The polished showroom floor, the unmistakable scent of a new car, the thrill of the deal—for many, this is the world of automotive sales. But behind the scenes, away from the sales floor, sits one of the most critical and potentially lucrative roles in the entire operation: the Finance & Insurance (F&I) Manager. If you've ever wondered about the true earning potential in the auto industry, the finance manager car dealership salary is a figure that commands attention, often soaring well into the six figures for skilled professionals.

This role is the financial engine of the modern dealership. It's a high-stakes, high-reward position that blends financial acumen with sales psychology and legal precision. I once observed an F&I manager work with a young family who were stretching their budget to buy a safe, reliable minivan. With remarkable empathy and expertise, he restructured their financing, found a better interest rate through his network of lenders, and explained the value of an extended warranty in a way that provided peace of mind, not pressure. He didn't just process a loan; he built trust and secured the dealership's profitability in a single, masterful interaction.

This guide is for anyone who aspires to that level of professional impact. We will dissect every facet of the finance manager car dealership salary, explore the factors that drive it, and lay out a clear roadmap for how you can enter and excel in this dynamic career.

### Table of Contents

- [What Does a Car Dealership Finance Manager Do?](#what-does-a-car-dealership-finance-manager-do)

- [Average Finance Manager Car Dealership Salary: A Deep Dive](#average-finance-manager-car-dealership-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion: Is a Career as a Dealership F&I Manager Right for You?](#conclusion-is-a-career-as-a-dealership-fi-manager-right-for-you)

What Does a Car Dealership Finance Manager Do?

The title "Finance Manager" can be slightly misleading. While finance is at its core, the role is an intricate blend of sales, customer service, and regulatory compliance. In most dealerships, this position is called the F&I Manager, which stands for Finance and Insurance. They are the final stop for a customer before they drive off in their new vehicle and are responsible for securing the profitability of a deal *after* the price of the car has been negotiated.

The F&I Manager is not just a paper-pusher; they are a primary profit center for the dealership. Their responsibilities are multifaceted and require a unique skill set to balance customer satisfaction with the dealership's financial goals.

Core Responsibilities and Daily Tasks:

- Securing Financing: The F&I manager is the liaison between the customer and a network of banks, credit unions, and captive lenders (like Ford Motor Credit or Toyota Financial Services). They review a customer's credit application, analyze their financial situation, and "shop" the loan to find the most favorable terms for both the customer and the dealership.

- Selling Aftermarket Products: This is a cornerstone of the job and a major driver of their income. F&I managers are responsible for presenting and selling a menu of optional, value-added products, including:

- Extended Service Contracts (Warranties): Protects the customer from costly repairs after the factory warranty expires.

- Guaranteed Asset Protection (GAP) Insurance: Covers the difference between the actual cash value of a vehicle and the amount still owed on the financing if the car is totaled or stolen.

- Tire & Wheel Protection, Dent Repair, and Key Replacement: Various smaller insurance products that cover common cosmetic or loss issues.

- Pre-Paid Maintenance Plans: Allows customers to lock in the price of future oil changes, tire rotations, and other routine services.

- Ensuring Legal Compliance: This is arguably the most critical non-revenue-generating aspect of the job. F&I managers must have a deep understanding of federal, state, and local regulations. They are responsible for ensuring all paperwork is executed flawlessly, including the buyer's order, retail installment sales contract, and disclosures required by laws like the Truth in Lending Act (TILA) and the Gramm-Leach-Bliley Act (GLBA). A single compliance mistake can lead to massive fines for the dealership.

- Contract Management and Funding: After the customer signs, the F&I manager's job isn't done. They must package the contract and all supporting documents and send them to the lender. They are then responsible for ensuring the lender "funds" the deal, meaning the dealership gets paid for the car.

#### A Day in the Life of an F&I Manager

To make this more tangible, let's walk through a typical high-volume Saturday:

- 9:00 AM: Arrive at the dealership. Review the deals from the previous night, checking for any missing paperwork or funding delays. Meet with the sales managers to discuss the day's goals and any customers scheduled to come in.

- 10:30 AM: The first customer of the day, who just agreed on a price for a new SUV, is introduced. The F&I manager builds rapport, reviews their credit application, and explains the next steps.

- 11:00 AM: While the car is being detailed, the manager sends the customer's application to three different lenders. Lender A offers the best interest rate. The manager structures the deal and prepares a digital menu of F&I products.

- 11:45 AM: The manager invites the customer back into their office. They present the financing terms clearly and transparently. Using the menu, they explain the benefits of an extended warranty and GAP insurance based on the customer's driving habits and loan term. The customer agrees to both.

- 12:30 PM: The manager prints all contracts, meticulously explains each document, and collects signatures. They congratulate the customer, hand them the keys, and the salesperson delivers the vehicle.

- 1:00 PM - 6:00 PM: This cycle repeats four or five more times with different customers and different financial situations. Some deals are straightforward; others require creative problem-solving to help a customer with challenged credit get approved. In between customers, they are on the phone with banks chasing down funding on deals from earlier in the week.

- 7:00 PM: The last customer leaves. The manager packages all the day's contracts, creates a report for the general manager detailing the department's profitability, and prepares for the next day.

This demanding schedule requires incredible stamina, focus, and the ability to switch between complex financial analysis and personable salesmanship at a moment's notice.

Average Finance Manager Car Dealership Salary: A Deep Dive

The compensation structure for an F&I manager is one of the most performance-driven in any industry. While there is a base salary, it often represents only a fraction of the total earnings. The majority of their income is derived from commissions and bonuses, meaning there is a direct correlation between skill, effort, and take-home pay.

It's crucial to distinguish between *base salary* and *total compensation*. When evaluating this career, always focus on the latter, as it reflects the true earning potential.

According to Salary.com, as of late 2023, the median total compensation for a Dealership F&I Manager in the United States is $143,892. The typical range falls between $124,198 and $164,749, but this can vary significantly based on the factors we'll discuss in the next section.

Payscale.com reports a similar average salary of $111,708 but shows a wider total pay range from $53,000 to $201,000, which includes base, bonus, and commission. This wide range highlights the performance-based nature of the role. An inexperienced manager at a low-volume store may be at the bottom end, while a top performer at a high-volume luxury dealership can easily clear $200,000 or more.

#### Salary Brackets by Experience Level

Let's break down how total compensation typically evolves throughout an F&I manager's career. These figures are estimates combining data from multiple sources and industry knowledge.

| Experience Level | Typical Base Salary Range | Typical Total Compensation Range | Key Characteristics |

| :--- | :--- | :--- | :--- |

| Entry-Level / Trainee

(0-2 years) | $30,000 - $50,000 | $70,000 - $120,000 | Learning the role, often from a sales position. Focus is on mastering compliance and basic product presentation. Commission rates may be lower. |

| Mid-Career

(3-8 years) | $45,000 - $65,000 | $120,000 - $200,000 | Has strong lender relationships and a deep understanding of product benefits. Consistently achieves or exceeds performance targets. |

| Senior / Top-Performer

(8+ years) | $50,000 - $80,000 | $200,000 - $350,000+ | The elite of the industry. Often works at high-volume luxury stores, handles the most complex deals, and may mentor junior managers. Can have the title of F&I Director. |

*Sources: Data compiled and synthesized from Salary.com, Payscale.com, Glassdoor, and industry expert analysis (as of Q4 2023).*

#### The Components of F&I Compensation

To truly understand the salary, you must understand how it's built.

1. Base Salary: This is the fixed, guaranteed portion of their pay. It provides a level of stability but is rarely high. Dealerships use it to attract talent, but they expect the manager to earn their keep through commissions. A higher base might come with a lower commission percentage, and vice-versa.

2. Commissions: This is the lifeblood of F&I income. It's almost always calculated as a percentage of the *total F&I profit* generated by the manager. This profit comes from two main sources:

- Finance Reserve (or "The Spread"): When a bank approves a customer for a loan, they might offer the dealership a "buy rate" of, for example, 5%. The dealership is often allowed to sign the customer at a slightly higher rate, say 6%. The 1% difference is the finance reserve, which is profit for the dealership. F&I managers typically earn a commission on this reserve. (Note: This practice is heavily regulated and subject to rate caps).

- Aftermarket Product Sales: This is the most significant source of commission. The F&I manager earns a percentage (e.g., 15-25%) of the net profit on every extended warranty, GAP policy, and other product they sell.

3. Bonuses and Spiffs: On top of regular commissions, dealerships use various bonuses to incentivize performance.

- Volume Bonuses: A cash bonus for hitting a certain number of contracts or product sales in a month.

- PVR Bonuses: The most important metric for an F&I manager is PVR (Per Vehicle Retail). This is the average F&I profit generated per vehicle sold. A manager might get a significant bonus for maintaining a PVR above a certain threshold (e.g., $1,500).

- CSI Bonuses: To discourage high-pressure tactics, many dealerships tie a portion of a manager's pay to their CSI (Customer Satisfaction Index) score. If customers complain about their F&I experience, it can negatively impact their income.

- Spiffs: Short-term cash incentives offered by product providers (e.g., "Sell 10 of our warranties this week and get a $500 bonus").

4. Benefits: Standard benefits like health insurance and a 401(k) plan are common. A significant perk unique to the industry is the demonstrator vehicle (demo). Many managers are provided with a car to drive, with the dealership covering insurance and maintenance. This is a substantial non-taxable benefit that can be worth thousands of dollars a year.

Key Factors That Influence Salary

While performance is the primary driver, several external and personal factors create the wide salary spectrum we see in the F&I world. A manager earning $80,000 and one earning $280,000 may have the same job title, but their circumstances are vastly different.

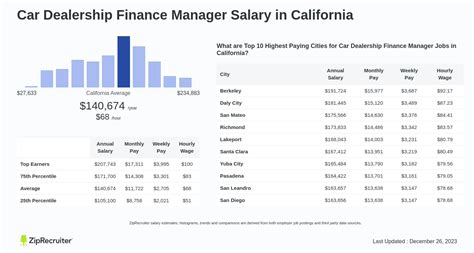

### Geographic Location

Where you work matters immensely. A dealership's location impacts the cost of living (which influences base salaries), the volume of sales, and the type of vehicles sold. High-income areas with a high cost of living naturally lead to higher salaries.

According to data from Zippia and Salary.com, states with major metropolitan areas and high vehicle sales tend to offer the highest compensation.

Top-Paying States for Dealership Finance Managers:

- California: Major markets like Los Angeles and the Bay Area combine high volume with luxury brand prevalence.

- Texas: Large, car-dependent cities like Dallas and Houston fuel massive sales volume.

- Florida: A combination of high population, significant wealth, and a strong car culture makes it a top state for F&I earnings.

- New York / New Jersey: The densely populated tri-state area supports a huge number of high-volume dealerships.

- Nevada: Especially in Las Vegas, a transient population and a culture of luxury spending can lead to high F&I profits.

Conversely, salaries tend to be lower in rural states with lower populations and a lower cost of living, such as Montana, West Virginia, and Mississippi. The difference between a top-performer in Los Angeles and an average manager in a small Midwest town can easily be over $100,000 per year.

### Dealership Type, Brand, and Size

Not all dealerships are created equal. The brand on the building and the ownership structure behind it have a profound impact on an F&I manager's desk.

- Volume vs. Luxury:

- High-Volume Brands (Toyota, Honda, Ford): These dealerships provide a massive number of opportunities. An F&I manager might see 8-10 customers a day. While the profit per vehicle might be lower than a luxury brand, the sheer quantity of deals allows for high income through accumulation.

- Luxury Brands (Mercedes-Benz, BMW, Lexus, Porsche): These dealerships see fewer customers, but the profit margins on both the vehicles and the F&I products are much higher. A single Porsche deal could generate as much F&I profit as five Honda deals. Customers often have better credit and are more receptive to premium protection products. Top earners are frequently found in high-performing luxury stores.

- Large Public Dealer Groups vs. Private Single-Owner Stores:

- Large Groups (e.g., AutoNation, Penske Automotive Group, Lithia Motors): These corporations often provide more structured training, better benefits, clearer paths for advancement, and potentially a higher base salary. However, they may have more rigid processes, corporate oversight, and potentially capped commission structures.

- Private/Family-Owned Stores: These dealerships can offer more autonomy and potentially a higher commission percentage. A top performer might be able to negotiate a very favorable pay plan directly with the owner. However, they may lack the formal training, benefits, and career mobility of a larger group.

### Years of Experience and Proven Performance

Experience in F&I is not just about time served; it's about a proven track record of performance. This is the most significant personal factor influencing salary.

- The Learning Curve (Years 0-2): New F&I managers, often promoted from the sales floor, face a steep learning curve. Their primary focus is on mastering the menu-selling process, learning underwriting guidelines for various lenders, and, most importantly, becoming experts in compliance. Their PVR will be lower as they build confidence and skill.

- The Prime Earning Years (Years 3-10): A mid-career F&I manager has developed deep relationships with lenders, allowing them to get difficult deals approved. They have mastered their sales presentation and can consistently produce a high PVR (e.g., over $2,000). They are a trusted financial professional in the dealership and their income reflects this. This is where most managers hit the $150k - $250k range.

- The Elite Tier (F&I Director): A seasoned professional with a decade or more of experience may be promoted to F&I Director. They oversee the entire F&I department for one or multiple stores. Their role shifts from selling to training, motivating, and managing other F&I managers. They are responsible for the department's overall profitability, compliance, and lender relations. Their compensation is often a combination of a significant salary plus a bonus based on the department's total profit, easily reaching $250,000 to $400,000+ in a large, successful dealer group.

### In-Demand Skills and Certifications

In a performance-based role, skills directly translate to dollars. A manager who actively cultivates the right abilities will earn substantially more.

- Ethical Sales and Persuasion: The modern F&I manager is not a high-pressure salesperson. They are a consultant who educates customers on the value of their products. The ability to build rapport quickly, listen to a customer's needs, and present solutions ethically is paramount.

- Mastery of Compliance: A manager who is known for "bulletproof" paperwork that never has compliance issues is invaluable. They protect the dealership from massive legal and financial risk.

- Lender Relationship Management: The ability to pick up the phone and talk to a specific underwriter at a bank to advocate for a customer is a superpower. Strong lender relationships get more deals approved at better terms.

- High PVR Achievement: The ability to consistently maintain a high PVR without sacrificing customer satisfaction is the ultimate measure of success. This requires mastering the menu-selling process and truly believing in the products offered.

### The Impact of Education and Certifications

While a specific degree is not a strict requirement for becoming an F&I manager, a relevant educational background can provide a significant advantage. A Bachelor's degree in Finance, Business Administration, or Marketing can equip a candidate with a foundational understanding of financial principles, business ethics, and sales psychology.

More important than a degree, however, are industry-specific certifications.

- AFIP Certification: The Association of Finance & Insurance Professionals (AFIP) offers the most respected certification in the industry. Becoming an AFIP Certified F&I Professional demonstrates a commitment to ethical conduct and a mastery of the complex state and federal regulations governing the field. Many dealer groups now require this certification. Holding it can be a significant negotiating tool for a higher salary, as it reduces the dealership's liability.

- F&I Training Schools: Reputable programs from organizations like the Reahard & Associates F&I Training Institute or the College of Automotive Management provide intensive, hands-on training in the F&I process. Graduating from one of these schools signals to a potential employer that you are serious about the profession and have already invested in a professional foundation.

Job Outlook and Career Growth

The automotive industry is in a constant state of evolution, but the need for skilled financial professionals within the dealership structure remains robust. While the U.S. Bureau of Labor Statistics (BLS) does not track "Dealership F&I Manager" as a distinct profession, we can analyze the outlook by looking at related categories and industry-specific trends.

The BLS projects that employment for Financial Managers in general is expected to grow 16 percent from 2022 to 2032, which is much faster than the average for all occupations. The BLS states, "Services provided by financial managers, such as planning, directing, and coordinating investments, will continue to be in demand as the economy grows." While this applies broadly, the principles of managing financial transactions and directing cash flow are directly applicable to the F&I role.

More specific to the auto industry, a 2023 report from Cox Automotive highlights that dealership profitability, especially from F&I departments, has remained remarkably strong. Even as vehicle transaction prices fluctuate, the F&I department continues to be a stable and growing source of gross profit for dealers. This ensures that skilled F&I managers who can drive that profit will remain in high demand.

#### Emerging Trends and Future Challenges

The role of the F&I manager is not static. A successful professional must adapt to significant shifts in the industry.

1. The Rise of Digital Retailing: More customers are completing large portions of the car-buying process online. This is transforming F&I. Managers must now be proficient with digital menu presentations, e-contracting platforms, and remote communication tools. The "one-person sales model," where a single salesperson handles the entire transaction from test drive to financing, is being tested at some dealerships, which could change the F&I landscape. However, the complexity of compliance and financing often necessitates a dedicated specialist.

2. Increased Regulatory Scrutiny: The Consumer Financial Protection Bureau (CFPB) and other government agencies continue to closely monitor dealership F&I practices. This places an even greater premium on compliance. The future F&I manager will be as much a compliance officer as a salesperson, with impeccable ethics and attention to detail being non-negotiable.

3. The Electric Vehicle (EV) Transition: EVs have fewer moving parts and require less routine maintenance than internal combustion engine (ICE) vehicles. This can make traditional service contracts a harder sell. Successful F&I managers are adapting by offering new protection products tailored to EVs, such as battery and charging equipment warranties, and focusing more on other products like GAP and cosmetic protection.

4. Data-Driven Decisions: Modern dealerships are leveraging data like never before. F&I managers will increasingly use analytics to understand customer profiles and tailor product presentations to individual buyers, increasing both effectiveness and customer satisfaction.

#### Career Path and Advancement Opportunities

A career in F&I is not a dead end; it's a launchpad. The skills learned in the F&I office—financial management, sales leadership, compliance, and profitability management—are directly transferable to senior leadership roles.

The typical career ladder looks like this:

- Car Salesperson -> F&I Manager -> F&I Director (overseeing the entire department) -> General Sales Manager (overseeing all sales and F&I) -> General Manager (responsible for the entire dealership's operations and profitability) -> Dealership Owner / Partner.

Virtually every General Manager in the country has a deep understanding of the F&I department because it's so integral to the dealership's financial health. A successful tenure as an F&I manager is often a prerequisite for climbing to the top of the dealership hierarchy.

How to Get Started in This Career

Breaking into the F&I office is a process that requires patience, strategy, and a demonstrated ability to perform within the dealership environment. Unlike many finance jobs, you cannot simply apply for an F&I manager position with a degree and no relevant experience. Dealerships are entrusting you with millions of dollars in transactions and significant legal liability; they need to see a proven track record first.

Here is a step-by-step guide for aspiring F&I professionals:

#### Step 1: Get Your Foot in the Door (Usually in Sales)

The vast majority of F&I managers begin their careers on the sales floor. There are several reasons why this is the most common and effective path:

- Learn the Business: Working as a salesperson teaches you the fundamental product (the cars), the sales process, how to interact with customers, and the overall rhythm of the dealership.

- Prove Your Mettle: To be considered for F&I, you must first prove you can sell. Consistently being a top-performing salesperson demonstrates your work ethic, your ability to connect with people, and your drive to succeed in a commission-based environment.

- Build Internal Relationships: As a salesperson, you will work directly with the F&I department. This allows you to observe them, learn from them, and build relationships with the managers who will eventually train you and the general manager who will ultimately promote you.

#### Step 2: Declare Your Intentions and Seek Mentorship

Once you have established yourself as a reliable and successful salesperson (typically after 1-2 years), it's time to make your career goals known.

- Talk to Your Managers: Schedule a formal meeting with your General Sales Manager (GSM) and the General Manager (GM). Express your ambition to move into F&I. Ask them what