Table of Contents

- [Introduction](#introduction)

- [What Does "Exempt" Really Mean? A Primer on the FLSA](#what-does-exempt-really-mean-a-primer-on-the-flsa)

- [The 2024 Exempt Minimum Salary: A Deep Dive into the New DOL Rule](#the-2024-exempt-minimum-salary-a-deep-dive-into-the-new-dol-rule)

- [Key Implications of the New Salary Thresholds](#key-implications-of-the-new-salary-thresholds)

- [Impact Across Industries and Job Roles](#impact-across-industries-and-job-roles)

- [What To Do Next: An Action Plan for Employees and Employers](#what-to-do-next-an-action-plan-for-employees-and-employers)

- [Conclusion: Navigating the New Era of Overtime Pay](#conclusion-navigating-the-new-era-of-overtime-pay)

---

Introduction

In the complex landscape of professional compensation, few terms are as consequential—and as frequently misunderstood—as "exempt." For millions of American workers, this single word dictates whether they are entitled to overtime pay for hours worked beyond the standard 40-hour week. In 2024, the rules governing this status are undergoing their most significant transformation in two decades, a change that will directly impact the paychecks and work lives of an estimated 4 million employees. The central pillar of this change is the "exempt minimum salary," a critical threshold that is set to rise substantially.

Understanding this shift isn't just an exercise in legal compliance for businesses; it's a fundamental aspect of career management for every salaried professional. Whether you are an employee wondering if your salary is fair, a manager budgeting for your team, or an HR professional tasked with navigating this new terrain, the 2024 update to the Fair Labor Standards Act (FLSA) is one of the most important professional development topics of the year. The new standard salary level for exemption will jump from $35,568 to $43,888 on July 1, 2024, and then again to $58,656 on January 1, 2025.

I recall a pivotal moment early in my career when a former colleague, a dedicated marketing coordinator, was reclassified from exempt to non-exempt. While she initially worried it was a demotion, she soon found herself earning significantly more through overtime during our busy conference seasons—money she was rightfully owed but had previously worked for free. This personal experience solidified my belief that knowledge of labor law isn't just for lawyers; it's a tool of empowerment for every working individual.

This article is designed to be your ultimate guide to the "exempt minimum salary 2024." We will demystify the legal jargon, provide a comprehensive breakdown of the new rules, and explore the strategic implications for both employees and employers. We will delve into how these changes will ripple through different industries, what they mean for your career growth, and most importantly, what actions you need to take now to prepare. Consider this your definitive resource for navigating one of the biggest workplace financial shifts of our time.

---

What Does "Exempt" Really Mean? A Primer on the FLSA

Before we can analyze the impact of the 2024 salary changes, we must first build a solid foundation of understanding. The terms "exempt" and "non-exempt" are at the heart of this discussion, and they originate from a landmark piece of American legislation: the Fair Labor Standards Act (FLSA).

Enacted in 1938, the FLSA is the federal law that establishes minimum wage, overtime pay, recordkeeping, and youth employment standards affecting workers in the private sector and in Federal, State, and local governments. Its most well-known provision is the requirement that most employees be paid at least one and a half times their regular rate of pay for any hours worked over 40 in a workweek.

However, the law includes exemptions for certain types of employees. These "exempt" employees are not entitled to overtime pay. Conversely, "non-exempt" employees are protected by the overtime rules and must be paid for every hour worked, with a premium for overtime.

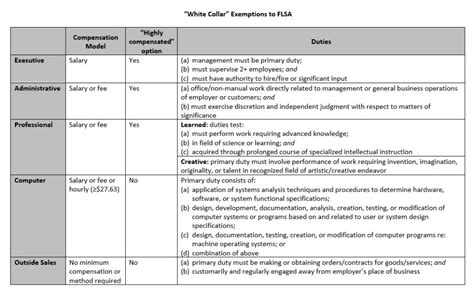

For an employee to be classified as exempt, they must meet three specific tests as defined by the U.S. Department of Labor (DOL):

1. The Salary Basis Test: The employee must be paid a predetermined and fixed salary that is not subject to reduction because of variations in the quality or quantity of the work performed. This means whether they work 35 hours or 45 hours, their base salary for the week remains the same.

2. The Salary Level Test: The employee must be paid a salary that meets a minimum specified amount. This is the threshold that is changing dramatically in 2024 and 2025. If an employee's salary is below this level, they are automatically non-exempt and eligible for overtime, regardless of their job duties.

3. The Duties Test: The employee’s primary job duties must involve the kind of work associated with exempt executive, administrative, or professional employees. This is often the most complex part of the analysis.

It is crucial to understand that a job title does not determine exempt status. Simply calling someone a "manager" or paying them a salary does not automatically make them exempt. Their actual, day-to-day responsibilities must align with the specific criteria set out in the duties test. The primary categories for the duties test are:

- Executive Exemption: The employee’s primary duty must be managing the enterprise or a recognized department. They must customarily and regularly direct the work of at least two or more other full-time employees and have the authority to hire or fire other employees (or their suggestions on these matters must be given particular weight).

- Administrative Exemption: The employee’s primary duty must be the performance of office or non-manual work directly related to the management or general business operations of the employer or the employer’s customers. Their duties must also include the exercise of discretion and independent judgment with respect to matters of significance.

- Professional Exemption: This splits into two types:

- Learned Professional: The employee’s primary duty must be the performance of work requiring advanced knowledge, predominantly intellectual in character, and which includes the consistent exercise of discretion and judgment. The advanced knowledge must be in a field of science or learning and customarily acquired by a prolonged course of specialized intellectual instruction (e.g., lawyers, doctors, engineers, accountants).

- Creative Professional: The employee's primary duty must be the performance of work requiring invention, imagination, originality, or talent in a recognized field of artistic or creative endeavor (e.g., writers, artists, musicians).

- Computer Employee Exemption: The employee must be employed as a computer systems analyst, computer programmer, software engineer, or other similarly skilled worker in the computer field.

- Outside Sales Exemption: The employee’s primary duty must be making sales or obtaining orders or contracts for services, and they must be customarily and regularly engaged away from the employer’s place of business. (Note: The Outside Sales exemption has no minimum salary requirement).

If an employee meets all three tests—Salary Basis, Salary Level, and the specific criteria of a Duties Test—the employer can legally classify them as exempt from overtime. If even one test is not met, the employee is non-exempt and must be paid for all hours worked, including overtime.

---

The 2024 Exempt Minimum Salary: A Deep Dive into the New DOL Rule

The component of the exemption test generating the most significant national conversation is the Salary Level Test. On April 23, 2024, the U.S. Department of Labor announced its final rule, "Defining and Delimiting the Exemptions for Executive, Administrative, Professional, Outside Sales, and Computer Employees," which dramatically increases this minimum salary threshold. This rule represents a concerted effort to align the regulations with current wage realities and extend overtime protections to millions of lower-paid salaried workers.

Let's break down the precise figures, timelines, and mechanisms of this landmark change.

### The New Salary Thresholds: A Two-Phased Increase

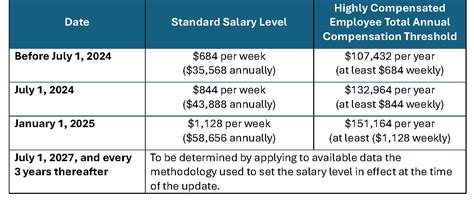

The previous standard salary level, set in 2019, was $684 per week, which annualizes to $35,568 per year. The new rule implements a significant increase in two distinct steps:

- Effective July 1, 2024: The standard salary level will increase to $844 per week, which is equivalent to an annual salary of $43,888.

- Effective January 1, 2025: The standard salary level will take another major leap to $1,128 per week, which is equivalent to an annual salary of $58,656.

Any employee subject to the executive, administrative, or professional (EAP) exemptions who earns less than these amounts as of these dates must be reclassified as non-exempt and become eligible for overtime pay.

In addition to the standard salary level, the rule also raises the threshold for the Highly Compensated Employee (HCE) exemption. The HCE test is a streamlined way to determine exemption for high-earning employees. To be exempt as an HCE, an employee must earn above a certain total annual compensation level and customarily and regularly perform at least one of the duties of an exempt executive, administrative, or professional employee.

The HCE threshold will also increase in two steps:

- Effective July 1, 2024: The total annual compensation requirement for HCEs increases from $107,432 to $132,964.

- Effective January 1, 2025: The HCE threshold will increase again to $151,164.

### The New Mechanism: Automatic Updates

Perhaps the most forward-looking component of the new rule is the introduction of a mechanism for automatically updating these earnings thresholds every three years. This is designed to prevent the thresholds from becoming outdated as wages and inflation change over time, which is precisely what happened in the decades leading up to this rule.

- Methodology: The standard salary level will be automatically updated to remain at the 35th percentile of weekly earnings of full-time salaried workers in the lowest-wage Census Region (currently the South). The HCE threshold will be pegged to the 85th percentile of full-time salaried workers nationally.

- Schedule: The first automatic update is scheduled for July 1, 2027, and subsequent updates will occur every three years thereafter. The DOL will publish the new thresholds at least 150 days before they take effect to give employers time to prepare.

This automatic updating mechanism ensures that the salary test remains a relevant and effective tool for determining overtime eligibility for years to come, marking a fundamental shift from a static rule to a dynamic one.

### Comparison of Salary Thresholds: Old vs. New

To visualize the magnitude of this change, consider the following comparison table.

| Exemption Type | Previous Threshold (until June 30, 2024) | New Threshold (Effective July 1, 2024) | New Threshold (Effective Jan 1, 2025) |

| --------------------------- | ------------------------------------------ | -------------------------------------- | ------------------------------------- |

| Standard Salary Level | $35,568 per year ($684/week) | $43,888 per year ($844/week) | $58,656 per year ($1,128/week) |

| Highly Compensated (HCE)| $107,432 per year | $132,964 per year | $151,164 per year |

*Source: U.S. Department of Labor, "Defining and Delimiting the Exemptions for Executive, Administrative, Professional, Outside Sales, and Computer Employees" Final Rule, 2024.*

### Use of Bonuses and Commissions

The DOL rule continues to allow employers to use nondiscretionary bonuses and incentive payments (including commissions) to satisfy up to 10% of the standard salary level. To count towards the threshold, these payments must be made on at least an annual basis. If an employee does not earn enough in these incentive payments to meet the salary threshold, the employer can make a "catch-up" payment at the end of the year (within one pay period of the 52-week period's end) to bring their earnings up to the required level.

For example, to meet the $58,656 threshold in 2025, an employer could pay a salary of $52,790.40 (90%) and rely on at least $5,865.60 (10%) in bonuses or commissions. If the employee only earns $4,000 in bonuses, the employer would need to make a catch-up payment of $1,865.60 to maintain the exempt status.

This provision offers some flexibility for employers, especially in sales-driven or performance-based roles, but requires careful tracking and administration to ensure compliance.

---

Key Implications of the New Salary Thresholds

The ripple effects of these new salary thresholds will be felt by millions of individuals and nearly every organization in the country. The implications are complex, creating both opportunities and challenges. This section breaks down what the new rule means for different stakeholders and how factors like geography and state law add further layers to the situation.

### For Employees: Empowerment and Uncertainty

For workers whose salaries fall between the old and new thresholds, this rule is a watershed moment. They now face a few potential scenarios, each with significant consequences for their finances and work-life balance.

1. A Raise in Salary:

The most straightforward outcome is that their employer chooses to raise their salary to meet or exceed the new threshold to maintain their exempt status. For an employee earning $50,000, their employer might increase their pay to $58,656 on January 1, 2025. This is a direct financial gain and preserves the flexibility often associated with salaried, exempt roles.

2. Reclassification to Non-Exempt:

If an employer decides not to raise an employee's salary, they must reclassify them as non-exempt. This has several key implications:

- Overtime Eligibility: The employee is now entitled to 1.5 times their regular rate of pay for all hours worked over 40 in a workweek. For those who regularly work long hours, this could result in a substantial increase in total compensation, potentially exceeding what they would have received from a simple raise.

- Time Tracking: They will now be required to meticulously track all their work hours. This includes time spent checking emails after hours, taking work calls, or finishing up projects from home.

- Potential Loss of Flexibility: Some employers may institute stricter policies to control overtime costs. This could mean prohibiting work outside of scheduled hours, requiring approval for any overtime, or reducing the flexibility that exempt employees often enjoy.

3. How to Determine Your Status:

As an employee, you can proactively assess your situation:

- Check Your Salary: Compare your current annual salary to the new thresholds of $43,888 (July 1, 2024) and $58,656 (Jan 1, 2025).

- Review Your Job Duties: Even if your salary is above the threshold, you must also meet the duties test. Read the definitions for the executive, administrative, and professional exemptions carefully. Do your primary tasks *truly* involve management, the exercise of independent judgment on significant matters, or work requiring advanced, specialized knowledge? If you are primarily performing routine, non-discretionary tasks, you may be misclassified.

- Talk to HR: If you believe you will be affected, schedule a conversation with your Human Resources department to understand the company's plan.

### For Employers: Strategic Decisions and Compliance Burdens

For businesses, the new rule necessitates a period of intense analysis and strategic decision-making. The financial and operational impacts can be substantial.

1. Auditing the Workforce:

The first step is a comprehensive audit. HR and management must identify every employee currently classified as exempt and compare their salary to the new thresholds. This list of "at-risk" employees is the foundation for all subsequent planning.

2. The Core Strategic Choice: Raise vs. Reclassify:

For each affected employee, the employer faces a critical choice:

- Raise Salaries: This is often the preferred option for retaining key talent and avoiding the administrative complexities of reclassification. However, the cumulative cost of salary increases across many employees can be a significant financial burden, especially for small businesses and non-profits.

- Reclassify to Non-Exempt: This avoids the immediate cost of a salary hike but introduces new challenges. The employer must:

- Set an Hourly Rate: Convert the employee's current salary to an hourly wage. For someone earning $55,000 annually, the hourly rate would be $26.44 ($55,000 / 2080 hours).

- Budget for Overtime: Analyze how many hours these employees typically work. If that same employee works an average of 45 hours per week, the employer must now budget for 5 hours of overtime at $39.66 per hour ($26.44 * 1.5), adding nearly $200 per week to their labor cost.

- Implement Timekeeping Systems: Ensure reliable systems are in place for newly non-exempt employees to accurately record all their working time.

- Train Managers: Managers must be trained on the new rules to prevent "off-the-clock" work and effectively manage schedules and overtime.

3. Communicating Changes:

Clear, empathetic, and transparent communication is vital. Being reclassified can feel like a demotion to some employees. Employers must explain that the change is due to a federal regulation, not performance, and clearly outline what it means for pay, time tracking, and work expectations.

### Geographic Location & State Laws: An Essential Caveat

The FLSA sets the *floor*, not the *ceiling*. Many states have their own wage and hour laws, including higher minimum wages and their own salary thresholds for exemption. When federal and state laws conflict, the employer must comply with the law that is more generous to the employee.

This is a critical point. For employers in certain states, the federal change may be less impactful because their state laws are already more stringent.

Examples of States with Higher Salary Thresholds (as of early 2024):

| State | 2024 Salary Threshold for Exemption | Key Consideration |

| -------------- | ---------------------------------------------------------------------- | --------------------------------------------------------------------------------------------------------------- |

| California | $66,560 per year (2x the state minimum wage for employers of all sizes) | Already higher than the new 2025 federal level. Employers in CA have been operating under a high threshold for years. |

| New York | Varies by region: $62,400 (NYC, Long Island, Westchester), $58,500 (Rest of State) | NYC's threshold is already near the new 2025 federal level. The rest of the state will see a significant jump. |

| Washington | $67,724.80 per year (2x the state minimum wage) | Similar to California, Washington's state law currently requires a higher salary for exemption than the new federal rule. |

| Colorado | $55,000 per year | Colorado's threshold sits between the two new federal levels, so employers will need to adjust in January 2025. |

| Maine | $42,450.20 per year | Maine's threshold is below the first federal update, so employers there will need to comply with the new federal rule. |

*Note: State laws are subject to change. Always consult with legal counsel for the most up-to-date information for your specific location.*

Employers must analyze both federal and their specific state (and sometimes city) laws to ensure full compliance. For many, this means adhering to a patchwork of regulations that requires careful legal and HR oversight.

---

Impact Across Industries and Job Roles

The new overtime rule is not a uniform event; its impact will be concentrated in specific sectors and job functions where salaries for lower-level management and entry-level professional roles have lagged. Understanding this distribution is key for both career planning and business strategy.

### High-Impact Industries

Certain industries rely heavily on a salaried workforce in the $40,000 to $60,000 range, often in roles that require work beyond a 40-hour week. These sectors will face the most significant adjustments.

- Retail: This industry will be profoundly affected. Roles like "Assistant Store Manager," "Department Manager," or "Key Holder" are frequently classified as exempt but often have salaries that will fall below the new $58,656 threshold. Companies will need to decide whether to give substantial raises to their entire field management team or reclassify them and start paying significant overtime, especially during peak holiday seasons.

- Hospitality and Food Service: Restaurant managers, hotel front desk managers, and event coordinators are classic examples of roles at risk. These positions are known for long hours and salaries that often hover in the $45,00 to $55,000 range. The financial pressure on restaurants and hotels to either raise salaries or pay overtime will be immense.

- Non-Profits: Non-profit organizations are particularly vulnerable. With tight budgets dependent on grants and donations, they employ many "Program Coordinators," "Volunteer Managers," and "Development Associates" in salaried roles that will likely fall under the new threshold. Finding the funds for salary increases or overtime budgets will be a major challenge and may require strategic shifts in staffing models.

- Healthcare Support: While doctors and registered nurses are typically well above the salary threshold, many administrative and support roles in clinics and hospitals are not. Positions like "Office Manager" in a private practice, "Patient Services Coordinator," or certain lower-level lab supervisors could be impacted.

- Higher Education: University administrative roles, such as "Admissions Counselor," "Residential Life Coordinator," or certain research assistants, often fall into the affected salary band.

- Startups and Small Businesses: Smaller companies, particularly tech startups that offer equity in lieu of higher cash salaries, may find their junior developers, marketing specialists, and operations staff falling below the new threshold. This could force a change in compensation philosophy earlier in a company's lifecycle.

### Analyzing the Impact on Specific Job Functions

Let's look beyond broad industries and examine how the rule will affect common professional roles. The key is the intersection of typical salary and the nature of the work.

- Management & Supervisory Roles: This is the epicenter of the rule's impact. First-line supervisors and junior managers in almost every industry are the primary target. The "Executive Exemption" requires management duties, but these roles often don't command salaries above the new $58,656 threshold.

- Career Advice: If you are an aspiring manager, be aware that the pathway may change. Companies might create more non-exempt "team lead" positions instead of exempt "assistant manager" roles. When negotiating for a first-time management role, be prepared to discuss the exempt salary threshold directly.

- Administrative & Operational Roles: The "Administrative Exemption" is one of the most frequently misapplied. The new rule will force a re-evaluation of many of these positions.

- Examples: "Executive Assistants," "Office Managers," "Project Coordinators." While some high-level EAs or senior project managers earn well above the threshold, many do not.

- Career Advice: For those in these roles, focus on developing and documenting skills related to "discretion and independent judgment." Taking on budget management, vendor negotiation, or significant operational decision-making can help justify a salary that keeps you in the exempt category if that is your goal.

- Marketing & Communications: Entry-level and mid-level marketing roles can be a gray area.

- Examples: "Marketing Coordinator," "Social Media Specialist," "Content Writer." These roles may or may not meet the "Creative Professional" or "Administrative" duties tests, but their salaries are frequently in the affected range.

- Career Advice: Specializing in high-demand technical areas like marketing analytics, SEO/SEM, or marketing automation can increase your salary potential faster, pushing you above the threshold. For creative roles, building a strong portfolio that demonstrates "invention, imagination, and originality" is crucial for justifying the creative professional exemption.

- Finance & Accounting: While CPAs and senior financial analysts are clearly exempt professionals, junior roles are not.

- Examples: "Staff Accountant" (non-CPA), "Financial Analyst I," "Payroll Clerk." These employees often perform work that, while important, may be more routine and not meet the duties test. The new salary level will make the classification question moot for many.

- Career Advice: Pursuing certifications like the CPA is the clearest path to securing exempt status and higher pay in this field.

- Information Technology (IT): The "Computer Employee Exemption" has its own specific duties test, but it is also subject to the standard salary level.

- Examples: "Help Desk Technician," "Junior Systems Administrator." While software developers and senior analysts are typically paid high salaries, many essential IT support roles are not.

- Career Advice: Gaining certifications in high-demand areas like cybersecurity, cloud computing (AWS, Azure), or network engineering is the fastest way to increase earnings and ensure your role is compensated at a level that comfortably exceeds the exemption threshold.

---

What To Do Next: An Action Plan for Employees and Employers

Knowledge is only powerful when acted upon. With the deadlines of July 1, 2024, and January 1, 2025, rapidly approaching, now is the time for proactive planning. Here is a step-by-step guide for both employees and employers to navigate this transition effectively.

### Action Plan for Employees

As an individual professional, understanding these rules is a form of self-advocacy. Use this moment to assess your career, understand your rights, and plan your next move.

Step 1: Get the Facts on Your Situation (Now)

- Confirm Your Salary: Don't guess. Look at your paystub or offer letter to find your exact gross salary. Calculate your annual figure.

- Compare to the Thresholds: Is your salary below $43,888? You should be affected by the July 1 deadline. Is it between $43,888 and $58,656? If so, the January 1 deadline is the key date for you.

- Honestly Evaluate Your Duties: Read the FLSA duties test definitions from the Department of Labor website. Keep a log for one week of your primary tasks. Do you spend most of your time managing others? Making significant business decisions? Using advanced, specialized knowledge? Or are your tasks more routine, following established procedures? This self-audit will give you a realistic view of whether you are currently classified correctly.

Step 2: Initiate a Conversation with Your Employer (1-2 Months Before Deadline)

- Schedule a Meeting: Request a one-on-one meeting with your direct manager or an HR representative. Frame it as a proactive discussion about professional development and the upcoming FLSA changes.

- Ask Direct Questions: Go into the meeting prepared. Good questions to ask include:

- "I've been reading about the new DOL overtime rule. Is the company aware of my position in relation to the new salary thresholds?"

- "Has the company developed a plan for employees