#Decoding the Dollars: A Comprehensive Actuarial Salary Survey

For professionals and students with a flair for mathematics, statistics, and business, the actuarial profession represents a pinnacle career path. It's a field renowned for its intellectual challenge, significant impact on financial industries, and, most notably, its exceptional earning potential. If you're wondering what you can expect to earn, you've come to the right place. An entry-level actuary can expect to start in the range of $70,000 to $95,000, while experienced, credentialed Fellows frequently command salaries well over $200,000.

This guide provides a data-driven look at actuarial salaries, breaking down the key factors that determine your compensation on this rewarding career journey.

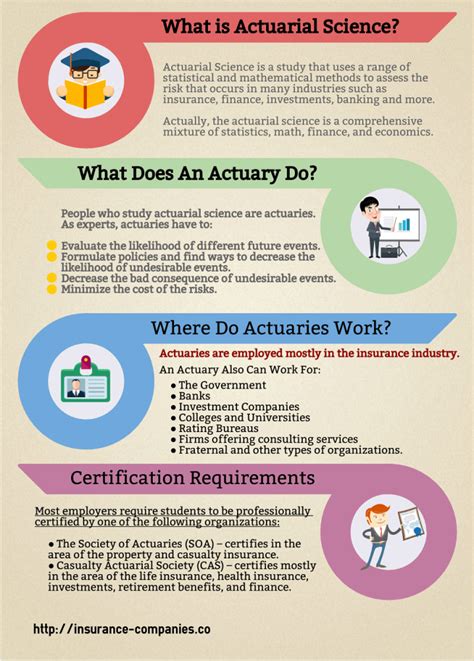

What Does an Actuary Do?

Before we dive into the numbers, let's clarify the role. Actuaries are the risk architects of the financial world. They use a powerful combination of mathematics, statistics, and financial theory to analyze and quantify the financial costs of risk and uncertainty. Their work is the bedrock of the insurance industry, but their skills are also in high demand in consulting, government, and corporate risk management.

In essence, actuaries help businesses plan for the future and protect themselves from loss. They design insurance policies, determine pension plan funding, and provide strategic advice to help companies make sound financial decisions.

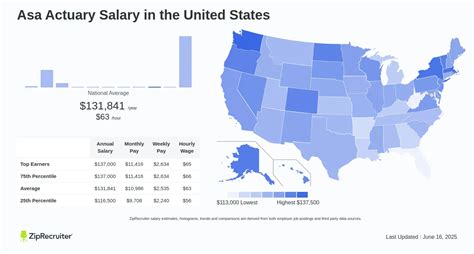

Average Actuary Salary

The compensation for an actuary is among the highest for business professionals, reflecting the rigorous training and critical importance of the role.

According to the U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook, the median annual wage for actuaries was $126,380 as of May 2023.

However, this median figure only tells part of the story. The salary range is incredibly broad and is directly tied to progress and experience:

- Entry-Level (0-3 years, 1-3 exams passed): Aspiring actuaries typically start their careers with a bachelor's degree and one or two passed exams. Salary aggregators like Salary.com and Payscale place this range between $70,000 and $95,000, which includes base salary and potential signing bonuses.

- Mid-Career (Associate-level): After several years of experience and passing the required exams to earn an Associate designation (ASA or ACAS), salaries see a significant jump. Total compensation often falls between $120,000 and $180,000.

- Senior/Experienced (Fellow-level): Actuaries who achieve Fellowship status (FSA or FCAS) and have significant experience are at the top of the profession. Their salaries typically start around $180,000 and can easily exceed $250,000, especially in management or specialized consulting roles.

Key Factors That Influence Salary

Unlike many professions, an actuary's salary is highly structured and predictable, based on a clear set of milestones. Understanding these factors is key to maximizing your earning potential.

### Level of Education and Professional Credentials

This is arguably the most significant driver of an actuary's salary. While a bachelor's degree in mathematics, statistics, or a related field is the entry point, your earnings are directly correlated with your progress through a series of professional examinations administered by the Society of Actuaries (SOA) or the Casualty Actuarial Society (CAS).

- Exams Passed: Companies reward progress. Each passed exam typically comes with a salary increase and/or a bonus. A candidate with three exams will earn substantially more than a candidate with one, even with the same years of experience.

- Associate Designation (ASA/ACAS): Earning your Associate credential is the first major milestone. It signals full competence in the fundamentals of actuarial practice and results in a significant salary increase, solidifying your position in the six-figure range.

- Fellow Designation (FSA/FCAS): This is the profession's highest credential. Achieving Fellowship status requires passing a final, specialized set of exams and demonstrates mastery in a chosen practice area. According to respected industry recruiters like DW Simpson, reaching Fellowship can add $30,000-$50,000 or more to your annual compensation compared to an Associate with similar experience.

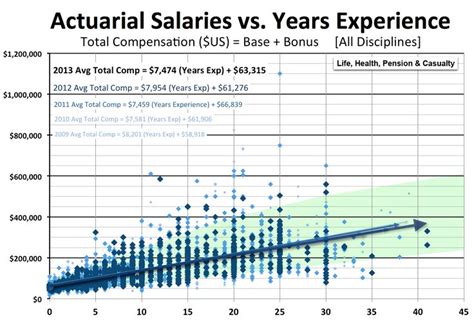

### Years of Experience

As with any profession, experience matters. However, in the actuarial field, experience is deeply intertwined with credentialing.

- 0-3 Years (Analyst): The focus is on learning the business and, most importantly, passing exams. Your value and compensation grow with each exam you pass.

- 4-10 Years (Associate/Manager): By this stage, most actuaries have earned their Associate designation and are either pursuing Fellowship or taking on more complex project management responsibilities.

- 10+ Years (Fellow/Director/Chief Actuary): Senior actuaries move into strategic leadership roles. They manage teams, set pricing and reserving strategies, and advise executive leadership. At this level, compensation includes a high base salary plus significant annual bonuses and potential stock options.

### Geographic Location

Where you work has a considerable impact on your paycheck, largely due to differences in cost of living and the concentration of major employers. According to data from the BLS and Salary.com, major metropolitan areas and insurance hubs offer the highest salaries.

Top-paying states and metropolitan areas for actuaries often include:

- New York, NY: The financial capital of the world offers top-tier salaries, especially in consulting and finance.

- Hartford, CT: Known as the "Insurance Capital of the World," this city is home to many major insurance carriers.

- Chicago, IL: A major hub for insurance, reinsurance, and consulting firms.

- Boston, MA: A strong center for both health and property & casualty insurance.

Salaries in these regions can be 15-25% higher than the national average.

### Company Type

The type of company you work for directly influences your salary structure and overall compensation package.

- Insurance Carriers: This is the most traditional path. They offer competitive salaries, excellent benefits, and strong support for the exam process (study time, exam fees, raises for passing).

- Consulting Firms: Actuarial consultants often earn higher base salaries and larger bonuses than their counterparts in insurance. However, this comes with the expectation of longer hours, more travel, and higher pressure.

- Reinsurance Companies: These companies insure the insurance companies. Roles here are complex and highly analytical, often commanding premium salaries.

- Government: While government actuaries (e.g., at the Social Security Administration or IRS) may have a lower salary cap than the private sector, they often enjoy superior work-life balance and excellent job security.

### Area of Specialization

The specific field of practice you choose also affects your earnings. According to salary surveys from actuarial recruiting firms, some specializations tend to be more lucrative than others.

- Property & Casualty (P&C): This field, which deals with auto, home, and liability insurance, is consistently cited as one of the highest-paying specializations.

- Health: A highly complex and in-demand field due to ever-changing regulations and healthcare systems.

- Life & Annuities: The largest and most traditional field, offering stable and strong compensation.

- Pension & Retirement: While a more mature field, it remains a core practice area, particularly within consulting.

Job Outlook

The future for actuaries is exceptionally bright. The U.S. Bureau of Labor Statistics projects that employment for actuaries will grow 23 percent from 2022 to 2032, which is categorized as "much faster than the average for all occupations."

This incredible growth is fueled by an increasing need for data-driven risk management across all industries. As data becomes more complex, so does the need for experts who can interpret it to make sound financial predictions and strategies.

Conclusion

The actuarial career path is a marathon, not a sprint. It demands dedication, discipline, and a genuine passion for problem-solving. However, the rewards are clear and substantial. The profession offers a transparent and merit-based ladder for advancement, where your salary is directly tied to tangible achievements—passing exams and gaining valuable experience.

For those considering this career, the message is encouraging: if you are willing to invest the effort in the rigorous examination process, you will be rewarded with a secure, intellectually stimulating, and highly lucrative profession that is poised for significant future growth.