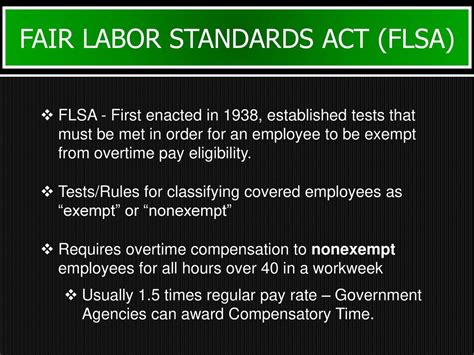

It's one of the most persistent myths in the workplace: if you earn a salary, you’re not eligible for overtime pay. While this is often true, it's far from a universal rule. The reality is that your eligibility for overtime doesn't depend on *how* you are paid (hourly vs. salary), but on a specific set of legal criteria established by the Fair Labor Standards Act (FLSA).

Understanding these rules is crucial for both your financial well-being and career planning. This guide will demystify the regulations, explain who qualifies for overtime, and empower you to ensure you're being compensated fairly for your hard work.

What Does it Mean to be a Salaried Employee?

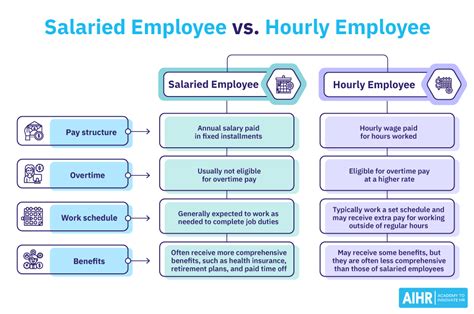

At its core, being a salaried employee means you receive a fixed amount of pay, or a "salary," for each pay period, regardless of the exact number of hours you work. This provides predictable income but often comes with the expectation of working the hours necessary to get the job done.

However, for the purposes of overtime, the U.S. Department of Labor (DOL) divides all employees into two categories: non-exempt and exempt. This classification is the single most important factor in determining overtime eligibility.

- Non-Exempt Employees are entitled to overtime pay (at least 1.5 times their regular rate of pay) for all hours worked over 40 in a workweek. Most hourly workers fall into this category, but so do many salaried employees.

- Exempt Employees are *not* entitled to overtime pay. To be classified as exempt, an employee must meet all three of the following tests:

1. Be paid on a salary basis.

2. Be paid at least the federal or state minimum salary threshold.

3. Perform specific job duties that are considered "exempt."

If a salaried employee does not meet all three of these criteria, they are legally considered non-exempt and must be paid overtime.

The Salary Threshold: The First Test for Overtime Eligibility

The most straightforward test for overtime eligibility is the salary threshold. If you earn a salary below a certain amount, you are automatically considered non-exempt and are eligible for overtime, regardless of your job title or duties.

Under a new rule from the U.S. Department of Labor, this salary threshold is significantly increasing in 2024 and 2025.

- Effective July 1, 2024: The minimum salary threshold for exemption will rise to $844 per week, which is equivalent to $43,888 per year.

- Effective January 1, 2025: The threshold will increase again to $1,128 per week, which is equivalent to $58,656 per year.

Source: [U.S. Department of Labor, "Defining and Delimiting the Exemptions for Executive, Administrative, Professional, Outside Sales, and Computer Employees" Final Rule, 2024](https://www.dol.gov/agencies/whd/overtime/rulemaking).

This means if your annual salary is below these figures, you are legally entitled to overtime pay for any hours worked beyond 40 in a week.

Key Factors That Influence Overtime Eligibility

If you meet the salary threshold, your overtime eligibility then depends on several other factors, primarily your specific job duties. An employer cannot simply give you a managerial title and declare you exempt; your day-to-day responsibilities are what matter.

###

Job Duties and Responsibilities (The "Duties Test")

The FLSA outlines specific categories of "exempt" duties. To be considered exempt, your primary job duty must fall into one of these categories:

- Executive Exemption: Your primary duty must be managing the enterprise or a recognized department. You must customarily and regularly direct the work of at least two other full-time employees, and you must have the authority to hire or fire (or your recommendations on these matters must be given particular weight).

- Administrative Exemption: Your primary duty must be the performance of office or non-manual work directly related to the management or general business operations of the employer or its customers. This work must include the exercise of discretion and independent judgment with respect to matters of significance.

- Professional Exemption: This splits into two types:

- Learned Professional: Your primary duty must be work requiring advanced knowledge in a field of science or learning, customarily acquired by a prolonged course of specialized intellectual instruction (e.g., doctors, lawyers, registered nurses, architects, teachers).

- Creative Professional: Your primary duty must be work requiring invention, imagination, originality, or talent in a recognized field of artistic or creative endeavor (e.g., actors, musicians, writers, painters).

###

Area of Specialization

Beyond the main categories, the FLSA has specific rules for certain specializations:

- Computer Professionals: May be considered exempt if they are paid at least $27.63 per hour or meet the standard salary threshold, and their primary duties involve systems analysis, programming, software engineering, or similar skilled work.

- Outside Sales Employees: Are exempt if their primary duty is making sales or obtaining orders, and they are customarily and regularly engaged away from the employer’s place of business. There is no salary threshold requirement for this exemption.

- Highly Compensated Employees (HCEs): Employees who earn a total annual compensation of $132,964 (rising to $151,164 on January 1, 2025) are exempt if they customarily and regularly perform at least one of the exempt duties of an executive, administrative, or professional employee. The duties test for HCEs is much less strict.

###

Geographic Location

Federal law sets the minimum standard, but your state may have more employee-friendly laws. Several states have higher salary thresholds for exemption and/or different definitions for exempt duties.

For example, states like California, New York, and Washington have their own, often higher, salary thresholds that employers must adhere to. It is critical to check the regulations with your state's Department of Labor, as state law supersedes federal law when it provides greater protection to the employee. For instance, according to Salary.com, salary ranges for the same job can vary by more than 20% depending on the metropolitan area, and state overtime laws add another layer to this complexity.

###

Company Type

While not a direct factor in the legal test, company type and size can influence how these rules are applied. Large corporations often have robust Human Resources and legal departments that are well-versed in FLSA classifications. Startups and smaller businesses may be less familiar with the nuances and can sometimes misclassify employees, often unintentionally. Regardless of company size or industry, the law applies equally to all covered employers.

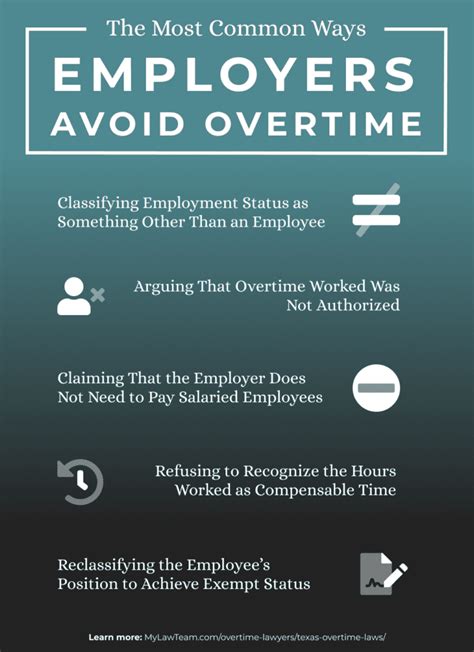

What To Do If You Believe You're Owed Overtime

If you are a salaried employee and, after reading this guide, believe you have been misclassified as "exempt," it's important to take professional and measured steps.

1. Review Your Job Description: Compare your actual day-to-day tasks with your official job description and the "duties tests" described above.

2. Document Your Hours: Keep a detailed, private log of all the hours you work each week.

3. Consult with HR: Approach your Human Resources department with your concerns in a professional manner. Frame it as a request for clarification about your classification under the new DOL rules.

4. Contact the Department of Labor: If you are not satisfied with your employer's response, you can file a confidential complaint with the DOL's Wage and Hour Division (WHD). They can investigate on your behalf.

5. Consult an Employment Lawyer: For complex situations, seeking advice from an attorney specializing in employment law can provide clarity on your specific rights and options.

Conclusion: Knowledge is Your Greatest Asset

Determining overtime eligibility for salaried employees is far more complex than a simple "yes" or "no." The answer lies at the intersection of your salary level, your specific job responsibilities, and the laws in your state.

Key Takeaways:

- Salary is Not the Deciding Factor: Being salaried does not automatically make you ineligible for overtime.

- Know the Thresholds: With the new DOL rule, if you earn less than $43,888 after July 1, 2024, or less than $58,656 after January 1, 2025, you are owed overtime.

- Duties Matter Most: If you earn above the threshold, your primary job duties determine your exemption status. You must perform specific executive, administrative, or professional tasks to be exempt.

- State Laws Can Offer More: Always check your state's labor laws, as they may provide greater protection and higher salary thresholds.

By understanding your rights under the FLSA, you can ensure you are being compensated fairly for your time and dedication. This knowledge not only protects your income but also empowers you to make informed decisions throughout your career.