In the intricate world of business, where every decision can impact the bottom line, the Senior Accountant stands as a guardian of financial integrity and a crucial strategic partner. This isn't just a role about crunching numbers; it's about interpreting the story those numbers tell, guiding leadership toward profitability, and ensuring the fiscal health of an organization. If you're an aspiring financial professional or a staff accountant looking toward the next rung on the ladder, understanding the average senior accountant salary is more than just a matter of curiosity—it's about charting a course for a prosperous and rewarding career.

The path to becoming a Senior Accountant is one of dedication and a commitment to precision. The rewards, however, are substantial. Nationally, senior accountants command impressive salaries, often ranging from $75,000 to well over $115,000 annually, with total compensation packages pushing those figures even higher. This role represents a significant milestone, a transition from executing tasks to overseeing processes, mentoring junior staff, and contributing directly to financial strategy. I once had the privilege of working alongside a Senior Accountant named Maria during a complex system migration. While everyone else was focused on the technical glitches, she was the one who calmly identified a critical flaw in how revenue was being recognized post-migration, saving the company from a potentially disastrous financial misstatement. It was a masterclass in seeing beyond the spreadsheets and understanding the real-world impact of every single journal entry. Her expertise, forged over years of experience, was invaluable.

This comprehensive guide is designed to be your definitive resource on the journey to becoming a Senior Accountant. We will dissect every facet of the role, from daily responsibilities to the nuanced factors that dictate your earning potential. We'll explore the career trajectory, the skills you need to cultivate, and a step-by-step plan to help you achieve your goals.

### Table of Contents

- [What Does a Senior Accountant Do?](#what-does-a-senior-accountant-do)

- [Average Senior Accountant Salary: A Deep Dive](#average-senior-accountant-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

---

What Does a Senior Accountant Do?

While a Staff Accountant is often focused on the foundational tasks of accounting—such as processing invoices, preparing journal entries, and reconciling bank statements—the Senior Accountant operates at a higher, more analytical level. They are the experienced linchpins of the accounting department, bridging the gap between the day-to-day transactional work of junior staff and the high-level strategic oversight of the Accounting Manager or Controller.

The core of the Senior Accountant's role is to ensure the accuracy, integrity, and timeliness of a company's financial records. They are responsible for the more complex accounting activities and for reviewing the work of others to maintain quality control. Their responsibilities are a blend of technical accounting, process management, and mentorship.

Core Responsibilities and Daily Tasks:

- Financial Reporting & Month-End Close: This is a primary function. Senior Accountants are instrumental in the monthly, quarterly, and annual closing of the books. This involves preparing and reviewing complex journal entries, reconciling challenging balance sheet accounts (like accrued liabilities or deferred revenue), and performing variance analysis to explain why actual results differ from the budget or forecast.

- General Ledger Management: They act as the guardians of the general ledger (GL), ensuring all transactions are recorded accurately and in compliance with Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

- Technical Accounting Research: When the company encounters a new or complex transaction (e.g., a new lease agreement under ASC 842, a business acquisition), the Senior Accountant is often tasked with researching the proper accounting treatment and documenting the company's position.

- Audit & Compliance: They are a key point of contact for external auditors, preparing schedules, providing requested documentation, and answering questions about accounting policies and procedures. They also play a role in ensuring compliance with internal controls and regulations like the Sarbanes-Oxley Act (SOX).

- Mentorship and Review: Senior Accountants review the work of staff and junior accountants, providing feedback, guidance, and training. They help develop the next generation of accounting talent within the organization.

- Process Improvement: A great Senior Accountant doesn't just follow procedures—they improve them. They are constantly looking for ways to make the accounting process more efficient, accurate, and automated, whether through better use of the ERP system or by redesigning a workflow.

### A Day in the Life of a Senior Accountant

To make this tangible, let's imagine a typical day for a Senior Accountant during the third week of the month (post-close, pre-planning).

- 9:00 AM - 9:45 AM: Arrive and review the team's progress on balance sheet reconciliations from the previous month's close. Notice an issue in the prepaid expenses reconciliation prepared by a junior accountant. Make a note to connect with them. Respond to urgent emails from the FP&A (Financial Planning & Analysis) team requesting details on a specific operating expense variance.

- 9:45 AM - 11:00 AM: Meet with the junior accountant to walk through the prepaid reconciliation. Instead of just giving the answer, you ask guiding questions to help them identify the error themselves, turning it into a coaching opportunity. You then sign off on the corrected reconciliation.

- 11:00 AM - 12:30 PM: Dive into a technical accounting project. The company just signed a new cloud computing contract, and you need to research the GAAP guidance to determine if it should be capitalized or expensed. You draft a technical memo outlining your findings and conclusion.

- 12:30 PM - 1:15 PM: Lunch.

- 1:15 PM - 2:30 PM: Prepare a set of ad-hoc reports for the Controller on inventory turnover trends. This involves pulling data from the ERP system, manipulating it in Excel using VLOOKUPs and PivotTables, and creating a clear summary of your analysis.

- 2:30 PM - 3:30 PM: Attend a cross-functional meeting with the operations team to discuss a new inventory management process they're proposing. You provide input on the financial controls and reporting implications, ensuring the accounting department's needs are met.

- 3:30 PM - 5:00 PM: Work on preparing schedules for the upcoming quarterly audit. This involves gathering supporting documents for significant transactions and ensuring everything is organized and ready for the auditors' review. You end the day by creating a to-do list for tomorrow, prioritizing the next steps in the technical memo and flagging a follow-up with the IT department.

This snapshot illustrates the dynamic nature of the role—a mix of deep analytical work, collaborative problem-solving, and essential mentorship.

---

Average Senior Accountant Salary: A Deep Dive

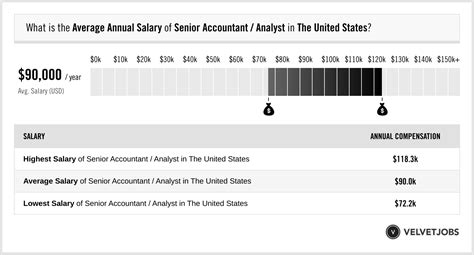

Now, let's get to the heart of the matter: compensation. The average senior accountant salary is a compelling figure that reflects the skill, responsibility, and value this role brings to an organization. It's important to look at data from multiple reputable sources to form a comprehensive picture, as methodologies and user-submitted data can vary.

According to recent 2023-2024 data, the national average salary for a Senior Accountant in the United States typically falls within a consistent range:

- Salary.com reports the median salary for a Senior Accountant is $90,103, with a typical range falling between $81,591 and $99,578.

- Payscale shows a slightly lower average base salary at $78,920, with the full range spanning from $61,000 to $101,000.

- Glassdoor, which incorporates user-submitted data, reports a total pay average of $95,338, with a likely base pay around $83,000.

- The Robert Half 2024 Salary Guide, a highly respected industry benchmark, provides salary percentiles for corporate accounting roles. For a Senior Accountant at a medium-sized company ($50M - $500M revenue), the salary range is $89,000 (25th percentile) to $114,250 (75th percentile).

Synthesizing this data, a realistic and conservative estimate for the national average base salary for a Senior Accountant is between $80,000 and $95,000. The most qualified candidates in high-demand markets with specialized skills can easily command salaries exceeding $100,000 to $120,000.

### Salary Progression by Experience Level

The title "Senior Accountant" itself implies a level of experience, but there's still a clear progression in salary as one moves from a newly-promoted senior to a seasoned veteran within the role. The journey typically begins as a Staff Accountant.

| Career Stage | Typical Years of Experience | Representative Salary Range (Base) | Key Responsibilities & Expectations |

| :--- | :--- | :--- | :--- |

| Staff Accountant | 1-3 years | $60,000 - $75,000 | Executes core accounting tasks: journal entries, basic reconciliations, A/P, A/R. Focus is on learning procedures and accurate data entry. |

| Early-Career Senior Accountant | 3-5 years | $75,000 - $90,000 | Recently promoted or hired. Manages month-end close tasks, handles more complex reconciliations, begins to review junior staff work. Still learning to navigate complex issues. |

| Mid-Career Senior Accountant | 5-8 years | $88,000 - $105,000 | Fully proficient in all aspects of the role. Independently manages complex accounting areas, leads projects, actively mentors junior staff, and is a key contact for auditors. |

| Experienced/Lead Senior Accountant | 8+ years | $100,000 - $125,000+ | Acts as a subject matter expert. May lead a small team or a major accounting function (e.g., revenue recognition, fixed assets). Often considered for promotion to Accounting Manager. |

*Note: Salary ranges are national averages and can vary significantly based on the factors discussed in the next section.*

### Beyond the Base Salary: A Look at Total Compensation

The base salary is only one piece of the puzzle. A Senior Accountant's total compensation package is often significantly higher, thanks to bonuses, profit sharing, and other valuable benefits.

- Annual Bonuses: This is the most common form of variable pay. Bonuses are typically tied to a combination of individual performance and company profitability. According to Payscale, the average annual bonus for a Senior Accountant is around $4,000, but this can range from $1,000 to over $10,000, especially in high-performing industries like finance or tech. In public accounting, particularly at the "Big Four" firms, bonuses can be even more substantial.

- Profit Sharing: Some companies, particularly private or smaller firms, offer profit-sharing plans. This can add an additional $500 to $8,000 to annual earnings, directly linking the accountant's success to the company's financial performance.

- Stock Options/Equity: This is most common in publicly traded companies and startups. Stock options or Restricted Stock Units (RSUs) can be an incredibly lucrative part of compensation, though their value is tied to the company's stock performance. For a senior-level role, an annual equity grant can be worth thousands or even tens of thousands of dollars over the vesting period.

- Retirement Savings: A 401(k) or 403(b) plan with a company match is a standard and valuable benefit. A common match is 50% of contributions up to 6% of your salary. For a Senior Accountant earning $90,000, this equates to an extra $2,700 in tax-deferred savings each year.

- Health and Wellness Benefits: Comprehensive health, dental, and vision insurance is a given. Many companies also offer wellness stipends, gym memberships, and generous paid time off (PTO), which add significant, though non-cash, value.

- Professional Development: Companies often pay for Continuing Professional Education (CPE) credits required to maintain certifications like the CPA. They may also cover the cost of professional association memberships or even contribute toward an advanced degree, saving you thousands of dollars in out-of-pocket expenses.

When you combine a base salary of $90,000 with a $5,000 bonus, a $3,000 401(k) match, and other benefits, the total compensation package for a Senior Accountant can easily approach or exceed $100,000, making it a financially robust and secure career choice.

---

Key Factors That Influence a Senior Accountant Salary

While national averages provide a useful benchmark, your individual earning potential as a Senior Accountant will be determined by a specific set of interconnected factors. Understanding these levers is the key to maximizing your compensation throughout your career. This is where you can move from an "average" salary to an exceptional one.

###

Level of Education & Professional Certifications

Your educational background and professional credentials are the foundation of your accounting career and have a direct, measurable impact on your salary.

- Bachelor's Degree: A Bachelor's degree in Accounting is the non-negotiable entry ticket. It provides the fundamental knowledge of accounting principles, taxation, audit, and business law required for the profession.

- Master's Degree (MAcc or MBA): Pursuing a Master of Accountancy (MAcc) or a Master of Business Administration (MBA) with a concentration in accounting can provide a salary bump of 5-15%. A Master's degree is often pursued to meet the 150-semester-hour requirement for the CPA license. It signals a deeper level of expertise and commitment to the profession, making candidates more attractive, especially for leadership-track roles.

- Certified Public Accountant (CPA): This is the single most impactful credential an accountant can earn. The CPA license is the gold standard in the accounting industry. It demonstrates a high level of competency, a commitment to a strict code of ethics, and is a legal requirement for signing audit reports. The Robert Half Salary Guide consistently notes that professionals with a CPA license can command a salary premium of 5% to 15% over their non-certified peers. For a Senior Accountant, this can translate to an extra $8,000 to $15,000 per year. The CPA opens doors to higher-level positions, public accounting, and specialized roles that are simply unavailable without it.

- Other Certifications: While the CPA is paramount, other certifications can also boost your salary and marketability, especially in specific niches:

- Certified Management Accountant (CMA): Ideal for those in corporate finance and management accounting. It focuses on strategic decision-making and financial planning, making it highly valuable in industry roles.

- Certified Internal Auditor (CIA): The premier certification for professionals in internal audit, risk management, and compliance.

- Certified Fraud Examiner (CFE): Essential for those specializing in forensic accounting and fraud investigation.

###

Years of Experience

Experience is arguably the most significant driver of salary growth. As you accumulate years of relevant experience, your value to an employer increases exponentially. You move from someone who executes tasks to someone who solves problems, manages processes, and mitigates risk.

- The Transition (3-5 Years): The jump from Staff Accountant to Senior Accountant typically occurs around the 3-to-5-year mark. This is where you see the first major salary increase. You've mastered the fundamentals and are trusted to handle the month-end close and more complex responsibilities. Your salary will likely be in the $75,000 to $90,000 range.

- The Expert (5-8 Years): At this stage, you are a fully-fledged Senior Accountant. You are not just proficient; you are an expert in your company's systems and processes. You can work independently, mentor effectively, and begin to lead small projects. Your problem-solving skills are sharp, and your salary reflects this, pushing into the $88,000 to $105,000 range. You may be given the title of "Senior II" or "Lead Accountant" in some organizations.

- The Veteran (8+ Years): With nearly a decade of experience, you are a subject matter expert. You are likely the go-to person for the most complex accounting issues and may be responsible for a critical area like SEC reporting or revenue recognition. You are actively involved in strategic initiatives and are on the clear path to an Accounting Manager role. Salaries for these highly experienced professionals can easily top $110,000 to $125,000+, especially when combined with a CPA and specialized skills.

###

Geographic Location

Where you work matters—a lot. Salaries are adjusted for the local cost of living and the demand for talent in a specific market. A Senior Accountant salary in San Francisco will be vastly different from one in Omaha, Nebraska.

High-Paying Metropolitan Areas:

Cities with major financial centers, a high concentration of large public companies, and a booming tech scene typically offer the highest salaries. According to data from Salary.com and Robert Half, you can expect to earn significantly more than the national average in cities like:

- San Francisco, CA: (35-40% above national average)

- New York, NY: (30-35% above average)

- San Jose, CA: (30-35% above average)

- Boston, MA: (25-30% above average)

- Washington, D.C.: (20-25% above average)

- Los Angeles, CA: (20-25% above average)

In these markets, a Senior Accountant salary can realistically range from $110,000 to $140,000 or more.

Areas Closer to the National Average:

Major cities in the Midwest and South tend to have salaries that align more closely with, or slightly above, the national average.

- Chicago, IL

- Dallas, TX

- Atlanta, GA

- Denver, CO

Lower-Paying Areas:

Salaries will generally be lower in smaller cities and rural areas where the cost of living is substantially less. However, the purchasing power of your salary in these locations may still be very strong.

The rise of remote work has added a new dimension to this. Some companies now pay a national-rate salary regardless of location, while others use a location-based pay model, adjusting your salary if you move to a different cost-of-living area. This is a critical factor to clarify during the interview process for remote roles.

###

Company Type & Size

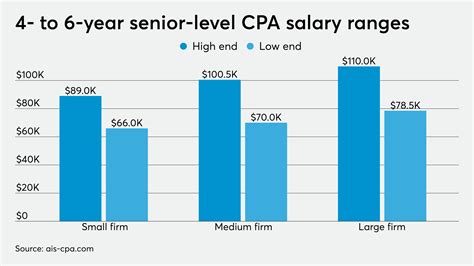

The type of organization you work for and its size play a huge role in determining your compensation and work-life balance.

- Public Accounting (especially the "Big Four"): Firms like Deloitte, PwC, EY, and KPMG are known for offering highly competitive starting salaries and bonuses to attract top talent. A Senior Accountant (often called a "Senior Associate") at a Big Four firm in a major market can earn a base salary of $95,000 to $120,000+. The trade-off is notoriously long hours, especially during busy season. However, the experience gained is unparalleled and acts as a career accelerator.

- Large Corporations (Industry/Private Accounting): Fortune 500 companies and other large, publicly traded enterprises offer very competitive salaries, excellent benefits, and more predictable work-life balance compared to public accounting. The average senior accountant salary is often highest in these environments, especially in high-margin industries like technology, pharmaceuticals, and financial services.

- Startups & Small/Medium-Sized Businesses (SMBs): Salaries at startups can be a mixed bag. Early-stage, cash-strapped startups may offer lower base salaries but compensate with significant equity (stock options), which carries high risk and high potential reward. More established, venture-backed startups will offer competitive market-rate salaries. SMBs may offer slightly lower salaries than large corporations but can provide broader experience as you may wear many hats.

- Government: Federal, state, and local government accounting roles offer the greatest job security and excellent benefits, including pensions. The salaries are often lower than in the private sector, but the work-life balance is typically the best available (e.g., a strict 40-hour work week). A Senior Accountant (or an equivalent GS-12/13 federal grade) might earn $80,000 to $110,000 depending on the agency and location.

- Non-Profit: Non-profit organizations typically offer the lowest salaries due to budget constraints. However, they provide the opportunity for mission-driven work that many find personally fulfilling.

###

Area of Specialization

Within the Senior Accountant role, developing a specialization can make you a more valuable and higher-paid professional.

- SEC Reporting & Technical Accounting: Senior Accountants who specialize in preparing SEC filings (10-K, 10-Q) and researching complex GAAP issues are in high demand at publicly traded companies. This is a highly technical and detail-oriented field that commands a salary premium.

- IT Audit / SOX Compliance: With the increasing reliance on technology, accountants who can bridge the gap between finance and IT are invaluable. Specializing in IT controls, SOX compliance, and system implementations can lead to higher pay.

- Revenue Recognition (ASC 606): In industries like software (SaaS), telecommunications, and construction, revenue recognition is incredibly complex. Senior Accountants who are experts in ASC 606 are critical assets and are compensated accordingly.

- Forensic Accounting: This specialization involves investigating financial discrepancies and fraud. It requires a unique skill set and often a CFE certification, leading to higher earning potential.

- Tax Accounting: While often a separate career path, some corporate accounting roles have a heavy tax component. Senior Tax Accountants responsible for tax provision and compliance also command high salaries.

###

In-Demand Skills

Beyond your formal credentials, a specific set of technical and soft skills can directly influence your salary negotiations and career trajectory.

High-Value Technical Skills:

- Advanced Excel: This is table stakes. You must be a power user, proficient in PivotTables, VLOOKUP/INDEX(MATCH), Power Query, and data modeling.

- ERP System Proficiency: Deep experience with a major ERP system like SAP, Oracle NetSuite, or Microsoft Dynamics 365 is a huge plus. Companies are willing to pay more for someone who can hit the ground running on their specific system.

- Data Analytics & Visualization: Skills in using tools like Tableau, Power BI, or Alteryx to analyze and visualize financial data are becoming increasingly important. This elevates you from a record-keeper to a strategic analyst.

- SQL (Structured Query Language): The ability to pull and manipulate data directly from databases is a powerful skill that sets you apart from many of your peers.

Essential Soft Skills:

- Communication & Presentation: You must be able to clearly explain complex financial concepts to non-financial stakeholders.

- Leadership & Mentorship: As a senior, your ability to train, guide, and motivate junior staff is a key part of your value.

- Critical Thinking & Problem-Solving: Your job is to identify issues, analyze the root cause, and propose effective solutions.

- Business Acumen: Understanding the broader business operations and how your work impacts the company's goals is crucial for advancing into management.

---

Job Outlook and Career Growth

Investing time and effort into a career path requires confidence in its future stability and growth potential. For Senior Accountants, the outlook is exceptionally positive. The skills they possess are fundamental to the operation of any business, making the profession resilient to economic downturns and poised for steady growth.

According to the U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook, employment for Accountants and Auditors is projected to grow 6 percent from 2022 to 2032, which is faster than the average for all occupations. This growth is expected to result in about 126,500 openings for accountants and auditors each year, on average, over the decade. Many of those openings will arise from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire.

This stable demand is underpinned by several key factors:

- Economic Growth: As the economy grows, businesses expand, and new companies are created, all of which require accounting professionals to manage their finances.

- Increasingly Complex Regulations: Globalization, evolving tax laws, and a continued focus on corporate governance (like SOX) necessitate the expertise of skilled accountants to ensure compliance and mitigate risk.

- Focus on Data Analysis: Businesses are increasingly looking to their finance teams to provide strategic insights. Accountants who can analyze financial data to support decision-making are more valuable than ever.

### The Career Path Beyond Senior Accountant

The Senior Accountant role is not a final destination; it's a launchpad for leadership positions. The skills, experience, and business acumen developed in this role provide a direct and clear pathway for advancement.

The typical career ladder looks like this:

1. Staff Accountant (1-3 years): The starting point.

2. Senior Accountant (3-8 years): The focus of this guide.

3. Accounting Manager: The next logical step. The Accounting Manager oversees the entire accounting department, manages the team (including senior accountants), and is responsible for the accuracy of the financial statements. They often report directly to the Controller. Salaries for Accounting Managers typically range from $100,000 to $150,000+.

4. Controller: The head of the accounting function. The Controller is a high-level strategic role responsible for all accounting operations, including financial reporting, budget management, and internal controls. They often have significant input on the company's financial strategy. Controller salaries can range from $130,000 to over $250,000, depending on company size.

5. Chief Financial Officer (CFO) or VP of Finance: The pinnacle of a corporate finance career. The CFO is a C-suite executive responsible for the entire financial health of the organization, including accounting, finance, treasury, and corporate strategy. This is a highly strategic role with compensation often reaching well into the high six or even seven figures.

### Emerging Trends and Future-Proofing Your Career

While the core principles of accounting remain constant, the profession is evolving. To