### A Disclaimer from the Author

*Before we begin, it's crucial to understand that this article is intended for informational and educational purposes only. I am an expert career analyst and professional development writer, not an attorney. The information provided here should not be construed as legal advice. Employment laws are complex and vary significantly by state and jurisdiction. If you are facing a salary reduction, it is always best to consult with a qualified employment lawyer to discuss the specifics of your situation.*

Introduction

The email arrives with an innocuous subject line: "An important update regarding our company's direction." Your stomach tightens. You open it, and your eyes scan past the corporate jargon until they land on the words that make your heart sink: "...a necessary adjustment to our compensation structure... a reduction in base salary, effective next pay period." In that moment, a whirlwind of questions floods your mind. Is this legal? Can they just *do* that? What are my options?

This scenario, once a rarity, has become an increasingly common reality for many professionals navigating economic uncertainty and corporate restructuring. The question, "can an employer reduce salary," is not just a legal query; it's a deeply personal one that strikes at the core of your financial security and professional worth. The answer is complex, nuanced, and depends heavily on the specifics of your employment agreement and location.

Navigating a pay cut is one of the most challenging situations a professional can face. I once coached a senior marketing director who was informed her salary was being cut by 20% due to a company-wide "realignment." Instead of panicking, we worked together to methodically review her contract, research the company's financial health, and prepare a counter-proposal that focused on variable compensation tied to performance. While she didn't get her full salary back immediately, she successfully negotiated a path to restoring it within six months, contingent on meeting specific targets—which she did. Her experience underscores a vital truth: knowledge and strategy can transform a moment of vulnerability into a position of agency.

This guide is designed to be your comprehensive playbook for understanding and responding to a potential or actual salary reduction. We will demystify the legal landscape, explore the critical factors that determine your rights, and provide a step-by-step roadmap for how to proceed. You will leave this article not with fear, but with clarity, confidence, and a strategic plan to protect your career and financial well-being.

### Table of Contents

- [What Does a Salary Reduction Truly Entail?](#what-does-a-salary-reduction-truly-entail)

- [The Legality of Salary Reductions: A Deep Dive](#the-legality-of-salary-reductions-a-deep-dive)

- [Key Factors That Determine Legality and Your Options](#key-factors-that-determine-legality-and-your-options)

- [Navigating the Aftermath: Career Impact and Professional Growth](#navigating-the-aftermath-career-impact-and-professional-growth)

- [How to Respond to a Proposed Salary Reduction: A Strategic Guide](#how-to-respond-to-a-proposed-salary-reduction-a-strategic-guide)

- [Conclusion: Taking Control of Your Career Narrative](#conclusion-taking-control-of-your-career-narrative)

What Does a Salary Reduction Truly Entail?

At its simplest, a salary reduction is a decrease in your agreed-upon rate of pay. However, the term can encompass several different actions by an employer, each with unique implications. Understanding these distinctions is the first step in assessing your situation accurately. It’s not just about a smaller number on your paycheck; it’s about the underlying reasons, the duration, and the formal mechanism your employer is using.

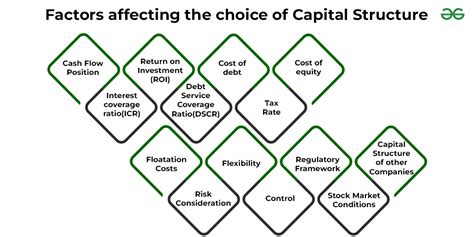

The primary reason employers resort to pay cuts is typically financial distress. According to a 2023 report from the Society for Human Resource Management (SHRM), cost-cutting measures, including salary freezes and reductions, are common strategies companies consider to avoid layoffs during economic downturns. By reducing labor costs across the board, a company hopes to preserve cash flow and remain solvent. Other reasons can include a fundamental restructuring of the business, a merger or acquisition, or a demotion due to performance or role elimination.

Let's break down the common forms this can take:

- Direct Salary Reduction: This is a straightforward cut to your base salary or hourly wage. For example, your annual salary of $80,000 is reduced to $70,000. This is typically a permanent or long-term change to your compensation structure.

- Reduction in Hours: For hourly employees, an employer might not change the wage rate but instead cut the number of scheduled hours. While your per-hour pay remains the same, your total take-home pay decreases significantly. This can sometimes be a way for employers to indirectly reduce labor costs without formally cutting wages.

- Furlough: A furlough is a mandatory, temporary, unpaid leave of absence. You are still an employee, but you are not working or being paid for a specific period (e.g., one week per month). The expectation is that you will return to your regular work schedule and pay after the furlough period ends. Your benefits, like health insurance, often continue during this time, though you may be required to pay the full premium.

- Elimination of Bonuses or Commissions: For roles where a significant portion of compensation is variable (e.g., sales, finance), an employer might change the commission structure or eliminate annual bonuses. While your base salary may remain untouched, your total earning potential could be drastically reduced.

### A "Day in the Life" of Receiving the News

Imagine you're "Alex," a project manager at a mid-sized tech company. Your day starts normally—a morning stand-up meeting, reviewing project timelines, and responding to emails. At 11:00 AM, a calendar invitation pops up from HR for a "Mandatory Team Meeting" at 2:00 PM. A nervous buzz spreads through your team's chat channel.

At 2:00 PM, you join the video call. The Chief Operating Officer is present, her expression grim. She speaks of "unprecedented market headwinds" and the "difficult decisions necessary to ensure the company's long-term viability." Then comes the blow: to avoid layoffs, all employees at the Director level and below will receive a 15% salary reduction, effective in two weeks. The call ends abruptly, leaving a stunned silence.

Alex's immediate reaction is a mix of shock, anger, and anxiety. The mortgage, the car payment, the family budget—all flash through their mind. The first instinct is to vent to colleagues, but Alex pauses, takes a deep breath, and shifts into a more strategic mindset. The first action isn't to fire off an angry email, but to save a copy of the official communication. The second is to pull up their original offer letter and employment agreement from their personal files. The third is to block off time for a quiet, focused review of their personal finances. This measured, information-gathering approach is the critical first step in navigating the difficult road ahead.

The Legality of Salary Reductions: A Deep Dive

This is the central, most pressing question on your mind: "Is what my employer doing legal?" In the majority of cases in the United States, the unfortunate answer is yes, it can be. The legality of a pay cut hinges on a few core legal principles, most notably the concept of "at-will" employment.

### The Foundation: At-Will Employment

Most U.S. states operate under the doctrine of at-will employment. This principle, which governs the majority of private-sector employment relationships, means that an employer can terminate an employee for any reason, or no reason at all, as long as the reason is not illegal (e.g., discriminatory). Conversely, an employee can quit for any reason, or no reason at all.

This doctrine extends to the terms and conditions of employment, including compensation. Just as an employer can end the employment relationship, they can also change its terms, including your salary. However, this power is not absolute and is subject to crucial limitations.

The Golden Rule of Salary Reductions: Prospective, Not Retroactive

The single most important legal constraint is that an employer cannot retroactively reduce your pay. They cannot decide today that you were overpaid for the work you *already performed* last week and deduct that amount from your upcoming paycheck. The Fair Labor Standards Act (FLSA), the federal law governing wages and overtime, is very clear on this. You must be paid the agreed-upon wage for all hours you have already worked.

A pay reduction can only be applied prospectively, meaning it affects your pay for work you perform *after* you have been notified of the change.

Example:

- Illegal (Retroactive): On Friday, the end of a pay period, your employer informs you that your salary for the two weeks you just completed will be 10% lower than you expected.

- Likely Legal (Prospective): On Friday, your employer informs you that starting on Monday, the beginning of the *next* pay period, your new salary will be 10% lower.

This requirement of advance notice is key. While the amount of notice required can vary (and in some cases, may not be legally mandated at all unless a contract specifies it), an employer cannot surprise you with a pay cut for time already served.

### The Legal Framework: Where to Look for Protection

While at-will employment gives employers significant leeway, several layers of legal protection can make a salary reduction illegal in specific circumstances. Your rights are generally defined by a combination of federal laws, state laws, and personal contracts.

1. Federal Law: The primary federal protections come from anti-discrimination and wage laws.

- The Fair Labor Standards Act (FLSA): As mentioned, this is the big one. It mandates payment for work already performed and establishes the federal minimum wage. An employer cannot reduce your salary or hourly wage below the current federal minimum ($7.25 per hour as of late 2023, though many states have a higher minimum). It also governs overtime pay for non-exempt employees. A salary reduction cannot be used as a way to avoid paying legally required overtime.

- Anti-Discrimination Laws: The U.S. Equal Employment Opportunity Commission (EEOC) enforces several landmark laws, including Title VII of the Civil Rights Act, the Age Discrimination in Employment Act (ADEA), and the Americans with Disabilities Act (ADA). These laws make it illegal for an employer to reduce your pay for a discriminatory reason. For example, if an employer only cuts the salaries of women, employees over 40, or employees of a certain race, it is likely illegal discrimination.

2. State Law: State laws are often a source of greater employee protection than federal laws. Many states have:

- Higher Minimum Wages: Your pay cannot be reduced below your state's or city's minimum wage.

- Specific Notice Requirements: Some states may have laws dictating how much notice an employer must give before changing your wage rate.

- Wage Payment Laws: States have their own regulations about the timing and method of paying wages, which can be violated by improper pay reductions. For instance, reputable sources like the legal information website Nolo.com provide state-by-state guides on final paycheck laws, which can be relevant if a pay cut leads to a resignation.

3. Contract Law: This is where an individual's situation can diverge significantly from the general rule. If you are not an at-will employee because you have a contract, that document is paramount.

As an expert career analyst, my strongest recommendation is to understand which of these frameworks apply to you. Start by identifying your employment status (at-will or contract), then familiarize yourself with the basic wage and discrimination laws at the federal and state levels. The U.S. Department of Labor (DOL) website is an authoritative and invaluable resource for this information.

Key Factors That Determine Legality and Your Options

While the general rule is that employers can reduce pay prospectively, the devil is in the details. The legality and your strategic options are shaped by several critical factors. A thorough analysis of each of these areas is essential before you decide how to respond.

###

Employment Contracts & Offer Letters

This is the single most important factor that can override the at-will employment doctrine. If you have a signed employment contract that specifies your salary, its duration, and the conditions under which it can be changed, your employer is legally bound by those terms.

- What to Look For:

- Salary Clause: Does the contract state, "Employee's annual salary shall be $X for the duration of this agreement"? Language like this creates a binding commitment.

- Duration/Term: Is the contract for a fixed term (e.g., two years)? If so, the employer generally cannot change the terms, including salary, until the contract expires or is renegotiated.

- Modification Clause: Check for language detailing how the contract can be amended. It often requires the written consent of both parties. If this clause exists, your employer cannot unilaterally change your pay.

- "For Cause" Termination: Contracts often list specific reasons (e.g., gross misconduct, failure to perform duties) for which you can be terminated. A salary reduction is not typically listed, making a unilateral cut a potential breach of contract.

Offer letters can sometimes be interpreted as contracts, but this is a grayer area. An offer letter that simply states a starting salary is less likely to be considered a binding contract for the future. However, if it includes language promising that salary for a specific period (e.g., "Your salary for the first year of employment will be..."), it carries more weight.

Actionable Advice: Locate your original offer letter and any subsequent employment agreements or amendments. Read them carefully, specifically looking for the terms related to compensation, contract duration, and modification procedures. If you believe your employer has violated these terms, this is a strong basis for a legal challenge.

###

Collective Bargaining Agreements (CBAs)

If you are a member of a labor union, you are not an at-will employee. Your employment is governed by a Collective Bargaining Agreement (CBA) negotiated between your union and the employer.

- How CBAs Protect You: CBAs are legally binding contracts that meticulously detail wages, benefits, hours, and working conditions. They almost always contain specific wage scales and predictable schedules for pay increases.

- Employer Obligations: An employer cannot unilaterally reduce the pay of union members. Any changes to compensation must be negotiated with the union representatives as stipulated in the CBA. Attempting to do so is an unfair labor practice and will be met with a swift response from the union, likely including grievances and legal action.

Actionable Advice: If you are a union member, contact your union steward or representative immediately upon learning of a proposed pay cut. They are your primary resource and advocate and will handle the official response on your behalf.

###

The Importance of Notice

As established, a pay cut must be prospective. This implies that some form of notice is required. The key questions are how much notice and in what form.

- Is There a Legal Minimum? In many at-will situations, there is no specific, legally mandated notice period (e.g., two weeks) at the federal level for a pay cut, as long as it's not retroactive. However, some state laws do impose notice requirements. For example, some states may require the employer to give notice at least one full pay period in advance.

- Reasonableness: Even without a specific law, courts may look at the "reasonableness" of the notice. Informing an employee of a pay cut an hour before their next shift begins could be viewed unfavorably, even if technically prospective.

- Written vs. Verbal Notice: Always insist on receiving notification of a salary change in writing. A formal, written document from HR or management provides clear proof of when you were notified and the exact terms of the change. Verbal notice is messy, hard to prove, and can lead to disputes. A 2022 survey by Payscale found that transparency in pay processes is a major driver of employee satisfaction; a lack of clear, written communication about pay changes is a significant red flag.

Actionable Advice: If you are notified verbally, follow up immediately with a polite, professional email to your manager or HR. For example: "Dear [Manager's Name], Thank you for speaking with me today. To ensure I understand correctly, I want to confirm that effective [Date], my annual salary will be adjusted to [New Salary]. Please let me know if my understanding is incorrect." This creates a written record.

###

Discriminatory Practices

This is where an otherwise legal pay cut becomes unequivocally illegal. Even in an at-will state, an employer cannot use a pay cut to discriminate against an employee based on their membership in a protected class.

- Protected Classes: Under federal law enforced by the EEOC, this includes race, color, religion, sex (including pregnancy, sexual orientation, and gender identity), national origin, age (40 or older), disability, and genetic information. State laws may add other protections (e.g., marital status, political affiliation).

- How to Spot Discrimination: Discrimination can be blatant or subtle. The key is to look for patterns. Is the pay cut being applied unevenly?

- Are only employees over 50 having their salaries reduced? (Potential age discrimination).

- Were all the women in a department given a 15% cut while the men received only 5%? (Potential gender discrimination).

- Did you recently return from maternity leave or request a disability accommodation, only to be met with a pay cut? (This could be discrimination or retaliation).

Actionable Advice: Observe your surroundings and gather information (discreetly and professionally). Look at who was affected by the pay cuts. If you notice a pattern that suggests a protected class is being disproportionately targeted, this is a serious red flag. Document your observations, including names, roles, and the nature of the pay changes if known. This information is crucial if you decide to file a complaint with the EEOC or consult an attorney.

###

Retaliation

Similar to discrimination, retaliation is an illegal reason to reduce an employee's pay. Retaliation means an employer is punishing you for engaging in a legally protected activity.

- Protected Activities Include:

- Filing a complaint about discrimination or harassment.

- Acting as a witness in an EEO investigation.

- Requesting a reasonable accommodation for a disability or religious belief.

- Reporting a safety violation to OSHA.

- Inquiring about or discussing your wages with coworkers (a right protected by the National Labor Relations Act).

Example: You recently served as a witness in a harassment investigation against a senior manager. A month later, your manager informs you that your salary is being cut due to "budgetary realignments," but no one else on your team is affected. The timing and specificity of this action strongly suggest it could be illegal retaliation for your participation in the investigation.

Actionable Advice: Keep a detailed timeline of events. Document when you engaged in the protected activity and when you were notified of the pay cut. Note any related comments or changes in behavior from your management. This "causal link" is critical to proving a retaliation claim.

###

Minimum Wage & Overtime Laws

This is a hard, legal floor that cannot be breached.

- Minimum Wage: Your employer cannot reduce your pay below the highest applicable minimum wage—federal, state, or local. For salaried, exempt employees, there's an additional test. Under the FLSA, to qualify for the "exempt" status (meaning you're not eligible for overtime), you must be paid a minimum salary. As of 2023, the federal minimum salary threshold is $684 per week ($35,568 per year). If a pay cut drops your salary below this threshold, your employer must reclassify you as non-exempt and pay you overtime for any hours worked over 40 in a week. Many states (like California and New York) have significantly higher salary thresholds for exempt status.

- Overtime Pay: For non-exempt (typically hourly) employees, an employer must continue to pay overtime at 1.5 times your regular rate of pay for all hours over 40. A pay cut cannot be a back-door way to avoid overtime obligations.

Actionable Advice: Check the current federal salary threshold on the Department of Labor website and research your specific state and city's minimum wage and exempt salary threshold. A quick search for "[Your State] exempt salary threshold" will usually yield results from your state's labor department. If a pay cut puts you below this line, your legal classification changes, and you are owed overtime.

Navigating the Aftermath: Career Impact and Professional Growth

A salary reduction isn't just a financial event; it's a significant professional one that can have a lasting impact on your career trajectory, morale, and future job prospects. How you interpret and react to this event can define your next career chapter. While the immediate focus is on the financial hit, it's equally important to conduct a clear-eyed assessment of what this means for your long-term growth.

### The Immediate Impact: Morale, Trust, and Engagement

The first casualty of a pay cut is almost always employee morale. It's difficult not to feel devalued when your compensation—a tangible measure of your contribution—is reduced. This can lead to a cascade of negative feelings:

- Erosion of Trust: Your faith in the company's leadership and its financial stability can be shattered. You may start to question their decision-making and transparency.

- Decreased Engagement: It's a psychological reality that when you feel you're being paid less, your motivation to go above and beyond may wane. You might be tempted to "act your wage," doing the bare minimum required rather than investing discretionary effort.

- "Survivor's Guilt" and Resentment: In cases where pay cuts are unevenly applied, it can breed resentment among those affected and a sense of unease among those who were spared. The entire workplace culture can become tense and distrustful.

According to Glassdoor's Economic Research, companies that undergo significant negative events like pay cuts or layoffs often see a sharp drop in their employee satisfaction ratings. The way the leadership communicates and handles the process is a major factor in whether they can eventually rebuild that trust.

### To Stay or To Go? A Critical Career Crossroads

A salary reduction forces a fundamental question: Should I stay or should I look for a new job? There is no single right answer. Your decision should be based on a careful analysis of the company's situation and your own career goals.

Reasons to Consider Staying:

- The Cut is Temporary and Transparent: If leadership is open about the financial challenges, presents the cut as a short-term measure to avoid layoffs, and provides a clear, written timeline for when pay will be restored, it might be worth weathering the storm.

- You Believe in the Company's Future: If you genuinely believe this is a temporary setback for an otherwise strong company with a promising future, staying could be a good long-term bet.

- The Non-Financial Benefits are High: Perhaps you have incredible work-life balance, a supportive team, a short commute, or are working on a passion project you don't want to leave. These factors have real value that may (temporarily) outweigh the reduced pay.

- The Job Market is Weak: In a tough economy, it may be more prudent to hold onto your current role while cautiously exploring other options, rather than jumping into an uncertain job market.

Reasons to Start Your Job Search Immediately:

- The Cut Feels Punitive or Discriminatory: If you suspect the reduction is illegal or targeted at you unfairly, your primary goal should be to find a new, healthier environment (after consulting with legal counsel).

- Leadership is Opaque and Untrustworthy: If the news was delivered poorly, without empathy or a clear plan, it signals a deeper problem with the company culture. This breach of trust may be irreparable.

- This is a "Sinking Ship": If the pay cut is one of several red flags (e.g., losing clients, high executive turnover, constant "restructuring"), it's likely a sign of fundamental instability. It's time to find a more secure vessel.

- Your Role is Being Devalued: If the pay cut is accompanied by a reduction in responsibilities or being moved to lower-impact projects, your growth at the company has stalled.

### How to Talk About a Pay Cut in Future Interviews

If you decide to look for a new job, you may need to address why you're leaving and explain your previous salary. Honesty and a forward-looking perspective are your best tools.

When asked why you're looking for a new role, avoid emotional or overly negative language. Instead, be factual and strategic.

- Poor Response: "My old company cut my pay, they were cheap and I was so angry. The leadership had no idea what they were doing."

- Excellent Response: "My previous company went through a significant financial restructuring that included a company-wide reduction in compensation. While I understood the business reasons, it prompted me to re-evaluate my long-term career goals. I'm now seeking an opportunity where I can fully apply my skills in a stable, growth-oriented environment like the one here at [New Company]."

When asked about your previous salary, state the pre-reduction salary.

- Interviewer: "What was your compensation in your last role?"

- You: "My salary was $90,000 annually. There was a recent company-wide adjustment, but my compensation for the role and its responsibilities was set at $90,000."

This is truthful and frames your value correctly based on your skills and the role you performed, not on a temporary, company-specific financial issue.

How to Respond to a Proposed Salary Reduction: A Strategic Guide

Receiving news of a pay cut can be paralyzing, but you are not powerless. Your response in the hours and days that follow can significantly influence the outcome. The key is to move from an emotional reaction to a strategic, information-driven approach. Here is a step-by-step guide.

### Step 1: Stay Calm and Acknowledge the Information

Your immediate reaction in the meeting or on the call is critical. Avoid a heated emotional outburst. A calm, professional demeanor preserves your leverage for future negotiations.

- What to Say: "Thank you for sharing this information with me. This is significant news that I'll need some time to process. Can you provide me with the details of this change in writing?"

- Why it Works: You are not agreeing to anything. You are acknowledging receipt of the information, asserting your need to review it, and creating a paper trail by requesting written confirmation.

### Step 2: Gather Your Documents and Information

Before you do anything else, become your own researcher. Collect all relevant documents and store them in a personal file, not on a company-owned computer.

- Your Document Checklist:

- The written notification of the pay cut.

- Your original offer letter.

- Your signed employment contract or agreement (if you have one).

- Your most recent performance reviews.

- Any emails or documents that praise your work or detail your accomplishments (e.g., meeting sales targets, successfully launching