial area of professional life.

### Table of Contents

- [What Does "Salaried Exempt" Mean in Washington State?](#what-does-salaried-exempt-mean-in-washington-state)

- [Washington's 2024 Minimum Salary Threshold: A Deep Dive](#washingtons-2024-minimum-salary-threshold-a-deep-dive)

- [Key Factors Impacting Exempt Status & Actual Salary](#key-factors-impacting-exempt-status-actual-salary)

- [The Future of Exempt Salary Rules & Compliance in Washington](#the-future-of-exempt-salary-rules-compliance-in-washington)

- [How to Navigate Exempt Status: A Guide for Employers & Employees](#how-to-navigate-exempt-status-a-guide-for-employers-employees)

- [Conclusion: Mastering the Rules for a Fair and Compliant Workplace](#conclusion-mastering-the-rules-for-a-fair-and-compliant-workplace)

What Does "Salaried Exempt" Mean in Washington State?

Before we can dive into the numbers, we must first build a solid foundation. What does it actually mean to be an "exempt" employee? The term refers to being *exempt* from the minimum wage and overtime protections of the federal Fair Labor Standards Act (FLSA) and the Washington Minimum Wage Act.

Non-Exempt Employees:

- Must be paid at least the state minimum wage for all hours worked. In 2024, Washington's minimum wage is $16.28 per hour.

- Must be paid overtime, calculated at 1.5 times their regular rate of pay, for all hours worked over 40 in a workweek.

- Are typically (but not always) paid on an hourly basis.

Exempt Employees:

- Are paid a fixed salary that does not change based on the quantity or quality of work performed.

- Are not entitled to overtime pay, regardless of whether they work 45, 60, or more hours in a week.

- Must meet specific criteria regarding their job duties and be paid a salary that meets or exceeds a legally mandated threshold.

For an employee in Washington to be properly classified as exempt, they must meet all three of the following tests:

1. The Salary Basis Test: The employee must be paid a predetermined, fixed salary that is not subject to reduction because of variations in the quality or quantity of work.

2. The Salary Threshold Test: The employee's salary must meet or exceed the minimum threshold set by Washington State law. This is the primary focus of our guide.

3. The Duties Test: The employee’s primary job duties must fit into one of the state-recognized exempt categories: Executive, Administrative, Professional, Computer Professional, or Outside Salesperson.

This "Duties Test" is where many employers make mistakes. Simply giving someone a manager title and a salary is not enough. The employee's *actual, day-to-day responsibilities* must align with the legal definitions.

- Executive Exemption: Primary duty is managing the enterprise or a recognized department. They must customarily and regularly direct the work of at least two or more other full-time employees and have the authority to hire or fire (or their recommendations must be given particular weight).

- Administrative Exemption: Primary duty must be the performance of office or non-manual work directly related to the management or general business operations of the employer or the employer’s customers. The role must include the exercise of discretion and independent judgment with respect to matters of significance.

- Professional Exemption: This splits into two types:

- Learned Professional: Primary duty requires advanced knowledge in a field of science or learning, customarily acquired by a prolonged course of specialized intellectual instruction (e.g., doctors, lawyers, engineers, architects, teachers).

- Creative Professional: Primary duty requires invention, imagination, originality, or talent in a recognized field of artistic or creative endeavor (e.g., writers, musicians, artists).

- Computer Professional Exemption: Specific roles like systems analysts, computer programmers, and software engineers whose primary duties meet a high-level criteria. In Washington, these roles can sometimes be paid on an hourly basis (at a very high rate) and still be exempt.

- Outside Sales Exemption: Primary duty is making sales or obtaining orders/contracts for services, and they must be customarily and regularly engaged *away* from the employer’s place of business. This is the only category that does not have a minimum salary requirement.

### A Tale of Two Employees: The Difference in Practice

To make this concrete, let's imagine two "Store Managers" working at a retail chain in Bellevue, Washington.

- Employee A (Properly Exempt): Maria is the Store Manager. Her salary is $85,000 per year. Her primary duties include hiring, training, and scheduling her team of 15 employees. She analyzes sales reports to develop store strategy, manages the store's budget, handles escalated customer complaints, and has the final say on inventory purchasing. While she might occasionally help on the cash register during a major rush, over 70% of her time is spent on management and operational strategy. Maria's role fits the Executive Exemption. She meets the salary basis test, the salary threshold test, and the duties test. She is not owed overtime if she works 50 hours during the holiday season.

- Employee B (Misclassified): David is also called a "Store Manager," but at a smaller location. His salary is $65,000 per year. While he has the "manager" title, he spends nearly 80% of his day working the cash register, stocking shelves, and cleaning—the exact same tasks as the three hourly employees he "supervises." His authority is limited; he cannot hire or fire without approval from a district manager, and all inventory and sales strategies are dictated by corporate.

In this scenario, David is misclassified. First, his 2024 salary of $65,000 is below the state's minimum threshold of $67,724.80. Second, his primary duties do not involve management or the exercise of independent judgment. He is a frontline worker with a manager title. Legally, David should be classified as non-exempt and paid for all his hours worked, including overtime for any week he works over 40 hours. If he were to file a wage complaint, his employer could be liable for years of back overtime pay, plus penalties.

Washington's 2024 Minimum Salary Threshold: A Deep Dive

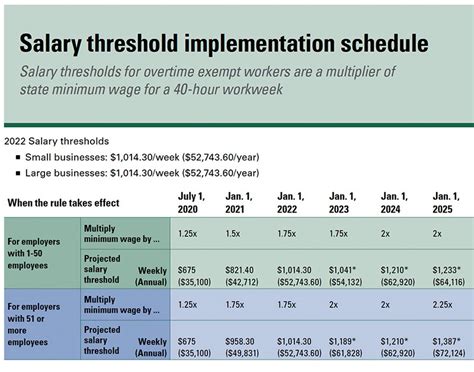

This is the core of the issue for so many businesses and professionals in the state. Washington has implemented a multi-year schedule to significantly increase the minimum salary an exempt employee must be paid. This schedule is designed to ensure that the overtime protections of the Minimum Wage Act are not eroded by inflation and that salaried status is reserved for genuinely higher-paid, professional-level employees.

The threshold is not an arbitrary number. It is calculated as a *multiplier* of the state's hourly minimum wage. This dynamic formula means that every time the state minimum wage increases due to inflation, the exempt salary threshold also automatically increases.

The Official 2024 Numbers

The Washington State Department of Labor & Industries (L&I) is the authoritative body that sets and enforces these rules. According to L&I, the calculation for 2024 is as follows:

- 2024 Washington State Minimum Wage: $16.28 per hour.

- 2024 Salary Threshold Multiplier: 2.0 times the minimum wage. (Note: As of 2024, the multiplier is the same for all business sizes).

The Calculation:

The state calculates the annual salary based on a standard 40-hour workweek for 52 weeks a year.

- Minimum Weekly Salary: $16.28 (min. wage) x 40 (hours) x 2.0 (multiplier) = $1,302.40 per week

- Minimum Annual Salary: $1,302.40 (weekly salary) x 52 (weeks) = $67,724.80 per year

Any employee classified as exempt under the Executive, Administrative, or Professional categories in 2024 must be paid a salary of at least $67,724.80 per year, which equates to $1,302.40 per week.

### How Washington Compares to the Federal Standard

To understand how significant Washington's rule is, it's essential to compare it to the federal standard set by the U.S. Department of Labor.

| Rule Type | Federal FLSA Standard (as of early 2024) | Washington State Standard (2024) | Difference |

| :--- | :--- | :--- | :--- |

| Minimum Weekly Salary | $684 | $1,302.40 | +$618.40 (90% higher) |

| Minimum Annual Salary | $35,568 | $67,724.80 | +$32,156.80 (90% higher) |

As the table clearly shows, Washington's minimum salary threshold is 90% higher than the federal requirement. This is a critical distinction. An employer who is only aware of the federal rule would be grossly out of compliance in Washington State. When state and federal laws conflict, the employer must follow the law that is more generous to the employee. In this case, Washington's law is far more protective and is the one that must be followed.

### The Future Schedule: Where Are We Headed?

Washington's plan is phased. The salary threshold will continue to increase until it reaches 2.5 times the minimum wage in 2028.

| Year | Multiplier for All Businesses | Estimated Annual Salary (based on projected min. wage) |

| :--- | :--- | :--- |

| 2024 | 2.0x | $67,724.80 |

| 2025 | 2.0x | To be determined by 2025 min. wage |

| 2026 | 2.25x | To be determined by 2026 min. wage |

| 2027 | 2.25x | To be determined by 2027 min. wage |

| 2028 | 2.5x | To be determined by 2028 min. wage |

*(Source: Washington State Department of Labor & Industries, Exempt Salaried Employees)*

This forward-looking schedule signals to businesses that they must plan for continued increases in labor costs for their salaried workforce. For employees, it provides a clear and predictable path toward higher guaranteed salary levels for exempt work.

### Compensation Components: What Counts Towards the Salary Threshold?

The rule specifies that the employee must receive their full salary "free and clear." This means that deductions for things like cash register shortages, damaged equipment, or the cost of uniforms cannot bring the employee's pay below the minimum salary threshold.

Importantly, the L&I rule states that bonuses, commissions, and other forms of non-guaranteed compensation cannot be used to meet the minimum salary requirement. The employee's base salary alone must meet or exceed the $1,302.40 per week threshold. An employee with a base salary of $60,000 who receives a $10,000 bonus at the end of the year is still not legally exempt, because their guaranteed weekly pay does not meet the test. This is another common and costly mistake for employers.

Key Factors Impacting Exempt Status & Actual Salary

While the state sets the *minimum* salary for an exempt position, the *actual* salary an exempt employee earns is influenced by a host of factors. The $67,724.80 figure is the floor, not the ceiling. For many professional roles in Washington, especially in high-cost-of-living areas, this floor is often viewed as an entry-level salary for a professional career.

Let's explore the key variables that determine both the validity of the exempt classification and the real-world compensation an individual can expect to command.

### `

`Level of Education and Specialization`

`Education is a cornerstone of the "Learned Professional" exemption. The duties of the role must require knowledge customarily acquired through a prolonged course of specialized study.

- Impact on Exemption: A role requiring a Juris Doctor (for a lawyer), a Doctor of Medicine (for a physician), or a Professional Engineer (P.E.) license inherently meets the educational component of the duties test. A generic "bachelor's degree" is often not considered specialized enough on its own, unless it's in a specific field like accounting for a CPA role.

- Impact on Salary: Advanced degrees and highly specialized knowledge directly translate to higher earning potential. An exempt Software Development Engineer with a Master's in Artificial Intelligence will command a significantly higher salary than one with a bachelor's in general computer science.

Example Salary Data for Specialized Exempt Roles in Washington:

- Financial Analyst (Bachelor's Degree): The typical salary range in Washington is $75,000 to $95,000. (Source: Salary.com, 2024)

- Licensed Architect (Master's Degree + Licensure): The average salary in Seattle is approximately $105,000, with senior roles easily exceeding $150,000. (Source: Glassdoor, 2024)

- Biomedical Engineer (Advanced Degree): The median salary in the Seattle metropolitan area is around $112,000. (Source: U.S. Bureau of Labor Statistics, May 2023)

These figures demonstrate that while the state minimum is $67,725, the market rate for roles requiring specialized education is substantially higher.

### `

`Years of Experience`

`Experience is a powerful driver of both responsibility and compensation. As an employee gains experience, their duties are more likely to involve the discretion and independent judgment required for the Administrative exemption or the management authority for the Executive exemption.

- Impact on Exemption: An "entry-level manager" might not meet the duties test if they spend most of their time doing the work of their subordinates. A senior manager with 10 years of experience, however, is far more likely to be primarily focused on strategic tasks like budgeting, long-range planning, and personnel development, thus solidifying their exempt status.

- Impact on Salary: The salary growth trajectory for exempt roles is steep. Companies pay a premium for proven expertise and a track record of success.

Salary Progression by Experience for an Exempt Role (e.g., Marketing Manager in Washington):

| Experience Level | Typical Title | Typical Salary Range (Washington State) |

| :--- | :--- | :--- |

| Entry-Level (0-3 years) | Marketing Coordinator, Junior Manager | $68,000 - $80,000 |

| Mid-Career (4-8 years) | Marketing Manager, Brand Manager | $90,000 - $130,000 |

| Senior (8-15+ years) | Senior Marketing Manager, Director | $140,000 - $200,000+ |

*(Source: Data compiled and synthesized from Payscale and Glassdoor, 2024)*

As you can see, an experienced manager's salary is more than double the state's minimum exempt threshold, reflecting the value the market places on their accumulated skills and judgment.

### `

`Geographic Location`

`While the minimum exempt salary is a statewide rule, the cost of living and competition for talent vary dramatically across Washington. The market pressures in the Seattle-Bellevue-Redmond tech corridor are vastly different from those in Spokane, Yakima, or the Tri-Cities.

- Impact on Exemption: Location doesn't change the legal duties test, but it does change the labor market dynamics. A small business in a rural area might struggle more to meet the $67,725 threshold for a manager than a large corporation in Seattle.

- Impact on Salary: This is where location has its greatest effect. Companies in high-cost-of-living (HCOL) areas must offer significantly higher salaries to attract and retain exempt-level talent.

Salary Comparison for an Exempt Role (e.g., Operations Manager) by WA City:

| City | Average Base Salary | Cost of Living Index (US Avg = 100) |

| :--- | :--- | :--- |

| Seattle | $125,500 | 165.7 |

| Bellevue | $128,000 | 188.4 |

| Spokane | $98,000 | 110.4 |

| Tacoma | $106,000 | 120.9 |

| Vancouver | $104,000 | 118.0 |

*(Source: Salary data from Salary.com, 2024; Cost of living data from Payscale, 2024)*

An Operations Manager in Bellevue can expect to earn around $30,000 more per year than their counterpart in Spokane for a similar role, a direct reflection of the enormous difference in housing costs and market competition.

### `

`Company Type & Size`

`The type of organization you work for has a profound impact on compensation and how these rules are applied.

- Impact on Exemption & Compliance: Large corporations (e.g., Amazon, Microsoft, Boeing) have extensive HR and legal departments dedicated to compliance. They are highly likely to classify employees correctly and often set their internal salary floors well above the state minimum to avoid any legal gray areas. Startups and small businesses, often operating with fewer resources, are at a higher risk of misclassification due to a lack of awareness or the inability to meet the high salary threshold.

- Impact on Salary:

- Large Corporations: Generally offer the highest base salaries, structured bonuses, and comprehensive benefits packages (stock options/RSUs, 401k matching, premium health insurance).

- Tech Startups: May offer a lower base salary but compensate with potentially lucrative stock options. The risk is higher, but so is the potential reward if the company succeeds.

- Non-Profits: Tend to offer lower salaries than for-profit entities due to budget constraints. They often attract employees with a mission-driven focus, but must still adhere to the same $67,725 minimum for their exempt staff.

- Government/Public Sector: Salaries are often transparent and set by pay scales. They offer excellent job security and benefits (pensions, generous leave), but may have a lower ceiling for top-end earnings compared to the private tech sector.

### `

`Industry Nuances`

`The industry in which a role exists is a massive determinant of salary. An exempt Project Manager in construction will have a different compensation structure than one in software development.

- Technology: By far the highest-paying sector in Washington. Roles in software engineering, cloud computing, AI/ML, and cybersecurity routinely start well above $100,000, even for relatively junior exempt positions.

- Healthcare: Strong salaries for clinical roles (doctors, physician assistants) and administrative roles (hospital administrators, practice managers). Providence, Swedish, and UW Medicine are major employers with competitive, structured pay.

- Aerospace & Manufacturing: Home to Boeing and its vast supply chain, this sector offers robust engineering, supply chain management, and program management salaries.

- Retail & Hospitality: This is an industry to watch closely. Management roles in this sector have historically been salaried positions. The high Washington threshold means many companies may have to re-evaluate, either significantly increasing manager salaries or reclassifying them as non-exempt and paying overtime.

- Agriculture: A major industry in Central and Eastern Washington. Exempt roles like farm operations managers must meet the same threshold, creating unique challenges for a sector with different economic pressures than urban tech.

### `

`In-Demand Skills`

`Beyond formal titles, specific skills can add a significant premium to an exempt employee's salary. In today's market, certain competencies are in such high demand that they can increase earning potential by 10-30% or more.

High-Value Skills for Exempt Professionals in Washington:

- Cloud Computing & DevOps: Expertise in AWS, Azure, or Google Cloud Platform, along with skills in containerization (Docker, Kubernetes) and CI/CD pipelines.

- Data Science & Analytics: Proficiency in Python or R, machine learning frameworks, data visualization tools (Tableau, Power BI), and SQL.

- Cybersecurity: Certifications like CISSP or CISM, and experience in network security, threat intelligence, or compliance (SOC 2, ISO 27001).

- Project & Product Management: Agile/Scrum certifications (CSM, CSPO), experience with tools like Jira, and a proven ability to lead products from conception to launch.

- Business Development & Sales Strategy: A demonstrable track record of exceeding revenue targets, particularly in B2B or SaaS sales environments.

- Digital Marketing & SEO/SEM: Expertise in performance marketing, lead generation, and managing large advertising budgets with a positive ROI.

An exempt employee who proactively develops and demonstrates these skills is not just solidifying their value but is also positioning themselves for roles that pay far beyond the legal minimum.

The Future of Exempt Salary Rules & Compliance in Washington

The landscape of work and compensation is not static. The rules in place for 2024 are part of a larger trend, and both employers and employees must be prepared for