Are you a meticulous, detail-oriented individual with a knack for numbers? A career as an Accounts Payable (AP) Clerk could be the perfect entry point into the vital world of finance and accounting. This role is fundamental to the financial health of any organization, offering a stable career path with significant growth potential. But what can you expect to earn?

This in-depth guide will break down the AP Clerk salary, exploring the national averages and the key factors that can significantly increase your earning potential. For prospective professionals, you'll be pleased to know that a typical AP Clerk salary in the United States ranges from approximately $42,000 to over $65,000 per year, with ample opportunity to grow.

What Does an Accounts Payable Clerk Do?

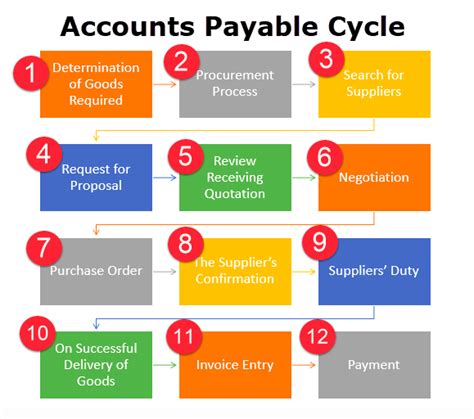

An Accounts Payable Clerk is the financial gatekeeper of a company's outflowing funds. They ensure that all of the company's bills and invoices are legitimate, accurate, and paid on time. This role is far more than simple data entry; it requires a sharp eye for detail, strong organizational skills, and effective communication.

Key responsibilities typically include:

- Processing Invoices: Receiving, verifying, and entering vendor invoices into accounting software (like SAP, Oracle, or QuickBooks).

- Verifying Transactions: Matching purchase orders, invoices, and receiving reports (a "three-way match") to prevent errors and fraud.

- Managing Payments: Scheduling and preparing checks, wire transfers, and ACH payments to vendors.

- Reconciling Accounts: Regularly reviewing the accounts payable ledger to ensure all payments are accounted for and posted correctly.

- Vendor Relations: Serving as the primary point of contact for vendor inquiries regarding payment status and discrepancies.

Average AP Clerk Salary

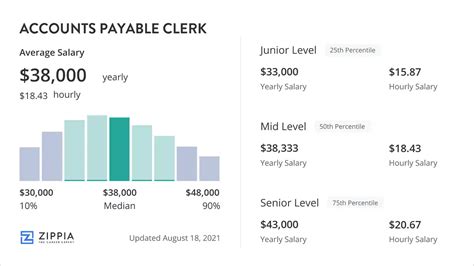

When determining the average salary for an AP Clerk, it's essential to look at data from several authoritative sources to get a complete picture.

According to the U.S. Bureau of Labor Statistics (BLS), AP Clerks fall under the broader category of "Bookkeeping, Accounting, and Auditing Clerks." The most recent data from May 2022 reports a median annual wage of $47,440, or $22.81 per hour.

However, leading salary aggregation websites, which collect real-time, user-reported data, often show slightly higher figures, reflecting current market conditions.

- Salary.com reports that the median AP Clerk salary in the U.S. is around $51,689, with a common range falling between $46,477 and $57,789.

- Payscale places the average base salary at approximately $48,500 per year.

- Glassdoor calculates an average total pay (including base and additional compensation) of $53,245 per year.

Taking all sources into account, a realistic salary range for a professional in this role spans from $42,000 for an entry-level position to over $65,000 for a senior or lead AP Clerk in a high-demand market.

Key Factors That Influence Salary

Your specific salary as an AP Clerk is not set in stone. Several key factors can dramatically impact your compensation. Understanding these variables is the first step toward maximizing your earning potential.

### Level of Education

While a high school diploma is the minimum requirement for many entry-level AP positions, further education provides a significant salary advantage.

- High School Diploma: Qualifies you for basic, entry-level roles, typically at the lower end of the salary spectrum.

- Associate's Degree: An associate's degree in Accounting or a related field makes you a more competitive candidate and can increase your starting salary by several thousand dollars.

- Bachelor's Degree: A bachelor's degree in Accounting or Finance not only commands a higher salary but also lays the groundwork for advancement into senior, analyst, or management roles.

- Certifications: Earning professional certifications is one of the fastest ways to boost your value. The Accounts Payable Specialist (APS) or Accounts Payable Manager (APM) certifications from organizations like the Institute of Finance & Management (IOFM) demonstrate a high level of expertise and can lead to a significant pay increase.

### Years of Experience

Experience is arguably the most critical factor in determining an AP Clerk's salary. Employers pay a premium for professionals who can operate with speed, accuracy, and autonomy.

- Entry-Level (0-2 years): Professionals in this stage are learning the fundamentals. Salaries typically range from $40,000 to $48,000.

- Mid-Career (3-7 years): With a solid grasp of AP processes and software, these clerks can handle more complex tasks and require less supervision. Their earnings often fall between $48,000 and $57,000.

- Senior/Lead (8+ years): A senior AP Clerk may mentor junior staff, manage complex vendor accounts, and lead process improvement projects. Their salaries can easily exceed $58,000 and push past $65,000, especially with lead responsibilities.

### Geographic Location

Where you work matters. Salaries are often adjusted based on the local cost of living and the demand for financial professionals in that area. Major metropolitan areas and tech hubs typically offer the highest salaries.

For example, an AP Clerk working in San Francisco, CA, or New York, NY, might earn 20-30% more than the national average. In contrast, the same role in a smaller city in the Midwest or Southeast might pay closer to or slightly below the national median. Always research the salary benchmarks for your specific city or region when evaluating job offers.

### Company Type

The size and industry of your employer play a significant role.

- Industry: Industries with complex billing structures or high-volume transactions, such as technology, financial services, healthcare, and large-scale manufacturing, tend to pay more.

- Company Size: Large, multinational corporations (Fortune 500 companies) generally have more structured pay scales and larger budgets, often resulting in higher salaries and better benefits packages compared to small businesses or non-profit organizations.

### Area of Specialization

Developing specialized skills can make you an indispensable asset. Proficiency in a specific Enterprise Resource Planning (ERP) system like SAP, Oracle NetSuite, or Microsoft Dynamics 365 is highly sought after. Furthermore, expertise in a niche area—such as international payments, tax compliance (W-9s and 1099s), or construction industry payables with their unique lien waivers—can set you apart and command a premium salary.

Job Outlook

The career outlook for AP Clerks is undergoing a transformation. The BLS projects a 2% decline in employment for bookkeeping, accounting, and auditing clerks from 2022 to 2032.

However, this statistic requires context. The decline is largely due to automation and software handling more routine data entry tasks. This shift doesn't mean the career is disappearing; it means the role is evolving. The modern AP Clerk is becoming more of an analyst. Companies increasingly need professionals who can manage automated systems, troubleshoot complex discrepancies, analyze spending patterns, and maintain strong vendor relationships—skills that software cannot replace. Those who adapt and upskill will be in high demand.

Conclusion

A career as an Accounts Payable Clerk offers a rewarding and stable path into the world of finance. With a strong national average salary and clear, actionable ways to increase your earnings, it’s an excellent choice for organized and detail-driven individuals.

Your journey to a higher salary begins with understanding these key takeaways:

- A Solid Foundation: The national median salary provides a competitive starting point, typically landing between $47,000 and $52,000.

- Experience is King: Your salary will grow consistently as you gain hands-on experience.

- Invest in Yourself: Pursuing higher education and professional certifications like the APS is a direct investment in your earning potential.

- Be Strategic: Targeting high-paying industries and geographic locations can significantly boost your income.

- Embrace Technology: The future of the role belongs to those who can master accounting software and leverage automation for higher-level analysis.

By focusing on continuous learning and skill development, you can build a successful and financially rewarding career as an Accounts Payable professional.