A Note on Structure: The query "can salaried employees get overtime" is a legal and regulatory question rather than a specific job role. To provide the most accurate and helpful article, I have adapted the requested structure to fit the topic. The framework will guide a professional through understanding their eligibility for overtime pay, which is a critical aspect of salary and compensation analysis.

Can Salaried Employees Get Overtime? A Guide to Your Rights

It's one of the most persistent myths in the workplace: if you earn a salary, you’re automatically ineligible for overtime pay. This common misconception can lead to uncompensated work and confusion about your rights as an employee. The truth is far more nuanced. Many salaried professionals are legally entitled to overtime pay, and understanding your status is key to ensuring you are compensated fairly for your time and expertise.

The regulations governing overtime are primarily set by the Fair Labor Standards Act (FLSA). Whether you qualify for overtime doesn't just depend on *how* you are paid (salary vs. hourly), but on your specific job duties and your total compensation. This guide will break down the rules, tests, and factors that determine if you, as a salaried employee, should be earning time-and-a-half for those extra hours.

Understanding the Core Concepts: Salaried, Exempt, and Non-Exempt

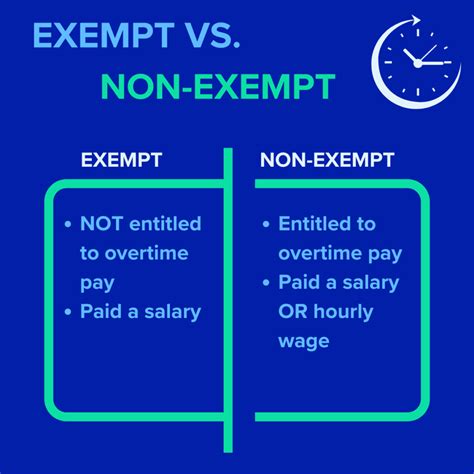

Before we dive into the details, it's crucial to understand the language used by the U.S. Department of Labor (DOL). The conversation isn't really about "salaried vs. hourly"; it's about "exempt vs. non-exempt."

- Salaried: This simply refers to a payment method. You receive a fixed amount of pay (your salary) for each pay period, regardless of the specific number of hours you worked.

- Non-Exempt: A non-exempt employee is one who is *not exempt* from the FLSA's overtime rules. They are entitled to overtime pay, typically at 1.5 times their regular rate of pay, for all hours worked over 40 in a workweek. Most hourly workers fall into this category, but so do many salaried employees.

- Exempt: An exempt employee is one who is *exempt* from the FLSA's overtime rules. To be classified as exempt, an employee must meet specific criteria related to their salary level and job duties. These employees are not legally entitled to overtime pay.

The critical question is not "Am I salaried?" but "Am I properly classified as an exempt employee?"

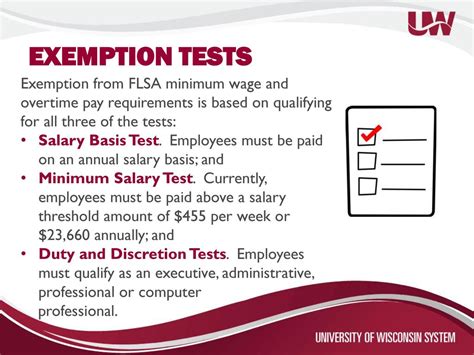

The Three Tests for Exemption: The Key to Overtime Eligibility

For most employees, federal law dictates that you must meet all three of the following tests to be classified as exempt and therefore be ineligible for overtime.

1. The Salary Basis Test: You must be paid on a salary basis, meaning you receive a predetermined amount of compensation each pay period that is not subject to reduction because of variations in the quality or quantity of the work performed.

2. The Salary Level Test: Your salary must meet a minimum threshold. As of the latest federal update, this threshold is $684 per week, which equals $35,568 per year. If you are a salaried employee earning less than this amount, you are almost certainly non-exempt and must be paid overtime, regardless of your job duties. *This salary threshold is subject to change, and proposed new rules may significantly increase it in the near future.*

3. The Job Duties Test: Your primary job duties must fall into one of the specific "exempt" categories defined by the DOL. Having a fancy title is not enough; the work you actually perform is what matters. The main categories are:

- Executive Exemption: The employee’s primary duty must be managing the enterprise or a department, they must customarily direct the work of at least two other full-time employees, and they must have the authority to hire or fire (or their recommendations must be given particular weight).

- Administrative Exemption: The employee’s primary duty must be the performance of office or non-manual work directly related to the management or general business operations of the employer, and their duties must include the exercise of discretion and independent judgment with respect to matters of significance.

- Professional Exemption: This is split into "Learned Professionals" (e.g., doctors, lawyers, engineers whose work requires advanced knowledge in a field of science or learning) and "Creative Professionals" (e.g., artists, musicians, writers whose work requires invention, imagination, or talent).

If you are paid a salary but do not meet all three of these tests, you are likely misclassified and should be receiving overtime pay.

Key Factors That Influence Overtime Eligibility

Beyond the three core tests, several other factors can influence whether you are owed overtime pay.

### State and Local Laws

This is one of the most critical factors. The FLSA sets the federal *minimum* standard. Many states have their own labor laws that are more generous to employees. For example, California has a significantly higher salary threshold for exemption (in 2024, it's $66,560 per year for all employers) and requires overtime for hours worked over eight in a single day, not just over 40 in a week. Always check your state and local labor department websites for rules that may supersede federal law.

### Years of Experience

While experience itself isn't a legal test, it directly impacts the "Job Duties Test." An entry-level employee in a professional field may perform routine tasks under direct supervision, making them non-exempt. As that employee gains experience, they are often given more responsibility, autonomy, and decision-making authority ("discretion and independent judgment"), which may transition their role into an exempt classification.

For example, an entry-level "Marketing Coordinator" who primarily schedules social media posts from a pre-approved content calendar is likely non-exempt. A senior "Marketing Manager" who develops the entire marketing strategy, manages a budget, and oversees a team would meet the criteria for the administrative or executive exemption.

### Area of Specialization

The FLSA has specific rules for certain job types. For instance, there is a distinct Computer Employee Exemption. To qualify, an employee must be paid at least $684 per week on a salary basis (or $27.63 per hour) and be employed as a computer systems analyst, computer programmer, software engineer, or other similarly skilled worker in the computer field. Similarly, Outside Sales Employees who customarily and regularly work away from the employer's place of business are often exempt.

### Company Policy

Some companies choose to offer more generous compensation packages than the law requires. A company may have a policy to pay overtime to its exempt employees as a way to promote work-life balance and reward extra effort, even though they are not legally obligated to do so. This is often referred to as "paid overtime" or may come in the form of compensatory time off. This is a matter of company policy, not legal right, so it's important to check your employee handbook.

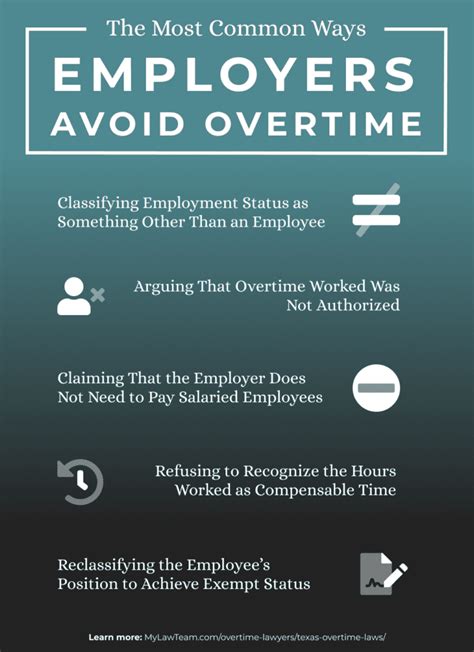

What to Do If You Believe You're Owed Overtime

If you've reviewed the criteria and believe you have been misclassified as an exempt employee, you have several options.

1. Document Everything: Keep a detailed, personal record of all the hours you work each day. Note your start times, end times, and any breaks taken.

2. Review Your Job Description: Compare your actual day-to-day duties with your official job description and the DOL's definitions for the exemption tests.

3. Consult HR: You can approach your Human Resources department to professionally and calmly inquire about your classification. Frame it as a request for clarification, not an accusation.

4. Seek External Advice: You can file a complaint with your state's labor department or the U.S. Department of Labor's Wage and Hour Division. You may also consult with an employment attorney to understand your rights and options.

Conclusion: Know Your Rights and Your Value

The question of overtime for salaried employees is complex, but the answer is clear: a salary does not automatically disqualify you from overtime pay. Fair compensation is a cornerstone of a healthy professional career. Understanding your classification under the Fair Labor Standards Act and your state's specific laws is not just about compliance; it's about being empowered to advocate for your own value.

For professionals and students alike, remember these key takeaways:

- Exempt vs. Non-Exempt is the key distinction, not Salaried vs. Hourly.

- Federal law requires three tests (Salary Basis, Salary Level, and Job Duties) to be met for an employee to be exempt.

- If you earn less than the federal threshold of $35,568 per year, you are very likely owed overtime.

- State laws can provide greater protections and higher salary thresholds.

By arming yourself with this knowledge, you can ensure you are being paid fairly for every hour of your hard work and dedication.

---

Sources:

- U.S. Department of Labor, Wage and Hour Division. (n.d.). *Fact Sheet #17A: Exemption for Executive, Administrative, Professional, Computer & Outside Sales Employees Under the Fair Labor Standards Act (FLSA)*.

- U.S. Department of Labor. (n.d.). *Overtime Pay*.

- California Department of Industrial Relations. (2024). *Overtime*.

- Salary data for illustrative examples can be benchmarked against sources like the U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook, Salary.com, and Glassdoor.