In the digital bloodstream of the global economy, few institutions carry as much weight as Bank of America. Behind every seamless mobile deposit, every secure transaction, and every algorithm-driven investment decision lies a vast and sophisticated technology infrastructure, powered by tens of thousands of dedicated IT professionals. For those with a passion for technology and an ambition to work at the heart of global finance, a career in IT at Bank of America represents a pinnacle of stability, challenge, and significant financial reward.

But what does that reward actually look like? The query "Bank of America IT salary" is more than just a search for a number; it's a question about value, opportunity, and the potential for a life-changing career. This guide is designed to provide a comprehensive, authoritative answer. We will dissect not just the salary figures but the entire ecosystem that defines a technology career at one of the world's largest financial institutions. We'll explore the roles, the growth trajectories, the skills that command top dollar, and a step-by-step plan to get you there.

I once had the opportunity to consult on a project that involved interfacing with the technology risk division of a major bank. The sheer scale was staggering—not just the lines of code or the petabytes of data, but the immense responsibility of safeguarding the financial well-being of millions of customers. It was a powerful reminder that an IT role in this sector is not just about writing code or managing servers; it's about building and protecting the digital fortress of modern commerce.

This guide will serve as your blueprint, whether you're a student mapping out your future, a mid-career professional considering a change, or an experienced technologist aiming for the major leagues.

### Table of Contents

- [What Does an IT Professional at Bank of America Do?](#what-does-a-bank-of-america-it-professional-do)

- [Average Bank of America IT Salary: A Deep Dive](#average-bank-of-america-it-salary-a-deep-dive)

- [Key Factors That Influence Your Bank of America IT Salary](#key-factors-that-influence-your-bank-of-america-it-salary)

- [Job Outlook and Career Growth in Financial IT](#job-outlook-and-career-growth-in-financial-it)

- [How to Get Started on Your Bank of America IT Career Path](#how-to-get-started-on-your-bank-of-america-it-career-path)

- [Conclusion: Is a Career in IT at Bank of America Right for You?](#conclusion-is-a-career-in-it-at-bank-of-america-right-for-you)

What Does an IT Professional at Bank of America Do?

An "IT professional" at an institution as massive as Bank of America is not a single job but a vast spectrum of roles, each critical to the bank's operation. The bank's technology division, officially known as Global Technology & Operations (GT&O), employs over 100,000 people and is responsible for the end-to-end delivery of technology, operations, and information security across all lines of business.

At its core, the mission of a Bank of America IT professional is to build, maintain, secure, and innovate the technological systems that enable the bank to serve its 67 million clients. This work is characterized by three non-negotiable principles:

1. Security: Protecting client data and the bank's assets from ever-evolving cyber threats is paramount.

2. Stability: Ensuring that systems like online banking, ATMs, and trading platforms are available 24/7/365 with near-perfect uptime.

3. Scalability: Building systems that can handle trillions of dollars in transactions and immense volumes of data without faltering.

Daily Tasks and Typical Projects

The day-to-day responsibilities vary dramatically depending on the specific role, but they generally fall into several key domains:

- Software Development: Designing, coding, testing, and deploying applications. This could be anything from a new feature for the mobile banking app, a high-frequency trading algorithm for Merrill Lynch, or an internal risk-management platform.

- Cybersecurity: Actively monitoring for threats, conducting penetration tests, managing identity and access controls, and responding to security incidents.

- Infrastructure Management: Managing the bank's massive network of servers, data centers, and cloud environments (both private and public, like Microsoft Azure). This includes roles like network engineers, systems administrators, and cloud architects.

- Data Science and Analytics: Using big data to drive business decisions. This involves building machine learning models for fraud detection, analyzing customer behavior to personalize services, or assessing credit risk.

- IT Project & Program Management: Overseeing large-scale technology initiatives, ensuring they are completed on time, within budget, and in compliance with strict regulatory requirements.

- IT Support and Operations: Providing technical assistance to the bank's employees and ensuring the smooth operation of all end-user technology.

### A Day in the Life: "Priya, Assistant Vice President (AVP), Cybersecurity Analyst"

To make this more concrete, let's imagine a typical day for Priya, a cybersecurity analyst working at Bank of America's major tech hub in Charlotte, North Carolina.

- 8:30 AM - Threat Intelligence Briefing: Priya starts her day by reviewing the latest threat intelligence feeds and overnight alerts from the Security Operations Center (SOC). She looks for new malware variants, phishing campaigns targeting financial institutions, or vulnerabilities discovered in software the bank uses.

- 9:00 AM - Agile Stand-up Meeting: Her team gathers for a 15-minute meeting to discuss their current "sprint." Priya gives an update on her investigation into a series of suspicious login attempts and listens to updates from colleagues working on implementing a new endpoint detection tool.

- 9:30 AM - Investigation and Analysis: Priya spends the next few hours deep in analysis. She uses tools like Splunk to query massive log files, tracing the digital footprints of the suspicious login attempts. She correlates data from multiple systems to determine if it was a coordinated attack or isolated incidents.

- 12:00 PM - Lunch: She grabs lunch with a few colleagues from the application development team to casually discuss an upcoming security review for their new project. Building these relationships is key to fostering a security-conscious culture.

- 1:00 PM - Regulatory Compliance Review: Priya joins a video conference with a project manager and a compliance officer. They are reviewing the architecture of a new cloud-based application to ensure it meets the stringent data protection requirements set by regulators like the Federal Reserve.

- 2:30 PM - Phishing Simulation Campaign: Priya helps configure and launch an internal phishing simulation to test employee awareness. She will later analyze the results to identify departments that may need additional training.

- 4:00 PM - Documentation and Reporting: She meticulously documents her findings from the morning's investigation, creating a detailed report with recommendations for a new firewall rule to block the malicious IP addresses she identified. Clear, precise documentation is crucial for audits and future reference.

- 5:00 PM - Team Knowledge Share: Before logging off, Priya shares an interesting article about a new "zero-day" exploit in a weekly team chat, sparking a brief discussion on how they can proactively defend against it.

This day illustrates the blend of deep technical work, collaborative problem-solving, and process-driven rigor that defines a technology role at Bank of America.

Average Bank of America IT Salary: A Deep Dive

Now, let's address the central question. A Bank of America IT salary is not a single number but a complex package influenced by role, rank, location, performance, and specialization. However, by aggregating data from reputable sources, we can build a very clear picture of the earning potential.

According to data compiled from thousands of employee-submitted profiles on platforms like Glassdoor, Payscale, and Levels.fyi, the average total compensation for a technology professional at Bank of America can range significantly. As of late 2023 and early 2024, the overall salary landscape for IT and software development roles looks something like this:

- Average Base Salary: Approximately $115,000 per year.

- Typical Total Compensation Range (including bonuses and stock): $80,000 to $250,000+ per year.

This wide range reflects the diverse hierarchy within the bank. A junior IT support analyst will be at the lower end, while a senior vice president in quantitative development will be at the very high end, or even exceed it.

*Disclaimer: Salary data is dynamic and subject to change. The figures presented here are estimates based on publicly available, self-reported data from early 2024 and are intended for informational purposes.*

### Salary Brackets by Experience Level and Title

Bank of America, like most large corporations, uses a structured hierarchy of titles that directly correlate with salary bands. Understanding these titles is key to understanding compensation.

| Title / Level | Experience Level | Typical Base Salary Range | Typical Total Compensation Range (with Bonus/Stock) | Notes |

| ----------------------------- | ------------------- | ----------------------------- | --------------------------------------------------- | ---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- |

| Analyst / Specialist | Entry-Level (0-3 yrs) | $70,000 - $95,000 | $75,000 - $110,000 | This is the starting point for recent graduates. Roles include Technology Analyst, Information Security Specialist, or Junior Developer. The bonus is typically a smaller percentage of the base salary. |

| Associate | Early-Career (2-5 yrs) | $90,000 - $120,000 | $100,000 - $145,000 | After a few years of solid performance, an Analyst is typically promoted to Associate. Responsibilities increase, but they are still primarily individual contributors. |

| Assistant Vice President (AVP) | Mid-Career (5-10 yrs) | $115,000 - $150,000 | $130,000 - $190,000 | This is a key mid-career level. AVPs are often senior individual contributors, subject matter experts, or new team leads. Stock awards (RSUs) may become a more regular part of the compensation package. |

| Vice President (VP) | Senior (8-15+ yrs) | $145,000 - $200,000 | $180,000 - $280,000+ | A significant jump in responsibility and compensation. VPs are typically team leaders, architects, or principal engineers. The annual bonus and stock awards become a substantial portion of total pay. |

| Senior Vice President (SVP) / Director | Leadership (12+ yrs) | $190,000 - $250,000+ | $250,000 - $500,000+ | These are senior leadership roles, managing large teams, entire departments, or critical technology platforms. Compensation is heavily tied to performance and the bank's overall success. |

*Sources: Data aggregated and synthesized from Glassdoor, Levels.fyi, and Salary.com for Bank of America technology roles as of Q1 2024.*

### Beyond the Base: Deconstructing the Compensation Package

A common mistake is to focus only on the base salary. At a large financial institution, total compensation is a much more important metric. A typical Bank of America IT salary package includes several components:

1. Base Salary: This is the fixed, predictable portion of your pay. It is determined by your role, level, and location.

2. Annual Performance Bonus: This is a variable cash payment awarded once a year based on both your individual performance and the bank's overall performance. For junior roles, this might be 5-15% of the base salary. For senior roles like VP or Director, it can be 30-100% or more of the base salary, making it a massive part of the annual take-home pay.

3. Stock Awards (Restricted Stock Units - RSUs): For mid-level positions (typically AVP and above), a portion of the compensation is awarded in company stock. These RSUs vest over a period of time (e.g., 3-4 years), which serves as a powerful incentive to stay with the company and contribute to its long-term growth. The value of these awards can be substantial, especially at senior levels.

4. Benefits and Perks: While not direct cash, these have significant financial value. Bank of America is known for its comprehensive benefits packages, which typically include:

- 401(k) Plan: A generous company match (e.g., matching 100% of employee contributions up to 5% of pay). This is essentially free money for retirement.

- Health and Wellness: High-quality medical, dental, and vision insurance. They also offer wellness programs, mental health support (a significant focus post-pandemic), and backup childcare/eldercare.

- Paid Time Off (PTO): A competitive vacation and sick day policy.

- Parental Leave: Often provides generous paid leave for new parents.

- Education Assistance: Tuition reimbursement programs for employees pursuing further education or certifications.

When evaluating a job offer, it is crucial to consider this entire package. A slightly lower base salary might be more than offset by a larger bonus potential and excellent benefits.

Key Factors That Influence Your Bank of America IT Salary

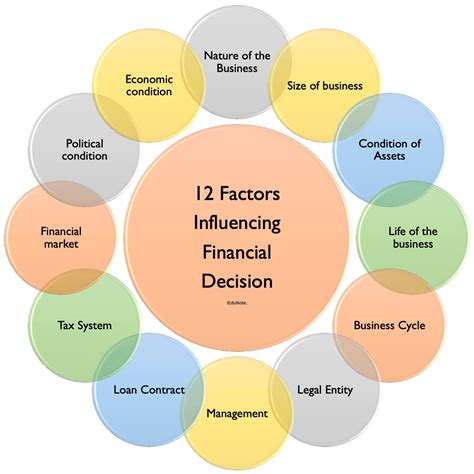

Two people with the same job title at Bank of America can have vastly different salaries. Understanding the levers that control compensation is the key to maximizing your earning potential. This is the most critical section for anyone planning a career in this field.

###

1. Level of Education and Certifications

While hands-on experience often trumps all, your educational foundation sets your starting point and can influence your long-term trajectory.

- Bachelor's Degree: This is the standard entry requirement for almost all professional IT roles at Bank of America. Degrees in Computer Science, Information Technology, Management Information Systems (MIS), Cybersecurity, or a related STEM field are most common. A strong academic record from a reputable university can give you an edge and potentially a higher starting salary.

- Master's Degree: An advanced degree can provide a significant salary boost, particularly in specialized fields.

- A Master of Science in Computer Science, Data Science, or Cybersecurity can qualify you for more senior, specialized roles right out of school and can command a 10-20% salary premium over a Bachelor's degree.

- An MBA with a technology or finance concentration is highly valuable for those aiming for leadership roles like IT project management, program management, or strategy, where a blend of business acumen and technical knowledge is required.

- Professional Certifications: In the world of IT, certifications are a powerful way to validate specific skills and often translate directly to higher pay. They demonstrate a commitment to continuous learning. High-value certifications for a financial IT career include:

- Cybersecurity: Certified Information Systems Security Professional (CISSP), Certified Information Security Manager (CISM), Offensive Security Certified Professional (OSCP). Possessing a CISSP can often add $10,000-$15,000 to a candidate's annual salary.

- Cloud Computing: AWS Certified Solutions Architect (Professional or Associate), Microsoft Certified: Azure Solutions Architect Expert. As banks migrate more services to the cloud, these are in extremely high demand.

- Project Management: Project Management Professional (PMP), Certified ScrumMaster (CSM). Essential for roles managing complex, multi-million dollar projects.

- Networking: Cisco Certified Network Professional (CCNP) or Internetwork Expert (CCIE).

###

2. Years and Quality of Experience

This is, without a doubt, the single most significant factor. Salary growth is directly tied to a demonstrated track record of success and increasing responsibility.

- Entry-Level (0-3 years): At this stage, you are learning the ropes, the bank's specific systems, and its culture of risk management. Your salary reflects your potential more than your proven impact. The focus is on executing tasks under supervision. The salary jump from year 1 to year 3 can be modest, but the real goal is to gain the experience necessary for promotion to Associate.

- Mid-Career (3-10 years): This is where significant salary growth occurs. As an Associate and then an AVP, you move from just doing tasks to owning projects or features. You are a subject matter expert who can work independently and mentor junior team members. Each promotion (e.g., from Analyst to Associate, Associate to AVP) comes with a substantial pay increase, often in the 15-25% range.

- Senior/Leadership (10+ years): As a VP and above, your value shifts from technical execution to strategic impact. You are leading teams, setting technical direction, managing budgets, and interfacing with senior business leaders. Your compensation, particularly the bonus and stock components, becomes highly leveraged based on the performance of your team and your division. A VP leading a critical trading platform team will earn significantly more than a VP in a less revenue-critical function. The quality of your experience matters immensely; 10 years spent leading complex, successful projects is far more valuable than 15 years in a maintenance role.

###

3. Geographic Location

Where you work has a massive impact on your base salary. Bank of America operates in a "location-based pay" model, meaning they adjust salary bands based on the cost of living and the local market competition for talent in a specific city.

Here’s a comparative look at potential base salaries for a mid-career Software Developer (AVP level) in different BofA tech hubs:

| City | Estimated Base Salary (AVP Software Developer) | Cost of Living Context |

| ---------------------- | ---------------------------------------------- | ------------------------------------------------------------ |

| New York, NY | $145,000 - $170,000 | Very High. Top-tier pay to compensate for extremely high housing and living costs. |

| Charlotte, NC | $125,000 - $145,000 | Medium. A major tech hub for the bank with a much lower cost of living than NYC, offering a high quality of life. |

| Dallas/Plano, TX | $120,000 - $140,000 | Medium. A rapidly growing tech hub with no state income tax, making it very attractive financially. |

| Chicago, IL | $130,000 - $150,000 | High. A major financial center with salaries that reflect its status. |

| Jersey City, NJ | $140,000 - $165,000 | Very High. Often serves as a less expensive alternative to Manhattan, with salaries that are still highly competitive. |

| Jacksonville, FL | $110,000 - $125,000 | Low-Medium. An operations and technology center with lower salaries but also a significantly lower cost of living. |

*Source: Synthesized data from Salary.com's cost-of-living calculators and Glassdoor's location-based salary estimates.*

An IT professional in New York might earn 15-20% more in base pay than their counterpart in Charlotte, but the difference in their disposable income after housing costs could be negligible or even favor the Charlotte employee.

###

4. Company Type & Size (Contextual Comparison)

While this guide focuses on Bank of America, understanding how its compensation compares to other employers is crucial for negotiation and career planning.

- Bank of America (Large Universal Bank): Offers high stability, excellent benefits, and strong, predictable base salaries with significant bonuses at senior levels. The work environment is structured and risk-averse. Total compensation is very competitive but may trail the absolute top of the market.

- Big Tech (e.g., Google, Meta, Amazon): Often offers higher total compensation, driven by massive stock grants that can dwarf even large bank bonuses. The culture is typically faster-paced and more product-focused. The competition for these roles is arguably the most intense in the world.

- FinTech Startups (e.g., Chime, Brex): Compensation is a mix. Base salaries may be lower or on par with BofA, but they offer equity (stock options) that could be worth a fortune if the company succeeds—or nothing if it fails. This is a high-risk, high-reward path with less stability and fewer benefits.

- Hedge Funds / Quantitative Trading Firms (e.g., Citadel, Jane Street): This is the top of the pay scale. For elite roles like quantitative developers or researchers, total compensation can be astronomical, easily reaching $500,000 to $1,000,000+ for top performers. However, the work is incredibly demanding and the culture is hyper-competitive.

Bank of America occupies a sweet spot for many: offering compensation far above a typical corporate IT job, with more stability and work-life balance than the most extreme ends of the FinTech and quant trading worlds.

###

5. Area of Specialization

Not all IT roles are created equal. Within Bank of America, certain specializations are more critical, more complex, or in higher demand, and are therefore compensated more generously.

- Top Tier (Highest Pay):

- Quantitative Development/Analytics: These "Quants" use advanced mathematics and programming (often C++, Python) to build and optimize trading algorithms. They work directly with the revenue-generating parts of the bank (Global Markets) and are compensated accordingly. Their bonuses can be multiples of their base salary.

- AI/Machine Learning Engineering: Professionals who build sophisticated models for fraud detection, algorithmic trading, or credit risk assessment are at the cutting edge and command top salaries.

- High Demand Tier:

- Cybersecurity: With financial institutions being a primary target for cyberattacks, skilled security professionals (especially in offensive security, threat intelligence, and cloud security) are paid a premium.

- Cloud Architecture/Engineering: Experts in AWS, Azure, and Google Cloud who can design and manage secure, scalable, and cost-effective cloud infrastructure are in a constant war for talent.

- Data Science and Engineering: Beyond just AI/ML, professionals who can build and manage the data pipelines and infrastructure that power the entire bank's analytics capabilities are highly valued.

- Core Technology Tier:

- Software Development (Enterprise): This includes the vast majority of developers working on the mobile app, online banking, internal applications, etc. Compensation is strong and follows the standard hierarchy. Java and Python are common languages.

- DevOps/SRE (Site Reliability Engineering): These roles, which bridge development and operations, are crucial for ensuring the stability and performance of the bank's services.

- IT Project Management: Skilled managers who can navigate the bank's complex bureaucracy and regulatory landscape to deliver projects on time are well-compensated.

- Standard Tier:

- Infrastructure and Networking: While absolutely essential, salaries for traditional network administrators and systems engineers may be slightly lower than for cutting-edge development or security roles, though still very competitive.

- IT Support / Help Desk: These entry-level and operational roles have the lowest salaries within the IT organization but serve as a critical entry point into the company.

###

6. In-Demand Skills

Finally, your specific skillset is your currency. The more you have of what the bank needs most, the more you will earn.

- Programming Languages: Python and Java are the workhorses for enterprise applications. C++ is king in high-performance and quantitative finance.