Earning $23 an hour is a significant financial milestone. It's a figure that often represents a transition from entry-level wages to a stable, professional income—a launchpad for a thriving career and a more secure financial future. For many, hitting this number feels like unlocking a new level of professional respect and personal capability. It’s the point where you can begin to plan, save, and invest with more confidence.

But what does a $23-per-hour wage truly mean in the grand scheme of your career? How does it translate into an annual salary? What kinds of jobs pay this rate, and more importantly, what is the long-term growth potential from this starting point? This guide is designed to answer all those questions and more. We will move beyond the simple math and delve into the strategic decisions that can turn a $23/hour job into a lucrative and fulfilling long-term career.

As a career analyst, I've seen countless professionals begin their journeys at this exact pay level. I remember a client, a skilled administrative professional, who initially felt that $23 an hour was her ceiling. Through strategic skill development and a better understanding of her market value, she leveraged that position to become an executive assistant to a C-suite leader, more than doubling her income within five years. Her story underscores a critical truth: a $23/hour role is not an endpoint; it's a powerful and promising beginning.

This comprehensive article will serve as your roadmap. We will dissect the annual salary, explore the jobs available at this rate, analyze the critical factors that can increase your pay, and lay out a clear, step-by-step plan to help you get started and advance.

### Table of Contents

- [What Does a $23/Hour Role Look Like?](#what-does-a-23hour-role-look-like)

- [The $23/Hour Salary: A Deep Dive into Your Annual Earnings](#the-23hour-salary-a-deep-dive-into-your-annual-earnings)

- [Key Factors That Influence Your Salary](#key-factors-that-influence-your-salary)

- [Job Outlook and Career Growth from a $23/Hour Position](#job-outlook-and-career-growth-from-a-23hour-position)

- [How to Get a $23/Hour Job (and Grow Beyond It)](#how-to-get-a-23hour-job-and-grow-beyond-it)

- [Conclusion: Your $23/Hour Salary as a Career Launchpad](#conclusion-your-23hour-salary-as-a-career-launchpad)

What Does a $23/Hour Role Look Like?

A wage of $23 an hour translates to an annual gross salary of approximately $47,840. This figure places you squarely in the heart of the American workforce. In fact, according to the U.S. Bureau of Labor Statistics (BLS), the median hourly wage for all occupations in the United States was $23.11 in May 2023. This means that earning $23 an hour puts you right at the national midpoint—a solid foundation upon which to build a career.

Jobs that pay in this range are typically not entry-level, minimum-wage positions. They require a specific set of skills, some level of post-secondary education or training, and a degree of professional responsibility. These are the crucial roles that keep businesses, non-profits, and government agencies running smoothly. Professionals in this bracket are often the operational backbone of their organizations.

The work is characterized by a blend of technical competency and essential soft skills. You are expected to be proficient with specific software, understand industry-specific procedures, and communicate effectively with colleagues, clients, and vendors.

### Common Job Titles and Industries at the $23/Hour Mark

While this pay rate spans numerous industries, several key professions frequently fall within the $22 to $25 per hour range, especially for professionals with a few years of experience.

- Administrative and Office Support:

- Administrative Assistant: Manages schedules, coordinates meetings, prepares reports, and handles office communications.

- Executive Assistant (Entry to Mid-Level): Provides high-level support to one or more executives, requiring exceptional organization and discretion.

- Office Manager: Oversees the daily operations of an office, including supervising staff, managing budgets, and ensuring efficiency.

- Finance and Business Operations:

- Bookkeeper / Accounting Clerk: Records financial transactions, manages accounts payable and receivable, and assists with financial reporting.

- Payroll Clerk/Specialist: Processes employee payroll, ensures tax compliance, and manages benefits deductions.

- Human Resources Assistant: Supports HR functions like recruiting, onboarding, benefits administration, and maintaining employee records.

- Information Technology (IT):

- IT Support Specialist (Tier 1 or 2): Provides technical assistance and troubleshooting for hardware, software, and network issues.

- Help Desk Technician: The first line of support for users experiencing technical difficulties.

- Healthcare Support:

- Medical Biller and Coder: Translates medical procedures into standardized codes for billing insurance companies.

- Certified Medical Assistant (with experience): Performs both administrative and clinical tasks in a healthcare setting.

- Skilled Trades and Technicians:

- HVAC Technician (Apprentice/Junior): Installs, maintains, and repairs heating, ventilation, and air conditioning systems.

- Maintenance and Repair Worker: Performs routine maintenance on buildings, machinery, and equipment.

### A Day in the Life of a $23/Hour Professional

To make this more tangible, let’s imagine a composite "Day in the Life" for a professional in this earning bracket. We'll blend tasks from an Administrative, IT, and Bookkeeping role to illustrate the level of responsibility and skill involved.

8:45 AM: Arrive at the office (or log in remotely). Start the day by reviewing your email inbox and task management software (like Asana or Trello). You flag urgent requests: an executive needs a meeting rescheduled, an employee has a password reset issue, and an invoice from a key vendor is due.

9:15 AM: You tackle the urgent tasks first. You skillfully navigate the executive's packed calendar to find a new meeting slot, communicate the change to all attendees, and update the calendar invite. You then access the IT support portal, reset the employee's password, and send them a confirmation with instructions.

10:00 AM: Time for focused project work. Today, you're responsible for compiling the monthly expense report. You log into the accounting software (like QuickBooks or NetSuite), export the raw data, and begin organizing it in Microsoft Excel. You use formulas and PivotTables to categorize spending and identify any variances from the budget.

12:00 PM: Lunch break.

1:00 PM: You attend a weekly team meeting. You’re responsible for taking minutes, but you’re also an active participant. You provide an update on your projects and offer suggestions on how to improve the current workflow for processing invoices, drawing on your direct experience.

2:00 PM: A new challenge arises. The office printer network is down, affecting the entire department. Instead of just reporting it, you perform initial troubleshooting steps based on your training: checking connections, restarting the print server, and consulting the knowledge base for common issues.

3:30 PM: You dedicate time to vendor and client communication. You call the vendor whose invoice you flagged this morning to clarify a line item, ensuring accurate payment. You then draft a polite, professional email to a client regarding an overdue payment, following company protocol.

4:45 PM: You wrap up your day by organizing your files, updating your task list for tomorrow, and sending a summary of the meeting minutes to the team. You log off, feeling a sense of accomplishment from having solved problems and moved important business functions forward.

This "day in the life" showcases the blend of reactive problem-solving and proactive project management common in these roles. You are not just following a list of tasks; you are a trusted operator who thinks critically and contributes directly to the organization's success.

The $23/Hour Salary: A Deep Dive into Your Annual Earnings

Understanding your salary goes far beyond a single number. While $23 an hour is the starting point, it's crucial to analyze what this means annually, how it fits into the broader economic landscape, and—most importantly—how total compensation can dramatically increase your overall earnings.

### The Basic Calculation: From Hourly to Annual

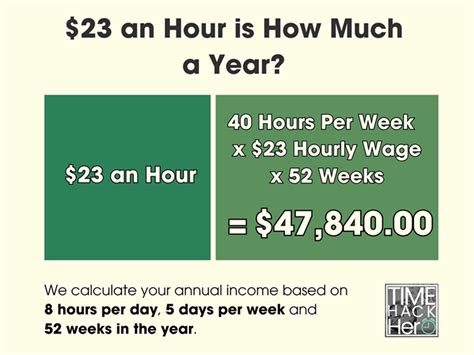

The standard formula for converting an hourly wage to an annual salary assumes a full-time schedule of 40 hours per week for 52 weeks a year.

$23 per hour × 40 hours per week = $920 per week

$920 per week × 52 weeks per year = $47,840 per year

This $47,840 is your gross annual income. It's the number that will appear on your employment offer letter. However, it's not the amount you'll see in your bank account. Your net income, or take-home pay, will be lower after deductions for:

- Federal, state, and local income taxes

- Social Security and Medicare taxes (FICA)

- Health, dental, and vision insurance premiums

- Retirement contributions (e.g., 401(k) or 403(b))

- Other potential deductions (e.g., life insurance, disability insurance)

The exact amount of these deductions varies significantly based on your geographic location (state and local taxes), your filing status (single, married, etc.), the number of dependents you have, and the benefit choices you make. As a rough estimate, you can expect deductions to account for 20-30% of your gross pay.

### Salary Trajectory: From Entry-Level to Senior Professional

A $23/hour wage is often characteristic of a professional who has moved beyond the entry-level phase but is not yet considered a senior expert. The salary landscape for these roles shows a clear and promising growth trajectory with experience.

Let's use a common role, the Administrative Assistant, as an example to illustrate this progression. Salary data from major aggregators paints a clear picture.

Typical Salary Ranges by Experience Level (Administrative Professional)

| Experience Level | Hourly Wage Range | Annual Salary Range | Description of Role & Responsibilities |

| :--- | :--- | :--- | :--- |

| Entry-Level (0-2 Years) | $18 - $22 / hour | $37,440 - $45,760 | Performs basic administrative tasks like data entry, answering phones, scheduling, and managing office supplies. Requires direct supervision. |

| Mid-Career (3-5 Years) | $22 - $28 / hour | $45,760 - $58,240 | This is the $23/hour sweet spot. Handles more complex tasks, manages small projects, supports multiple team members, and works with greater autonomy. |

| Experienced (6-9 Years) | $26 - $34 / hour | $54,080 - $70,720 | Often specializes (e.g., Legal Admin, Senior Admin). May supervise junior staff, manage department-level projects, or support senior managers. |

| Senior/Lead (10+ Years) | $32 - $45+ / hour | $66,560 - $93,600+ | Typically an Executive Assistant to C-suite leaders. Involves strategic calendar management, complex travel coordination, event planning, and acting as a gatekeeper. |

*(Sources: Data compiled and synthesized from Payscale, Glassdoor, and Salary.com, updated for 2024. Ranges are national averages and can vary significantly by location and industry.)*

This table clearly demonstrates that a career path starting around $23 an hour has significant upward mobility. The key is to actively pursue the skills and responsibilities that define the next level.

### Beyond the Paycheck: The Full Value of Total Compensation

Focusing solely on the hourly wage or annual salary is one of the biggest mistakes a professional can make. Total compensation provides a much more accurate picture of your financial reality. It includes your base salary plus the monetary value of all the benefits, perks, and bonuses your employer provides. These elements can add 15% to 40% to your base salary's value.

Here's a breakdown of the key components of total compensation:

- Bonuses: Many companies offer performance-based bonuses. For a professional earning $47,840, an annual bonus could range from 3% to 10% of their salary ($1,400 - $4,700), rewarding excellent performance or company-wide success.

- Health Insurance: This is a massive financial benefit. The average annual premium for employer-sponsored health insurance for single coverage was $8,435 in 2023, with employers covering about 83% of that cost, or nearly $7,000 (Source: KFF 2023 Employer Health Benefits Survey). This is non-taxed compensation that you would otherwise have to pay for yourself.

- Retirement Savings Plans (401k/403b): The employer match is free money. A common matching formula is 100% of your contribution up to 3-6% of your salary. If you earn $47,840 and your employer matches 5%, that's an extra $2,392 per year added directly to your retirement savings.

- Paid Time Off (PTO): This includes vacation days, sick leave, and paid holidays. An employee with 15 vacation days, 5 sick days, and 10 paid holidays receives 30 paid days off per year. That's 6 weeks of paid time, which has a direct monetary value of approximately $5,520 at a $23/hour rate.

- Professional Development & Tuition Reimbursement: Many companies invest in their employees' growth. A professional development stipend ($500 - $2,000 per year) or tuition assistance (often $5,250 per year, the maximum tax-free amount) is a direct investment in your future earning potential.

- Other Perks: Don't underestimate the value of other benefits like:

- Life and disability insurance

- Flexible spending accounts (FSAs) or health savings accounts (HSAs)

- Commuter benefits

- Wellness stipends (gym memberships)

- Employee stock purchase plans (ESPPs)

When you add it all up, a $47,840 salary can easily be part of a total compensation package worth $60,000 to $70,000 or more. When evaluating a job offer, always look beyond the base salary and analyze the entire benefits package.

Key Factors That Influence Your Salary

While $23 an hour is a national median, your personal earning potential is not fixed. It's a dynamic figure influenced by a combination of your skills, choices, and circumstances. Understanding these factors is the first step toward strategically increasing your income. This section provides a detailed analysis of the six primary drivers of salary for professionals in this bracket.

###

1. Level of Education and Certifications

Your educational background and specialized credentials are foundational to your earning power. While many roles at the $23/hour level do not strictly require a bachelor's degree, having one often provides a competitive edge and a higher starting salary. More importantly, targeted certifications can provide a significant and immediate return on investment.

- High School Diploma vs. Post-Secondary Education: While some administrative or trade roles are accessible with a high school diploma and relevant experience, an Associate's Degree from a community college (e.g., in Business Administration, Accounting, or IT) can make you a much stronger candidate. It signals a baseline level of knowledge and commitment. A Bachelor's Degree (e.g., in Business, Communications, or a related field) typically places you at the higher end of the pay scale for these roles and is often a prerequisite for future management positions.

- The Power of Certifications: For many practical roles, certifications are more impactful than an advanced degree. They are laser-focused, industry-recognized credentials that validate specific, in-demand skills.

- For Administrative Professionals: The Certified Administrative Professional (CAP) designation offered by the International Association of Administrative Professionals (IAAP) is a prestigious credential that can significantly boost earning potential and career opportunities.

- For Bookkeeping and Accounting Clerks: Becoming a QuickBooks Certified User or a QuickBooks Certified ProAdvisor demonstrates mastery of the most common accounting software for small and medium-sized businesses. The American Institute of Professional Bookkeepers (AIPB) also offers a Certified Bookkeeper (CB) designation that signals a high level of expertise.

- For IT Support Specialists: The CompTIA A+ certification is the industry standard for establishing a career in IT support. Further certifications like CompTIA Network+ or Google IT Support Professional Certificate can lead to higher pay and more specialized roles. A professional with an A+ and Network+ certification can often command a starting wage closer to $25-$30 per hour compared to a non-certified peer.

###

2. Years of Experience

Experience is arguably the most significant factor in salary growth. Employers pay for proven results and reduced risk. An experienced professional requires less training, makes fewer errors, and can handle more complex situations with autonomy. As we saw in the salary trajectory table, the journey from an entry-level professional to a senior lead is marked by substantial pay increases at each stage.

- 0-2 Years (The Learning Phase): In this stage, you are primarily learning the ropes, mastering core software, and understanding company procedures. Your value is in your potential and your ability to learn quickly. Your salary will typically be in the bottom quartile for your role.

- 3-5 Years (The Competency Phase): You have mastered the fundamentals and can now work independently. You begin to anticipate needs, troubleshoot common problems, and perhaps take the lead on small projects. This is where you cross the $23/hour threshold and become a reliable core member of the team.

- 6-9 Years (The Expertise Phase): You are now a subject matter expert in your domain. You might train junior employees, manage complex projects, or specialize in a high-value area (e.g., supporting C-level executives, managing the books for a specific grant, or specializing in network security). Your salary should be well above the median.

- 10+ Years (The Strategic Phase): With a decade or more of experience, you transition from purely operational work to more strategic responsibilities. As an Executive Assistant, you act as a strategic partner to your executive. As a senior IT technician, you might design new systems or manage a help desk team. As a lead bookkeeper, you could be on the path to becoming a Controller. Salaries at this level are in the top 10-25% for the profession.

###

3. Geographic Location

Where you live and work has a profound impact on your salary. A $23/hour wage can feel very different in a low-cost-of-living rural area compared to a major metropolitan center. Companies adjust their pay scales based on the local market rate for talent and the cost of living.

- High-Paying Metropolitan Areas: Major tech hubs and financial centers typically offer the highest salaries to attract top talent in a competitive market.

- Example for an Administrative Assistant: According to Salary.com (2024), the median salary for an Administrative Assistant in San Jose, CA, is around $60,000/year (~$29/hour), and in New York, NY, it's around $58,000/year (~$28/hour).

- Example for an IT Support Specialist: Data from Glassdoor (2024) shows that salaries in cities like Seattle, WA, and Boston, MA, are often 15-25% higher than the national average.

- Lower-Paying States and Rural Areas: Conversely, salaries are generally lower in states with a lower cost of living.

- Example for a Bookkeeper: The same role that pays $25/hour in a major city might pay $19-$21/hour in parts of Mississippi, Arkansas, or West Virginia.

- The Cost of Living (COL) Caveat: A higher salary doesn't automatically mean more wealth. The crucial factor is your purchasing power. A $60,000 salary in San Francisco may leave you with less disposable income than a $48,000 salary in Omaha, Nebraska, due to dramatic differences in housing, transportation, and taxes. Before