Introduction

Earning $15 an hour represents a significant milestone for millions of workers. It's the rallying cry of a national movement, a benchmark for progressive employers, and for many, the first step onto a ladder of economic self-sufficiency. But what does an annual salary of 15 per hour truly mean for your life, your budget, and your professional future? It's a figure that holds both promise and challenges, a wage that can be a stable foundation in one city and a financial tightrope walk in another. This guide is designed to move beyond the headlines and provide a comprehensive, data-driven look at the reality of earning $15 an hour.

The leap to this wage level is often a pivotal moment. I once coached a young professional, let's call her Maria, who had just landed her first full-time job as a Certified Nursing Assistant (CNA) at just over $15 an hour. She was immensely proud, yet also anxious about making ends meet and figuring out her "next step." Together, we mapped out not just her monthly budget, but a two-year plan for additional certifications that would significantly increase her earning potential. That experience underscored a crucial truth: a $15/hour job isn't just a paycheck; it's a critical launchpad, and knowing how to leverage it is the key to building a prosperous career.

This article is your map. We will dissect the annual salary of 15 per hour from every angle, exploring the types of jobs available, how your pay is affected by location and skills, and the concrete steps you can take to grow your income and advance your career. We will ground our analysis in authoritative data from sources like the U.S. Bureau of Labor Statistics (BLS) and leading salary aggregators to ensure you have the most accurate and trustworthy information at your fingertips.

### Table of Contents

- [What Kinds of Jobs Pay $15 an Hour?](#what-kinds-of-jobs-pay-15-an-hour)

- [Understanding Your Annual Salary at $15 an Hour: A Deep Dive](#understanding-your-annual-salary-at-15-an-hour-a-deep-dive)

- [Key Factors to Increase Your Earnings Beyond $15 an Hour](#key-factors-to-increase-your-earnings-beyond-15-an-hour)

- [Job Outlook and Career Growth from a $15/Hour Foundation](#job-outlook-and-career-growth-from-a-15hour-foundation)

- [How to Secure a Good $15/Hour Job (and Prepare for the Next Step)](#how-to-secure-a-good-15hour-job-and-prepare-for-the-next-step)

- [Conclusion: Your Career is a Journey, Not a Destination](#conclusion-your-career-is-a-journey-not-a-destination)

What Kinds of Jobs Pay $15 an Hour?

While $15 per hour is a specific wage, it’s not tied to a single profession. Instead, it represents an entire ecosystem of crucial, entry-level, and foundational roles across numerous industries. These are the jobs that keep our economy running daily. Understanding the types of roles available in this pay bracket is the first step in making a strategic choice about your career path. Many of these positions serve as vital entry points into fields with significant long-term growth potential.

Here's an overview of common jobs that often have starting wages in the $14 to $17 per hour range, effectively centering around the $15/hour mark.

#### Common Roles and Responsibilities

- Customer Service Representative: These professionals are the voice of a company. They handle customer inquiries, resolve complaints, process orders, and provide information about products and services via phone, email, or chat.

- Median Pay (2022): $18.16 per hour / $37,780 per year (Source: [BLS](https://www.bls.gov/ooh/office-and-administrative-support/customer-service-representatives.htm)). Entry-level positions frequently start around $15/hour.

- Certified Nursing Assistant (CNA): CNAs provide basic care for patients in hospitals and long-term care facilities, such as nursing homes. They assist with daily living activities like bathing, dressing, and eating, and they monitor vital signs. This role is a common entry point into the healthcare ladder.

- Median Pay (2022): $16.31 per hour / $34,460 per year (Source: [BLS](https://www.bls.gov/ooh/healthcare/nursing-assistants-and-orderlies.htm)).

- Retail Sales Associate / Cashier: The backbone of the retail industry, these individuals assist customers, manage transactions, stock shelves, and maintain the sales floor. Experienced associates or those in supervisory roles can earn more.

- Median Pay (2022): $14.41 per hour / $29,970 per year (Source: [BLS](https://www.bls.gov/ooh/sales/retail-sales-workers.htm)). Many large retailers like Target and Amazon have committed to a $15/hour minimum starting wage, pushing the effective rate higher in many regions.

- Administrative or Office Assistant: These workers perform clerical and administrative duties in an office setting. Tasks include answering phones, scheduling appointments, maintaining files, and supporting other staff.

- Median Pay (2022): $20.44 per hour / $42,520 per year (Source: [BLS](https://www.bls.gov/ooh/office-and-administrative-support/secretaries-and-administrative-assistants.htm)). Entry-level positions, especially in smaller companies or non-profits, typically fall in the $15-$18/hour range.

- Warehouse and Fulfillment Associate: With the boom in e-commerce, these roles are in high demand. Workers receive, sort, scan, pack, and ship goods in a warehouse or distribution center.

- Median Pay (2022): $17.81 per hour / $37,040 per year (for Hand Laborers and Material Movers) (Source: [BLS](https://www.bls.gov/ooh/transportation-and-material-moving/hand-laborers-and-material-movers.htm)). Companies like Amazon have set a high bar, often starting employees well above $15/hour.

#### A Day in the Life: Example of a Customer Service Representative ($15/hr)

To make this more tangible, let's imagine a day for Alex, an entry-level customer service representative for a mid-sized e-commerce company.

- 8:45 AM: Alex arrives at the office (or logs into the remote system), grabs coffee, and reviews any overnight updates or new promotions.

- 9:00 AM - 12:00 PM: The "Morning Rush." Alex is on the phones and responding to emails. He helps one customer track a missing package, processes a return for another, and walks a third, less tech-savvy customer through placing an order on the website. He documents every interaction in the company's CRM (Customer Relationship Management) software.

- 12:00 PM - 1:00 PM: Lunch Break.

- 1:00 PM - 3:00 PM: The focus shifts. Alex spends an hour on "live chat," answering quick questions. He then has a 30-minute team meeting to discuss common customer issues from the past week. His supervisor provides tips on handling a particularly tricky return scenario.

- 3:00 PM - 5:00 PM: The queue slows down. Alex uses this time to follow up on complex cases from the morning, sending emails to the warehouse to confirm shipping details. He finishes his day by organizing his notes and preparing for tomorrow.

This example highlights that even in an entry-level role, the work is dynamic and requires a blend of soft skills (patience, communication) and hard skills (CRM software, product knowledge). The experience gained—problem-solving, digital literacy, and customer management—is highly transferable and forms the bedrock of a future career in sales, marketing, or operations.

Understanding Your Annual Salary at $15 an Hour: A Deep Dive

The number "$15 an hour" is straightforward, but its conversion into an annual salary—and more importantly, into take-home pay—involves several steps. A clear understanding of these numbers is essential for budgeting, financial planning, and evaluating job offers.

#### From Hourly to Annual: The Gross Salary Calculation

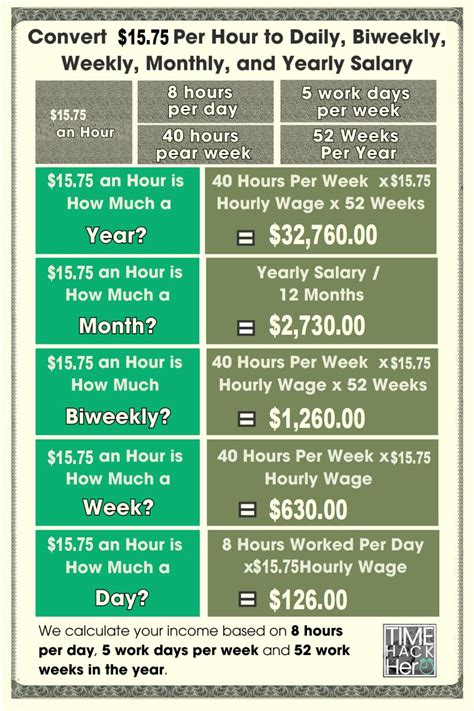

The standard calculation for a full-time annual salary is based on a 40-hour work week and 52 weeks in a year.

- Calculation: $15 (per hour) × 40 (hours per week) × 52 (weeks per year) = $31,200 per year

This $31,200 figure is your gross annual income. It's the total amount of money you earn before any deductions are taken out. Here’s how that breaks down over different pay periods:

| Pay Period | Gross Income Calculation | Gross Income Amount |

| :--- | :--- | :--- |

| Weekly | $15 × 40 hours | $600 |

| Bi-Weekly (26 pay periods) | $600 × 2 weeks | $1,200 |

| Semi-Monthly (24 pay periods) | ($31,200 / 24) | $1,300 |

| Monthly | ($31,200 / 12) | $2,600 |

#### Gross Pay vs. Net Pay: What You Actually Take Home

Your net pay, or take-home pay, is the amount you receive in your bank account after all deductions. This is the most critical number for creating a budget. The difference between gross and net pay can be substantial, often between 15% and 30%, depending on your location and personal situation.

Key Deductions:

1. Federal Income Tax: This is a progressive tax, meaning higher incomes are taxed at higher rates. For a single filer with a $31,200 income in 2023, you would fall into the 12% marginal tax bracket. The amount withheld depends on the information you provide on your W-4 form (e.g., filing status, dependents).

2. State Income Tax: This varies significantly. Seven states have no state income tax (Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, and Wyoming), while others like California and New York have relatively high rates.

3. FICA Taxes (Federal Insurance Contributions Act): This is a flat tax that funds Social Security and Medicare.

- Social Security: 6.2% on income up to the annual limit ($168,600 in 2024).

- Medicare: 1.45% on all earnings.

- Total FICA: You will always pay 7.65% of your gross income in FICA taxes (your employer pays a matching amount).

Hypothetical Net Pay Example:

Let's estimate the net pay for a single individual with no dependents earning $31,200 annually, living in a state with a moderate income tax of around 4%.

| Income / Deduction | Calculation | Amount |

| :--- | :--- | :--- |

| Gross Annual Income | | $31,200 |

| FICA Taxes | $31,200 × 7.65% | -$2,386.80 |

| Federal Income Tax (est.)* | Varies based on W-4 and deductions | ~$1,785 |

| State Income Tax (est.)* | $31,200 × 4% | -$1,248 |

| Total Annual Deductions (est.) | | ~$5,419.80 |

| Net Annual Income (est.) | $31,200 - $5,419.80 | ~$25,780.20 |

| Net Monthly Income (est.) | $25,780.20 / 12 | ~$2,148.35 |

*\*Note: Tax calculations are simplified for illustrative purposes. Your actual tax liability depends on your filing status, dependents, deductions, and tax credits. Using the official IRS Tax Withholding Estimator is recommended.*

This example shows that a gross monthly income of $2,600 can quickly become a net monthly income of around $2,150. This 17% reduction is a critical factor for anyone budgeting at this income level.

#### Beyond the Paycheck: Total Compensation and Benefits

A job offer is more than just the hourly wage. The value of your total compensation package includes benefits, which can be worth thousands of dollars a year. When evaluating a $15/hour job, it's crucial to look at the full picture.

Key Benefits to Consider:

- Health Insurance: This is often the most valuable benefit. An employer-sponsored health plan can save you hundreds of dollars per month compared to buying a plan on the open market. Look at the monthly premium (what you pay), the deductible (what you pay before insurance kicks in), and co-pays.

- Paid Time Off (PTO): This includes vacation days, sick leave, and paid holidays. A standard package might offer 10 vacation days, 5 sick days, and 8 paid holidays. This is paid time you aren't working, adding significant value.

- Retirement Savings Plan (e.g., 401(k) or 403(b)): Many employers offer a retirement plan and will often match a portion of your contributions. For example, an employer might match 100% of your contributions up to 3% of your salary.

- Example: If you contribute 3% of your $31,200 salary ($936/year), your employer also contributes $936. This is free money and an instant 100% return on your investment. Prioritizing this, even with a tight budget, is one of the most powerful wealth-building tools available.

- Other Potential Benefits:

- Dental and Vision Insurance

- Life Insurance and Disability Insurance

- Tuition Reimbursement or Professional Development Funds

- Employee Discounts

A $15/hour job with excellent, low-cost health insurance and a 401(k) match is far more valuable than a $16/hour job with no benefits at all. Always analyze the full offer.

Key Factors to Increase Your Earnings Beyond $15 an Hour

While $15 an hour is a solid starting point, the goal for most professionals is career progression and income growth. Your ability to earn more is not a matter of luck; it's a direct result of strategic decisions and continuous self-investment. This section provides a detailed roadmap of the factors you can influence to move your hourly wage from $15 to $20, $25, and beyond.

### `

` Level of Education `

`Formal education and targeted training are among the most reliable pathways to higher income. It's not just about getting any degree; it's about pursuing education with a clear return on investment (ROI).

- Certifications: For many hands-on roles, a specific certification can provide a faster and more affordable salary boost than a full degree.

- Healthcare: A Certified Nursing Assistant (CNA) earning ~$16/hour can pursue training to become a Licensed Practical Nurse (LPN). LPNs have a median pay of $25.66 per hour ($54,620 per year), according to the [BLS](https://www.bls.gov/ooh/healthcare/licensed-practical-and-licensed-vocational-nurses.htm). This jump is achievable in 1-2 years through a community college or vocational program.

- Information Technology (IT): An entry-level help desk technician earning $17/hour can significantly increase their value by earning certifications. The CompTIA A+ is a foundational cert, but adding the CompTIA Network+ or Security+ can open doors to junior network administrator or cybersecurity roles paying $25-$35 per hour.

- Skilled Trades: A warehouse associate earning $15/hour can obtain a forklift operator certification in a matter of days, often leading to an immediate pay increase of $2-$4 per hour.

- Associate's Degree (A.A. or A.S.): A two-year degree from a community college is a powerful stepping stone. It's more affordable than a four-year university and often focuses on in-demand, technical skills.

- Example: An administrative assistant with an associate's degree in business administration or accounting is qualified for higher-level bookkeeper or executive assistant roles. Bookkeepers and Accounting Clerks have a median pay of $21.84 per hour ($45,430 per year), according to the [BLS](https://www.bls.gov/ooh/office-and-administrative-support/bookkeeping-accounting-and-auditing-clerks.htm).

- Bachelor's Degree (B.A. or B.S.): A four-year degree remains a primary driver of lifetime earnings. Workers with a bachelor's degree have median weekly earnings of $1,432, compared to just $853 for those with only a high school diploma (Source: [BLS, 2022](https://www.bls.gov/careeroutlook/2023/data-on-display/education-pays.htm)). Many companies offer tuition reimbursement, allowing you to earn a degree part-time while your employer foots a portion of the bill. This is a powerful, often underutilized benefit.

### `

` Years of Experience `

`Experience is currency. As you move from an entry-level employee to a seasoned professional, your value—and your salary—should increase accordingly. The key is to be strategic about the experience you gain.

- Entry-Level (0-2 Years):

- Salary Range: $15 - $18 per hour ($31,200 - $37,440)

- Focus: Your primary goal is to learn the fundamentals of your job and the industry. Master the core tasks, demonstrate reliability, develop a strong work ethic, and be a positive team member. Document your accomplishments, even small ones. For example: "Resolved an average of 50 customer tickets per day with a 95% satisfaction rating."

- Mid-Career (3-7 Years):

- Salary Range: $19 - $28 per hour ($39,520 - $58,240)

- Focus: Move from *doing* to *improving*. Don't just follow procedures; look for ways to make them more efficient. Volunteer to train new hires. Take on a complex project. Your goal is to become the go-to person on your team for a specific task or skill. This is the stage where you might transition into a "Senior Customer Service Rep," "Lead CNA," or "Shift Supervisor" role.

- Senior/Experienced (8+ Years):

- Salary Range: $28+ per hour ($58,240+)

- Focus: Leadership and strategy. At this stage, your value comes from your ability to lead teams, manage projects, and contribute to the broader goals of the department. You are now a mentor to junior employees. Your career path leads toward management roles like "Customer Service Manager," "Operations Manager," or "Director of Nursing." These roles often transition from hourly pay to an annual salary with significant bonus potential.

### `

` Geographic Location `

`Where you live is one of the single biggest factors determining how far your $15/hour salary will go, and what your potential for growth looks like. A $31,200 salary can be comfortable in a low-cost-of-living (LCOL) area but is extremely challenging in a high-cost-of-living (HCOL) area.

- The Power of Cost of Living: The same $15/hour job might pay $18/hour in a suburban area and $22/hour in a major metropolitan city to account for the difference in living expenses. However, that pay bump rarely covers the full increase in costs for housing, transportation, and taxes.

- Example Comparison:

- San Francisco, CA (HCOL): According to the MIT Living Wage Calculator, a single adult with no children needs to earn $31.57 per hour to support themselves. A $15/hour wage covers less than half of the basic living expenses.

- Brownsville, TX (LCOL): In contrast, a single adult in Brownsville needs to earn $14.24 per hour to cover living expenses. Here, a $15/hour job provides a livable wage with a small cushion.

- Highest Paying States and Cities: Wages for entry-level and support roles are often highest in states with high costs of living and strong labor protections. According to Payscale and Glassdoor data, metropolitan areas in California, New York, Washington, and Massachusetts tend to offer higher nominal wages. For example, an administrative assistant might start at $20-$22/hour in Seattle, WA, compared to $15/hour in Birmingham, AL.

- The Remote Work Factor: The rise of remote work has changed this dynamic slightly. If you can secure a remote customer service or administrative job based in a HCOL area while living in a LCOL area, you can maximize your real income. This is a significant strategic advantage for those in fields that allow for remote work.

### `

` Company Type & Size `

`The type of organization you work for can have a major impact on your pay, benefits, and career trajectory.

- Large Corporations (e.g., Fortune 500):

- Pros: Often offer higher starting wages (e.g., Amazon, Target, Bank of America have corporate minimums of $15-$25/hour). They typically provide superior benefits packages (health insurance, 401(k) matching, tuition reimbursement) and have structured, clear paths for career advancement.

- Cons: Roles can be highly specialized, and navigating corporate bureaucracy can be challenging.

- Startups and Small Businesses:

- Pros: You may have the opportunity to wear many hats and gain a wide range of experience quickly. There is often more flexibility and a direct line to leadership. Success can sometimes lead to rapid promotions or even stock options.

- Cons: Salaries and benefits are often lower than at large corporations. Job security can be less stable.

- Non-Profits:

- Pros: Work is often mission-driven and can be personally fulfilling. You can build strong community connections.

- Cons: Pay is typically lower than in the for-profit sector. Budgets are often tight, limiting resources for training and development.

- Government (Local, State, Federal):

- Pros: Government jobs are known for their stability, excellent benefits (especially pensions and healthcare), and predictable work-life balance.

- Cons: The hiring process can be slow and bureaucratic. Salary increases are often tied to rigid pay scales and seniority rather than performance.

### `

` Area of Specialization `

`Even within a specific job title, specialization can create significant pay differentiation. Becoming an expert in a niche area makes you more valuable and harder to replace.

- Customer Service: A general customer service rep might earn $15/hour.

- A Bilingual (e.g., Spanish-speaking) Representative can earn a premium of $1-$3 more per hour.

- A Technical Support Representative (Tier 1) who can troubleshoot software or hardware issues may start at $18-$22/hour.

- A representative specializing in a complex product like financial services or enterprise software can earn even more.

- Administrative Support: A general office assistant might start at $16/hour.

- A Legal Administrative Assistant or Paralegal with specialized knowledge of legal terminology and procedures has a median pay of $28.52 per hour ($59,330 per year), per the [BLS](https://www.bls.gov/ooh/legal/paralegals-and-legal-assistants.htm).

- An Executive Assistant who supports high-level executives requires exceptional organizational and communication skills and earns a significantly higher salary, often exceeding $30/hour.