Decoding Your Earning Potential: A Deep Dive into the Chase Teller Salary

A career as a bank teller at a globally recognized institution like JPMorgan Chase is a popular and stable entry point into the dynamic world of financial services. It offers a unique opportunity to build foundational skills in customer service, cash handling, and banking operations. But what can you expect to earn?

For those considering this path, the salary is a crucial factor. A Chase Bank Teller can expect to earn a competitive hourly wage that typically translates to an annual salary ranging from $35,000 to $48,000, with the potential for additional performance-based incentives. This guide will break down that figure, explore the key factors that influence your pay, and examine the career outlook for this essential role.

What Does a Chase Teller Do?

Before diving into the numbers, it's important to understand the role. A Chase Teller is the face of the bank, handling the day-to-day financial transactions for a diverse range of customers. They are brand ambassadors who build trust and foster customer loyalty.

Key responsibilities include:

- Processing Transactions: Accurately handling deposits, withdrawals, loan payments, and money orders.

- Customer Service: Answering account inquiries, resolving issues, and providing a positive and professional banking experience.

- Cash Management: Balancing a cash drawer daily and adhering to strict security and compliance protocols.

- Product Awareness: Identifying customer needs and introducing them to other bank products and services, such as new accounts, credit cards, or connecting them with a personal banker for mortgage or investment advice.

- Digital Engagement: Assisting customers with online and mobile banking tools to enhance their experience.

The role is a blend of precision, security, and exceptional interpersonal skills.

Average Chase Teller Salary

When analyzing salary data, it's best to look at multiple authoritative sources to get a complete picture.

Across the United States, the average base salary for a full-time Bank Teller at Chase falls within a consistent range.

- Glassdoor reports that the typical salary for a Chase Teller is around $21 per hour, which equates to an annual base salary of approximately $43,680. The likely range spans from $18 to $24 per hour ($37,000 to $50,000 annually).

- Payscale data indicates a similar average hourly rate of about $19.50, with a general range of $16 to $23 per hour. This includes base pay and may reflect a broader mix of experience levels.

For context, the U.S. Bureau of Labor Statistics (BLS) reports that the median annual wage for all tellers across all banking institutions was $36,980, or $17.78 per hour, as of May 2023. This suggests that a large national bank like Chase often pays at or above the national median for the profession.

It is also important to note that many Chase Tellers may be eligible for additional compensation, including quarterly performance bonuses and incentives tied to customer satisfaction and referrals, which can increase total annual earnings.

Key Factors That Influence Salary

Your specific salary as a Chase Teller isn't a single, fixed number. It's influenced by a combination of professional and geographic factors. Understanding these can help you maximize your earning potential.

### Level of Education

For an entry-level teller position, the standard requirement is a high school diploma or GED. While a college degree is not typically necessary to be hired, possessing an associate's or bachelor's degree in finance, business, or a related field can be a significant advantage. It signals a deeper commitment to the industry and can make you a stronger candidate for faster promotion into higher-paying roles like Lead Teller, Personal Banker, or Assistant Branch Manager.

### Years of Experience

Experience is one of the most significant drivers of salary.

- Entry-Level (0-2 years): New tellers will typically start at the lower end of the pay scale, likely in the $17-$19 per hour range.

- Mid-Career (3-5 years): An experienced teller who has mastered the role and demonstrated reliability and strong performance may command a higher wage, moving into the $20-$22 per hour range. They may also be promoted to a Lead Teller, which comes with supervisory responsibilities and a corresponding pay increase.

- Senior-Level (5+ years): Tellers with extensive experience are highly valued. While there is a ceiling for the teller role itself, these individuals often transition into specialized or management positions with substantially higher salaries.

### Geographic Location

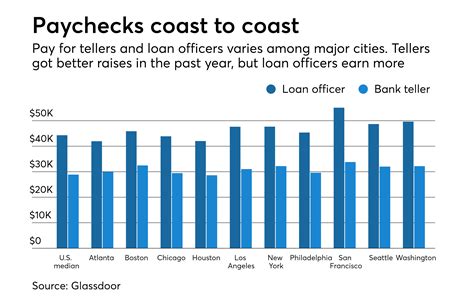

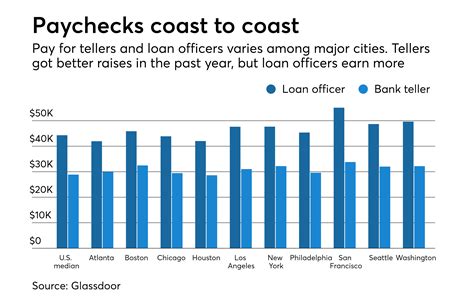

Where you work matters immensely. Banks, including Chase, adjust their pay scales to reflect the local cost of living. A teller working in a high-cost-of-living (HCOL) metropolitan area will earn significantly more than a teller in a rural community.

For example, a Chase Teller in New York, NY, or San Jose, CA, might earn a starting wage closer to $23-$25 per hour to compensate for higher housing and living expenses. In contrast, a teller in a smaller city in the Midwest or the South might start closer to the $17-$19 per hour range. Always research the specific salary data for your target city on sites like Salary.com or Glassdoor.

### Company Type

The query is specific to Chase, a large, multinational investment bank and financial services company. Compared to other types of institutions, large national banks like Chase often have highly structured, standardized pay bands. They also tend to offer very competitive and comprehensive benefits packages (health insurance, 401(k) matching, paid time off) that add significant value to the total compensation. Smaller community banks or credit unions may offer similar or slightly different hourly rates, but their benefits packages and opportunities for advancement might not be as extensive.

### Area of Specialization

The "teller" role is often a launchpad, not a final destination. The most impactful way to increase your salary is to specialize and move up the career ladder within the bank.

- Lead Teller: Supervises the teller line and handles more complex issues. This role typically comes with a pay raise of 10-15% over a standard teller position.

- Personal Banker / Relationship Banker: This is a common and lucrative next step. Personal Bankers work directly with clients to open accounts, handle loan applications, and offer financial advice. This role often includes a higher base salary plus significant commission and bonus potential, with total earnings frequently exceeding $60,000-$70,000 or more.

- Branch Management: Progressing to an Assistant Branch Manager or Branch Manager role involves leadership, operational oversight, and P&L responsibility, with salaries increasing substantially at each level.

Job Outlook

According to the U.S. Bureau of Labor Statistics (BLS), employment of tellers is projected to decline 12 percent from 2022 to 2032. This decline is largely attributed to the rise of online and mobile banking, which automates many traditional transactions.

However, this statistic doesn't signal the end of the role; it signals its evolution. While routine tasks are being automated, the need for skilled, in-person banking professionals to handle complex problems, provide personalized advice, and build customer relationships remains strong. The modern teller is less of a transaction processor and more of a financial concierge. Those who excel at customer service, problem-solving, and identifying sales opportunities will continue to be valuable assets to institutions like Chase.

Conclusion

A career as a Chase Teller offers a stable foundation with a competitive starting salary and a clear path for growth. While the national average hovers around $43,000 per year, your actual earnings will be shaped by your experience, your location, and most importantly, your ambition to specialize and advance.

For anyone with strong communication skills and a passion for helping people, the teller position is more than just a job—it's an entry ticket to a rewarding and potentially high-earning career in the financial services industry. By focusing on performance and professional development, you can leverage this role into a future as a personal banker, financial advisor, or branch manager.