For many, the first tangible step into the world of finance isn't on a high-stakes trading floor, but on the other side of a polished counter, interacting with a friendly and knowledgeable bank teller. This role, often seen as the face of the bank, is a critical entry point into the vast and rewarding financial services industry. If you're considering this path, you're likely asking the central question: "What is a typical bank teller salary, and what is the true potential of this career?"

The answer is more complex and promising than you might think. While the national median salary for a bank teller hovers around $36,000 to $38,000 per year, this figure is merely a starting point. It doesn't account for the significant variations based on your experience, location, the type of institution you work for, and most importantly, the career trajectory you choose to follow.

I still vividly remember the first time I walked into a bank by myself at eighteen to open my first "real" savings account. The teller who helped me wasn't just processing a transaction; she took the time to explain interest rates and overdraft protection, making the intimidating world of personal finance feel accessible. That single positive interaction shaped my view of banking and underscored the immense value of a skilled and empathetic professional in this role.

This guide is designed to be your definitive resource, moving beyond simple salary numbers to provide a comprehensive roadmap. We will dissect every factor influencing your earning potential, explore the evolving nature of the job in a digital age, and lay out a clear, step-by-step plan to launch and advance your career.

### Table of Contents

- [What Does a Bank Teller Do?](#what-does-a-bank-teller-do)

- [Average Bank Teller Salary: A Deep Dive](#average-bank-teller-salary-a-deep-dive)

- [Key Factors That Influence a Bank Teller's Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth for Bank Tellers](#job-outlook-and-career-growth)

- [How to Become a Bank Teller: A Step-by-Step Guide](#how-to-get-started-in-this-career)

- [Conclusion: Is a Bank Teller Career Right for You?](#conclusion)

What Does a Bank Teller Do?

A bank teller is far more than a human cash dispenser. They are the primary point of contact for most bank customers, serving as a navigator, problem-solver, and relationship builder. While their core function revolves around handling financial transactions, their true value lies in ensuring customer satisfaction, maintaining security, and identifying opportunities to deepen the customer's relationship with the bank.

The role is a unique blend of meticulous administrative work and high-touch customer service. Accuracy is paramount, as tellers handle significant amounts of cash and sensitive client information daily. At the same time, they must be personable, patient, and excellent communicators, capable of explaining complex financial products in simple terms.

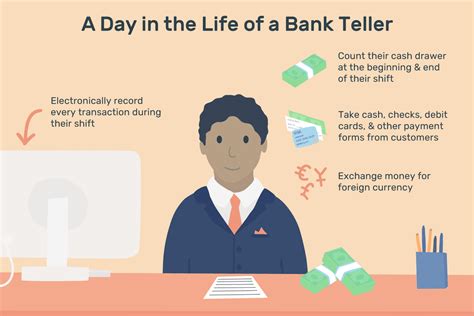

Core Responsibilities and Daily Tasks:

- Processing Transactions: This is the most fundamental duty. Tellers handle deposits, withdrawals, loan payments, check cashing, and money orders. They must be proficient in verifying signatures, checking account balances, and ensuring the legitimacy of negotiable instruments.

- Cash Management: Each teller is responsible for their own cash drawer. This involves starting the day with a set amount of cash, managing it throughout the day, and "balancing the drawer" at the close of business. This requires scrupulous attention to detail to ensure the physical cash matches the transaction records.

- Customer Service and Support: Tellers answer a wide range of customer inquiries, from questions about account balances and transaction histories to issues with debit cards or online banking. They are the first line of defense for problem-solving.

- Product and Service Promotion (Cross-Selling): Modern tellers are increasingly trained to identify customer needs and suggest relevant bank products. If a customer makes a large deposit, a teller might mention high-yield savings accounts or certificates of deposit (CDs). This sales-oriented aspect is a key part of the evolving role.

- Following Security and Compliance Protocols: Tellers operate in a highly regulated environment. They are trained to adhere to strict security procedures to prevent fraud and theft, and they must comply with federal regulations like the Bank Secrecy Act (BSA), which involves reporting suspicious transactions.

- Administrative Duties: This can include processing mail, scanning documents, ordering checks for customers, and handling foreign currency exchanges.

### A Day in the Life of a Bank Teller

To make the role more tangible, let's walk through a typical day:

- 8:45 AM - Opening Procedures: The day begins before the doors open. The teller retrieves their cash drawer from the vault, counts the money to verify the starting balance, and organizes their workspace. They log into the banking terminal and review any internal memos or daily briefings from the branch manager.

- 9:00 AM - Doors Open: The first customers arrive. The morning is often busy with local business owners making their daily deposits and individuals cashing paychecks. The teller processes transactions efficiently while greeting each customer warmly.

- 11:00 AM - Mid-Morning Lull: The initial rush subsides. An elderly customer comes in, confused about a fee on her statement. The teller patiently pulls up her account, explains the charge, and offers a solution to avoid it in the future, building trust and rapport.

- 1:00 PM - Post-Lunch Rush: The lunch hour brings another wave of customers. A young couple asks about opening a joint account. After handling their initial deposit, the teller notices they don't have a credit card with the bank and briefly explains the benefits of their rewards card, handing them a brochure and suggesting they speak with a personal banker when they have more time.

- 3:00 PM - Winding Down: The pace slows again. The teller uses this time to complete administrative tasks, like bundling and sorting currency for the vault and ensuring all scanned checks have been processed correctly.

- 4:45 PM - Closing Procedures: As the branch prepares to close, the teller begins the crucial process of balancing their drawer. They count every coin and bill, run a final transaction report, and ensure the totals match perfectly. Any discrepancies must be investigated and resolved immediately.

- 5:15 PM - End of Day: With the drawer balanced and secured in the vault, the teller tidies their station and signs out, completing another day as the dependable face of the bank.

Average Bank Teller Salary: A Deep Dive

Understanding the compensation for a bank teller requires looking beyond a single number. The salary is composed of a base wage, potential bonuses, and a benefits package. Furthermore, it's heavily influenced by your experience level, creating a clear path for financial growth as you build your career.

### National Averages and Salary Ranges

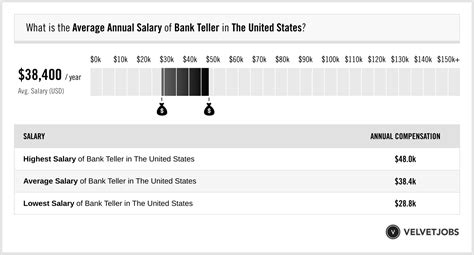

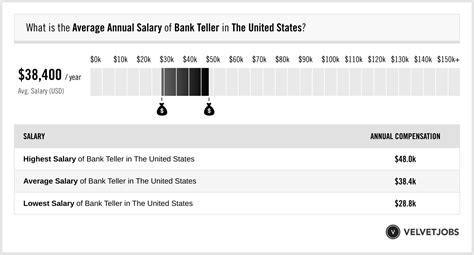

According to the most recent data from the U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook, the median annual wage for tellers was $36,980 as of May 2023. This "median" figure means that half of all tellers earned more than this amount, and half earned less.

The BLS also provides a more detailed range:

- The lowest 10 percent earned less than $29,550.

- The highest 10 percent earned more than $47,930.

Reputable salary aggregator sites provide a similar, and often more real-time, perspective. For example, Salary.com reports that as of late 2023, the typical salary range for a Bank Teller I in the United States falls between $32,593 and $41,595, with an average of around $36,890. This data reinforces the BLS figures and highlights that a starting salary in the low-to-mid $30,000s is common, with significant room to grow toward the low $40,000s even within the core teller role.

### Salary Progression by Experience Level

Your earnings as a teller are not static. As you gain experience, efficiency, and trust, your value to the bank increases, and your compensation should reflect that. The career ladder often includes roles like Senior Teller or Head Teller, which come with higher pay and more responsibility.

Here is a typical salary progression based on experience, compiled from data from sources like Payscale and Salary.com:

| Career Stage | Typical Years of Experience | Salary Range (Annual) | Key Responsibilities & Skills |

| :--- | :--- | :--- | :--- |

| Entry-Level Bank Teller | 0-2 Years | $30,000 - $36,000 | Learning basic transactions, cash handling, bank policies, and customer service fundamentals. Focus is on accuracy and efficiency. |

| Mid-Career Bank Teller | 2-5 Years | $35,000 - $42,000 | Fully proficient in all standard transactions, strong customer relationships, begins to cross-sell products, and may help train new hires. |

| Senior / Lead Teller | 5+ Years | $39,000 - $48,000+ | Handles complex customer issues, authorizes larger transactions, manages branch cash vaults, oversees other tellers, and assists with scheduling and branch operations. |

*Note: These ranges are national averages and can be significantly higher in major metropolitan areas or at larger financial institutions.*

### Beyond the Paycheck: Total Compensation

A bank teller's salary is only one piece of the puzzle. Financial institutions, from large national banks to local credit unions, typically offer competitive benefits packages that add significant value to the overall compensation. When evaluating a job offer, it's crucial to consider these components:

- Bonuses and Incentives: Many banks have moved towards a performance-based pay structure. Tellers can often earn quarterly or annual bonuses based on several factors:

- Referral/Sales Goals: Receiving a bonus for successfully referring a customer to a mortgage lender or wealth management advisor.

- Customer Satisfaction Scores: Achieving high marks on customer surveys.

- Branch Performance: A bonus tied to the overall success of the branch.

These incentives can add several thousand dollars to an annual income.

- Health and Wellness Benefits: Comprehensive health, dental, and vision insurance is a standard offering. This is a significant financial benefit that isn't reflected in the base salary number.

- Retirement Savings Plans: Access to a 401(k) or similar retirement plan is a crucial long-term benefit. Many banks offer a company match, which is essentially free money toward your retirement. For example, a bank might match 100% of your contributions up to 5% of your salary.

- Paid Time Off (PTO): This includes paid vacation days, sick leave, and federal holidays. Banks are known for observing all federal holidays, providing a better work-life balance than many retail positions.

- Tuition Assistance/Reimbursement: This is a particularly valuable benefit for career-minded individuals. Many banks will help pay for college courses or certifications related to finance, business, or accounting, directly supporting your advancement to higher-paying roles within the organization.

- Employee Banking Perks: Tellers often receive preferential rates on loans and mortgages, free checking accounts, and other discounted banking services.

When you factor in these benefits, the "total compensation" for a bank teller is often 20-30% higher than their base salary alone, making it a much more attractive financial proposition.

Key Factors That Influence a Bank Teller's Salary

While we've established a baseline salary range, your actual earnings can vary dramatically based on a combination of personal qualifications, professional choices, and market forces. This is where you have the power to strategically influence your income. Let's break down the most critical factors.

###

1. Level of Education and Certifications

For an entry-level bank teller position, the standard educational requirement is a high school diploma or GED. Banks prioritize on-the-job training for the specific systems and procedures they use. Therefore, having a college degree will not necessarily translate to a significantly higher starting salary *as a teller*.

However, education plays a pivotal role in career advancement and long-term earning potential.

- Associate's or Bachelor's Degree: An employee with a degree in finance, business administration, or accounting is a prime candidate for promotion. A bank manager will see this individual not just as a teller, but as a future Personal Banker, Loan Officer, or Assistant Branch Manager. While you might start in the same role as someone with a high school diploma, your path to a $50,000+ role will be much faster. Many banks use their tuition reimbursement programs to encourage promising tellers to pursue these degrees.

- Professional Certifications: For those looking to excel within the teller career track or specialize, certifications from reputable organizations like the American Bankers Association (ABA) can lead to higher pay and promotions. Key certifications include:

- Bank Teller Certificate: This foundational certificate covers essential skills like cash handling, customer service, and sales, formally validating your expertise.

- Supervisor/Manager Certificate: For tellers aiming for a Lead Teller or Head Teller role, this certification demonstrates leadership and operational management skills.

- Certified Universal Banker (CUB): This is becoming increasingly important. It validates skills beyond basic transactions, including new account opening, consumer loan applications, and in-depth product knowledge, positioning you for the hybrid "universal banker" role which commands a higher salary.

Possessing these credentials signals a commitment to the profession and provides you with a competitive edge.

###

2. Years of Experience

Experience is perhaps the most direct and reliable driver of salary growth in the teller profession. As outlined in the table above, there's a clear and predictable increase in pay as you move from an entry-level trainee to a seasoned, senior teller.

- Entry-Level (0-2 years): In this stage, your value is in your potential. Your salary reflects that you are in a learning phase, mastering the core functions of the job. Your focus is on accuracy, speed, and building a foundational understanding of banking procedures.

- Mid-Career (2-5 years): By now, you are a proficient and reliable member of the team. You can handle nearly any standard customer request without supervision. Your salary increases because your efficiency contributes directly to the branch's smooth operation. You are trusted with more complex situations and may begin mentoring newer employees. Your salary could see a 15-25% increase from your starting wage.

- Senior/Lead Teller (5+ years): At this level, you are a leader on the teller line. You are the go-to person for escalated issues and have the authority to make decisions that junior tellers cannot. You are responsible for operational duties like vault management and auditing. This leadership and responsibility command a premium salary, often 30-50% higher than an entry-level position. Many Head Tellers earn in the mid-to-high $40,000s, and in high-cost-of-living areas, this can exceed $50,000.

###

3. Geographic Location

Where you work is one of the most significant factors determining your paycheck. Salaries are adjusted based on the local cost of living and the demand for labor in a specific market. A teller salary in rural Arkansas will be vastly different from one in downtown San Francisco.

High-Paying States and Metropolitan Areas:

According to BLS data, the states with the highest annual mean wages for tellers typically include:

- Washington: ~$44,980

- California: ~$43,710

- Massachusetts: ~$43,450

- Connecticut: ~$43,150

- New York: ~$42,750

Metropolitan areas within these states (and others) pay even more. For example, tellers in the San Francisco-Oakland-Hayward, CA metro area can earn an average of $48,150, while those in the Seattle-Tacoma-Bellevue, WA area earn around $46,590.

Lower-Paying Areas:

Conversely, states with a lower cost of living tend to have lower average salaries. States like Mississippi, Arkansas, Louisiana, and West Virginia often fall at the lower end of the national pay scale, with averages in the low $30,000s.

It is essential to weigh a higher salary against a higher cost of living. A $45,000 salary in Seattle might not give you the same purchasing power as a $35,000 salary in a smaller Midwestern city.

###

4. Company Type and Size

The type of financial institution you work for also impacts your compensation structure.

- Large National Banks (e.g., JPMorgan Chase, Bank of America, Wells Fargo): These institutions often have highly structured and standardized pay scales. They may offer slightly higher starting base salaries and more robust benefits packages, including comprehensive health insurance, tuition reimbursement, and structured career development programs. They also present more opportunities for internal mobility across different departments and geographic locations.

- Regional and Community Banks: These smaller banks thrive on personalized customer service and deep community ties. While their base salaries might be competitive with, or slightly lower than, large national banks, they may offer a different work culture. There can be a stronger sense of team camaraderie, and your individual contributions may be more visible to senior management, potentially leading to faster recognition.

- Credit Unions: As non-profit, member-owned organizations, credit unions have a different philosophy. They often boast a very strong pro-employee and pro-member culture. Salaries are competitive, but the real advantage can be in the benefits and work-life balance. Credit unions may offer more generous retirement contributions, more paid holidays, and a less high-pressure sales environment compared to some commercial banks.

###

5. Area of Specialization and Advancement

The term "bank teller" is often a starting point. The most significant salary increases come from advancing *from* the teller line into specialized roles. A teller position provides the ideal training ground and visibility to move into these higher-paying positions.

The Advancement Pathway:

1. Bank Teller (Starting Point)

2. Head Teller: (Supervisory role, ~$45,000)

3. Personal Banker / Relationship Banker: This is the most common next step. Personal bankers open new accounts, handle consumer loans (auto, personal), and build deeper client relationships. The average salary for a Personal Banker is around $45,000 to $55,000, with significant bonus potential.

4. Assistant Branch Manager: This role involves operational management, staff supervision, and helping to run the branch. Salaries typically range from $55,000 to $70,000.

5. Loan Officer / Mortgage Loan Originator: Specializing in lending is highly lucrative. Loan officers, especially those in the mortgage sector, often work on a commission basis and can earn well over $100,000 annually depending on the market.

6. Branch Manager: The leader of the branch, responsible for profitability, staff, operations, and community engagement. Branch managers regularly earn $70,000 to $90,000+, with top performers at large branches exceeding six figures.

###

6. In-Demand Skills

In today's evolving banking landscape, certain skills can make you a more valuable employee and justify a higher salary, even in a teller role.

- Sales and Relationship Management: The ability to move beyond simple transactions and actively listen for customer needs is paramount. Tellers who can confidently and effectively cross-sell or refer are top earners. This involves product knowledge and the soft skill of building rapport.

- Digital Literacy and Tech Savviness: As banks push digital adoption, tellers who can not only use the bank's internal software flawlessly but also patiently guide customers through using the mobile app or online portal are invaluable. They bridge the gap between traditional and digital banking.

- Problem-Solving and De-escalation: Every teller faces unhappy customers. The ability to remain calm, listen empathetically, and find a resolution is a high-value skill that managers prize. It retains customers and protects the bank's reputation.

- Meticulous Attention to Detail: Given the financial and regulatory risks, a proven track record of accuracy (e.g., consistently balanced drawers, zero compliance errors) is non-negotiable and a key differentiator between an average teller and a great one.

- Bilingualism: In diverse communities, the ability to speak a second language (particularly Spanish) is a massive asset. Banks will often pay a premium or offer a "language skill" stipend to bilingual tellers, as they can serve a wider customer base.

By actively developing these skills, you can position yourself for higher pay, incentive bonuses, and faster promotion.

Job Outlook and Career Growth

When considering a career, the long-term outlook is just as important as the starting salary. For bank tellers, the future presents both a significant challenge and a unique opportunity. It's a story of transformation, not extinction.

### The Official Outlook: A Necessary Dose of Realism

The U.S. Bureau of Labor Statistics (BLS) projects that employment of tellers is expected to decline 12 percent from 2022 to 2032. This is a sharp contrast to the average growth rate for all occupations and a statistic that must be addressed head-on.

Why the projected decline?

The primary drivers are technological. The rise of digital and mobile banking has empowered customers to perform many traditional teller functions themselves:

- Mobile check deposit has reduced the need to visit a branch.

- Online bill pay and transfers are now standard.

- ATMs and ITMs (Interactive Teller Machines) have become more sophisticated, handling cash withdrawals, deposits, and even connecting users to a live remote teller.

As these technologies become more widespread, banks will need fewer staff members dedicated solely to routine transactional tasks.

### The Evolution of the Role: From Transactional to Relational

This is where the opportunity lies. The decline in *transactional* tellers is being met by a rise in demand for *relational* bankers. The bank branch is not disappearing; its purpose is shifting. Branches are evolving from simple transaction hubs into centers for advice, problem-solving, and relationship building.

The teller of the future—and increasingly, of the present—is a Universal Banker or Relationship Banker. This hybrid role combines the traditional duties of a teller with the responsibilities of a personal banker.

Key characteristics of the evolving role:

- Holistic Customer View: Instead of handling one transaction at a time, the universal banker looks at the customer's entire financial picture to identify needs and opportunities.

- Complex Problem-Solving: They handle more than just simple deposits. They troubleshoot online banking issues, help customers with fraud claims, and provide in-depth product support.

- Sales Through Service: They are trained to open new accounts, discuss loan options, and make qualified referrals to mortgage, investment, and business banking specialists. Their sales goals are integrated into their service role.

- Technology Ambassadors: They are experts in the bank's digital offerings and are tasked with educating and migrating customers to these platforms,