Introduction

What does a $46-an-hour career truly represent? On the surface, it's a number. But beneath that figure lies a significant professional milestone—a marker of specialized skill, valuable experience, and financial stability. Earning $46 an hour translates to an annual salary of approximately $95,680 (based on a standard 2,080-hour work year). This level of income places you comfortably above the U.S. median household income, opening doors to greater financial freedom, investment opportunities, and a higher quality of life. It’s a salary that signifies you have moved beyond entry-level roles and are now a trusted, impactful professional in your field.

This guide is designed to be your definitive resource for understanding and achieving this career benchmark. We will move beyond the simple math and delve into the very fabric of the professions that offer this level of compensation. We'll explore which jobs pay in this range, what skills they demand, and the strategic steps you can take to secure such a role. Throughout my years as a career analyst, I've seen countless professionals strive for this exact target. I once mentored a young data analyst who was brilliant but stuck in a role paying far below her capabilities. We worked together to identify her highest-value skills, rebrand her resume, and target roles that recognized her worth. The day she called to tell me she had accepted an offer at the equivalent of $47 an hour, the excitement in her voice was about more than just money; it was about recognition and a new trajectory for her future.

This article is for anyone who sees "$46 an hour" not just as a wage, but as a goalpost. Whether you're a student planning your future, a professional looking to level up, or someone contemplating a career change, this in-depth analysis will provide the data-backed insights, expert advice, and actionable roadmap you need to turn aspiration into reality.

### Table of Contents

- [What Does a Professional Earning $46 an Hour Do?](#what-does-a-professional-earning-46-an-hour-do)

- [Average $46 an Hour Salary: A Deep Dive](#average-46-an-hour-salary-a-deep-dive)

- [Key Factors That Influence a $95,000 Salary](#key-factors-that-influence-a-95000-salary)

- [Job Outlook and Career Growth for High-Earning Professionals](#job-outlook-and-career-growth-for-high-earning-professionals)

- [How to Get Started on Your Path to a $95,000 Career](#how-to-get-started-on-your-path-to-a-95000-career)

- [Conclusion: Your Future at $46 an Hour and Beyond](#conclusion-your-future-at-46-an-hour-and-beyond)

What Does a Professional Earning $46 an Hour Do?

A role that compensates at $46 an hour, or roughly $95,000 a year, is far from an entry-level position. This is the domain of the experienced and competent professional—an individual who has moved past foundational tasks and now operates with a degree of autonomy, expertise, and strategic responsibility. While the specific industries vary widely, from technology and healthcare to finance and engineering, the core nature of the work shares common threads.

At this level, you are no longer just an executor of tasks; you are a problem-solver. You are trusted to analyze complex situations, devise effective solutions, and manage projects from conception to completion. Your work directly impacts business outcomes, patient health, system stability, or financial performance. This is a role where your individual contribution is visible and vital.

Core Responsibilities and Daily Tasks:

Professionals in this salary bracket typically engage in a blend of technical execution, strategic planning, and collaborative communication. Their daily docket is less about ticking off a checklist and more about navigating dynamic challenges.

- Project Management & Ownership: You might lead a small project team, manage a significant component of a larger initiative, or be the sole owner of a critical process. This involves setting timelines, coordinating with stakeholders, and ensuring deliverables meet quality standards.

- Specialized Technical Work: Whether it's writing and debugging complex code as a mid-level Software Developer, performing advanced diagnostic procedures as an experienced Registered Nurse, or building sophisticated financial models as a Financial Analyst, your "hard skills" are sharp, polished, and regularly put to the test.

- Data Analysis and Reporting: Regardless of the field, the ability to interpret data is paramount. You are expected to analyze performance metrics, identify trends, and communicate your findings to leadership to inform strategic decisions. This could be analyzing marketing campaign ROI, patient recovery rates, or network security vulnerabilities.

- Mentorship and Knowledge Sharing: While not a formal manager, you are often seen as a source of expertise for junior colleagues. A portion of your time might be spent answering questions, reviewing work, and helping to onboard new team members.

- Stakeholder Communication: You regularly interact with colleagues from other departments, present findings to management, or communicate with external clients or partners. Clear, concise, and professional communication is a non-negotiable skill.

### A Day in the Life: "Alex," a Mid-Career Professional

To make this tangible, let's imagine a day for "Alex," a composite character representing a professional earning around $46 an hour. Alex could be a Management Analyst, a Senior IT Systems Administrator, or a Physical Therapist—the core principles of the day are similar.

- 8:30 AM - 9:30 AM: Morning Sync & Prioritization. Alex starts the day by reviewing emails and messages. They join a brief daily stand-up meeting with their team to discuss yesterday's progress and today's priorities. Alex highlights a potential bottleneck in their project and proposes a quick workaround, which the team agrees to.

- 9:30 AM - 12:00 PM: Deep Focus Work. This is dedicated time for core tasks. If Alex is a Financial Analyst, they're deep in Excel, building a forecasting model for the next quarter. If they're a Registered Nurse in a specialized clinic, they're conducting patient assessments and administering complex treatments. If they're a Systems Administrator, they are implementing a new security patch across the company's servers.

- 12:00 PM - 1:00 PM: Lunch & Mental Recharge. A crucial break to step away from the screen or clinical setting.

- 1:00 PM - 2:30 PM: Collaborative Project Meeting. Alex joins a cross-functional meeting with members from Marketing and Sales. As the subject matter expert, Alex's role is to provide data-driven insights on the feasibility of a new product launch, explaining the technical requirements or market-fit analysis they've prepared. They answer questions and help the team align on a realistic timeline.

- 2:30 PM - 4:00 PM: Analysis & Reporting. Alex synthesizes the data from their morning's work into a clear, digestible report for their manager. This isn't just a data dump; it includes key insights, trends, and recommendations for next steps.

- 4:00 PM - 5:00 PM: Mentorship & Wind-Down. A junior colleague stops by with a question about a complex software tool. Alex patiently walks them through the process. Afterward, Alex spends the last 30 minutes planning their priorities for the next day, ensuring a smooth start.

This day illustrates the blend of autonomy, expertise, collaboration, and strategic thinking that defines a role at the $46-an-hour level. It's a challenging, engaging, and ultimately rewarding position that serves as a powerful engine for career growth.

Average $46 an Hour Salary: A Deep Dive

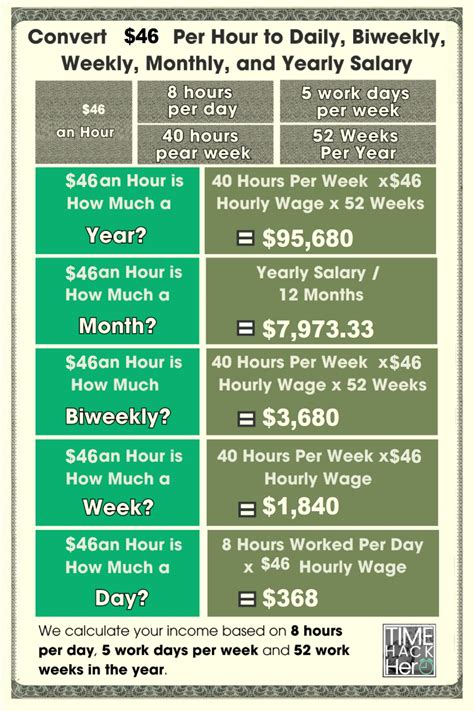

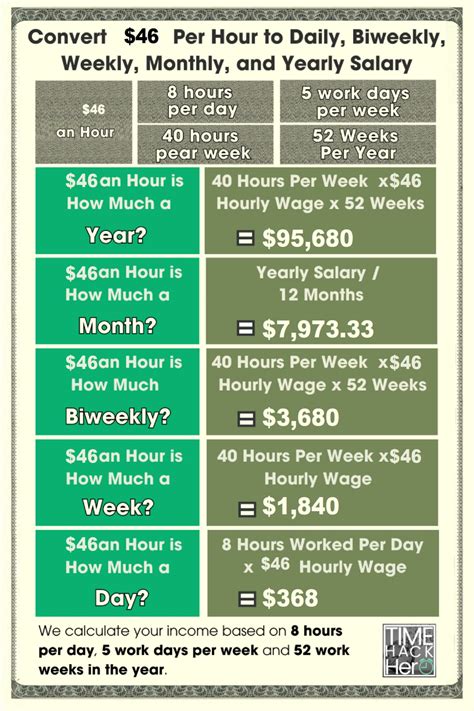

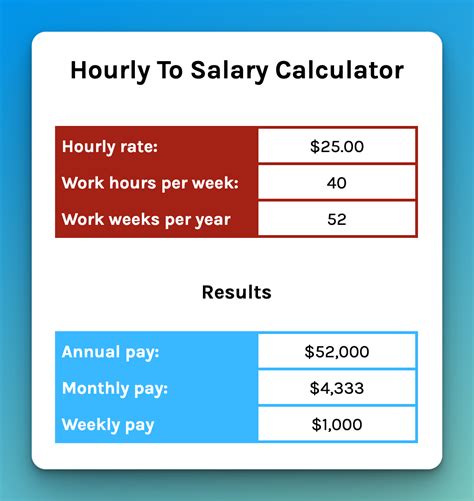

Converting an hourly wage to an annual salary is the first step in understanding its true value. The standard calculation assumes a 40-hour workweek for 52 weeks a year:

$46 per hour × 40 hours/week × 52 weeks/year = $95,680 per year

This figure, just shy of the six-figure mark, is a significant income in the United States. To put it in perspective, the U.S. Bureau of Labor Statistics (BLS) reported that the median usual weekly earnings for full-time wage and salary workers was $1,145 in the first quarter of 2024, which annualizes to $59,540. Therefore, a salary of over $95,000 is substantially higher—approximately 60% more than the national median. This positions individuals in this bracket in the upper-middle tier of earners, providing a strong foundation for financial security.

However, the "average" salary is just a starting point. The reality of compensation is nuanced, with significant variation based on experience, industry, and many other factors. Reputable salary aggregators like Salary.com place the national median salary for roles requiring a similar level of skill and experience in the $90,000 to $110,000 range, confirming that $95,680 is a very realistic and representative figure for a mid-career professional.

### Salary Progression by Experience Level

A $46-per-hour wage is typically not an entry-level salary. It is earned through a combination of education and, crucially, on-the-job experience. The journey to this income level follows a predictable and rewarding trajectory. Here's a breakdown of what to expect at different career stages for professions that commonly reach this pay scale.

Typical Salary Brackets by Experience Level (National Averages)

| Experience Level | Years of Experience | Typical Annual Salary Range | Description |

| :--- | :--- | :--- | :--- |

| Entry-Level | 0-2 Years | $60,000 - $75,000 | Roles for recent graduates with a relevant bachelor's degree. Focus is on learning core skills, executing defined tasks, and supporting senior team members. Examples: Junior Analyst, Staff Nurse, Associate Engineer. |

| Mid-Career | 3-8 Years | $75,000 - $115,000 | This is the sweet spot where the $95,680 ($46/hr) salary typically falls. Professionals have proven competency, work autonomously, manage small projects, and are seen as reliable experts. Examples: Senior Financial Analyst, Registered Nurse (with specialization), Systems Administrator, Mid-Level Software Developer. |

| Senior/Lead Level | 8-15+ Years | $115,000 - $160,000+ | At this stage, professionals are leading large projects or teams. They have deep technical expertise and are involved in strategic planning. Their work has a broad impact on the organization. Examples: Finance Manager, Nurse Practitioner, Senior Staff Engineer, IT Manager. |

*(Salary data is aggregated and synthesized from recent 2023-2024 reports from Payscale, Glassdoor, and the BLS Occupational Outlook Handbook for relevant professions.)*

For example, let's look at the progression for a Management Analyst, a role the BLS reports has a median pay of $95,290 per year as of May 2022.

- Entry-Level: An analyst right out of college might start around $68,000.

- Mid-Career (3-5 years): After gaining experience and a track record of successful projects, they are prime candidates for roles in the $85,000 to $105,000 range.

- Senior Analyst/Consultant: With deep industry knowledge and 8+ years of experience, earning over $130,000 is common.

This progression demonstrates that the $46-an-hour mark is a key milestone on a longer, more lucrative career path.

### Beyond the Base Salary: Understanding Total Compensation

One of the most critical aspects of evaluating a $46-an-hour role is looking beyond the base salary to the total compensation package. For professional roles at this level, base pay is often just one piece of a much larger financial puzzle. Neglecting to consider these other components can lead to a flawed comparison between job offers.

Key Components of a Total Compensation Package:

- Performance Bonuses: This is a cash payment awarded for meeting or exceeding individual, team, or company goals. For a $95,000 salary, an annual performance bonus can range from 5% to 15% of the base salary ($4,750 - $14,250), significantly boosting total earnings.

- Profit Sharing: Some companies distribute a portion of their annual profits to employees. This is variable and dependent on the company's success but can be a substantial addition to your income.

- Stock Options or Restricted Stock Units (RSUs): Particularly common in the tech industry but also found in many large public companies, equity compensation gives you a stake in the company's success. RSUs are grants of company stock that vest over a period of time (e.g., 25% per year over four years). This can add tens of thousands of dollars to your net worth over time if the company performs well.

- 401(k) or 403(b) Retirement Plans with Company Match: This is essentially free money. A common company match is 50% of your contribution up to 6% of your salary. For a $95,680 salary, if you contribute 6% ($5,741), your company adds an extra $2,870 to your retirement account each year.

- Health Insurance Premiums: The value of a good health insurance plan cannot be overstated. A company that covers 80-100% of your monthly premiums for medical, dental, and vision insurance is providing a benefit worth thousands of dollars a year compared to a company with a less generous plan.

- Paid Time Off (PTO): A generous PTO policy (e.g., 4 weeks vacation plus sick days and holidays) contributes to work-life balance and is a valuable, albeit non-monetary, part of your compensation.

- Other Perks: These can include tuition reimbursement, professional development stipends, wellness programs, and flexible work arrangements (remote or hybrid), all of which have a tangible financial or quality-of-life value.

When considering a role advertised at $46 an hour, it's imperative to ask about these additional benefits. An offer of $95,000 with a 10% bonus, a 4% 401(k) match, and excellent health benefits is far superior to a flat $100,000 salary with no bonus and expensive insurance.

Key Factors That Influence a $95,000 Salary

Achieving a salary of $95,000 is not a matter of luck; it's the result of a strategic combination of factors. Understanding these levers is the single most important tool you have for maximizing your earning potential. As a career analyst, I've seen professionals double their income by focusing on these key areas. This section provides an exhaustive breakdown of what truly drives compensation at this professional level.

###

1. Level of Education

While experience often trumps education later in a career, your academic foundation is the launching pad that sets your initial trajectory. For most roles in the $95k bracket, a bachelor's degree is the standard minimum requirement.

- Bachelor's Degree (The Baseline): A B.S. or B.A. in a relevant field (e.g., Computer Science, Nursing, Finance, Engineering) is the entry ticket. It proves you have the foundational knowledge and discipline to succeed in a professional environment. Without it, accessing these career paths is significantly more difficult, though not impossible, often requiring years of demonstrable, hands-on experience and certifications.

- Master's Degree (The Accelerator): Pursuing a master's degree can act as a powerful salary accelerator. It signals a deeper level of specialization and commitment to your field.

- Master of Business Administration (MBA): An MBA from a reputable school is one of the most reliable ways to increase earning potential, particularly when transitioning into management or strategy roles. It can often provide a 30-50% salary bump.

- Specialized Master's (M.S., M.Eng., MSN): A Master of Science in Data Science, a Master of Engineering in a high-demand field, or a Master of Science in Nursing (MSN) can unlock more senior, higher-paying roles. For instance, an RN with a BSN might earn $85,000, while an MSN-educated Nurse Practitioner in the same hospital system could earn $120,000 or more. According to Payscale, the average salary for someone with an MSN is approximately $103,000.

- Certifications (The Enhancer): In many fields, particularly technology and finance, certifications are a direct way to prove proficiency in a specific, high-value skill. They can often be the deciding factor between two otherwise equal candidates.

- Project Management Professional (PMP): Project managers with a PMP certification earn, on average, 16% more than their non-certified peers, according to the Project Management Institute (PMI).

- Certified Public Accountant (CPA): This is the gold standard in accounting, unlocking higher-level roles and a significant salary premium over non-certified accountants.

- Tech Certifications: Credentials like AWS Certified Solutions Architect, Certified Information Systems Security Professional (CISSP), or Google Professional Data Engineer are highly sought after and can add $10,000-$20,000 to your annual salary.

###

2. Years of Experience

Experience is the currency of the professional world. It's how you convert theoretical knowledge into practical, value-creating skill. Salary growth is directly correlated with the quality and quantity of your experience.

- 0-2 Years (The Foundation Stage): At this stage, your primary goal is learning. You're paid to absorb knowledge, master fundamental tools, and prove your reliability. Your salary ($60k-$75k) reflects that you are still an investment for the company.

- 3-8 Years (The Growth Stage - The $95k Zone): This is where you hit your stride. You have a track record of success. You've seen projects succeed and fail and have learned from both. You can work independently and are trusted with significant responsibility. Employers are willing to pay a premium—like $46 an hour—for this proven competence and reduced need for supervision. This is the stage where changing companies can often lead to the most significant salary jumps, as you leverage your newly proven skills in the open market.

- 8+ Years (The Expertise Stage): You are now a senior or lead professional. Your value lies not just in doing the work, but in shaping the work of others. You provide strategic direction, mentor junior staff, and solve the most complex problems. Your salary ($115k+) reflects your role as a force multiplier for the entire team or department. According to Salary.com, a Financial Analyst with over 10 years of experience can expect to earn well over $100,000, with top earners exceeding $125,000, before even moving into a management role.

###

3. Geographic Location

Where you live and work is one of the most potent factors influencing your nominal salary. A $95,000 salary in San Francisco, CA, has vastly different purchasing power than the same salary in Omaha, NE. Companies adjust their pay scales based on the local cost of labor and cost of living.

- High Cost of Living (HCOL) Areas: Major tech hubs and financial centers like the San Francisco Bay Area, New York City, Boston, and Los Angeles have the highest salaries in the nation. To attract talent, companies in these cities must offer inflated wages. The same job that pays $95,000 in a mid-sized city might command $120,000-$140,000 in Silicon Valley. However, this is offset by extremely high housing, tax, and daily living costs.

- Medium Cost of Living (MCOL) Areas: Growing cities like Austin, TX; Denver, CO; Raleigh, NC; and Atlanta, GA, offer a compelling balance. They have strong job markets and salaries that are well above the national average but without the extreme costs of HCOL hubs. A $95,000 salary in these cities can afford a very comfortable lifestyle.

- Low Cost of Living (LCOL) Areas: In many Midwestern and Southern states, the cost of living is significantly lower. While nominal salaries may also be lower (that $95k job might pay $80k here), your purchasing power can be just as high, if not higher, than in MCOL cities.

Salary Comparison for a "Data Analyst" Role (Mid-Career):

| City | Average Salary | Cost of Living Index (US Avg = 100) | Adjusted "Real Feel" Salary |

| :--- | :--- | :--- | :--- |

| San Jose, CA | $118,000 | 216.5 | ~$54,500 |

| New York, NY | $105,000 | 168.6 | ~$62,270 |

| Austin, TX | $96,000 | 101.8 | ~$94,300 |

| Chicago, IL | $94,000 | 100.3 | ~$93,700 |

| Kansas City, MO| $87,000 | 86.8 | ~$100,230 |

*(Source: Salary data from Glassdoor and cost of living data from Payscale, 2024. Adjusted salary is a conceptual illustration of purchasing power.)*

The rise of remote work has added a new dimension. Some companies now pay a single national rate regardless of location, while others use a location-based tiered system. Securing a role with a national pay scale while living in a MCOL or LCOL area can be an incredibly powerful financial strategy.

###

4. Company Type & Size

The type of organization you work for has a profound impact on both your salary and your overall work experience.

- Large Corporations (e.g., Fortune 500): These companies typically offer the most structured compensation. They have well-defined salary bands, consistent bonus structures, and excellent benefits packages (e.g., top-tier health insurance, generous 401k matches). A $95,000 base salary is very common for experienced professionals in these settings.

- Tech Startups (VC-Funded): Startups are a high-risk, high-reward environment. The base salary might be slightly lower than at a large corporation, but this is often compensated with significant equity (stock options). A $90,000 salary plus stock options that could be worth hundreds of thousands of dollars if the company succeeds is a common trade-off.

- **Government