For ambitious professionals in accounting, finance, and consulting, reaching the level of Partner at a "Big Four" firm like PricewaterhouseCoopers (PwC) represents the pinnacle of a career. It’s a role associated with immense prestige, industry leadership, and, of course, significant financial reward. But what does that compensation actually look like?

While the journey is demanding, the earning potential for a PwC Partner is substantial, with total compensation often starting in the mid-six figures and soaring well into the millions for senior leaders. This article will break down the complexities of partner earnings, explore the key factors that dictate compensation, and provide a realistic view of what it takes to reach this elite professional tier.

What Does a PricewaterhouseCoopers Partner Do?

Before diving into the numbers, it's crucial to understand that a PwC Partner is much more than a senior employee. A Partner is a part-owner of the firm. This distinction is fundamental to how they are compensated. Their role is multifaceted and carries ultimate accountability, typically revolving around three core responsibilities:

1. Business Development: Partners are the primary rainmakers. They are responsible for generating new business, cultivating a robust client pipeline, and expanding the firm's market share.

2. Client Relationship and Service Delivery: They serve as the final authority on major client engagements. They build and maintain trust with C-suite executives, ensure the highest quality of service delivery, and manage the firm's most critical relationships.

3. Firm Leadership and Stewardship: Partners guide the firm's strategic direction. They mentor and develop junior staff, manage the profitability of their practice area, and uphold the firm's values and standards.

In essence, they transition from being excellent practitioners (auditors, consultants, tax advisors) to being owners and operators of a large, complex business.

Average PricewaterhouseCoopers Partner Salary

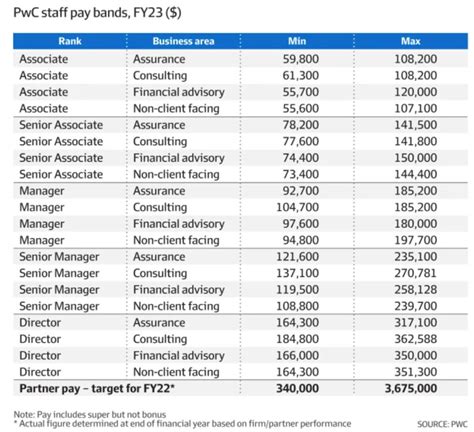

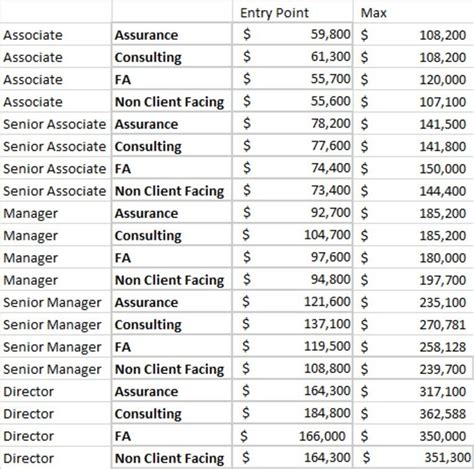

The term "salary" is slightly misleading when discussing partner compensation. Partners do not receive a traditional salary; instead, they receive a share of the firm's profits, often referred to as a "draw." This compensation is composed of a base draw, performance bonuses, and a portion of the overall profits allocated to them based on a "points" or "units" system.

Because compensation is tied to firm, practice, and individual performance, the numbers can vary significantly year to year. However, based on data from reputable sources, we can establish a reliable range.

- Average Total Compensation: According to data from Glassdoor and Salary.com, the estimated total pay for a Partner at PwC in the United States is approximately $655,000 per year, with a likely range between $450,000 and over $1,000,000. (Sources: Glassdoor, 2024; Salary.com, 2024).

- First-Year Partners: Newly admitted partners typically start at the lower end of the spectrum, with initial compensation packages often falling in the $400,000 to $600,000 range.

- Senior Partners: Highly experienced partners who lead major national practices or manage flagship client relationships can earn significantly more, with compensation packages that can exceed $3,000,000 per year.

These figures represent total compensation, which includes base draws, bonuses, and profit sharing.

Key Factors That Influence Salary

A partner's earnings are not static. They are influenced by a dynamic interplay of several key factors. Understanding these elements is essential to grasping the wide compensation range.

###

Years of Experience

Experience is arguably the most significant driver of a partner's compensation. The partner track is a long-term progression, and earnings grow with seniority and contribution.

- Junior Partner (Years 1-5): In the initial years, partners are focused on establishing their client portfolio and proving their value as firm leaders. Their "unit" or "point" allocation is lower, resulting in compensation at the bottom of the partner range.

- Mid-Career Partner (Years 5-15): These partners have a proven track record of winning business and managing large teams. Their influence and profit share grow substantially.

- Senior/Lead Partner (Years 15+): These are the leaders of the firm who manage entire service lines or geographic regions. They hold the largest number of profit units and therefore have the highest earning potential.

###

Area of Specialization

Not all service lines at PwC generate the same level of revenue or profit margin. A partner's area of specialization directly impacts their compensation potential.

- Advisory (Consulting): This is often the most lucrative practice. Partners in high-demand areas like Deals, Cybersecurity, Cloud & Digital Transformation, and Strategy consulting can command the highest compensation due to the high value and premium billing rates associated with their work.

- Tax: Tax partners, especially those specializing in complex areas like international tax, M&A tax, or transfer pricing, also have very high earning potential.

- Assurance (Audit): While essential to the firm's brand and a massive source of revenue, audit work has become more commoditized and regulated, leading to tighter margins. Consequently, assurance partners, while still earning exceptional incomes, are generally on a slightly lower compensation scale than their counterparts in Advisory and Tax.

###

Geographic Location

As with any profession, where you work matters. Partners in major metropolitan areas with a high cost of living and a high concentration of large corporate clients will earn significantly more than those in smaller markets.

- Tier 1 Cities (New York, San Francisco, Chicago): Partners in these financial hubs have the highest earning potential, as they manage the firm's largest and most complex client accounts.

- Tier 2 Cities (Atlanta, Dallas, Boston): Compensation is still extremely strong but may be moderately lower than in Tier 1 locations.

- Smaller Markets: Partners in smaller cities will be at the lower end of the national compensation range, though their earnings are still very high relative to their local economies.

###

Level of Education

While a bachelor's degree in accounting or a related field is the standard entry point, advanced education and certifications are critical for ascending to the partner level. A Certified Public Accountant (CPA) license is a non-negotiable requirement for partners in Assurance and Tax. Furthermore:

- Advanced Degrees: A Master of Business Administration (MBA), Master's in Taxation (MTax), or Juris Doctor (JD) can significantly enhance a candidate's profile and accelerate their path to partnership, particularly within the Advisory and Tax practices. These degrees signal a high level of business acumen and specialized expertise, indirectly leading to higher earning potential.

###

Firm and Practice Performance

Because partner pay is tied to profits, overall firm performance is a critical factor. In a strong economic year where PwC exceeds its revenue and profitability targets, the bonus pool and per-unit profit share will be larger for all partners. Conversely, a leaner year can result in flatter or reduced partner compensation. The performance of a partner's specific practice area (e.g., West Coast Cybersecurity) also has a direct impact on their individual performance-based bonus.

Job Outlook

While the U.S. Bureau of Labor Statistics (BLS) does not track "PwC Partner" as a distinct profession, we can look at the outlook for the underlying feeder profession: Accountants and Auditors.

According to the BLS Occupational Outlook Handbook, employment for accountants and auditors is projected to grow 4 percent from 2022 to 2032, which is about as fast as the average for all occupations. The BLS notes that globalization, a growing economy, and a complex tax and regulatory environment will continue to drive strong demand for accounting and auditing services.

This stable, consistent demand ensures that firms like PwC will continue to thrive and will have a persistent need for strong leaders to guide their practices, making the path to partner a competitive but enduring career goal.

Conclusion

Becoming a partner at PricewaterhouseCoopers is the culmination of a long, challenging, and dedicated career. It is a role that demands exceptional skill in sales, client management, and leadership.

For those who reach this level, the financial rewards are extraordinary. While the "average" compensation sits comfortably in the mid-to-high six figures, the path to multi-million-dollar earnings is paved by years of experience, a strategic choice of specialization, and a proven ability to drive the firm's bottom line. For aspiring students and professionals mapping out their futures, the role of a PwC Partner remains one of the most prestigious and financially rewarding destinations in the business world.