A career in banking offers a stable, structured path with significant opportunities for professional and financial growth. For those with strong interpersonal skills and a knack for finance, the role of a Personal Banker at a major institution like Wells Fargo can be an excellent entry point. But what can you realistically expect to earn?

This in-depth guide breaks down the typical Wells Fargo Personal Banker salary, exploring the key factors that influence your earning potential. While a starting salary can be competitive, top performers who leverage experience, location, and specialization can see their total compensation grow substantially, often ranging from $45,000 to over $75,000 annually when including bonuses and incentives.

What Does a Wells Fargo Personal Banker Do?

Before diving into the numbers, it's essential to understand the role. A Wells Fargo Personal Banker is the face of the bank for many customers, acting as a primary point of contact for financial needs beyond simple transactions. This is a relationship-focused role that blends customer service, problem-solving, and sales.

Key responsibilities typically include:

- Building Client Relationships: Engaging with new and existing customers to understand their financial goals.

- Account Management: Opening and managing checking accounts, savings accounts, and CDs.

- Financial Guidance: Identifying customer needs and recommending appropriate bank products and services, such as credit cards, personal loans, and lines of credit.

- Cross-Selling and Referrals: Referring clients to specialists for mortgages, investments, or small business solutions.

- Problem Resolution: Assisting customers with complex account issues and ensuring a high level of satisfaction.

In essence, a personal banker helps clients navigate their financial lives while helping the bank grow its business.

Average Wells Fargo Personal Banker Salary

When analyzing compensation, it's crucial to distinguish between base salary and total compensation, which includes bonuses, commissions, and profit-sharing.

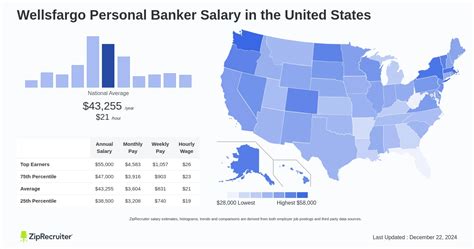

As of late 2023 and early 2024, data from reputable salary aggregators provides a clear picture:

- Average Base Salary: The average base salary for a Wells Fargo Personal Banker in the United States typically falls between $45,000 and $55,000 per year.

- According to Glassdoor, the estimated base pay for this role at Wells Fargo is around $48,500 per year.

- Payscale reports a similar average base salary of approximately $46,000 per year.

- Total Compensation: This is where the earning potential truly shines. Personal bankers are often eligible for significant incentive-based pay.

- Glassdoor estimates that with additional pay like bonuses and commission, the total compensation can range from $50,000 to $74,000 per year, with the average total pay hovering around $60,000.

- Salary.com, analyzing the broader "Personal Banker I" role, places the median salary at $46,550, but notes that the full range can extend well into the high $50,000s before considering senior roles.

Entry-level personal bankers can expect to start at the lower end of this range, perhaps in the low $40,000s, while experienced, high-performing senior bankers in prime locations can earn well over $75,000 in total compensation.

Key Factors That Influence Salary

Your salary isn't a single, fixed number. It's a dynamic figure influenced by several critical factors. Understanding these levers is key to maximizing your earning potential.

Level of Education

While a four-year bachelor's degree is not always a strict requirement, it is highly preferred and can significantly impact your career trajectory and starting salary.

- Minimum Requirement: Most personal banker positions require a high school diploma or GED, combined with relevant customer service or sales experience.

- The Bachelor's Degree Advantage: Candidates with a bachelor's degree in Finance, Business Administration, Economics, or a related field are often viewed more favorably. A degree demonstrates analytical skills, financial literacy, and commitment, potentially leading to a higher starting salary and a faster track to promotions or specialized, higher-paying roles like financial advising or branch management.

Years of Experience

Experience is one of the most significant drivers of salary growth in this role. As you build a track record of success, your value to the bank—and your compensation—increases accordingly.

- Entry-Level (0-2 years): In this stage, you are learning the bank's products, building customer service skills, and meeting initial sales goals. Your compensation will primarily consist of your base salary with smaller, more modest bonuses.

- Mid-Career (3-7 years): With a proven ability to retain clients, meet and exceed sales targets, and handle more complex financial scenarios, your value increases. Your base salary will see incremental growth, and your variable/bonus compensation will become a much larger and more consistent part of your total earnings.

- Senior/Lead (8+ years): Senior Personal Bankers often handle a portfolio of high-value clients, mentor junior bankers, and may take on leadership responsibilities. Their base salaries are at the top of the scale, and their bonus potential is highest due to their extensive client book and referral success.

Geographic Location

Where you work matters immensely. Salaries are adjusted based on the local cost of living and the competitiveness of the regional job market.

A personal banker in a major metropolitan area with a high cost of living will earn significantly more than a counterpart in a smaller, rural town. For example:

- High-Cost Areas: Cities like San Francisco, New York, San Jose, and Boston will offer the highest salaries to offset expensive living costs. According to Salary.com, salaries in these major markets can be 15-25% higher than the national average.

- Mid-to-Low Cost Areas: Salaries in cities in the Midwest or Southeast will likely be closer to or slightly below the national average, though the purchasing power may be equivalent or greater.

Company Type

While this article focuses on Wells Fargo, it's helpful to understand where a large national bank fits in the broader financial landscape.

- Large National Banks (Wells Fargo, Bank of America, JPMorgan Chase): These institutions typically offer highly structured compensation packages with clear salary bands, robust benefits, and well-defined bonus programs. They provide clear career paths and extensive training resources.

- Regional Banks and Credit Unions: Compensation at these smaller institutions can vary. Sometimes the base salary might be slightly lower, but they may offer a different culture, a better work-life balance, or unique local incentive structures.

Area of Specialization

The "Personal Banker" title can be a launchpad into more specialized, and often more lucrative, roles. Acquiring specific licenses and skills is the fastest way to increase your earnings.

- Licensed Personal Banker: This is the most critical specialization. By obtaining FINRA licenses like the Series 6 and Series 63, you become legally authorized to sell investment products like mutual funds and annuities. This unlocks significant commission-based earning potential far beyond what a non-licensed banker can achieve.

- Small Business Banking: Some personal bankers specialize in serving the needs of small business owners, a valuable and complex client segment.

- Affluent Banking: Top performers can transition to roles in priority or private banking, where they manage the finances of high-net-worth individuals, leading to substantially higher compensation.

Job Outlook

The career outlook for personal bankers is evolving with the rise of digital banking. According to the U.S. Bureau of Labor Statistics (BLS), the profession of "Financial Services Sales Agents," which is a close parallel to the modern personal banker role, is projected to grow 3% from 2022 to 2032.

While this is about as fast as the average for all occupations, it highlights a critical shift: the role is moving away from routine transactions and toward advisory and relationship management. Automation and mobile banking handle the simple tasks, making human bankers more valuable for complex advice, financial planning, and building long-term trust. The median annual wage for this broader category was $67,710 in May 2022, underscoring the strong earning potential for those who adapt.

Conclusion

A career as a Wells Fargo Personal Banker offers a promising blend of stability, customer interaction, and financial reward. While a typical base salary provides a solid foundation, the path to a high income lies in leveraging the key influencing factors.

For aspiring and current professionals, the key takeaways are:

- Aim for Total Compensation: Look beyond the base salary. Your ability to earn bonuses and incentives will define your true earning potential, with total pay often reaching $50,000 to $75,000+.

- Experience and Performance Pay: Your salary will grow as you build your client portfolio and consistently meet performance goals.

- Get Licensed: Obtaining FINRA Series 6 and 63 licenses is the single most effective way to unlock higher commission-based earnings.

- Location Matters: Be aware that salaries are higher in major metropolitan areas to reflect the cost of living.

For individuals with strong communication skills, a drive to help others, and a passion for finance, the personal banker role at Wells Fargo is not just a job—it's a gateway to a long and prosperous career in the financial services industry.